What's a Fiscal Cliff? Defining Disaster

The Fiscal Cliff, as it is being called, is an amalgamation of Congressionally created budgetary events tentatively scheduled to coincide with the beginning of 2013. The Bush Tax Cuts are set to expire, sequestration, and then the debt ceiling again in February/March.

While there may be temporary extensions - 60 days or 6 months - and most of the tax cuts can be applied retroactively to Jan. 1, I want to describe exactly what it means to fall off of the "cliff"..

Expiring Bush Tax Cuts--

As they are widely known, were passed initially as the Economic Growth and Tax Relief Reconciliation Act of 2001, and later extended in various forms in 2003 and again in 2010. The Bush Tax cuts are tentatively scheduled to expire on January 1st, 2013.

- Individual Federal Income Tax Rates

Federal income taxes are set to return to Clinton-era levels. The top bracket (above $388,350 in 2012) will go from 35% to 39.6%; the 33% bracket to 36%; 28% bracket to 31%; 25% bracket to 28%; and 10% bracket to 15%. For perspective, the top rate was 94% in 1945, 91% in the 1950's and '60s, and 70% as recently as 1980.

- Capital Gains Rate

Long-term rates will go from 15% to 20% after the first $50k. Qualified 5-year capital gains from 15% to 18%.

Dividends income rates on will be taxed at same levels as ordinary income.

- Estate Tax

The new rate will 55% after the $1 million exemption; from 35% with a $3.5 million exemption in 2009; and from a high of 77% in 1972.

- Alternative Minimum Tax

The AMT was instituted in it's current form in 1982, the AMT means that an individual must pay the greater of the regular income tax rate or the AMT rate. Nominal AMT rates were set in 1993 at 32.5% and 35%, and are not subject to inflation. Instead, Congress has passed "inflation patches" to allow exemptions along with the AMT such as the Child Tax Credit and the Student Loan Interest Deduction. Currently the AMT is set at 26% and 28% and allows inflation patches, in 2013 the AMT is set to revert back to 1993 form.

Budget Sequestration--

Passed in the Budget Control Act of 2011, the sequester simply means that $1.2 trillion will be cut from discretionary defense and discretionary non-defense spending and by way of 2% across the board cuts. While everyone claims to support reduction of deficits and debt, no one seems interested in going about it in this manner. The cuts were designed to be blunt and meant to be painful, while completely devoid of rational thought or strategy. This supposedly was intended to spur compromise with all parties wishing to avoid the blunt trauma that is the sequester...

Payroll Tax Holiday--

The two percent payroll tax holiday was initiated in 2011 and extended for 2012, basically to replace The Making Work Pay tax credit. OASDI (Social Security) for individuals is set to return to the usual 6.2% from 4.2% rate on earnings up to $113,700 in 2013, same 2013 rate for employers. Self-employed (SECA) OASDI will go back to 12.4% from 10.4%, only on the first $113,700.

HI (Medicare) will go from a matching 1.45% from both employers and employees, to the same 1.45% from employers and 2.35% from employees; with no wage cap.

Earned Income Credit--

Enacted in 1975. Should the 2009 EIC expansion expire, the EIC phaseout will go from $5,000 to $3,000 and decrease the wage subsidy from 45% to 40% for families with three or more children.

Child Tax Credit--

Expanded in 2001 and 2009, the Child Tax Credit will go from $1,000 to $500 while phasing out for families earning $110k and individuals at $75k.

Unemployment Insurance--

The Unemployment Insurance benefit extension will expire, reverting to a limit of six months. Of the five million people collecting for over six months, 40% will be removed from the program immediately. While benefits can be applied retroactively, unfortunately for them the unemployed generally have no rainy day fund of disposable income to survive in the mean time.--

Student loans interest deduction --

The amount of your student loan interest deduction will be phased out if your modified adjusted gross income is between $55k & $70k ($110k and $140k if you file a joint return). You will not be able to take a student loan interest deduction if your modified AGI is $70k or more ($140k or more if filing jointly).

Also expiring or changing

- American Opportunity Tax Credit

- Lifetime Learning Credit

- Hope Tax Credit

- Mortgage debt forgiveness

- Itemized deduction limit

- Personal exemption phase out

- Medicare SGR/Medicare Doc Fix--

- State and local tax deductions

- Educator expense deduction

- Electric vehicle passive activity credit

- Enhanced adoption credits

- Non-business energy credits

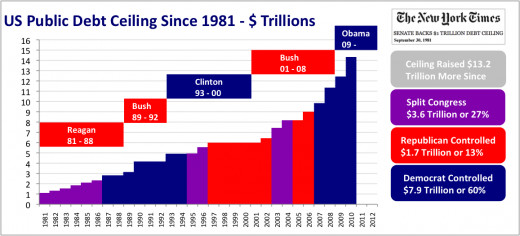

Debt Ceiling--

This is perhaps the most ridiculous aspect to our democracy. The debt ceiling is NOT new spending.

The Congress is responsible for passing our federal budget, and those budgets sometimes result in deficits rather than surplus. Cumulative deficit spending year after year has resulted in our national debt ($16+ trillion). While it is true that Congress alone has the responsibility of allocating budgetary resources (the House specifically, from whence budgets are Constitutionally required to emerge), in 1917 Congress decided that they needed to give themselves permission to pay the bills for what was already purchased in the budgets they already passed.

The original debt ceiling was set at $11.5 billion, and currently sits at $16.4 trillion.

It's like if you had bought a computer with your credit card - that's the budget - and when your credit card bill comes in the mail - that's the debt ceiling. The computer is already sitting at home being used, the decision now is whether to pay the credit card bill, or not, for what we already got. If no, then our credit score takes a beating. Hence the nation's credit being downgraded from AAA by Moody's and the like the last time we had this debt-ceiling debacle back in 2011.

12/31/12