Obamacare: Supreme Court's Hands May be Tied

from the Curmudgeon's desk:GA Anderson

The legal challenges to Obamacare may not be decided by the Supreme Court. Legal scholars and analysts are lining up on both sides of this issue, but the 1867 Federal Tax Anti-Injunction Act may leave the the Supreme Court justices with their hands tied.

In what seems to be a replay of the definition of "Is" Clinton argument, the rule of law may be already decided by the Anti-Injunction Act. U.S. Court of Appeals for D.C.Judge Brett Kavanaugh, has already suggested that his colleagues erred in reaching their decision because of their pragmatic desire to reach the merits of a health law challenge.

“There is no ‘early-bird special’ exception to the Anti-Injunction Act,”

Judge Kavanaugh chided his colleagues in a mostly procedural dissent from an opinion upholding the ACA on the merits.

Now it appears that the basis for his reasoning may mean the Supreme Court could be barred from hearing the Obamacare challenges. At least until the legal merits of the Anti-Injunction arguments are settled. Which amounts to a challenge of the challenge.

The Federal Tax Anti-Injunction Act of 1867

In layman's terms the The Federal Tax Anti-Injunction Act of 1867 requires taxpayers who object to the federal government’s assessment or collection of a tax to first pay up and only then bring a lawsuit seeking a refund, rather than marching immediately into court to ask for an order restraining the Internal Revenue Service. It prohibits bringing suit for an injunction before the tax has actually been paid.

The purpose of the Act initially was to facilitate the states ability to have quick and easy tax collections, without having to wait for court injunctions to play out. A second purpose was to protect tax collectors from refund suits.

Since the Supreme Court is a Federal court, perhaps technically it could be bound by the act and unable legally to even hear the case, much less pass a judgement.

It was Obama's initial planned defense for Obamacare

Initially, the Tax Anti-Injunction Act was the Obama administration's defense position when the Obamacare challenges started going to the courts, but it could only be used for Federal court rulings, not State courts, because the original purpose of the Act was to protect the states from federal intrusion.

But... the resulting mess, both as public relations, and fiscal issues, would smell so bad that even the Obama administration has now backed off that defense and has joined in the plaintiff's briefs seeking to argue that the Tax Anti-Injunction Act doesn't really apply to the case of Obamacare, and it is within the Courts pervue to hear the case.

The worst case scenario for taxpayers

It is because the Act requires a tax be paid first, then contested, that it would be such an expensive ruling if the courts deemed it valid.

The Obamacare "tax" would not take effect until 2014. And it would not be paid by anyone until tax time 2015.

The result - three years worth of program implementation, with all the associated program costs to both the government and private entities, plus the potential that Obamacare could decimate the private health insurance business - all for naught if the Supreme Court did find against Obamacare in its 2015 session.

That is potentially massive money to government and private entities, and massive damage to the private healthcare economy. Even the Democrats aren't willing to take the chance of having that hung around their neck.

The Real Obamacare Question

The Patient Protection and Affordable Care Act, [Obamacare], poses such a fundamental constitutional question that there is no surprise that it is one that will have to be decided by The Supreme Court of the Land.

Can your government, (Congress), force you to buy something? No matter how the question is phrased or framed, nor what context is applied to it - the constitutionality of Obamacare boils down to that simple question.

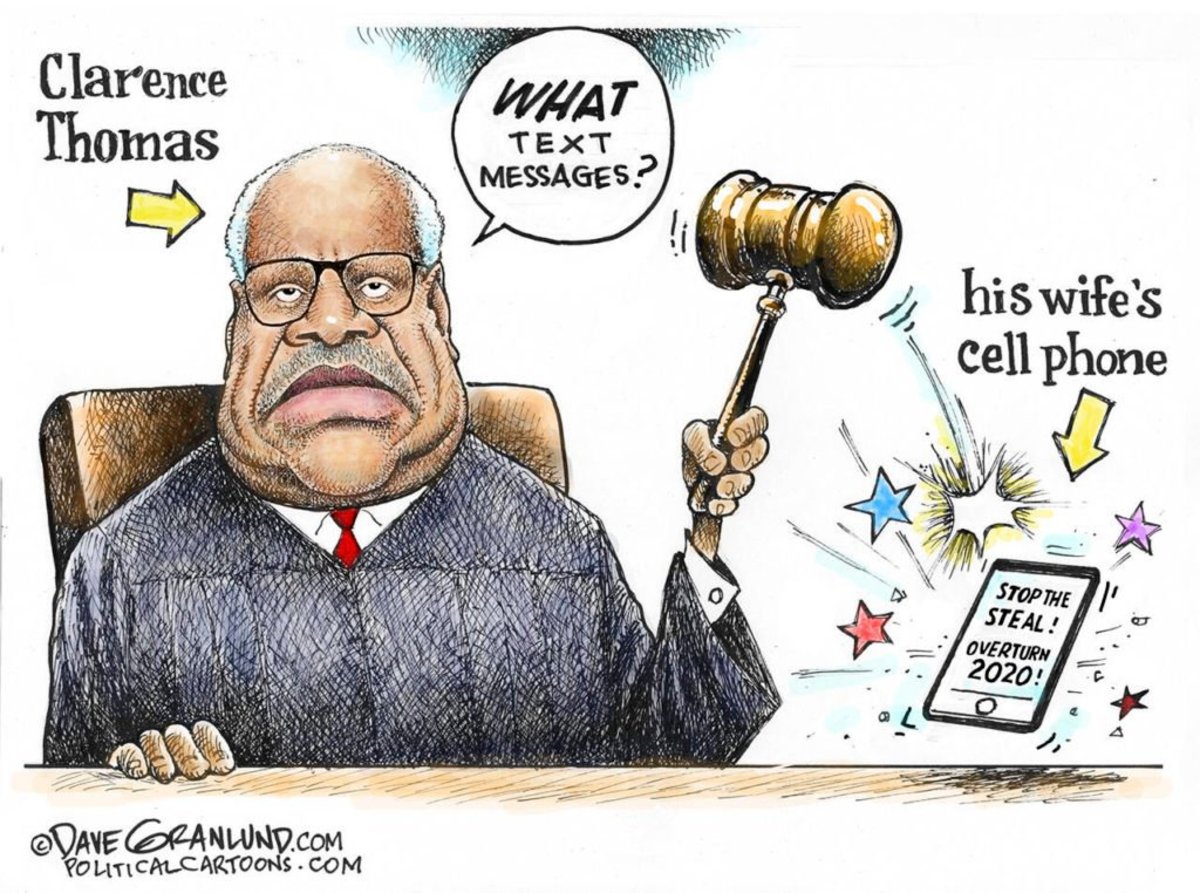

Another primary question that will surely be addressed in the Court's decision is whether the Commerce clause gives Congress the power to levy a "penalty," (a form of taxation), for what Congress calls "non-participation", but in reality means not buying.

Several state court challenges have already been decided - with mixed results, a win for Obama here, and a win for the states there. To date, the Obama wins have been on procedural and technical grounds, and the state's wins have been constitutional decisions.

This has surprised no one. All parties anticipated from the beginning that this issue would have to be settled by the Supreme Court. But now it appears that without either a separate legal decision on the application of the federal tax Anti-Injunction Act, or a legal consensus that the Act isn't applicable to the Obamacare question, the Supreme Court may be barred from hearing the case.

Is it a tax or a penalty

Referencing the analogy to Clinton's question of the definition of "Is", is the language Congress used in the law. The law calls the non-participation cost a penalty, not a tax. So some proponents are saying Congress is within its powers because it is not levying a tax. Opponents use the same language interpretation to say that very wording is why the federal tax Anti-Injunction Act does not apply to the case heading to the Court.

But everyone; proponents, opponents, the public, and the Courts, know this is just a semantics game, and the proponents of Obamacare know they are hiding behind semantics. No matter whether it is called a fee or a penalty - it is in all sense of the term, a tax. And that is the primary question the Court will address. Their decision on that question will also decide the question of Congress' power to force citizens to buy something. No one would even consider that Congress could force you to buy an American car for example, so why would they consider it proper for Congress to force you to buy healthcare?

The Legal Psychics Predict...

Both sides of this healthcare challenge agree the Court should hear this case. Delay would mean that many federal agencies, states, insurers, providers, and individuals would have to endure years of legal uncertainty, during which time many billions of dollars and enormous effort will be expended in implementing the myriad provisions of the health care law. Some or all of these provisions may not survive if the minimum coverage provision is invalidated, in which case all that money and effort will have been wasted.

Neither side wants this case barred from the Court, and the semantically trite arguments don't have much of a chance to succeed. The courts have established precedents of determining that whether it's called a penalty or a tax, it's still the same thing. So...

There is a light at the end of the tunnel. Several legal scholars plan on publishing an opinion in the Yale Law Journal Online that proposes that the tax Anti-Injunction Act does not apply for another very simple reason. The penalty/tax does not yet exist, it has not gone into effect yet, so the government’s authority to assess or collect a tax does not yet exist, a lawsuit challenging the tax does not have “the purpose” of restraining tax assessment or collection. Because the “penalty” for going without health insurance cannot lawfully be assessed or collected until 2014, challenges to the minimum coverage provision fall outside the prohibition of the Anti-Injunction Act.

In other words, the most sensible reading of the Anti-Injunction Act’s text and purpose is that it does not apply until the authority to assess and collect taxes has come into being, just as it does not apply after that authority has been exercised.

Voila', the Court is freed to hear the Obamacare challenges. The only surprise is that with both the administration, and the bill's opponents, wanting the bill to be heard - why didn't they think of that? It's not a semantical contortion of the Act, and it makes sense.

The Legal Psychic has peered into the crystal ball and predicts this is the interpretation the Court will accept, and Obamacare will have its day in court.

See more GA Anderson Political articles

See more GA Anderson Political and Social Issues Rants

I may not always be right, but I always have an opinion. See more of my writings at:

"Seeing it does not make it real, and reading it does not make it true. Use a little common-sense and trust your instincts." - GAA