Facing Up to the Consequences of our History

The Lingering Financial Crisis

When you are living in the midst of an ongoing crisis, a few years can seem like a long time. But decades later, when people look back to explain these events, a couple of years might be viewed as a small part of a larger historical era. And with the benefit of hindsight, people will develop a better sense of the causes of the crisis and of its long-term effects. Explanations that may seem plausible now will someday be discredited, particularly those that attempt to explain what is happening right now by focusing on very recent events and decisions.

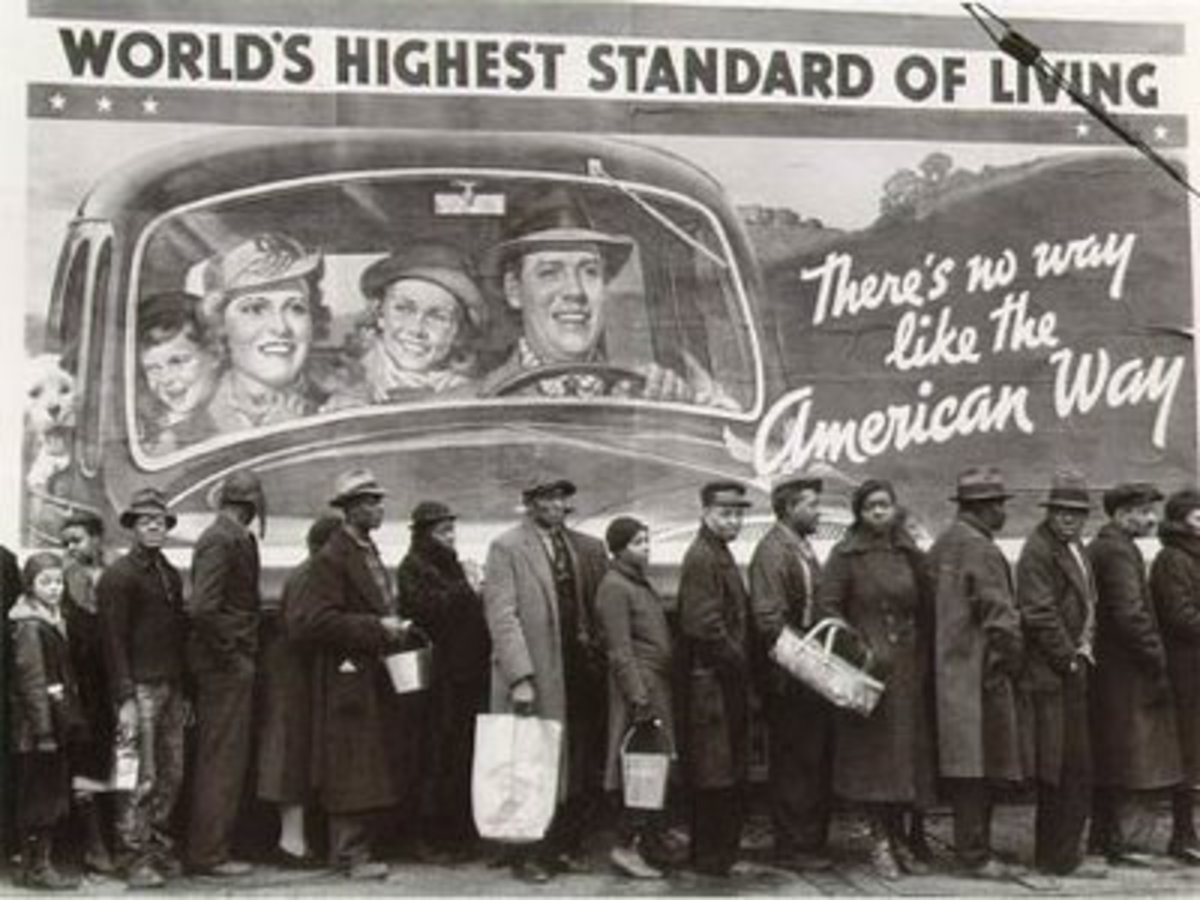

As I have learned through personal experience over the years, Americans are not particularly enthralled with the subject of history. Many people see events of the distant past as basically irrelevant to their lives today. And to Americans, the term “distant” often refers to a small number of years. So if a president, economist, or anyone else explains current circumstances by referring to events in the “distant” past, many Americans will instinctively reject that hypothesis. For just as the present is all that matters, explanations for our current situation must be rooted in the present. If someone blames current circumstances on mistakes made in the past, then he or she is probably a politician making excuses. Or, worse than that, he or she is some sort of a pessimistic fatalist claiming that we are doomed to suffer from past mistakes. America is supposed to be a land of “can-do” optimists who pull up their bootstraps and dig their way out of a crisis. So instead of fixating on the dead past and blaming someone else, we need to focus on the here and now and take responsibility for our situation.

To a certain degree, I agree with this attitude. Like it or not, we all have to deal with the present situation in which we find ourselves, and complaining about the past isn’t going to change it. Still, this fixation on the present can have some negative consequences. It can cause people to have an inflated sense of personal responsibility, leading them to beat themselves up over circumstances out of their control. It can also lead people to buy into simplistic or outright inaccurate explanations for the present situation, either forgetting or discounting the role of historical factors. And when this happens, too many people fail to learn some important lessons. They may also go running to aspiring leaders who claim to have the answers and blame everything on the opposing political party or other convenient scapegoats.

There is no single, simple explanation for the current economic and fiscal mess. I can say with some confidence, however, that you must go back years or even decades to formulate a decent explanation for the situation. Entitlement reform should have started years ago instead of waiting for a fiscal crisis to initiate some action. The population has been steadily getting older for decades, and short of letting older people drop dead, this trend will continue. So whether Republican or Democrat, people must come up with practical responses to this inevitable reality. Cutting taxes while embarking on a global war on terror was also not a fiscally responsible decision. But even if people in congress pull their heads out of their collective asses and implement some fiscally responsible policies, the government will continue to be saddled with debt if the economy does not start growing at a more significant pace.

So why are we still stuck? Is it the fault of gridlocked, inept Washington DC; state and municipal budget cuts; tighter lending practices; jobs eliminated by outsourcing and automation, fearful consumers; corporations unwilling to hire; the European debt crisis; high oil prices; recent natural disasters; illegal immigrants; or God punishing us for our sins? Other than the last one (and maybe two) items in my list, you could make a good case that all of those factors have played some role in the current situation. I do not personally believe, however, that any of these are the primary cause. Instead, we are paying the consequences for our history. What came to light a few years ago as a financial crisis triggered by foolish and unethical lending practices, along with other complex financial shenanigans, is still far from being over, and many of the items in the above list are at least partly the result of this financial collapse. The housing and construction sectors continue to be a tremendous drag on the economy, and it may take as many years to unravel the bubble as it took to build it in the first place. Prices are still too high, and too many people owe more on their homes than they are worth. So as people face foreclosure or just choose to walk away, more homes go out into the market, depressing prices further. And so the cycle continues.

The relative prosperity of the decade before the financial crisis, and the relative fiscal health of federal and local governments, was largely an illusion. As home prices went up, people who stayed in their homes thought that they were richer than they actually were, and some of their consumption was fueled by easy to get home equity loans. Others pocketed large amounts of money by flipping homes, and the real estate and construction sectors became bloated with all of the easy money to be made. Smart people either avoided the irresponsible behavior or walked away with the money before the bubble popped. Even smarter people bet on the bubble popping and ran off with even more money. And when the scam was finally revealed, no one forced the scammers to give the money back. Instead, the government bailed out the biggest fools, the large financial institutions, while never asking for some of those bonuses made by their employees during the boom years. So now the people who did not profit from the insanity are left holding the bag, and some of those people in the formerly overgrown real estate and construction sectors have not found anywhere else to go. And as people lost access to the easy money, they adjusted their consumption accordingly. Businesses adjusted by cutting back and shedding jobs, leading consumption to be further depressed. So far, this vicious cycle has not been sufficiently stopped.

No matter what anyone might do, this history cannot be unwritten. And just as some benefited from the party while it lasted, many now have to suffer from the hangover. We should be wary, therefore, of anyone who claims to have the “magic bullet” to get us out of the mess. This is not, however, an argument for excessive pessimism. For just as financial bubbles always come to an end, history shows that economic crises tend to play themselves out. The trouble is that we do not know at the moment how long this might take. It may come to an end soon, or it may have only just begun. In historical terms, three years is not a very long period of time, a fact that it not particularly comforting when you are in the middle of a story where you don’t know the exact ending.