Free Market Capitalism and Why the Middle Class is Shrinking

Myths, Folktales, and Fairy Tales

As defined by the Oxford Dictionary, a myth is, “a widely held but false belief or idea.”

America faces an uncertain future. Can we sustain our preeminence of the latter half of the 20th century in the 21st century and beyond? Our country has over 320 million citizens with very little in the way of consensus producing only gridlock and inaction, preventing the decisive action we need. An earnest dialogue is long overdue, and at the very least we must begin by dismissing our political myths.

Something is rotten in the state of Denmark, err, the United States

We all can feel it. To believe it to be true, it almost feels unpatriotic. But our instincts are right. Regular people have been getting a raw deal for quite some time (see my other post, A rising tide...). The middle and working classes are shrinking and have less and less despite hard work and trust in the system. Our economy continues to consolidate into oligopolies resulting in disproportionate negotiating power between consumers and producers, workers and employers. It is no coincidence that the growth of oligopolies has occurred at the same time as historic highs for corporate earnings and profits. These successes have unfortunately been borne by consumers and workers stuck with anemic price competition and wage stagnation.

"It's good to be the king" - History of the World Part I

The myth

First off, I support capitalism 100%. Capitalism is the most efficient system to allocate labor and resources and facilitate economic growth. Government intervention reduces the efficiency of our markets. Let me repeat, I support capitalism 100%. However, contrary to what politicians and the media tell us, capitalism is much more nuanced than you’re either a capitalist or a socialist.

Generally speaking, conservatives declare they support free markets and free market solutions. To the lay person, free market advocates are capitalists and their opponents therefore are socialists who favor regulation and big government. This characterization is patently untrue. Leaders who espouse this are mindlessly repeating a mantra without considering its validity. A more sinister interpretation is they are a wolf in sheep's clothing, only concerned with their re-election and their large donors.

For voters on either side of the issue, I sincerely hope you can set aside your pre-existing beliefs to consider a different characterization.

What precisely, are free markets and free market solutions?

In a capitalist economy, free markets occur when there is no outside intervention such as government regulations. Free market solutions, accordingly, are the mechanisms which self-correct and self-police prices, participants, and behaviors. This is sometimes referred to as the ‘invisible hand’ of the market.

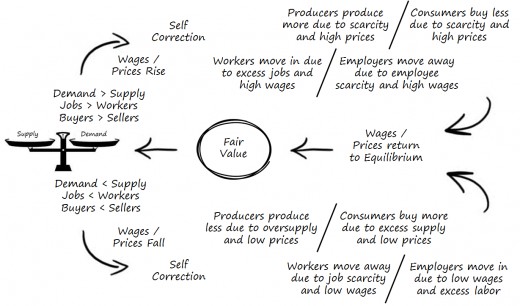

As shown in the following diagram, as supply and demand change, so do prices and wages. With higher or lower than equilibrium prices or wages, market participants change their behaviors and new market participants may enter or leave the marketplace due to the imbalance. Eventually, these mechanisms return things to equilibrium and fair value is reestablished.

Self-correcting markets

Fair value is a fair fight

Fair Value

Fair value is the price at which a willing and fully informed buyer and seller, under no compulsion, will exchange goods and services

While the diagram is an oversimplification, you can still see how free markets should behave. The most important takeaway is this; free markets gravitate towards equilibrium and equilibrium reflects fair value. Why is fair value so important? For lack of a better word, fair value is important because it is, well, fair. The market corrects over- and under-priced goods and services. The market corrects above and below market wages. If prices or wages aren't fair value, someone is getting the short end of the stick. Fair value is fair, because it's the value buyers and sellers would agree upon with a fair and level playing field.

On a more practical note, fair value is also important because being out of equilibrium for any sustained period is detrimental to the economy itself. For example, if wages are suppressed, workers are less able to buy goods and services making it difficult for companies to grow and increase sales. This might lead to cost cutting or layoffs, further reducing wages or the number of jobs, and thus a downward spiral begins. Picture a shopping mall slowly dying, one store at a time. On the flip side, if a shortage of labor yields sustained high labor costs, running a business becomes less profitable and the risk of bankruptcy increases. Think, union wages and the big three auto makers.

Which picture reflects reality?

Don't ignore the fine print

It sounds like the question on capitalism has been asked and answered. Free market advocates are clearly in the right, end of story. Let’s not get ahead of ourselves. The devil as they say, is in the details.

For self-correcting markets to work, there are a few conditions that have to be present and are assumed to always be in place. These assumptions are collectively known as perfect competition. Some of the conditions are:

- There is a large number of buyers and sellers, workers and companies

- No one has too much power to set prices/wages or negotiate unfair value

- There are no benefits from economies of scale, meaning small companies can enter an industry and compete with big firms. One word. Walmart

- All buyers, sellers, employers, and employees have full and equal information

- All products, goods, services, employees, and employers are identical and interchangeable

- All employers, employees, consumers, and sellers are 100% mobile. For example, a worker will select the best job available, ignoring the fact that one job may be thousands of miles away

First, in our diagram of a self-correcting market, all of these conditions are assumed to be in place and non-competitive characteristics do not exist. The reason this is important is self-correction (and thus fair value) only exists when there is competition. Without these conditions, this topic quickly changes from discussing the costs and benefits of free markets, to quibbling over how an imaginary state of the world may be more right or less right.

Put another way, when market participants; buyers, sellers, employers, and workers, have equal negotiating power, markets will self-correct and fair value will be the prevailing price. This is where a second and very important benefit comes in. With competition also comes self-policing mechanisms. For example, if there were two competing dry cleaners and one of the cleaners was sloppy in disposing of their chemicals, consumers could factor that into who they do business with. When market participants are on a level playing field, both sides can affect the other. When both sides can affect the other, unethical behaviors either self-correct or are forced out of the market. This self-policing mechanism can only occur in competitive markets.

So, what kind of markets do we have? Consider the assumptions above. Ask yourself, how do these assumptions increase competition and create a level playing field? How would their absence eliminate competition and a fair fight? Do you think we have competitive markets?

Are there a lot of companies to choose from?

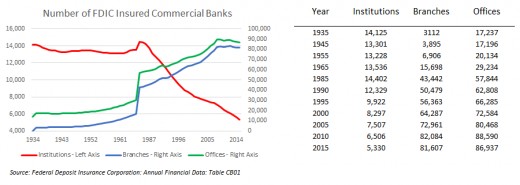

More banks, fewer choices

Let's say you are a banker and there is only one large bank in your town. You can't exactly shop your resume around. You're stuck with the only employer and have to take whatever salary they offer.

Looking at the table below, you'd think that sheer number of bank branches and offices (blue and green lines) would also indicate lots of job opportunities. Well, kind of. There's lots of jobs. But they are all with the same few big banks (red line). Everywhere.

Can prices/wages be set or negotiated away from fair value?

Real estate is a great example of this. Most of the time, the number of buyers and sellers is fairly equal and as such most real estate deals reflect fair value.

But when there's a shock, like the 2007 housing bubble, all of a sudden sellers are vulnerable. Buyers have lots of properties to choose from and can dictate prices. I personally like the nomenclature "fire sale." While disastrous for the seller, this is a natural price fluctuation caused by the bubble popping.

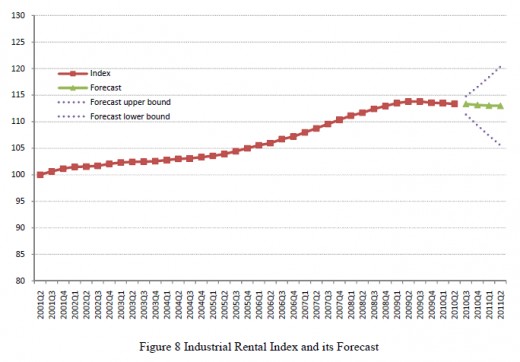

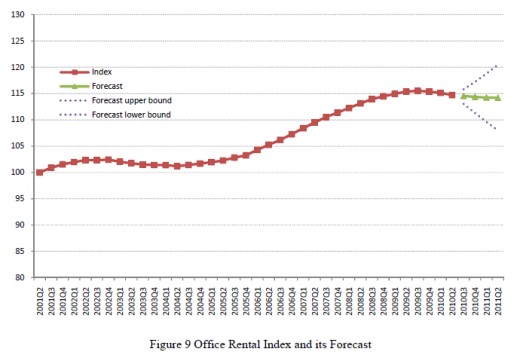

Can an oligopoly control rents regardless of the real estate market's heath? Many people don't realize just how concentrated commercial real estate is. Nationally, the number of public company real estate investment trusts (REIT) is surprisingly small. Industrial real estate is dominated by eight firms. Office property only has nine major players. Shopping malls? Eight. Student housing? Two. Apartments? Eight.

If we look at industrial and office rental data, the housing bubble clearly had no impact on rental rates. This is a stark departure from what residential property owners experienced. Oligopolies can and have controlled rents, immune from natural market forces.

Do buyers, sellers, employers, and employees have full and equal information?

When you’re negotiating salary for a new job, the hiring company knows your desired salary and salary history. You on the other hand, don’t know the salary of the previous employee or what other people in that department earn. You also don't know how many other applicants you are competing against. It’s a one sided negotiation.

In an ideal world, all market participants would be price/wage negotiators. In reality, our markets have a small number of price/wage setters leaving the rest of us to be price/wage takers.

Oligopoly

As defined by the Oxford Dictionary, an oligopoly is, “a state of limited competition, in which a market is shared by a small number of producers or sellers.”

Can we quantify the degree of competition, or lack thereof?

We can infer that our markets aren't competitive. We intuitively know perfect competition assumptions do not exist. We can cherry pick specific examples where there is little to no competition. But can we quantify this?

I propose that our markets are not competitive and this can be demonstrated by the prevalence and size of oligopolies. An oligopoly is similar to a monopoly, but more importantly, it can and often produces many of the same consequences. There is the potential for price gouging and abuses of power. The real disaster is economic power eventually transforms into political power, further entrenching an oligopoly.

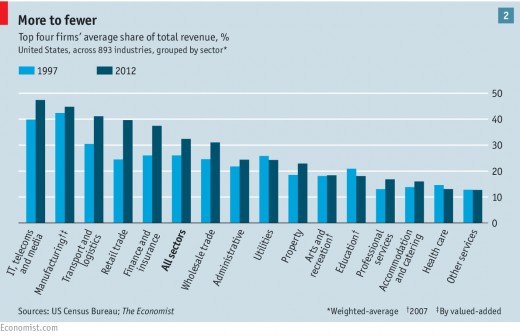

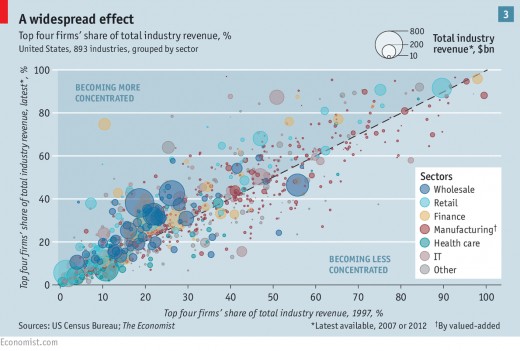

The Economist had an article on March 26, 2016 entitled “Too much of a good thing” where they discussed the consolidation of businesses into fewer and larger companies. They studied all 893 industries of the U.S. economy (i.e. credit card issuers, passenger car rental, full-service restaurants, etc...) and measured the share of total industry revenue (%) earned by the top four firms in 1997 and 2012 (the most recent data as of the article publishing date). Across all industries, the average percent share of revenue earned by the top four firms increased from 26% to 32%. What does this mean? The biggest firms got bigger.

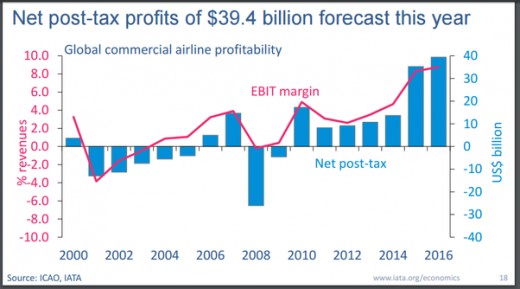

Why is this significant? Looking at Chart #1 (top), consolidation into oligopolies isn't just a change in the number of companies. It leads to marked gains in profitability and these increases typically come from two places; cost reduction (wage stagnation) or price increases. In other words, consumer and worker health is inversely related to the health of oligopolies. It's clear that oligopolies are quite healthy.

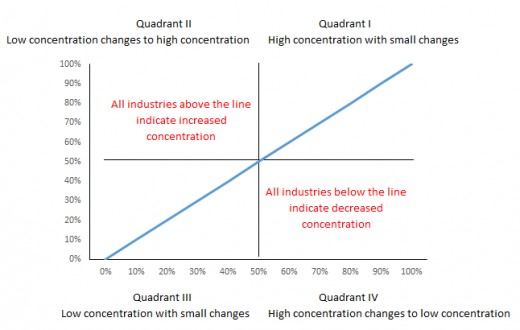

While + 6% may not sound like a tectonic shift, consider the following. Some industries decreased their concentration (Chart #2 - utilities, education, and healthcare became less concentrated). Other industries have been and remained decentralized (Chart #3 - lower left / quadrant III). So, to produce an overall + 6% change, two things happened. First, far more industries were above the line in Chart #3 than below the line. And second, the growth of oligopolies and their market share in the remaining industries was so large, it dragged the entire average upwards. As it turns out, 6% is a very significant change. Below are a few selected industries demonstrating the scale of this market concentration.

- Credit card issuing ($81.8 billion industry). Top four revenue share changed from approximately 53% to 77% or +23.8%

- Pharmacies and drug stores ($229.6 billion industry). Top four revenue share changed from approximately 47% to 70% or +22.5%

- Wireless telecommunication carriers, excluding satellite ($225.4 billion industry). Top four revenue share changed from approximately 51% to 89% or +38.2%

- For those of you who are curious, the circle in the upper left corner is companies who administer insurance and pension funds ($145.2 billion industry). Revenue share changed from approximately 11% to 77% or +65.8%.

Top four firms' average share of total revenue, %

Top four firms' share of total industry revenue, %

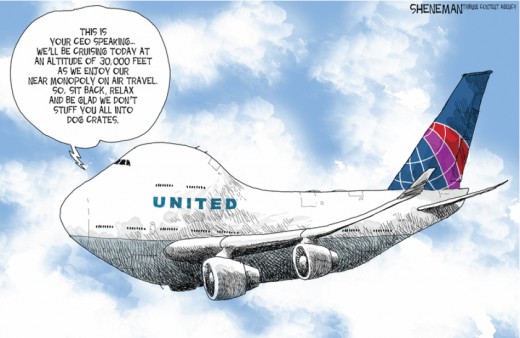

Flying the friendly skies

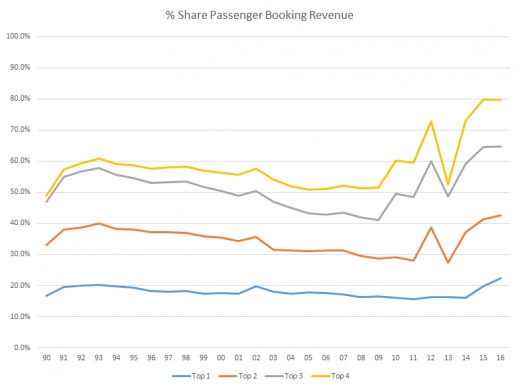

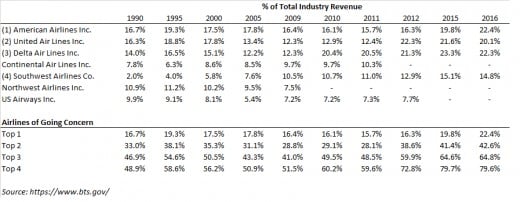

Commercial airlines also demonstrate an industry consolidating into an oligopoly. Since 1990, the percentage share of passenger booking revenue has concentrated into the hands of a few airlines due to multiple mergers and acquisitions. Below are some of the more significant deals.

- 2005 US Airways and America West

- 2008 Delta and Northwest

- 2010 Continental and United

- 2011 Southwest and AirTran

- 2013 US Airways and American Airlines

Data from the Bureau of Transportation Statistics (BTS) shows the four largest airlines increased their share of the market from 48.9% in 1990 to 79.6% in 2016.

Does consolidation reduce competition? Consider some anecdotal evidence. Do you remember in the 1990's when airlines would have fare wars? All of a sudden, you could fly to Paris for $249 or some other crazy amount. When is the last time we had one of those? Remember when baggage fees were supposed to only be an emergency response to skyrocketing fuel costs in 2007? Evidently, airlines can charge anything they want and there's nothing we can do about it. Does it feel like a level playing field? Does it feel like a fair negotiation?

Top four firms' % share of passenger booking revenue

Oligopoly formation by more than just mergers and acquisitions

There is a second way in which competition is nearly non-existent for commercial airlines. Because of (1) the “hub and spoke system” and because (2) airlines select different cities as hubs, where you live could make it so there is little to no competition between airlines.

A hub is a central airport that flights are routed through, and spokes are the routes to nearby non-hub cities. Many airline hubs do not have a competing airline hub in the same location, meaning one airline will control the vast majority of all flights in that entire region. In other words, some parts of the country are ostensibly serviced by monopolies.

Fine, our markets aren't competitive. Regulations are still bad though. Right?

I’ve often marveled at how many one-sided arguments are out there. It's true, there are countless rules and regulations that range anywhere from cumbersome, to counter-productive, to flat out pointless. Most everyone has first-hand experience with regulatory red tape so you rarely hear anyone espouse the benefits of government regulation. This silence has produced a de facto consensus that regulation is inherently bad, which in turn makes anything other than full throated support for free markets a fool’s errand.

This isn't an accurate assessment though. First, regulation is beneficial and crucial for countless things we never think twice about. We assume prescription drugs are safe because of the FDA. We trust that our money and bank accounts are safe because of the FDIC. We trust the planes we fly on are safe because of the FAA. We trust that our drinking water isn't contaminated thanks to the EPA. These are the things we take for granted and forget about when we think about regulation. I contend that in total, the benefits of regulation far outweigh the drawbacks.

Second, regulation is a fundamental societal need. The reason our markets need regulation is the very same reason we need laws, police, and courts. People are people, and invariably some will act unethically and to the detriment of others. We can easily recognize the need for laws when it comes to criminal or civil issues. These human abuses, however, are just as prevalent in business. Businesses after all, are run by people.

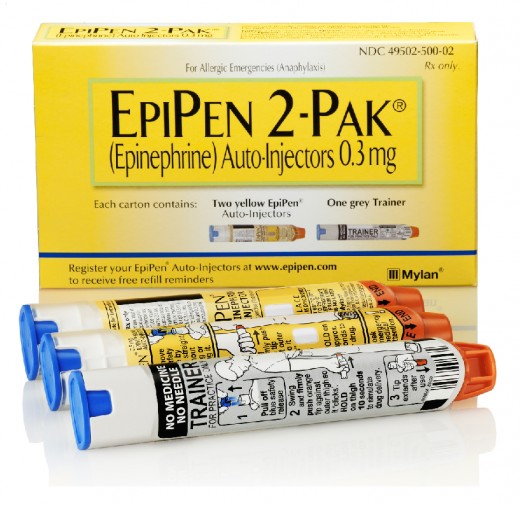

Price gouging...just because they could

Sometimes we just need a referee

In 2016, Mylan pharmaceuticals increased the price for an EpiPen from $100 to $600. At that time, there were no competing products so consumers had no choice but to pay the $600. With a monopoly, free market forces could not self-correct the price gouging.

Obviously, people felt cheated and taken advantage of. When we feel like we're being cheated, we all want a referee step in and blow the whistle. We all want someone who can stop the cheating.

Recognizing Mylan’s ability to dictate whatever price they wanted, Senators Chuck Grassley (Iowa-R) and Amy Klobuchar (Minn-D) both intervened. This was a stark departure for Mr. Grassley who is a staunch advocate for free markets and deregulation. Why do I specifically note that Mr. Grassley intervened? It shows that everyone wants a fair fight. Everyone wants a referee. It shows that intervention itself isn't bad. It shows that Republicans don't oppose intervention. They just oppose intervention they don't like.

And that is a very different argument than regulation as a principle is wrong.

This brings us to the third very important reason regulations are needed. As our markets become less competitive, as negotiating power becomes more uneven and free market forces lose their ability to self-correct, consumers and workers need an arbiter with comparable power to the oligopolies.

Look, it's a *cough* magic elephant

Are our markets on a level playing field? Is it a fair fight?

So, what exactly is the myth?

The myth is that regulation destroys our economy and capitalism itself. The myth is markets will always gravitate towards equilibrium and fair value on its own and therefore, has no need for oversight.

Here's a proper characterization. As markets become more competitive, the need for regulation decreases. Negotiating power equalizes, fair value becomes the prevailing price, and misbehavior starts to self-correct and be self-policed.

On the other hand, markets that aren’t competitive have a high potential for abuses. Market participants are either price/wage setters or price/wage takers. Absent self-correcting mechanisms, the need for regulation increases.

So, why would anyone advocate deregulating markets dominated by oligopolies where there aren't self-correcting mechanisms? Is there any defensible reason for this position?

No, and here's why:

- Excepting the Nick Naylors out there, we know there isn’t a level playing field anymore

- Negotiating power imbalances favor the affluent allowing for excess profit taking to the detriment of consumers and workers

- Therefore, political leaders who advocate free markets and free market solutions in markets filled with oligopolies, are either:

- Stunningly ignorant, incompetent, or some combination thereof; or

- Willfully propagandizing and lying to voters, misleading them to act against their own best interests for the benefit of a few (who just happen to be large campaign contributors)

What can be done?

I stand by my assertion that regulation is a necessary force. As markets become more imbalanced, the need for regulation increases. But that doesn’t mean regulation is the only remedy.

The problem with regulation is, it is nearly impossible to make an adjustment to a complex system, no matter how well intended the adjustment is, without creating unexpected and often times negative repercussions. Think, Africanized bees, kudzu, or Asian carp.

A better approach will focus on increasing competition instead of building a larger and more powerful referee. The Sherman Antitrust Act is intended to prohibit business activities that are anti-competitive. It has been used to break up monopolies and prevent anti-competitive mergers. This is the very tool that should be used to improve market competition.

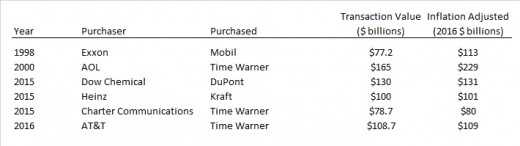

Unfortunately, antitrust legislation isn't enforced as often as one might expect. Looking at some of the recent and high dollar M&A deals, it's difficult to believe the Department of Justice is acting in the best interests of consumers and not campaign donors. Below are some of the larger deals with very recognizable company names. I don't see how these mergers can be viewed as anything other than consolidation into oligopolies.

Are the big companies just getting bigger?

The real solution is to use all available tools

Unlike most political commentary, I don't think this should be an all or nothing issue. We need to use all of the tools available. We need to be vigilant that our markets remain competitive. We need to enforce antitrust provisions. Lastly, we need to employ regulation judiciously and only when it can be effective.

We are more alike than we are different

Both Democrat and Republican voters have legitimate grievances with our economy. We all know something is wrong. We just don't agree on what that something is.

Our leaders have given us ridiculous things to blame. Is it school lunches? CEO bonuses? Foreign aid? No. It is none of these. Toss these distractions aside. Toss all of the noise aside.

As long as our leaders rely on large campaign donors for re-election and as long as news organizations rely on advertising revenue, we shouldn't expect them to point out the real culprit. We're going to have to do it on our own.

- Oligopolies are the something that is wrong. Consumers and workers are price/wage takers and this is why the middle and working classes are shrinking

- Americans just want a fair chance to succeed in our meritocracy, we aren't looking for a handout

- There are two ways to level the playing field

- The "referee" - Government regulation can act as a strong counter force to oligopolies. Regulation cannot be an exact tool to re-balance negotiating power. Regulation can also yield unexpected and negative consequences.

- "Yin and yang" - If our markets are kept competitive with self-correcting mechanisms, there will be little need for government regulation. Perfect competition will be a much a more precise tool to re-balance negotiating power than government regulation. Bear in mind, anti-competitive factors must be monitored and kept in check.

- Mismatched combinations are disastrous

- "Oligopolies and hegemony" - An oligopoly with no referee or counter force and little to no regulation leaves consumers and workers 100% at the mercy of producers and employers. In this situation, the bottom will fall out for normal Americans.

- "Red tape for the sake of red tape" - The combination of competitive markets with government regulation only produces a complicated market that would otherwise exhibit normal and healthy economic activity.

I will throw some politics in here at the end. To liberal readers, capitalism and wanting to earn a profit is not a bad thing. What has been wrong is the lack of competition and concentration of power. You should avoid "red tape for the sake of red tape" at all costs, and be content with either the "referee" or the better choice, "yin and yang".

To conservative readers, free markets without competition only yields "oligopolies and hegemony". Surely you can see that you were sold a bill of goods. Surely you now know you've been betrayed. Who was trying to sell this to you? What else did they lie about?

Whether we realize it or not, we all seek the same remedy. This is my contention. Make our economy competitive again and the need for government regulation will evaporate. Most importantly, make our economy competitive again and the working and middle classes might actually have a fighting chance to achieve economic success and prosperity.

© 2017 Alvie Dewade