Should We Return To The Gold Standard ???

The discussion of monetary policy is a complicated one with many aspects that are often misunderstood by the general public. The discussion of the Gold Standard in recent years has been brought back to the forefront by some in American politics, particularly the soon to be retiring congressman Ron Paul. While I personally don’t agree with all of his views, he makes some very valid points. He has been a very outspoken advocate of returning to the gold standard. So is there truly a benefit to the Gold Standard as a backing to the US currency ???

Is Gold Money ???

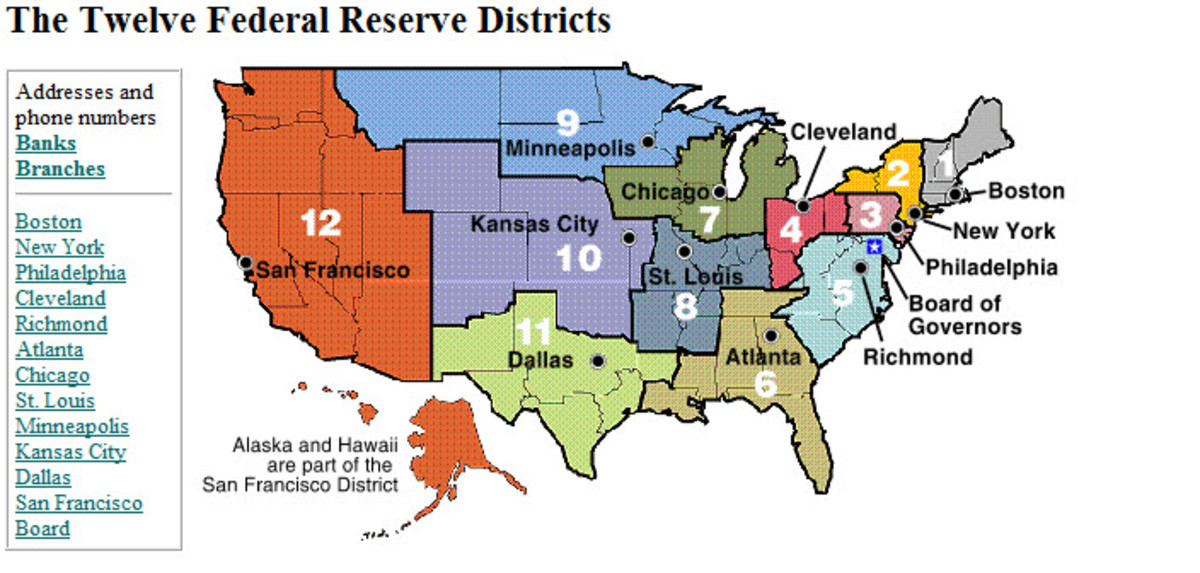

Technically speaking gold is not money in the sense that it is not our recognized currency. Only the Federal Reserve Bank can officially increase or decrease the money supply. They do this through multiple activities such as Federal open market operations, and the fractional reserve banking activity. Yet in modern economies, very little of the world’s currency is now in the form of physical currency. While we all enjoy the convenience of things like our direct deposits, is this something to be concerned with…Possibly.

The origin of the word “debase” comes from ancient Rome. During the rule of Nero from 54-68 AD and other previous emperors, the Roman Empire began to increase the money supply of coins without the gold & silver content it had previously contained. Nero was extremely popular with the lower classes who revered him as a savior. Rome had attempted to enrich its population with a worthless currency which provided its citizens with ever expanding benefits. By the rule of Emperor Claudius II Gothicus (268-270 AD) a silver coin that had once been made with 100% silver was being produced with only .02%. The ability to produce money without the inherent intrinsic value of precious metals proved fatal. This led to serious inflationary problems, and greatly contributed to the demise of the Roman Empire.

United States

In 1932 during the Depression, the expansion of government under FDR’s New Deal policies led many citizens to call into question the value of the paper money they held. FDR, concerned with his ability to finance his national programs issued Executive Presidential Order 6102 which required all US citizens with few exceptions to turn over their gold holdings to the Federal Government for a price of $20 per troy ounce. Once all the Gold had been redeemed, he set a new price of $35 per troy ounce. This significantly decreased the value and purchasing power of the dollar to the average American, and was likely once of the worst forms of an inflationary tax ever imposed on the American taxpayer.

In 1971 President Richard M. Nixon officially ended the Gold standard. In doing so, the Federal Reserve could produce money without the requirement of gold reserves to back its currency. Since that time the conventional wisdom among many economists has been that the flexibility of the Central Banks around world to increase or decrease the supply of currency is a vital tool to address economic contractions and overzealous expansions. Perhaps they are correct. Yet the evidence seems to be to the contrary.

While it is true that pinning a currency to a Gold Standard offers less flexibility in terms of addressing the immediate impact of an economic recession, the real question is if the damage done by the solution is greater than that of the initial problem. Since the creation of the US Central Bank in 1913 the US currency has lost more than 90% of its purchasing power. The gold standard on the contrary simply imposes fiscal discipline on the congressional branch of our government. It prevents political players from promising that which they have no resources to deliver. Politicians love to promise things to their constituents. The government can give you this…The government can give you that…But at what cost ??? Today, we are in late 2012 and the US GDP is currently at 15.4 Trillion dollars. Yet the unfunded liability of just the American entitlement programs alone (Social Security, Medicare, Medicare Prescription Drugs) is now 121.4 Trillion dollars. The evidence shows that the American people have already been promised more in benefits than there is money in existence to satisfy.

Over the last 4 years (2009-Nov 2012) the S&P 500 stock index has risen by better than 60%. Yet the price of gold over the same time period has risen by close to 130%. Much of this is a result of the expansionary policy of the Federal Reserve Bank. In simple terms, your assets have appreciated substantially, yet they buy less than they did before the appreciation. In reality the price of gold is actually fixed. Its intrinsic value does not change. The price of gold is more of a reflection of the increasing or decreasing value of a currency. It is in reality the currency itself that is changing in price. Although most developed nations do not use the gold standard, the marketplace still does. This is in reality as hidden tax on the citizens of the world by global central banks. It is not done because central banks are malicious by nature as many conspiracy theories have often suggested. Yet rather they attempt to solve the problems monetarily that are created by politicians who use the power of fiscal policy to grant the people things that they have no way to pay for. Elected officials make promises to the uninformed masses, and too often the central banks are asked to clean up the mess with financial tools that are inadequate and dangerous.

Even worse this, this type of an inflationary tax hits the lowest income earners the worst. The very people politicians promise benefits to are the least likely to hold financial assets. They must bare the same inflationary burden when they buy goods and services. However, they typically have significantly less exposure to financial assets like stocks and commodities…if any at all. In their case the appreciation in the price of tangible assets as a result of a devalued currency means nothing more than higher prices for gas and groceries. This is the root cause of the lower standard of living of many Americans, and the greater divide of wealth between the wealthy and the poor. Far too many of the world’s poorest citizens fail to recognize that the very people whom have promised them the security of the many things the government can do for them, have in reality simply had their pockets picked, and been placed on the equivalent of a political plantation for the poor.

So should we return to the gold standard ???

Some like congressman Paul suggest constitutionally we have to, and are in violation of the constitution. The constitution says he following….

"No State shall enter into any Treaty, Alliance, or Confederation; grant Letters of Marque and Reprisal; coin Money; emit Bills of Credit; make any Thing but gold and silver coin a Tender in Payment of Debts; pass any Bill of Attainder, ex post facto Law, or Law impairing the Obligation of Contracts, or grant any Title of Nobility."

This seems to be best left to the interpretation of the constitutional attorneys. However, it seems apparent that the rapid expansion and reckless creation of currency is a threat to the stability of any nation. It has created more poverty than wealth, and more asset bubbles than price stability. Of the few nations that had chosen to maintain a gold standard much longer such as Switzerland, the divide between the wealthy and poor was not nearly as wide. I attribute much of this to their currency stability.

Yet there is a relatively small amount of gold in supply globally. Limiting money creation to something so rare does pose some problems. Yet a gold standard does not have to be the only option. It has been proposed and is feasible that money creation be limited not just to the supply of gold, but rather pinned to a basket of commodities. Possibly a combination of precious metals and other agricultural commodities could be a solution. The most important component is not the specific commodity, but the restraining effect that any currency standard places on the elected officials who are so willing to give away that which they do not have at the expense of those they represent.

Many economists agree with this view, but a larger number seem to disagree. So why is this ??? In my view, the inherent flaw of human hubris often leads those in power to believe they can outsmart the collective conscious of the marketplace. Yet, in reality the lessons of history tell us this is unlikely to be successful. Whatever solutions are eventually found, the current course of events unfolding will lead to economic ruin if we simply wait for our elected officials to develop a strong sense of altruism and tell our citizens the truth. Which is that they just can’t keep the promises they have been making to the masses.

Suggested Reading

- Preparing For The Tax Law Changes In 2013

The topic of taxes is always one which is greatly debated from both a political as well as an economic perspective. Regardless of one’s political persuasion on such issues, one constant always remains the same. We each do all that we can to avoid... - Can The Government Create Jobs ???

The debate over whether gov’t can or should be attempting to create jobs is an interesting one. Those from all walks of economic theory have attempted to examine this from many different perspectives. Let’s first look at whether or not gov’t... - The Risks of Inverse and Leveraged ETF's: A Word of ...

In recent years there has been a rapid expansion of the ETF market as a solution to provide clients with low cost solutions that can provide a great deal of liquidity and transparency. As the ETF market place has grown, it has reinvented itself in... - The Tale of Two Depressions

Most of us who are too young to have lived through the Great Depression have either listened to our parents and grandparents tell us stories of what it was like, whereas others simply studied the cause and effects from as young as grade school. Yet.. - Starting A New Job...Understand Your Benefits Packag...

If you’re fortunate enough to have been hired into a new job there can be a number of things that need to be addressed at the beginning of employment. Often times it can be a little overwhelming to address all the issues that come up with regards... - The Risks Of Starting Your Own Business

Perhaps my nature was that of an entrepreneur at heart, or perhaps it was born out of the frustration of working under a large group of “yes men” in multinational conglomerates. However for many years I wished to work for myself. After years of... - What should your Financial Advisor ask you ???

Often we read articles & commentary about what to ask your financial advisor. But what should your financial advisor be asking you. Often times that alone can tell you whether or not you are engaged in a financial advisory relationship that is in - Passive vs Active Management…The Case for ETF’s

There has been an ongoing debate for decades about the benefits of actively managed mutual funds versus their passive counterparts. Those counterparts would be the exchange traded fund market (ETF’s) as well as traditional index funds. Those in... - Should I Pay off My Mortgage Early ???

For many Americans, the ability to pay down their mortgage sooner is simply not realistic. However in some cases it is quite possible. The Question of whether or not you should accelerate mortgage payments or use liquid cash to eliminate the... - What is a Private Equity Firm?

In recent months as we close out the political season of 2012 there has been much discussion of the career of Gov Romney and his work at Bain Capital in the business of private equity investing. It is not uncommon during an election for either party.