The Politics of Tax and Spend3

What are we trying to do?

Commerce and industry are the wealth generators of our country. In some countries agriculture is the main wealth generator. How do we use taxation and spending to help the economy?

We can work hard to build infrastructure, whether it be railways roads or airports. The Republican Party in America originally came together to campaign for improved infrastructure, to help agriculture and commerce and industry. President Eisenhower built the Interstate highway system, an investment that has paid for itself many times over.

The US government for many years had a government funded outreach system of agriculture education for farmers, helping sometimes poorly educated farmers to improve their farming techniques.

Can we achieve more with our limited public money by giving subsidies to private companies to build infrastructure instead, so that the infrastructure is built with mainly private money?

The British Labour Government Private Finance Initiative allowed Labour to commission huge amounts of building all over the country, using private sector money rather than public money. Alas it is now time to pay the rent, and the British state will end up spending huge amounts on renting buildings we could have built ourselves and actually own.

We can give tax breaks to “green” or new industries. We can tax petrol users more heavily.

Often we need a combination of carrot and stick to achieve our ends. The Construction Industry Levy Board mentioned in the first article is a good example.

Raising child benefit can make it less expensive to have children, and even profitable. If we wish to grow our population, that is one way to do it. A cheaper way may be to allow foreigners to immigrate. When Australia wished to grow its population after World War 2 Australia offered very cheap fares to help British people to immigrate..

If we believe that science and engineering are the way forward, we have to invest in our schools and universities so that they have the laboratories workshops and machines to teach people on – and we will have to subsidise the teaching because teaching science and engineering is much more expensive than Arts subjects.

The Keynesian argument that spending is the way out of recession seems to be broadly right. As a practical point, a construction worker in work is generally not receiving benefit and is paying tax and national insurance – and he is creating a capital asset. The same man unemployed is not paying tax and national insurance. He is receiving benefits. He is creating nothing. For not much more than it costs to keep him idle we can have something of value from him.

Local authorities used to have an important role employing people who were at a disadvantage in the labour market because of poor education, borderline low intelligence, or poor social skills. Working, they had pride in themselves and they did contribute to society. Now many of these folk are laid off contributing nothing. One has to ask whether there is any saving to the overall public purse.

Healthy Public Finances

The health of the public finances is closely related to the performance of the economy. If unemployment is low, and tax income is high, the public finances should be good. If unemployment is high, and tax income is reduced, the public finances will be bad. It's not rocket science.

A doctor can deal with a patient’s raging temperature by dunking the patient in cold water repeatedly. One would question whether this was the best treatment. The cons and neo-cons often look like the demented doctor!

The Opportunity

The mix between collecting taxes and the spending of the taxes raised gives every government the opportunity to try to move the country in the direction it wishes.

The Series!

- The Politics of Tax and Spend1

Every modern society has taxes, because every Government needs money to provide goods and services that are better provided communally. Our Armed Forces need forward planning and resource allocation, which... - The Politics of Tax and Spend 2

Most politicians are more comfortable with spending money than with raising it. Raising taxes hurts somebody. Spending money is supposedly all good. If the government decides to build subsidised housing in...

Politics and Humour

- The 2010 British General Election - The Unexpected R...

A spoof report on how Britain elected the Green/ Monster Raving Loony Party in 2010 and what this unexpected coalition government did. - Elected Councillor For Paradise

How Charles James increased the Labour vote 80% to take a safe Conservative council seat for Labour. Astonishing and true! - Increased Majority In Paradise

How Charles James improved his Labour vote and his majority in a further 48% increase on top of the 80% increase earlier recorded. How to hold a marginal seat. All true! - Some Political Jokes and Anecdotes

Political Jokes often present a political truth succinctly. Many are transferable across continents and across time. This is a series of political jokes and anecdotes added to as I remember them. - An Alternative To Democracy

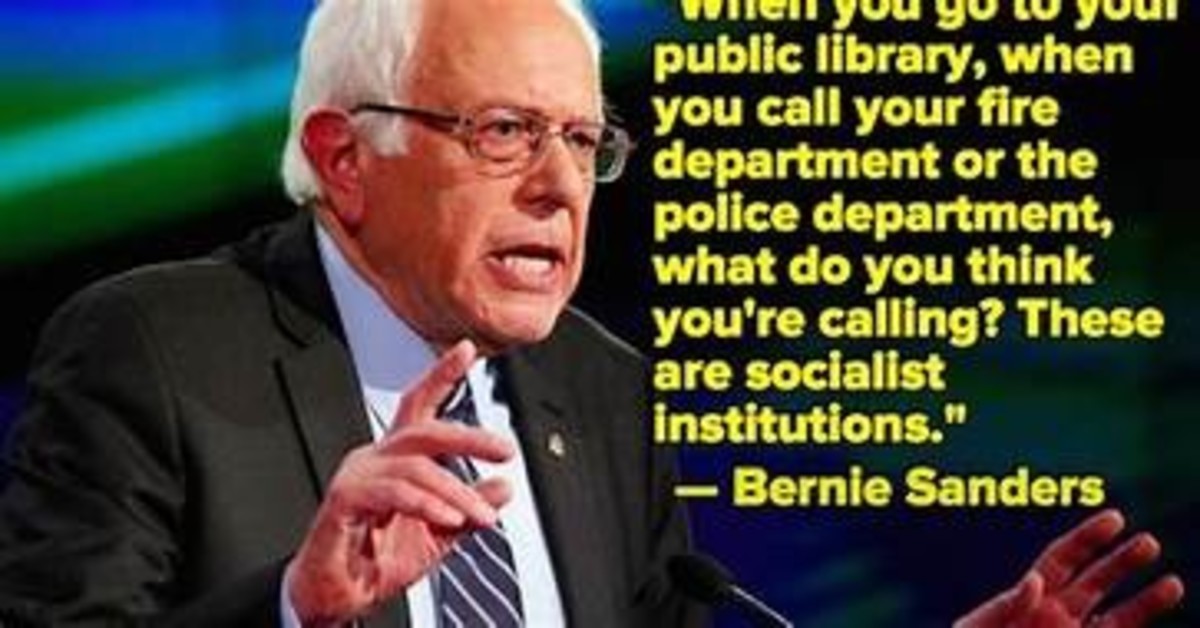

An interesting proposal to vary democracy by giving more votes to those who have raised kids, have worked abroad, have been officers or have degrees, or have economic success. Controversial but interesting. - Socialism Continues - What's "Left" For Socialists

Socialism in 2012. What should socialists do and how should we do it?

Some Interesting Arguments

- Tea And Social Class in England

A truthful and hilarious article about the role tea plays in displaying one's social class or lack of class in England. - socialism 101

A guide written to explain socialism to Americans. Intelligent people given correct information will reach the Left conclusion. - Rolling Stones Prove Tax Cuts Work

In a previous hub entitled How Tax Cuts Work I attempted to explain how reducing high marginal tax rates encourages people to work and produce more. This leads to a larger income base on which to levy taxes... - Government spending and taxes during recession.

During a recession, the private sector spending drops for a variety of reasons. Demand for goods and services drop. Private investors tend to restrict their investments. Factories tend to drop production... - California IOU Tax Refunds

Update: It has been reported that the California Supreme Court has allowed furloughs to be implemented. A lower court had overturned the furloughs and the Supreme Court will review them. But this Friday,... - Go to hell IMF: We don't want your austerity plans o...

What Will Happen to the 30 Year Mortgage? Americans must understand the IMF and German government view of things in order to protest IMF imposing plans for the US economy. The Value Added Tax, a hidden tax,... - Problems with Taxing the Rich

Whenever the subject of government revenue shortfalls (i.e. deficits) comes up, politicians and their allies on the left immediately begin demanding that the needed funds be raised by increasing taxes on the... - Senator John Kerry's Yacht and Tax Cuts

July 28, 2010In previous Hubs I have described the theory behind supply side tax cuts and how taxes influence the decisions of rock groups, like the Rolling Stones and other world class entertainers, when... - Democrat vs Republican Tax Cuts

In a previous Hub (see - How Tax Cuts Work

According to October 11, 2006 news reports, the Federal deficit (the amount by which government spending exceeds tax and other government revenues) has shrunk to its lowest amount in four years. In addition...