A Weighty Economic Problem

Tax Alcohol and Tobacco

Sin Tax

In the 1970’s some countries, faced with economic problems and struggling with increasing health costs, introduced a “Sin Tax”.

This sin tax was extra taxes added to nicotine and alcohol products.

The reasoning was: Although the governments did not want to prohibit a person’s right to choice, Nicotine addiction and over use of alcohol was taking a disproportionate percentage of the medical budgets and was unfair for people who chose to avoid these products, to have to pay extra for those who didn’t.

This meant that cigarettes and alcoholic beverages received a higher taxation and the proceeds, supposedly going to the health industry. This in turn, reduced the pressure of health needs on the rest of the budget, freeing up funds for other purposes.

American Economy

Today in America, there is an economic crisis. Somehow it has to raise more money [taxes] or reduce spending, preferably both.

Some say that the answer lies in taxing the rich more. In theory, I would agree with this but it has to be done carefully, if at all. If the rich think they are being unfairly taxed, they could move their assets abroad or even move themselves. This would not particularly help the overall problem and could even add to it.

The biggest expenses for the Government are Military, Health and Public Sector.

It is hard to reduce military spending when they are at war but still cuts can be made by increasing efficiency in none war zone areas. Public sector cuts, no matter how painful or unpopular most be made.

Healthy Tax

Health Care

This leaves us with the health care industry. I believe that funding could be increased by adding a “Weight Tax”. This is not to say that, you are overweight and so pay more tax but to pay more tax on the items that contribute to people being overweight.

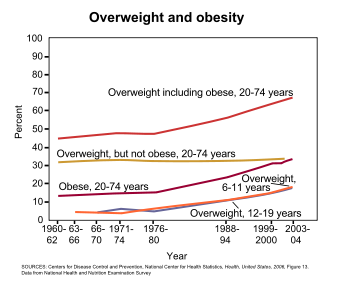

America is getting bigger or at least Americans are. Estimates from 2004 show that 70% of Americans were overweight, half of whom were considered to be obese.

In 2003, an estimated $75 billion was spent on problems relating to obesity.

In 2005, of all adults between the ages of 17 and 24, 27% were considered to be too obese for military service.

No matter how many fitness centers you see or diet products are on the shelves, these figures continue to rise, draining the assets of the health services.

I know that to eat healthy can be expensive and often people say that they can only afford to eat the cheap, fast foods available. This may be true and it is this that has to change.

Taxation must be applied so that the big ½ pound Burger dripping in fat is still available but is more expensive than a nourishing meal.

The whole concept of fast food needs to be overhauled with a view to health. Grocery products should be taxed according to their health value. Healthy foods perhaps receiving reductions and unhealthy foods having taxes added.

I, myself smoke, drink alcohol and am overweight but I make my own choices.

Although it is not the Governments job to tell us what we can and cannot eat, it is their responsibility, with their accessibility to experts, that they guide us, through taxation if need be, in what is healthy, not just for us but also for our country.