The Duopoly, Puppets for Neoliberalism

Neoliberalism is the fantastical belief that free markets will create fair trade and prosperity for the majority of people. The myth of free trade is the foundation of neoliberal policies, policies that increase inequality in our society. Deregulation of markets leads not to equity and sustained growth as classical economists purport but inequality and stagnation.

Laissez-faire economics means cuts to social programs and cuts in taxes because, they believe, “the market will work if we don’t interfere.” And Tinkerbell won’t die if we believe in fairies. Neoliberalism hurts everyone but the top quintile in the United States. Our twisted form of neoliberal adherence means assistance to big business and cuts to national investment and people, including failure to do the basic maintenance of our infrastructure.

Periods of economic recession in the United States have occurred due to laissez-faire economics advanced by Milton Friedman and the Chicago School of Economics. The period before the 1883 bank crisis, the Great Depression, the Savings and Loan crisis (due largely to deregulation under Reagan) and the hedge fund and banking deregulation under Clinton and Bush that lead to the recent economic collapse, are just some examples of the failure of deregulation. It was a lack of regulatory controls on banking and investments that caused the recent crisis, not regulation itself.

Currently, faith in neoliberal economics is unquestioned despite economic evidence that it creates inequality and suffering. Neoliberalism is whole-heartedly accepted by the duopoly, the two major parties that are nearly lockstep on fundamental economic issues. It is accepted as the way things are and will be. Adherence to neoliberal policies limits policy options to the failed economic strategies of the last thirty plus years. Solutions essential to our long-term economic wellbeing that address the economic cycles of boom and bust we currently suffer under are not options. Our leaders are so myopic and tied into the way things are that they see no choice but to live with a system that is not working for a majority of people. In fact, it does not serve the duopoly to change the economic policies, for most of our politicians benefit economically and politically from the system as it is.

The 1893 bank panic occurred because of massive debt accrued for railroad expansion. There were no limits to the debt railroads and their investors could incur, no borrower requirement to prove that railroads had the capital to cover these debts. This lack of regulation lead to failures of the Reading Railroad and the National Cordage Company. That lead to a stock market crash and bank closures. What it did not mean was regulation of the capital markets or laws to prevent future bank failures.

President Cleveland did little during the panic of 1893, for he thought that things would work themselves out. Meanwhile, the nation’s richest banker, J.P. Morgan, consolidated his banking assets during the crisis. A group of investors including Rockefeller took advantage of the flagging railroad industry and scooped up the Union Pacific Railroad, one of the largest at the time (All the Presidents’ Bankers). The burgeoning rail monopoly was addressed with later regulation such as the Sherman Antitrust Act. However, the act didn’t address usury and was more likely to hurt unions through its “conspiracy to restrict trade” clause that held that union strikes would harm industries and industrialists and were thus illegal.

The panic lead to business consolidation, and “The poorer elements of society…were left at the mercy of the trusts.” The reform efforts failed to address the underlying problems of trusts, monopolies, or labor issues.

The Sherman Anti-trust Act was also passed to address how trusts were formed, “Trusts used a number of techniques to eliminate competitors, including (1) buying them out, (2) temporarily undercutting their prices, (3) forcing customers to sign long-term contracts (4) forcing customers to buy unwanted products in order to receive the products they wanted and (5) dispatching thugs to use intimidation and violence when all other means of persuasion failed.” It was rarely used and more likely to be successfully used to squash union organizations as “illegal combinations.” (Ibid) With the current state of the political economy, I doubt that the Sherman Anti-Trust Act would be passed today let alone enforced.

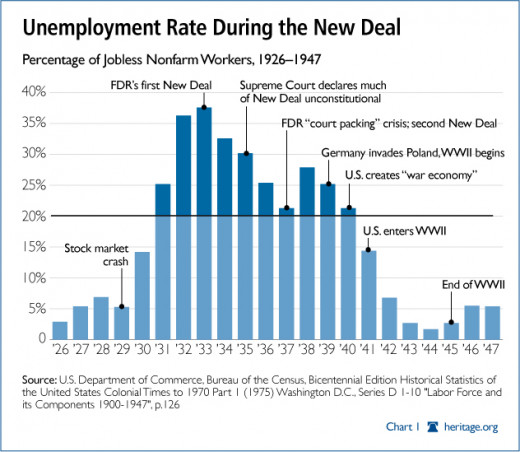

During the time of the 1920s, a lack of banking regulations caught up to the U.S. and the economy collapsed in the Great Depression. Before New Deal regulations, banks were able to lend on margin to people who lacked collateral, use depositors money for their own investments, and sell stocks to their costumers. Thus, when the stock market collapsed, thousands of banks went under and millions of people lost their deposits. Of course, that lead to 25% unemployment, loss of farms, homes, destitution and the worst economic conditions in U.S. history.

The government intervened with the New Deal, and it improved life for millions of Americans, including farmers and small business owners. And government spending during WWII, yes, government spending, brought about the final end to the Great Depression.

There were few regulations on banking practices before The Great Depression, “The fed government basically stayed out of the banking business until the ’30s, when FDR took office…” Then the government set up the SEC to formulate banking rules and the FDIC to protect deposits among other regulatory agencies.

The new rules meant that, “Companies that wanted to sell shares to the public to raise money had to disclose a host of financial information to potential investors. For the first time, investors could find out if a company was worth the stock price it was asking.” This and insured deposits brought back confidence that was understandably lacking during the depression and brought depositors back to the banks.

Gradually, these regulations have been eroded. First, the laws preventing certain mergers that were illegal from 1930 to 1969 were eliminated. These laws had blocked the too big to fail mergers. Today, too big to fail banks are common. Deregulation also lead to banks getting into the lucrative credit card business (Bank of America with Visa and Wells Fargo with Mastercard).

The banking industry is one of the largest lobbying groups in the nation. Finance companies, insurance and real estate firms spent $207,843,109 in lobbying and investing in campaigns in 2013-14. It means that most Congress members, state legislators, and other state and national politicians think twice before regulating these institutions, if they think about it at all. It means that what benefits the bankers will benefit the politicians. It means that these moneyed interests have power to influence the government, its laws and regulations while the rest of us have little say.

Obamacare, the Affordable Care Act (ACA), was supported by the health care lobby which include big pharma, insurance, hospitals and HMOs. The corporate law was supported by both parties, and is touted by the White House as a victory. Yes, it is a victory, for corporations. The ACA is exactly the kind of law neoliberals love; it kept corporations in the profit making business of healthcare by putting the costs onto taxpayers and those that buy insurance. And the insurance mandate meant more costumers for insurance companies to sell to.

Post WWII investment in veterans though the G.I. Bill helped educate veterans for the transition to a peace-time economy. Johnson’s Great Society programs reduced poverty among the elderly and led to gains in the economy. Also, during Johnson’s term there was the building of the Interstate Highway system, a great boon to the economy, “Over the year the interstate highway system has provided hundreds of thousands, possibly millions, of jobs during its initial construction and its continuing maintenance and expansion. It is the heart of the economic engine that drives our economy.” Public investment in the economy has a positive impact.

It was the in the 70s that laissez-faire economics started to take over from Keynesian, New Deal investment programs in the U.S. It was a return of the neoliberal economics of the Coolidge and Hoover years. Reagan and the neoliberals were winning, “With the accession of the Right into government in Britain in 1979, and in the United States in 1980, the doctrine of laissez-faire, emphasizing the retrenchment of state intervention in the economy, has been revived as a guide to economic policy making.”

Reagan is famous for saying that “government is the problem” with our nation. However, “The main problem with Reagan’s outlook was a failure to recognize that government regulation can serve business interests quite effectively. Many of the regulatory programs started by Franklin D. Roosevelt’s New Deal in the 1930s aimed to promote fairness in economic competition.” The real problem that leads to poverty is neoliberalism itself and the duopoly that unquestionably supports it.

Paul Krugman puts the recent banking crisis firmly on Reagan, “For the more one looks into the origins of the current disaster, the clearer it becomes that the key wrong turn — the turn that made crisis inevitable — took place in the early 1980s, during the Reagan years.” Clinton continued Reagan’s policies with an emphasis on deregulating Wall Street, “Wall Street deregulation, blamed for deepening the banking crisis, was aggressively pushed by advisers to Bill Clinton who have also been at the heart of current White House policy-making, according to newly disclosed documents from his presidential library.” Clinton was a master at convincing the people that he “feels your pain” while creating policies that increased their pain and profits for Wall Street.

According to Professor and author Gregory Albo, “In signing the Welfare Reform Bill of 1996 and the subsequent 1997 budget compromise, Clinton broke the back of the New Deal. The government commitment, however modest and poorly implemented, to protect the poor against the worst ravages of the market was thus ended.” Clinton’s signing on to the Reaganite, neoliberal policies was when the Chicago school of Economics won its final battle against Keynesian, New Deal economic investment. Bush and Obama have just continued along the same path.

Clinton was also responsible for promoting and signing the repeal of the Glass-Steagal act, a depression era law that regulated banks and made it illegal for banks to be both an investment and savings banks. President Obama for his part hired the same people that helped bring about the banking, housing market collapse of 2008, that turned the bailout “into an all-out giveaway.”

When the government has intervened and regulated certain aspects of the economy, it has helped U.S. growth. During the Civil War, the transcontinental railroad was planned and built. That is a prime example of how government and business can combine to do great things. The problem is that there was no regulation of working conditions, wages, age or hour restrictions, and this eventually lead to inequality of growth, Robber Barons and banking crisis in the late 19th Century. Only when progressive policies such as the minimum wage, child labor laws and anti-trust regulation were passed did the economy once again improve.

Critics of government fail to look at the historical and current government assistance to corporations and thus say that “the less government, the better.” The government bailout of the banks, the building of U.S. rails and highways, the creation of the Internet and many other corporate/government projects belie the idea that the government can do no good or that the government is anti-corporate. In fact, the government is all too corporate at the expense of the people. And since the late 1970s, the government has been removing many of the regulations of the Great Depression that helped put this nation on a firm economic ground for almost fifty years.

The United States democracy is retarded by their two-party controlled political system (duopoly) that is dominated by neoliberal ideology. The U.S. government started as a less than democratic government by accepting slavery, voting limitations, poor distribution of power among branches, a codification of a ruling class structure similar to that of a monarchy, and a failure to ratify economic rights along with politic rights among other failings. The Bill of Rights doesn’t address the problems of income inequality nor access to equal amounts speech and equality in judicial rights. Some call this a “nanny state”; I call this a fair day’s pay for a fair day’s work.

There have been moments in United States history when there was an opportunity to break out of the downward spiral of neoliberal politics and so-called “free market” economics. However, the reforms were too small or later overturned by the politics of our neoliberal government.

President Franklin Roosevelt made a plea for wealth opportunity when he addressed the nation and laid out his “economic bill or rights.”

“Excerpt from President Roosevelt's January 11, 1944 message to the Congress of the United States on the State of the Union:[2]

“We have accepted, so to speak, a second Bill of Rights under which a new basis of security and prosperity can be established for all—regardless of station, race, or creed.

Among these are:

1. The right to a useful and remunerative job in the industries or shops or farms or mines of the nation;

2. The right to earn enough to provide adequate food and clothing and recreation;

3. The right of every farmer to raise and sell his products at a return which will give him and his family a decent living;

4. The right of every businessman, large and small, to trade in an atmosphere of freedom from unfair competition and domination by monopolies at home or abroad;

5. The right of every family to a decent home;

6. The right to adequate medical care and the opportunity to achieve and enjoy good health;

7. The right to adequate protection from the economic fears of old age, sickness, accident, and unemployment;

8. The right to a good education.

All of these rights spell security...For unless there is security here at home there cannot be lasting peace in the world.”

The duopoly of the United States of America will not let those rights become law. Only until we get the corporations out of government and have actual choices of candidates to vote for, not one of two corporate parties, will this start to change. Otherwise, the booms and busts of economics will only get more pronounced and inequality will continue to increase. Until people receive a living wage for their work and the moneyed elites pay their share for the benefits they receive from our nation, revolution seems to be the only option.

Peace,

Tex Shelters