American Dream: Tax Policy Part 2 - Taxing the Wealthy.

Money, Money, Money

THEY SAY IF YOU write long comments, you should make a hub out of them; well, in this case I did. Normally, when I write, I generally do not know where I am going to end up at the time I start, and this is one of those times; I rather liked the direction my comment was going and wanted to expand a little bit one it. So, here is my comment to @LoveMyChris in my hub "Grover Norquist and the Tea Party Got Their Wish, They Broke America: The "Super Committee Fails"; I put annotation in [ ] and used undelines and bolding for emphasis which I couldn't do in the original comment.

While I agree with your [LoveMyChris] whole premise, I put it in different terms. First, look at the basic facts, the wealthy DO pay more, as a percentage, of their income in taxes than the rest of us, those that play by the rules anyway; that is a given. So saying [sarcastically] they shouldn't pay taxes or the such doesn't quite cut it; they do pay taxes and a lot of them.

The question I have is, do they pay enough in taxes to make up for the extra advatages their wealth affords them simply because they live in our society that is not available to the rest of us because we are not as wealthy and is totally independent on their ability to be productive; I personally do not think they do.

Nor do I think the tax code takes into account the natural unfairness built into any unrestrained Capitalist system that, because of its nature, provides positive feedback to those who succeed and NEGATIVE feedback to those who either "just do OK" or fail; this is the "rich-get-richer and the poor-get-poorer" effect. [Positive feedback means once the status quo is broken, those on the wining end keep winning at an accelerating rate, while Negative feedback is just the opposite.]

This leads back to my first point, because our system supports Capitalism, and rightly it should, the more powerful capitalists become, the better able they are to influence the tax laws effective them, therefore increasing their wealth and power even further[; much more so than their less wealthy fellow Americans.]

Now back to your statement about fuedal dictatorship or, more likely, corporate oligarchy ... left on its own, that is where Capitalism leads when uncontrolled. Capitalism [if allowed to] naturally redirects wealth from the poor to the rich, I don't call that welfare for the rich simply because it is a function of the operation of Capitalism itself; I like [the term] redistribution myself.

Consequently, it is my opinion, the government has every right to 1) correct that redistribution and let the less wealthy participate in the bounty of America's success and 2) counteract the ability of the wealthy to positively influence government and financial activity in order to increase their wealth without any productive activity that the rest of us have to put in to earn a dollar."

EVIDENCE OF UNEQUAL WEALTH DISTRIBUTION

Click thumbnail to view full-size

The Coup de Grace

I TOOK THE CHARTS above from my hub, "One Aspect of the Occupy Wall Street Movement ..." (see link below) which discussed wealth redistribution in much more detail. I present them again here just to emphasize that yes, indeed, wealth has been unfairly redistributed from the lower classes to the top 5% of society.

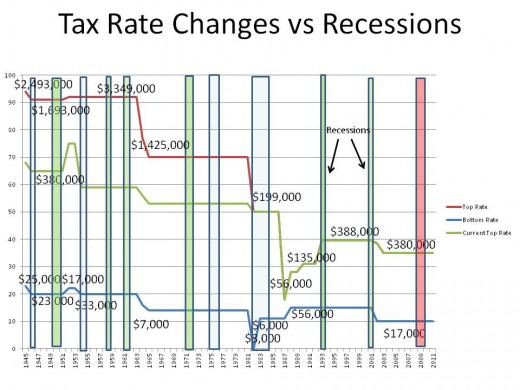

CHART 1 clearly shows that tax rates on the wealthy have been slashed massively while the tax rates on everybody else was much less impacted. For the very wealthy, tax rates fell from a high of 94% on income over $2.2 million to 35% today on $380 thousand; that, by itself, is not too meaningful a number because the top threshold bounced around all over the place over time. More meaningful is to look back and see what today's top tax rate threshold, $380,000, was taxed at back in 1945, which was about 72%. This is about a 50% cut.

The bottom rate from the chart, you will say, fell by around 50% as well, from 22% to 10% on $17,000; that is fair isn't? Well, let's put some taxable income numbers to it. Let's say our rich guy made 1% or $3,800 more 1952 as well as 2011 and our poverty-level guy made 1% or $170 more in 1952, as well as in 2011.

The additional tax our rich will pay on that extra $3,800 in 1952, is $2,850, the marginal tax rate times $3,800, while in 2011, it will be only $1,330, a savings of $1,520 or 75%. For our guy in poverty, however, the calculations are a bit more complicated because the tax rate is a ceiling, rather than a threshold. So, to turn an apple into an orange I need to look at the next higher tax rate and use that. In 1952, the next tax rate above 22.2% is 24.6%. Therefore, in 1952, an additional $42 was paid on that $170 and in 2011, the next higher tax rate is 15%, so our taxpayer is now paying $21 more; a $21 or 50% decrease from 1952; compared the 75% for our rich taxpayer..

In order to be equitable, the poverty-level taxpayer should have paid $42.50 less in taxes. So, here is the question, how much more is $42.50 worth in quality of life to a person whose annual earnings is $17,170 when compared to the $950 extra the taxpayer who earns $383,000 received because of a higher proportional tax deduction? Why might it? Because that $42.50 might actually put needed food on the table or buy a bottle of medicine, while the $950 goes toward a party for other family's soiree.

If the Poor are paying more on their Additional income in 2001 than in 1952, shouldn't the Rich may more also?

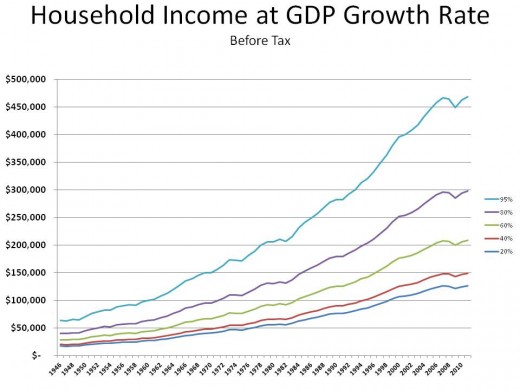

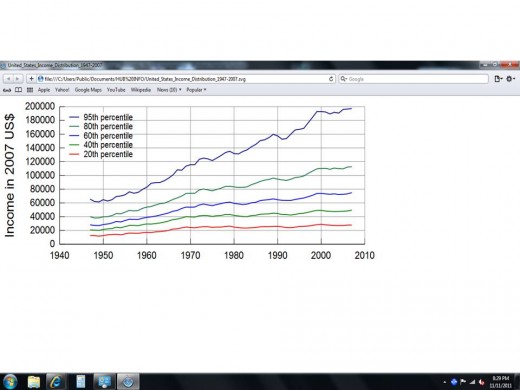

INCOME DISTRIBUTION 1946 - 2010

A Pictoral Guide to Unfair Wealth Distribution

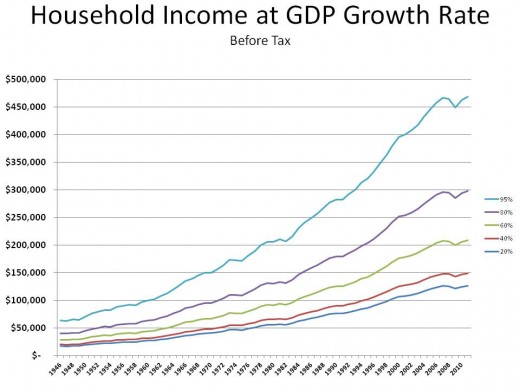

IF YOU TAKE A QUICK LOOK at Chart 2, you will see a series of upward sloping lines; each line represents an income group with the top line being the top 5% of income earners. The rest of the lines are broken down by 20% income levels; the chart ranges from about 1945 to 2011. For this discussion, the important numbers to keep in mind is that the percentage difference between the bottom line and the top line in 1945 is around 360%; in 2011, it is also about 360%. That means the top 5% of wage earners on the this chart always earn about 3.6 times more than the bottom 20%; not unexpected or unrealistic.

Now, Chart 2 is a hypothetical chart; it assumes all income levels participated equally in the growth and decline in America's economy over time in ALL income groups ... a FAIR economy, in other words, with no income group having an advantage over another.

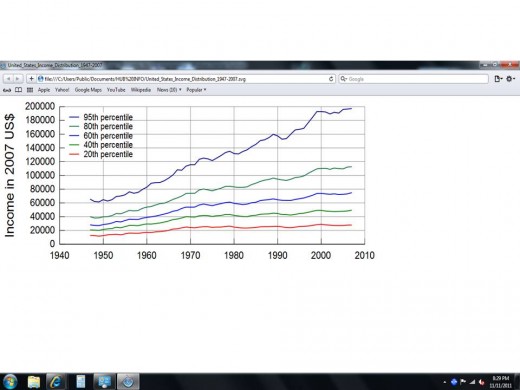

Now look at Chart 3; this is reality. It sort of looks the same, but it isn't, not by a long shot and it is very easy to see why. In 1945, the percentage difference between the lowest income group and the top income group is the same 3.6%, since I used the same starting point for both charts. In Chart 2, I let each income group grow or decline according to how the GDP changed that year, Chart 3, on the other hand, shows how income actually changed, consequently, the end points for each income level are substantially different.

In Chart 2, where all incomes grew according to GDP, the difference between the bottom and top income levels by 2011, is 300%, the same as it is in 1945. However, in Chart 3, reality, the difference between bottom and the top is 900% rather than the 300% where they started out at. That, my friends, is redistribution of wealth from the lower income levels to the top income levels.

How Do You Correct It and More Important, Should You Fix It?

TO ME, THE ANSWER to the last part of the question is self-evident ... a resounding YES! Not fixing it goes against everything good I believe this country stands for; it is simple as that. To let the kind of inequity I just presented exist in our society is just plain nonsense and unAmerican.

I am not even going to attempt to suggest how to change the tax code in this hub, I have my ideas, of course, I have ideas about everything, if you haven't noticed. But, I will make the following remarks:

- There should be a price put on the access the wealthy have to influence the financial markets and government simply because they are wealthy and they are not paying it.

- There should be a price put on the advantages one receives when one attains a certain level of wealth; doors open that are not available to others which allow the accumulation of greater wealth that is the result of unproductive work.

- Much of the inequity can be changed with changes to the tax code.

- You will never, ever be able to stop the rich from using their wealth from earning additional, unproductive wealth, often at the expense of the less wealthy, but you can regulate it and you can tax it, especially if it is at the expense of the less wealthy.

- You can't stop, nor do I believe you should stop, the wealthy from using their influence to shape policy through lobbying; that, up to a point, serves a useful governmental function, in my opinion. But, if Congress has the will, and the People make them do it, this can also be controlled.

It is all hard, but it can and should be done.

This content is accurate and true to the best of the author’s knowledge and is not meant to substitute for formal and individualized advice from a qualified professional.

© 2011 Scott Belford