United States' Gigantic Debt and the Reason for it.

"There is something behind the throne greater than the King Himself."

- Sir William Pitt, House of Lords -1770

"The real truth of the matter is that a financial element in the large centers has owned the government since the days of Andrew Jackson"

- Franklin D Roosevelt - 1933

“From now on, depressions will be scientifically created.”

—Congressman Charles A. Lindbergh Sr., 1913

“The high office of the President has been used to foment a plot to destroy the American's freedom and before I leave office, I must inform the citizens of this plight.”

—President John F. Kennedy - In a speech made to Columbia University on Nov. 12, 1963, ten days before his assassination!

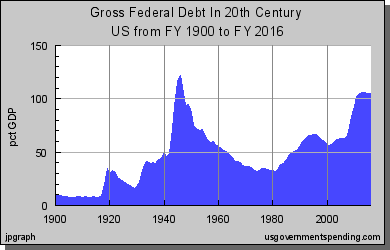

United States' Debt

United states has been one of the most influential countries in shaping the world history and playing an active role in the global politics. It appears since the early 2000s, that United States is going downhill on an economic strata. For a layman, it is just impossible to apprehend the cause and keep him/her-self prepared for unprecedented economic meltdowns.

We see in the news everyday that the national debt is [this much] and the feds are doing [something] to control the debt. For an ordinary American, having a full-time job has is now a thing of possession and value, and has no time to spend to ponder over what the federal debt really means.

A Federal Debt is generally the debt accrued when the government borrows money from the Federal Reserve Banks with an interest and will have to repay by taxing the citizens. Each tax dollar that you pay is also again borrowed from the federal banks that carries additional interest since the day it was printed. This means that the people of United States and its Government will always be in a perpetual debt to the federal banks no matter how much tax money is re-payed.

We will go through in detail about the Federal Reserve System later in this hub.

Other type of federal debt can be the money borrowed from other countries like China which owns about $1.2 trillion in bills, notes and bonds, according to the Treasury.

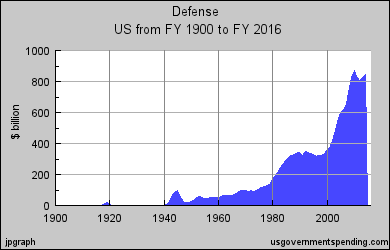

United States' Defense Spending

If we try to do a high-level postmortem by putting the U.S. Debt and U.S. Defense spending on a graph and compare, we can see that there is a relation to the growth of debt somewhat proportional to defense spending since the 1980s.

It has always been obvious about the growth of debt with the involvement of the U.S. in wars beginning somewhere during the World War 2. Moreover, none of the wars were raged due to any threat to the American land or its people but due to the the vested interests of few political lobbies.

"In the councils of government, we must guard against the acquisition of unwarranted influence, whether sought or unsought, by the military industrial complex. The potential for the disastrous rise of misplaced power exists and will persist.

- President Dwight D. Eisenhower, 1961

"War against a foreign country only happens when the moneyed classes think they are going to profit from it."

– George Orwell

“War is a racket. It always has been. It is possibly the oldest, easily the most profitable, surely the most vicious. It is the only one international in scope. It is the only one in which the profits are reckoned in dollars and the losses in lives.”

— General Smedley Butler

The Federal Reserve System

"Examining the organization and function of the Federal Reserve Banks, and applying the relevant factors, we conclude that the Reserve Banks are not federal instrumentalities for purposes of the FTCA, but are independent, privately-owned and locally controlled corporations." [Lewis vs. U.S., 680 F. 2d 1239, 1241]

Let us try to understand in a layman's terms, "What exactly the Federal Reserve System is?"

Hundreds of years ago people would pay the goldsmiths to store their gold for them in his locker in exchange for a receipt for the quantity of gold that was stored. The receipt wasn't cash, but as good as a cash substitute. It was common for people to use these receipts as payment since they can be exchanged for the gold held within the goldsmith's locker.

Imagine a case when, the goldsmith found out that a little amount of the gold was ever claimed since people just kept exchanging the receipts. The goldsmith started writing receipts for additional gold than he had, using some of the receipts to buy things and loaning the remainder at interest, while taking title to the real property as collateral. The gold for these additional receipts did not exist. By adding to the quantity of receipts in circulation, the goldsmith stole from the people with the important receipts and decreased the worth of the important gold receipts by creating inflation. The additional of one thing there is, the less it's worth and additional it takes to trade it for one thing else. Paper currency may be a money substitute, it's not money. it's solely valid when the number of paper currency equals the quantity of real money that it's a substitute for. By manipulating the number of receipts in circulation, the goldsmith stole the wealth of the town without anyone figuring it out. By lowering the number of receipts, he may make money scare, creating a depression where he may foreclose on the property and enlarge his riches. He may then quicken economic activity and produce abundance by raising the number of receipts until his next rip off.

It might be clear by now to all of you reading, that how the economy is built upon paper money which carries no value. The Federal Reserve Banks print money out of thin air and loans it to the government for an interest which you re-pay as tax.

What if U.S. economy sees a disastrous meltdown and the dollar remains with no value, in such a case no matter how much money one can hoard in their banks, it will be of no value.

Voice your Opinion

Do you support the world currency going back to the Gold Standard?

© 2012 viquar