Fair Tax - What Is The FairTax Act Law?

Fair Taxation with Representation?

Fair Tax Act

You might be wondering who is behind The Fair Tax Act. Is it the crazy left wing liberals? Maybe it's the wild eyed extremists on the right? Or is it those loony libertarians? However, supporters of the Fair Tax Act (H.R. 25) transcend all party lines.

Moreover, the Fair Tax supporters don't fit any predetermined mold. They come from all walks of life, rich, poor, upper class, and middle class. No, it's pretty hard to peg Fair Tax supporters. Therefore, just like the Boston Tea party protesters, they represent a broad cross section of America. They are liberal, conservative, libertarian, and everything else in between. Moreover, it is an American cause and believe it or not, it is not about politics at all. It's about taking back control of our government, and returning power back to the people, where it belongs in the first place. That is why I believe that the “Fair Tax Act” is better taxation with proper representation.

What Is The Fair Tax Act (HR 25, S 296) you might ask?

It Is the nonpartisan legislation. It abolishes all federal personal and corporate income taxes, gift, estate, capital gains, alternative minimum, Social Security, Medicare, and self-employment taxes and replaces them with one simple, visible, federal retail sales tax administered primarily by existing state sales tax authorities. (Fairtax.org, 2009a)

Therefore, the Fair Tax is a single-rate of 23% of federal retail sales tax collected only once, at the final point of purchase of new goods and services for personal consumption only (it is the final sellable product). Furthermore, all used items, and business-to-business purchases for the production of goods and services are not taxed. A rebate makes the effective rate progressive. Moreover,

The Fair Tax Act (H.R. 25) has several objectives

Including tax simplification and economic growth. It abolishes the Internal Revenue Service (IRS), the federal agency that currently collects and administers federal taxes, and shifts the vast majority of these responsibilities to the individual state sales tax authorities.

Adopting such a fundamental reform would have implications for the entire process of collecting and administering taxes in the United States. The roles and responsibilities of governments at all levels, businesses, and individuals would change under the FairTax.

Individuals would no longer file tax returns, businesses would be responsible for collecting and remitting the tax to the states, and state governments would process the revenue collections and forward the appropriate revenue amount to the federal government. (Tuerck, David G, 2007)

However, under our current Income Tax System, an individual can make an undisclosed amount of unreported income and not report it on their tax return. Moreover, this act of tax evasion is responsible for sucking billions and trillions of revenue away from our national treasury on an annual basis.

America has two economies: First, there's the legitimate economy, in which craftsmen are licensed and employers and employees pay taxes. Then there's the fast-growing underground economy, where millions of nannies, construction workers, landscapers and others are paid off the books, their incomes largely untaxed. The best guess as to the size of the output of this shadow economy is about $970 billion, or nearly 9% that of the real economy. It could soon pass $1 trillion. (McTague, Jim. 2005)

Furthermore, this willful act of tax evasion, which is wide spread on all economic levels, would come to a complete halt should the FairTax Act be implemented. Therefore, this act ensures Social Security and Medicare funding for future generations to enjoy. However, this security that might not be around by the time you or I retire under the current economic deficit. Furthermore, there would not be any more tax shelters for the rich to get richer and the poor to stay poorer. Moreover, the Fair Tax Act closes all loopholes and brings fairness to taxation. Therefore, the Act brings with it transparency and accountability to the tax policy.

The FairTax taxes us only on what we choose to spend on new goods or services, not on what we earn. The FairTax is a fair, efficient, transparent, and intelligent solution to the frustration and inequity of our current tax system. (Fairtax.org, 2009a)

Payroll Taxes

The Fair Tax plan is a comprehensive proposal that replaces all federal income and payroll based taxes with an integrated approach including a progressive national retail sales tax, a prebate to ensure no American pays federal taxes on spending up to the poverty level, dollar-for-dollar federal revenue neutrality, and, through companion legislation, the repeal of the 16th Amendment. (Fairtax.org, 2009a)

Therefore, This Act will allow workers to keep their entire paychecks, retirees to keep their entire pensions and will provide refunds in advance for the tax on purchases of basic necessities. However, under the 16th Amendment we impose taxes on wages, social security, pensions, and offer only the Welfare system to assist with basic needs for low income families. Therefore, the Probate works like this:

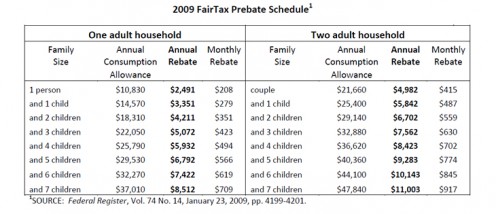

All valid Social Security cardholders who are U.S. residents receive a monthly prebate equivalent to the Fair Tax paid on essential goods and services, also known as the poverty level expenditures. The prebate is paid in advance, in equal installments each month. The size of the prebate is determined by the Department of Health & Human Services’ poverty level guideline multiplied by the tax rate. This is a well-accepted, long-used poverty-level calculation that includes food, clothing, shelter, transportation, medical care, etc. (Fairtax.org, 2009c)

2009 Fair Tax Prebate Schedule

How The Fair Tax is collected

By retail businesses from the consumer, just as the current sales tax that is currently collected. However, the Fair Tax is simply an additional line on the current sales tax reporting form. Firstly, retailers collect the tax and send it to the state taxing authority. Secondly, all businesses that are serving as collection agents receive a fee for collection, and the states also receive a collection fee. Thirdly, the tax revenues from the states are then sent to the U.S. Treasury.

Under the FairTax Plan, poor people pay no net Fair Tax at all up to the poverty level! Every household receives a rebate that is equal to the Fair Tax paid on essential goods and services, and wage earners are no longer subject to the most regressive and burdensome tax of all, the payroll tax. Those spending at twice the poverty level pay a tax of only 11.5 percent -- a rate much lower than the income and payroll tax burden they bear today. (Fairtax.org, 2009c)

However, our present income tax system is one of the reasons that people are finding it so hard to get ahead these days. Furthermore, this is also one of the reasons that our next generation will not have a standard of living as high as ours. Therefore, our current system of taxation is holding us back and making it to impossible to improve our future generation’s standard of living.

Imagine The FairTax -

Fair Tax Dramatically Improves Economic Growth

Under the federal income tax, slow economic growth and recessions have a disproportionately adverse impact on lower-income families.

Breadwinners

in these families are more likely to lose their jobs, are less likely to have

the resources to weather bad economic times, and are more in need of the initial

employment opportunities that a dynamic, growing economy provides. Retaining

the present tax system makes economic progress needlessly slow, thus harming

low-income people the most.

In contrast, the FairTax dramatically improves economic growth and wage rates

for all, but especially for lower-income families and individuals. In addition

to receiving the monthly FairTax prebate, these taxpayers are freed from

regressive payroll taxes, the federal income tax, and the compliance burdens

associated with each. They pay no more business taxes hidden in the price of

goods and services, and used goods are tax free. (Fairtax.org, 2009c)

Moreover, it is making it difficult for our businesses to compete with the international markets and it is wasting valuable resources by forcing us to complying with needless paperwork.

The current U.S. income tax code is widely regarded by just about everyone as unfair, complex, wasteful, confusing, and costly. Businesses and other organizations spend more than six billion hours each year complying with the federal tax code. Estimated compliance costs conservatively top $225 billion annually—costs that are ultimately embedded in retail prices paid by consumers.

The Internal Revenue Code cannot simply be "fixed," which is amply demonstrated by more than 35 years of attempted tax code reform, each round resulting in yet more complexity and unrelenting, page-after-page, mind-numbing verbiage (now exceeding 54,000 pages containing more than 2.8 million words). (Vance, Laurence M, 2005)

There is only one word to describe the fact that the federal government now spends almost $3 trillion a year: obscene. At least 90 percent of what the federal government spends is unconstitutional, wasteful, or against the limited-government principles of the Founders. The only thing the Fair Tax does is change the way the state confiscates the wealth of its citizens. As Congressman Ron Paul says: "The real issue is total spending by government, not tax reform." (Vance, Laurence M, 2005)

Fair Tax Benefits

Therefore, we as American’s can do better and we must. However, some individuals would like taxes to completely disappear.

Because the Fair Tax is a consumption tax, Murray Rothbard's conclusion about consumption taxes is apropos:

The consumption tax, on the other hand, can only be regarded as a payment for permission-to-live. It implies that a man will not be allowed to advance or even sustain his own life, unless he pays, off the top, a fee to the State for permission to do so. The consumption tax does not strike me, in its philosophical implications, as one whit more noble, or less presumptuous, than the income tax.

The Fair Tax does nothing to tame the federal leviathan. The solution is nothing less than a drastic reduction or wholesale elimination of its revenue source. What is fair about allowing the government to confiscate 23 percent of the value of every new good and service? Fair Tax proponents may call it necessary legislation, but I call it highway robbery. (Vance, Laurence M, 2005)

However, what individuals like the above fail to understand is that,

Research on the price of consumer goods reveals that up to 20% of all prices today represent hidden income taxes and payroll taxes. Once these taxes are repealed and replaced with the FairTax, it is likely that market pressure would force retail prices to fall.

Eliminating embedded taxes will also do something else -- it will remove significant price disadvantages suffered by American producers competing with tax-free imports. Eliminating corporate income taxes and capital gains taxes, which the Fair Tax would do, would likely make the American economy the most desirable place in the world to do business.

Another benefit of the Fair Tax is that, unlike other sales taxes, it would not hit the poorest Americans the hardest. The Fair Tax proposal calls for sending every American a "prebate" check to offset the cost of the national sales taxes paid by those living in poverty. This feature would effectively exempt those living below the poverty line from paying taxes to the federal government, and provide all taxpayers with a reimbursement of a portion of taxes paid.

The Fair Tax rate is 23% on retail sales when calculated "inclusively," as are income tax rates. It will, in a fairer, more transparent and less-expensive way, raise the same amount of money the federal government now collects through the income and payroll taxes. Because it would be levied on consumption at the final point of sale, instead of on earnings, it would dramatically expand the tax base. The Fair Tax would collect revenue from the underground economy. Even illegal immigrants and the 40 million foreign tourists who visit the U.S. each year would pay it. (Linbeck, Leo, 2007)

FairTax Greatest Benefit

The distributional effects of the Fair Tax have been extensively studied, and although the proposal has distinct advantages for investors and wealth creation across the income spectrum, the greatest benefit of the Fair Tax is to low- and moderate-income Americans. The effect of eliminating regressive payroll taxes is commonly overlooked when analyzing the Fair Tax, but it would have a very significant impact, as these taxes represent the single largest tax burden on these income earners.

Significantly, the Fair Tax eliminates all loopholes, gimmicks, exemptions and deductions from the federal tax system. Under the Fair Tax, Congress would no longer be able to reward friends, punish enemies or manipulate behavior through the tax code. The Fair Tax would also eliminate the lucrative tax lobbying practices that represent more than 50% of all lobby dollars spent annually in Washington.

It's no surprise, then, to see that vested interests have argued against the Fair Tax and in favor of keeping the mortgage interest deduction. But wouldn't it be better for everyone to stop the IRS from withholding from paychecks; to see the price of new homes -- and all other goods -- drop by removing embedded costs; and to have interest rates fall as the savings rate increases? Is it really in everyone's interests to keep the income-tax system so that one-third of taxpayers can go on deducting a portion of their mortgage interest from their federal taxes?

There have been many tax reform proposals over the years, but most of them simply call for reforming around the margins of the existing tax system. The President's Advisory Panel on Tax Reform was assembled by the Bush administration and concluded its work a few years ago. Instead of seriously looking at the Fair Tax, the panel looked at a very different type of consumption tax, riddled with exemptions, and then declared that it would be too expensive and that the rate would have to be far higher than the Fair Tax rate.

In Conclusion

Politically, the Fair Tax will only become law once enough citizens demand that it be enacted, overcoming the self-interest that members of Congress and others have in holding onto the current system. It is debatable whether a modern, citizen-led tax revolution is possible. But the growing popularity (even among presidential candidates) of the Fair Tax suggests that another Boston Tea Party may be at hand. (Linbeck, Leo, 2007)

I want to see this country return to the principles of personal freedom, liberty, and the pursuit of happiness. Therefore,

Do women have the right to vote in this country? Did we pass Prohibition? Did we repeal it? Do Civil Rights guarantee freedoms far beyond the lunch counter and mass transit? Do free-market economies dominate Eastern Europe, peoples once under the boot of communism?

All these were grassroots efforts that

effected significant changes in our nation and the world. Is the current income

tax system any less a yoke around the necks of otherwise free peoples? We think

not.

Passing the original 16th Amendment and the income tax wasn’t easy and

repealing the income tax and the 16th Amendment won’t be easy either.

That is why the Fair Tax has undertaken to build a grassroots movement and grassroots alliances to support the effort. When the Fair Tax generates unprecedented economic growth in the first few months of its effective date, citizens nationwide will make it clear to Washington that they want to make the change permanent. But this will only happen when the American people rally behind the effort, throw off the yoke, and demand rectification of 90 years of wrongs done by the income tax. (Fairtax.org, 2009b)

Moreover, our great “America” was

founded upon these principals and somehow we have allowed our government to

slowly take away our freedom. Furthermore, it is time that the sleepers awaken

to a new dawn and we demand our freedom from taxation without caring

representation. Therefore, that is why I believe that the “Fair Tax Act” is better taxation with proper

representation.

A Final Word

I hope you found this article informative and content rich. Please feel free to leave your comments and share your own observations. Send me an email if you have a request on a topic of interest or just to say Hello! It’s FREE to join my Fan club, Subscribe by Email, my RSS Feed, or simply join me here on Hub pages with a click of your mouse.

Article(C)2009 - 2010 cluense, all rights reserved. Cluense creates articles and posts online. She creates articles on, accounting, entrepreneur, political issues, small business, society, relationships, taxes, work from home businesses, and Tutorials. She also has a strong passion for writing.