Should Bank of America be Allowed to Make all of those Obscene Profits? Maybe, Maybe Not. [90]

Where the Profits Go.

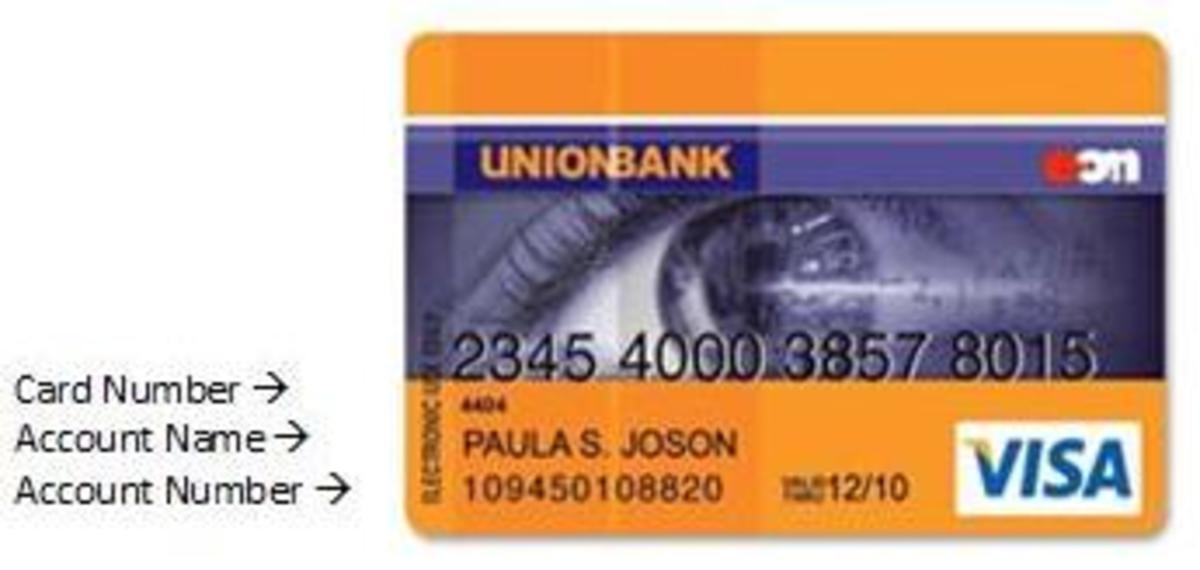

The New Debit Card Fees

WHEN BANK OF AMERICA recently announced they were going to charge, beginning January 1, 2012, their customers $5 per month if theY used their BoA Debit at least once during that month; a firestorm was set off. In fact BoA's website was shut down almost entirely for a week starting the day after the announcement; was that a coincidence? I don't know, but the timing sure is suggestive.

The reason for the new fee BoA, and other major banks, will be charging is to recoup losses in income from Interchange fees they can no longer collect from merchants for debit card transactions, fees the Federal Reserve, who has oversight and who was given authority in Obama's Financial Reform legislation, found to be excessive and therefore set limits on how much may be charged per transaction. This put a big dent in the banks income and they wanted it back.

The Question on the Table

The question on the table, of course, is, what right does the federal or state government have in putting any limits on what a bank may charge in the way of fees? The Conservatives are going to argue that the government has NO right at all, while the Liberals will argue the government has EVERY right to do so; of course, being a pragmatist, I land in the middle.

If the American economy was what the Conservatives naively believe it is, a market which is totally based on supply and demand as well as other normal market driven forces and where entry into the market areas is easy for anybody which leads to perfect competition competition everywhere, then the Conservatives would be absolutely right, the government has no business regulating rates. On the other hand, if the American economy were run solely by monopolies, whether set-up by the government or not, then the Liberals would be correct and government would have every right to intervene to protect the public from the vagaries of monopolies.

Reality is, of course, somewhere in the middle and the government has SOME right to regulate private business. When is that the case? Of course, Conservatives will say NEVER, but pragmatist will say the government has the right to regulate in areas were that sector of the economy is essentially controlled by an oligopoly or cartel (few sellers, many buyers; a cartel is when those that make up the oligopoly collude with each other in one fashion or another), such as the banking Debit card arena, or an effective monopoly (single seller, many buyers), like Major League Baseball or monopsony (single buyer, many sellers), like Walmart in certain areas of the market, when those monopolies, monopsonies, and cartels are abusing the system and there are no market forces available to make corrective actions.

So, What is Wrong With Swipe Fees?

In the case of debit card fees, known as swipe or interchange fees, charged to merchants by major banks, they had, in recent times, become excessive; at least in the view of retailers who had to pay them. This results, of course, is potentially higher prices to the consumer; in effect a hidden tax on Americans by the banks, instead of by the government.

Now, the banks have an absolute right to charge these swipe fees in order to recover their costs of providing this interchance service and nobody is arguing this point. What the retailers, and finally all but the Conservatives, began to complain about is the excessive nature of these fees; fees clearly in excess of the cost of the service provided. Conservatives will, and do, argue that there is no need for the government to intervene because "market forces" will ultimately drive these fees down as retailers find other sources for the interchange service or simply refuse to accept debit cards. If this extremely naive view were actually true, then no problem, the government need do nothing. The problem is of course, Conservatives are VERY WRONG, in this instance.

When talking about Interchange Fees, there is no free-market to rely on to adjust prices; a few major banks, like Bank of America, Wells Fargo, Citibank, etc form a Cartel-type oligopoly and control the prices. Because of the huge run-up in credit card interest rates, decreases in credit card limits, and other troubles in America's use of credit cards, the use of Debit Cards at retailers skyrocketed. Because the retailers have no choice in accepting debit cards or face bankruptcy, they were at the mercy of the banks, and, the banks began to take full advantage of this monopoly effect and began raising their Swipe Fee rates considerably even though their own costs were not increasing.

This was done in the middle of a major recession where retailers were sensitive to public's inability to absorbed price increases. As a consequence, the banks excess profits were coming at the expense of the retailers profits and the retailers could do absolutely nothing about it because there were no market forces at play, for, between them, the banks had a monopoly over Swipe Fees and using a Price Leader stategy acted as a legal Cartel.

PUBLIC ENEMY #1

Does the Government Have the Right to Regulate?

BACK TO THE QUESTION; does the government have the right to step in and force this "effective monopoly" to act responsibly and require them to only earn a reasonable profit for their service? I suspect the Conservatives will always say no, but without basis now, but only because that is their philosophy; I further suspect the rest of us probably agree with this reform, I know I do. I also believe this falls well within the idea of "limited" government our founding fathers had in mind when they wrote down the words "promote the General Welfare".

How about this $5 fee on debit cards? This is an entirely different story and the banks can give it their best shot. Bank of America, in defending their action, said they have a "right to make a profit"; I doubt nobody in America disagrees with that. I will go further, I doubt that no one in America, save for a few far left Liberals, would disagree with BoA's "right to make "obscene" profits"; so long as they do it in the light of day where market forces give them a chance to fail; such as with this debit card fee increase. Here, the government has no right to regulate and the banks are free to charge whatever the market will bear.

Why might the banks fail with charging a fee on debit cards, because in this situation, even though the banks are again acting as a Cartel and all are raising debit card fees, almost identically, the owners of those debit cards are not, like the retailers, a captive audience; We the People, as one of the Conservative hubbers I read like to call us, have options; we have choices. For my part, I will be closing my BoA account and start using my credit union and paying with cash a lot more; I am still very mad at the credit card industry as well, so I cut back on my use of those by about 60%. Unlike the Swipe Fees, which were kept hidden and abused terribly, without consequence by the big banks, the Debit Card fees are out in the open and subject to those market forces the Conservatives love so much.

It will be very interesting to see how it all plays out as credit cards come back in style and cash is much more of an option now a days. Personally, I don't think the fees will hold.