Cut, Cap, and Balance: Our Savior or Our Disaster - Does It Answer Our National Debt Crises Problem? [110*]

THEY THINK CUT, CAP, and BALANCE IS A GOOD THING

What This Slogan Means

CUT, CAP, and BALANCE is the Conservative slogan for their plan to forever protect Americans from the excesses of Congressional or Executive-inspired overspending, with limited exceptions for emergencies, although it is not clear if the rules would allow the government any real capability to react quick enough to avert disaster.

- CUT means: discretionary and mandatory spending reductions that would cut the deficit in half next year.- $700 Billion

- CAP means: statutory, enforceable caps to align federal spending with average revenues at 18 percent of Gross Domestic Product (GDP), with automatic spending reductions if the caps are breached

- BALANCED means: a Balanced Budget Amendment (BBA) with strong protections against federal tax increases and a Spending Limitation Amendment (SLA) that aligns spending with average revenues as described above.

This sounds very good, but is it? What does it really mean to take $700 billion out of government spending in 2012? I have written other hubs on the terrible impact this will have on the American economy beyond driving it back into recession. What is the effect of permanently limiting spending (outlays, actually) to 18% of Gross Domestic Product (GDP)? Or, how about the implications of preventing Congress from not being about enact budgets that have the flexibility the way the founding fathers originally intended?

A Quick Look at the Problem

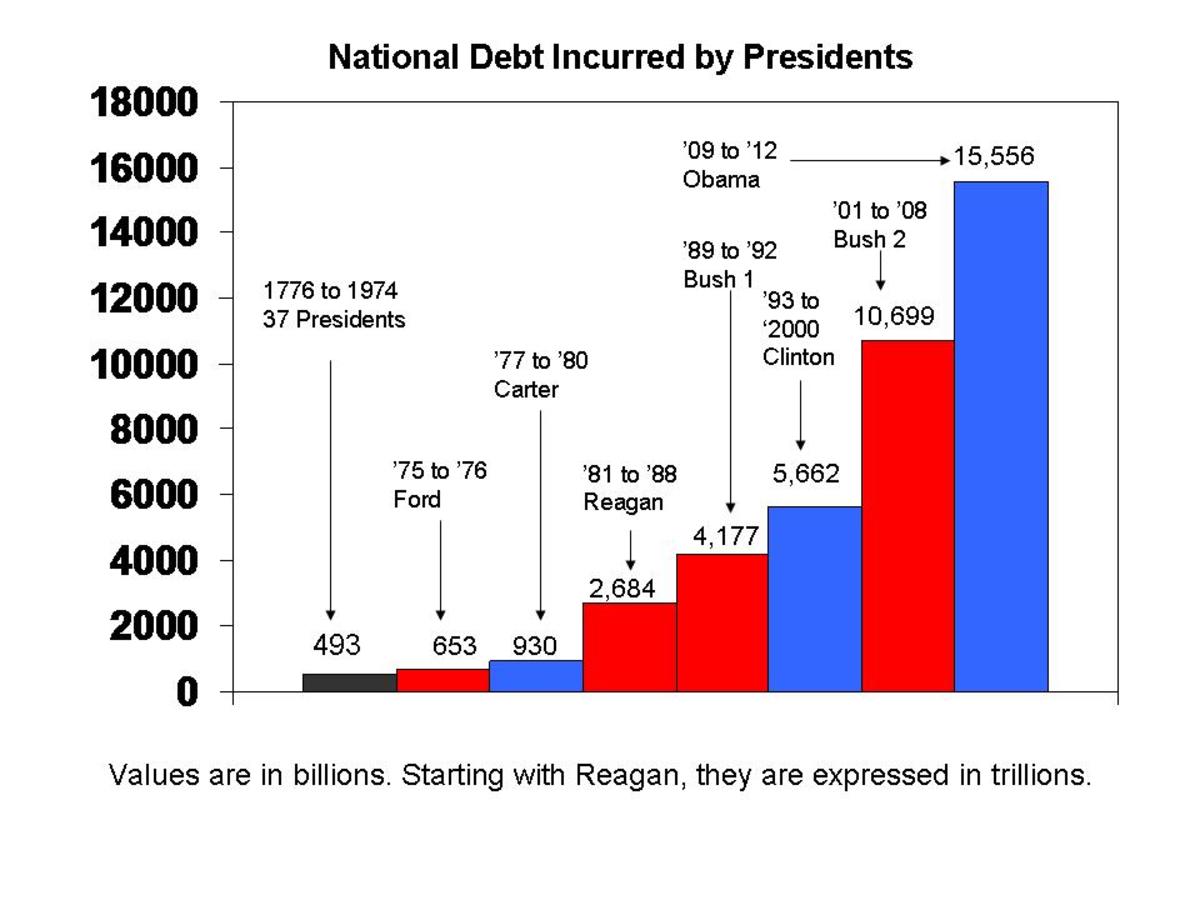

THE PROBLEM, from the Conservative point-of-view, is that government habitually spends more than it takes in and runs larger and larger deficits, I mean just look at what is happening today; we never seem to be able to get it right, don't you see. Never mind, of course, that the only two times in American history that our government ran non-war caused, beyond-belief, historic deficits are from the policies of the Reagan and Bush II administrations! In any case, to keep the Conservative Presidencies and Congresses under control (given they are the only ones that seem to have a problem), the Conservatives believe it is necessary to put rules in place such that the budget can't get out of control like it is today.

At one level, the problem can be pretty simple, the people want government to provide services which cost money for which the government must find sources of revenue (taxes and fees) to pay for those services. At the moment, the cost of those services far exceed the revenues coming in to pay for them, so the government must borrow money to keep on providing those services.

At this precise moment in time, the costs of PAST services, that is, already on the books, are growing much faster than the revenues to pay for them thereby leading to the runaway debt problem we are all screaming about now. What the CAP and BALANCE part of the Conservative idea is intended to do is prevent Congress from making decisions today which may get us into that kind of problem in the future; that is the THEORETICAL promise anyway. The CUT part is to help get us on the right path beginning in 2012.

(Side-note: The fact that this bill was tied to the fight to raise the debt ceiling was perplexing because, while this idea is very important in and of its own right, it had no direct bearing on the debt ceiling itself, nor does it resolve a thing about the debt ceiling other than probably end up increasing the amount that we are going to have to pay in the end because the unnecessary stand-off will raise interest rates. The place for this discussion always has been the 2012 budget. The actual result was a lowering of our credit rating because America couldn't get its collective act together. In any case, that isn't the point of this hub, but I thought it important to point out.)

The Gordian Knot Solution

Adding a Little Complexity

AHHH, IF IT WERE ONLY that simple. It sort of reminds me of that game where you have a mallet and board with a bunch of holes in it in front of you. When a gopher pops up in a hole, you hit it, only to see it pop up in another hole. You hit it there, but it appears in yet a different hole. Pretty soon, two gophers show up and you try to hit both of those; it just seems you can never get all of those gophers. Given its huge complexity, the federal budget isn't much different than this model; it boils down to the following: try to fix a problem in one place with a cure-all and some other problem pops-up someplace else that you had not anticipated, fix that, and yet another pops up; they keep popping up in a never ending series of possible holes in which they can appear. Tell me please, how can you build a small set of simple rules to handle a world full of complex situations, all of which have interdependency's with each other ... the answer is, you can't.

REVENUE- In its simplest sense, a budget is just the balancing of revenues with spending. With the federal budget, the revenue side is still pretty easy; while there are a multitude of ways the government receives revenues, there are only three principle sources, taxes on individuals, taxes on corporations, and borrowing; the other few dozen, taken together, don't equal the smaller of the previous three, corporate taxes. Today, I believe the percentage of total revenue provided by borrowing is 40%, that is why Aug 2, 2011, was said to be such an important date; it was then that accountants were saying that actual cash coming in may not be enough to meet the outlays that law requires to be paid out, and, absent the settlement, there would have been no borrowing authority left to sell more bonds to raise the shortfall in cash. The only choice the government apparently had at that point was to default on some obligation it owed or sell an asset it possessed to raise the money to pay the debt. e.g., sell the White House.

EXPENSES - Now this is where the FUN is, and all of the politics; not raising taxes aside. While there are only a few revenue sources there are a myriad, or as mathematicians for fond of saying, a countably infinite number of ways to spend money. And, that is the crux of the problem; that is what will take such an elegant solution as CUT, CAP, and BALANCE and turn it into a Gordian's Knot. It is impossible to talk intelligently about getting a handle on federal expenditures without writing a book or two about it, but that is why Slogans are used, isn't it, they are much easier to understand even though they aren't particularly intelligent.

What can be said about Expenses without getting too esoteric? Not a whole lot, but let me try anyway. The government uses the revenues it receives in three fundamental ways that have any budgetary significance: 1) discretionary spending, 2) mandatory spending, and 3) tax breaks and incentives; there are many others, of course, but again, together they don't amount to much.

Discretionary Spending - this is split 2/3 Security and 1/3 non-Security (normal government operations) related spending. For 2012, is is projected to be $1,344 billion.

Mandatory Spending - this is 55% Social Security/Medicare (with their own funding streams) and 45% mainly "welfare" kind of programs. For 2012, this is projected to be $2,109 billion.

Interest on the Debt - this is a 'gotcha' waiting in the wings. At the moment, it is projected to be only $240 billion but in nine years, it is projected to be almost $1 trillion.

Tax Breaks and Incentives - Technically speaking, these aren't true expenditures because they are not obligations that must be paid. They act like outlays, however, because they reduce expected revenues and are just as real as an actual debt ... this is what should be called a revenue problem. Tax breaks and incentives take two forms; they are the ones you are used to seeing on your Form 1040, mortgage interest deductions and the like but corporations get huge tax breaks as well as incentives, i.e., welfare, that are part of the tax code which is deeply hidden from prying eyes. No matter which way you cut it, these are a drain on expected revenue and must be considered a cost of doing business.

It is these five things the CUT, CAP, and BALANCE plan is trying to put a tight structure (some say straight-jacket) around; to create a plan such that government does not spend, via discretionary, mandatory, or tax breaks/incentives, more in outlays than it takes in from taxes and other sources so that interest on the debt is held in check and that spending is never more than 18% of GDP, no matter where you are in the economic cycle. Notice that borrowing money is no longer part of the equation, only interest from previous borrowing.

This is going to be quite a trick, don't you think?

And The Answer is ... You Can't.

THE ONLY WAY this feat can be pulled off is by magic, for it is simply impossible in the complex real world we live in. The reason it won't work is simple, lack of flexibility and responsiveness.

Two brief examples should make it clear as to why:

LACK OF FLEXIBITY: Why the CUT won't work - Let me create my simple world. Assume the following:

- Clinton's budget balancing worked beyond belief and wiped out the national debt by 2000. This is done to make the playing field as uncomplicated as possible.

- Bush did what Bush did, i.e, cut taxes, invaded Iraq, and responded to the 9/11 attack with the attack on Afghanistan and are still going on in 2008.

- The housing bubble burst and the 2008 recession happened just as it did.

- The Gross Domestic Product (GDP) from 2000 to 2008 was a constant $10 trillion; a made up number

- The Conservatives got their wish and the only thing the federal government spends tax dollars on is Congressional and Executive pay and National Defense.

The budget for these two items must be no more than 18% of GDP, according to CAP rules; this would be $1.8 trillion/annually. In 2008, the recession hits and GDP declines first 6% in 2008, and then another 5% in 2009, before reversing and climbing 2% in 2010.

What does that mean? It means that by the end of 2008, GDP fell to $9.4 trillion and by the end of 2009, it fell to $8.93 trillion. It then follows that national defense and Congressional pay must automatically be cut to $1.69 trillion (or a $ .11 trillion cut) in 2009, and to $1.61 trillion (or another $ .08 trillion) in 2010. Remember, America is still fighting two wars and the tax cut was unpaid for.

What is Congresses response? The Cap and Balance part of the Cut, Cap, and Balance program tie Congress' hands. The Cap requires the outlays be reduced for the only two items in the federal budget, national defense and Congressional/Executive pay, regardless of next years requirements. The Balance part says that Congress cannot borrow money, for expenses must equal revenue and becuase GDP fell, so did revenue. So, the only alternative left is cut the pay of Congressional and Executive workers as well as reduce what we can deliver in terms of National Defense. If GDP falls again the following year, as it does in our example, pay and National Defense gets but again.

No, No, Nanette

NO, NO, NO say Republicans, "we have that covered! We put in emergency provisions into our program."; and, yes they did. The CCB program would require a 3/5 vote to waive the 18% Cap limit for one year and a 2/3 vote to let expenses exceed revenues (borrow) for one year (waived in the case of declared war).

That means it would take only 34 (2/3) members of the Senate or 146 members of the House to prevent current levels of National Defense and Congressional/Executive pay from being maintained in our example; remember that we are fighting two undeclared wars and, in reality, there are enough members of each house right now who oppose Iraq and Afghanistan to muster the requisite votes to block waiving the provisions of the CCB program were it to have actually have passed. Consequently, I don't feel my simple example is so far-fetched after all.

LACK OF RESPONSIVENESS: Here is another brief example. What if we had the Iraq invasion of Kuwait scenario. How would President Bush's hands have been tied if the CCB been in place in 1990? This was another undeclared war so the provisions of the CCB could not be waived. As a result, you would need a 2/3 agreement in BOTH houses in order to waive the balanced budget requirement so that government could borrow money to fund a response to the invasion. That is a very high hurdle and given the controversy surrounding the original decision, it may take considerable time to approve the funding to respond to the invasion, if a response would be allowed at all.

In effect, you turn over the ability to react to events effecting national security and all other emergencies to 1/3 of the elected representatives and takes it away from the Executive branch. Somehow, I do not think this is a good thing, do you?

IT SOUNDS GOOD, BUT IT IS A TERRIBLE AND DANGEROUS IDEA

A WHOLE BOOK could be written on the dangers of Cut, Cap, and Balance. In fact, there may be one in the Amazon list down below; I have only touched on the surface. The Conservative argument is that we should run our government budget like we run our household budget; this is, on the face of it absurd. Just like my example above, assume your only two expenses were your mortgage and your meals and that every penny your family made went to pay for these two things every year. Then one year your GDP (your income) falls 20%. Well, CCB says you can't borrow money so what do you do? Sell your house? Lose a little weight because you have to involuntarily eat less? See how ridiculous this is when you simplify the scenario and make the choices stark?

Of course, the real world is much, much more complex and the consequences of not being able to be flexible with your budget at a national level can be catastrophic. The question is, do you really want to play with that much fire? Remember, part of this bill is a Constitutional amendment; as difficult as it is to get one passed, it is just as difficult to get one reversed and a lot of damage can be done in the meantime.

Mitt Romney loves to say the President Obama doesn't know what he is doing, that he doesn't understand the economy; I have to wonder if it really isn't the Conservatives who doesn't understand how the economy and federal budget really is supposed to work.