Obamacare In Plain English - Just the Facts

Now that the Supreme Court of the United States has upheld the Patient Protection and Affordable Care Act - and that President Obama has been reelected - it’s time we get to know our new friend, Obamacare.

First of all, Obamacare is not liberal by any means. Single-payer Medicare for all, or public-option with public/private competition, are the liberal answers for universal healthcare. Obama took The Heritage Foundation/conservative approach - of personal responsibility with an individual mandate for private insurance - in an effort to garner GOP support. To no avail, of course. Arlen Specter.

Second, you can keep your current insurance through your employer.

Third, we will still be purchasing insurance from private insurance companies, even if we go through the state or federal exchanges to get it. Obamacare simply is not a government takeover of the health insurance industry.

And lastly, I hereby dare Republican governors - specifically Governors Rick Scott & Perry - to bankrupt public hospitals by refusing Obamacare's billions in Medicare funds.

That is the extent of my editorial on the matter, the rest is on the books as fact.

So…what is Obamacare already doing?

- Insurance companies can no longer deny coverage for preexisting conditions.

- Insurance companies can no longer kick you off their rolls because you’re sick.

- Insurance companies can no longer apply lifetime limits on coverage.

- Millions of non-dependent children up to the age of 26 are covered under their parents’ health insurance plans.

- Rebate checks from insurance companies are being cashed by consumers because Obamacare says 85% of your premium must be spent on your coverage, or you get a refund for the difference. So insurance companies can no longer waste so much of our money on ad campaigns and CEO bonuses.

- Pharmaceutical companies now pay fees ($2.8bil in 2012 & 2013, $3bil in 2014-16...) for using brand name drugs with gov’t health programs.

- 10% tanning tax.

- Insurance companies are now required to comply with minimum standards of coverage.

- New 2.3% excise tax on manufacturers of medical devices (except hearing aides or contacts or glasses or other over-the-counter type devices).

In 2014...

- Insurance companies cannot apply annual limits on coverage.

- Insurance companies cannot charge women more for coverage, or deny contraceptive care (religious institution exemption allows their employees to get contraceptive coverage through the state).

- Insurance companies cannot charge you excessive amounts for your plan. The limit they can charge you will be 2% of your income for people making up to 133% FPL* a 6.3% premium limit up to 200% FPL, and 9.5% up to 400% FPL.

- Insurance companies must cover a minimum of 94% of your health care costs if you make up to 150% FPL, 87% coverage up to 200% FPL, and 70% up to 400% FPL.

- If you make 133%-200% FPL you can get coverage through a state Basic Health Plan.

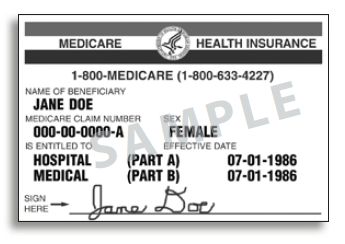

- If you make up to 133% FPL you can get expanded Medicaid through a new state health insurance exchange -- or American Health Exchanges and Small Business Options Program (SHOP).

- If you make 133%-400% FPL you can still get expanded Medicaid through SHOP at a higher rate, and a combination of a federal tax subsidy and employer contribution to cover the difference.

- Tax returns will include proof of health insurance for self and children, or an annual penalty for each family member starting at $95 (or 1% of income) and eventually up to $695 (or 2.5% of income) individually, or $2,250 max per family.

- Employers with fewer than 100 employees** can also utilize SHOP.

- Employers with 25 employees or less (making an average of $50k or less) get a tax credit for 50% of employee insurance costs.

- Employers with 50 or more employees will offer qualifying health insurance plans, or are fined $2k annually per employee over 30 employees if any one employee uses SHOP.

- If your employer offers a qualifying health plan, then you are ineligible for SHOP.

In 2017, employers with over 100 employees can use SHOP.

Want a more intensive look at Obamacare? Click here.

*Federal Poverty Level 2012 (FPL) - 133% of FPL equals about $15k annually for an individual, or about $30k for a family of four. 400% of FPL equals about $30k for an individual, or about $92k for a family of four.

**Employee - any employee averaging 30 hours weekly, or any combination of part-time employees working a cumulative of 120 hours monthly.

11/14/12

Sources - The Heritage Foundation; The Connecticut Post; whitehouse.gov; coverageforall.org