Obamacare: in Plain English

Understanding effects of the law will help ease the spookiness factor.

Click HERE for an ACA/Obamacare reference guide

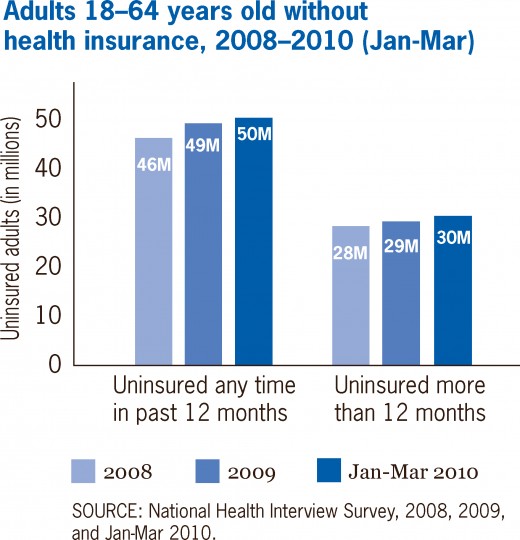

Our health care system is, for all intents & purposes, broken. Rather than targeted prevention, we administer countless tests & treatments & procedures. Rather than results-based reward system, we mostly rely upon fee-for-service care. Rather than a public-option of expanded Medicare, we have an individual mandate with Obamacare.

So what is ACA/Obamacare? and how did we get here?

While rhetoric would suggest otherwise - an individual mandate is the conservative approach of personal responsibility to universal coverage. Just ask the Heritage Foundation, Newt Gingrich and Mitt Romney.

Irregardless of the Supreme Court ruling, some conservatives are yet and still up in arms about Obamacare. The 112th Congress voted 33 times in an effort to repeal the law, costing us taxpayers $50 million. Republican governors are claiming refusal to implement the law in their states. More extreme voices have said It's a government takeover of healthcare. It's Socialism!

It is neither.

Being the good friend that I am, I did a bit of research on the Patient Protection and Affordable Act - detailed here for your convenience - so I might be able to allay some apprehensions of my conservatives brothers and sisters.

I have heard complaints that Obamacare is the largest tax increase in history. Some claim Obamacare is unwanted and unconstitutional - even since SCOTUS made their ruling. I would argue that there is a bit of evidence on this subject. Real life evidence in fact - as in Massachusetts - where literally less than one percent of residents choose to pay a tax penalty rather than procure themselves insurance coverage they could readily afford. And I believe the SCOTUS and Chief Justice Stevens addressed the constitutionality aspect, putting to rest any 10th Amendment concerns on the subject. “Original intent” is an altogether different conversation - I digress...

Realities

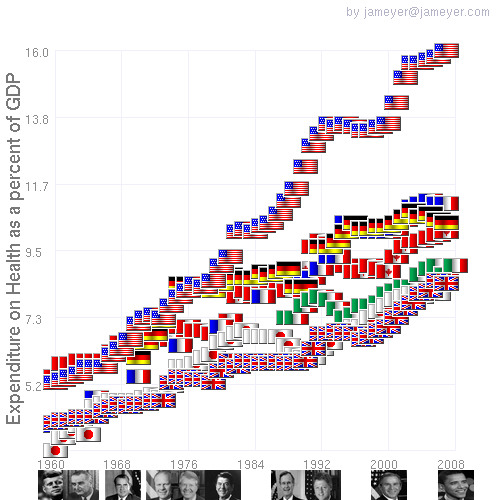

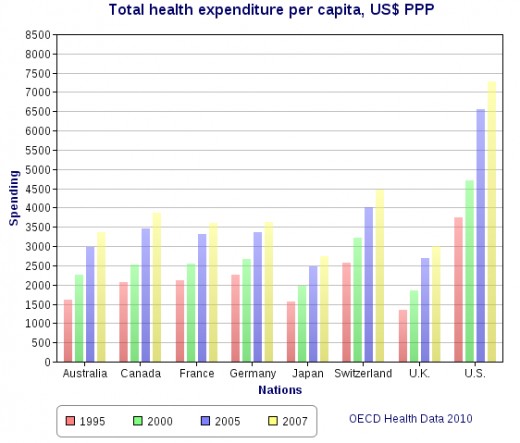

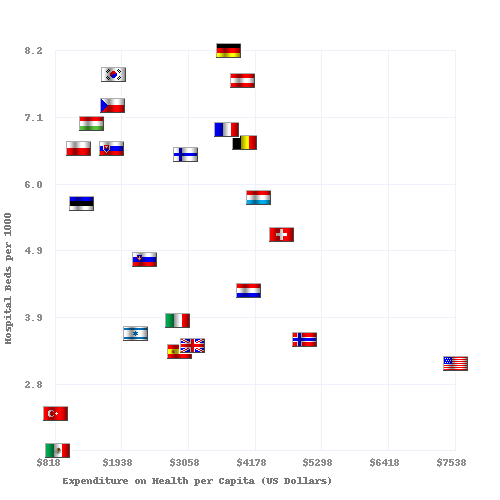

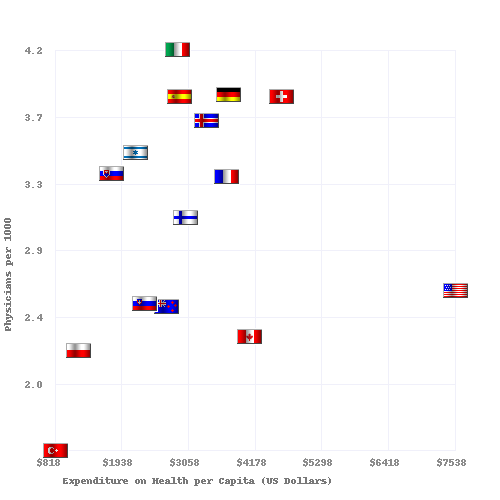

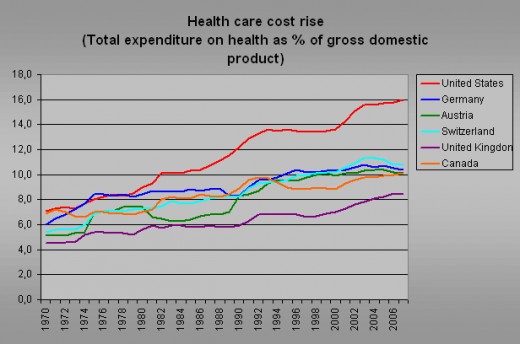

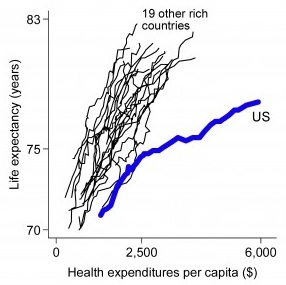

Maybe I should back up a little and take a meta approach. Let me start with the problem - the what; the U.S. spends roughly a third more than any other country on health care, or roughly 18% GDP at this point.

- We rank 37th in health care outcomes.

- Canadians live longer than us

- 35% of US citizens are obese

- We rank 34th in infant mortality rate

- We have the 7th highest cancer rate in the world

- The 13th highest number of heart disease deaths (WHO)

And we are the only civilized western nation without universal health care. Not for a lack of effort mind you, there have been attempts to adopt universal health coverage since Presidents Roosevelt and Truman.

E.R.

The EMTALA Act of 1986 says that if a hospital (excluding military hospitals) wishes to accept Medicare payments - which they do - they must provide emergency care regardless of coverage. Good luck with your cancer.

While that model is horrible, since the costs are passed along to the paying customers...

The good news is that this is the key to implementation of Obamacare - hospitals will be required to give the care and states will pay the taxes - so Republican governors will feel great pressure to cave on their intransigence.

Social Contract

We have decided as a country - by enacting Medicare, Medicaid, and Social Security - that we must care for the poor, the elderly, and the disabled.

As a benevolent people, we understand that the care of the poor and disabled should not be dependent upon their family's wealth.

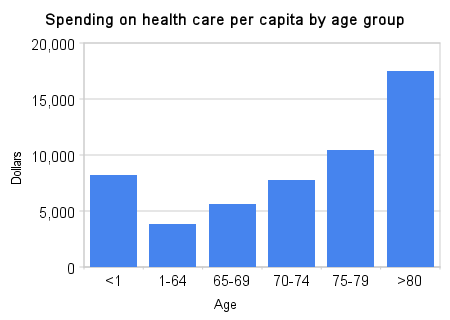

As a reasonable people, we have determined that the private insurance market has no profit, nor any interest, in covering health care needs of the elderly. And why would they? Our health costs while we are young and strong are relatively minimal - while the largest chunk is absorbed in our twilight years.

Most of us agree that we need these programs - what people must not assume is that they are free. We want the benefits, so we have to pay the cost. Our problem now is that our economy tanked by way of the housing market - at the same time health care costs have gone out of control. So yes, we need to find health care savings to ease the budgetary strains - but don't make the mistake of blaming our social programs for the problems with our healthcare system.

Primum Non Nocere

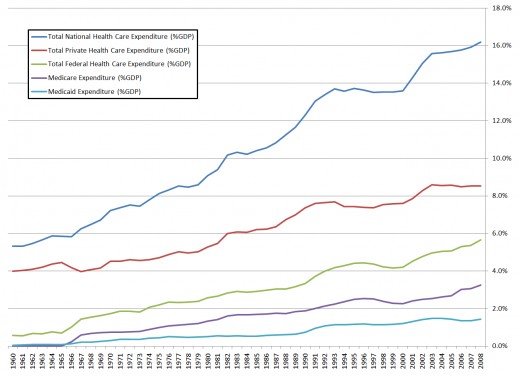

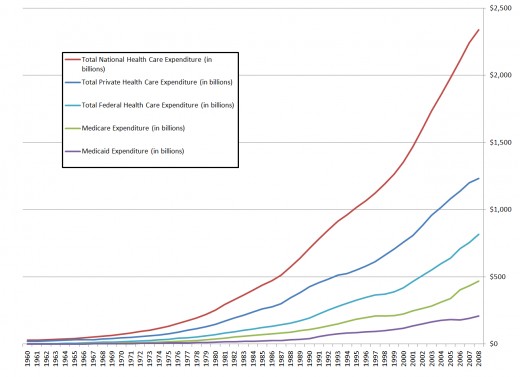

While some have been opposed to our social safety net since inception, these are the most popular programs in our country. And for good reason; Medicare has remained steady at about 6% GDP - while annual double digit rate increases for health insurance in the private market have pushed the cost to 12% GDP.

Perhaps most telling is this - insolvency projections for Medicare have remained relatively static at roughly 11 years - for literally decades now. While those opposed to the safety net are once again crying wolf - we must reform these programs to save them - this is simply their modus operandi.

The GOP want a Democratic president to cut our most popular programs - which I fear will happen- so that they can then turn around and blame Dems in the next election cycle for doing just that.

The response to this should be that Obama spent all of his first-term political capital on passing Obamacare - so let's see how that works out. It won't be fully in place until 2017, so give it a chance. It has already served to slow the rise in costs - if not yet enough.

Also, seniors should be able to negotiate for lower prescription drug prices.

Bad Ideas

We should not raise the eligibility age. While it seems reasonable since we are living longer - unfortunately poor people are not, in fact, living any longer. Bad idea. Plus, all that would accomplish would be to shift the burden from the federal gov't onto 60-somethings with outrageously expensive health care costs. Same difference with the voucher plan - it's just pushing costs onto senior citizens just to make the budget numbers look better. Likewise with the chained-CPI proposal; Worse Ideas yet. And no block grants. That is just a way for states to try and pocket the money and use it for other things while leaving the needy out in the cold.

Obamacare

Obamacare says if you already have insurance, you can keep it. Along with some new bonuses. Parents can keep kids of up to 26 years of age on their plans. Insurance companies can no longer discriminate against people with pre-existing conditions. Insurance companies can no longer put annual limits or lifetime caps on an individual’s medical costs. Insurance companies will also be required to spend 85% of your premium on your medical costs, or you get a rebate to covering the difference. Insurance premiums will be capped at 2% of annual income for the less fortunate among us (up to 133% of Federal Poverty Level) and capped at 9.5% for people making at least 400% of FPL. Medicaid is expanded to allow parents and children making less than 133% of FPL with Federal Medical Assistance Percentage. Also, the “donut-hole” in seniors coverage is filled while brand-name prescription-drug prices are reduced. Purchase health insurance, you get a tax credit. Small businesses also get a tax credit under Obamacare. Penalties for Medicare-fraud will be increased. Women will no longer be subject to price discrimination on their premiums. Plus, government health programs will be persuaded to save themselves more money by purchasing cheaper generic drugs.

And there seems to the rub, “government health programs.” Big government all up in my business. All up in my healthcare.

To be clear, the mandate encourages people to acquire health insurance for themselves. From a private insurance company. Either through employers or otherwise. The government is not taking over any private insurance companies, they are nudging more people into the health insurance market. Increased market for private companies. This is not a government takeover of private industry.

Obamacare offers choices. If you would like, you can choose to forgo the current system of pooling our resources with employer-based coverage, and you can choose to instead enter an insurance pool at the state level through a state exchange program, and you still purchase your coverage from a private insurance company through the state.

So. Brass tacks (brass… tax. Sorry, I digress…), you can choose to procure health insurance for yourself, and show proof of your health insurance in your tax filing, or else you are assessed a tax penalty of $95 (or 1% of income) beginning in 2014 (and is capped at either $695, or 2.5% of income after 2016). Strangely, there's no punishment enumerated in the Affordable Care Act if you don't pay the tax penalty. That’s simply the mechanism and the amount of the tax penalty associated with the individual mandate that we are so afraid of, and in Massachusetts, a mere 1% opt to pay the penalty. Band-aid removed. Now, that wasn’t so bad, was it?

Thus...

Weighed separately, the provisions in the Patient Protection and Affordable Care Act are exceedingly popular. It’s the “pay for”, the prospect of “mandated” change, and the very scary name of “Obamacare”, that has yet to sink in with people. It’s really not a scary story, we just need to shine more light on the subject so we all can see exactly how our lives will be positively effected going forward, and then share that info with our conservative friends. Obamacare is not a single-payer expansion of Medicare, but it's a step in the right direction. Remember, until people saw the real-life benefits, Social Security and Medicare were derided as “the end of freedom” and “the rise of socialism” in their times, too. I’d say Obamacare is in pretty good company.

8/16/12