Why the Affordable Care Act is constitutional: An unbiased summary of Obamacare and Supreme Court reasoning

Is Obamacare constitutional?

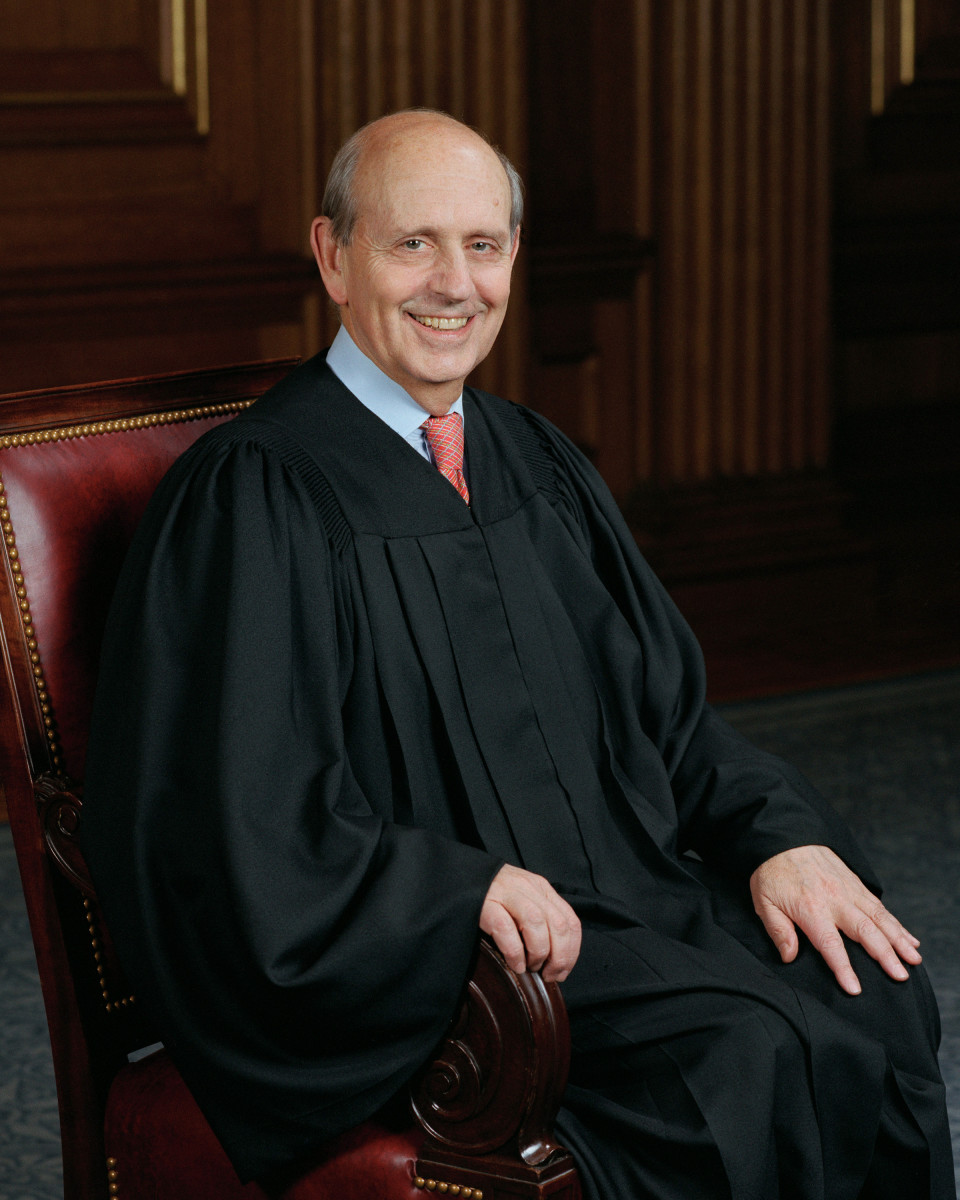

Today is Thursday, June 28, and the Affordable Care Act (or Obamacare), individual mandate and all, has been upheld by the Supreme Court as constitutional. The vote by the SCOTUS was 5-4, with Justice Roberts siding with the "liberal wing" of the Court in a decision that was a shock to many, including me.

But after reading the full text of the ruling (along with countless articles, tweets, and posts), guess what? This libertarian actually thinks the Court made the right call, and I agree that Obamacare is in fact constitutional. Yeah, you read that right. The right call, and is constitutional. Whether it's a good policy or not is a different matter; I just agree wholeheartedly with the Court majority's ruling (written by Chief Justice John Roberts) that the ACA is constitutional.

I don't know about any other conservatives out there, but my morning went something like this. When I got up and checked my laptop, I read that Obamacare has been upheld, which honestly shocked me. My shock lead me onto the Internet, where I read that the ruling was 5-4, not surprisingly. What did surprise me was that Justice Roberts, not Kennedy, sided with the liberal side and declared the ACA constitutional.

That gave me some pause. I have a lot of respect for Chief Justice Roberts, and I suspected there was a very good reason he voted the way he did. So I hunted down the full decision (In a good reflection on transparency in the US government, it's everywhere), plopped myself down, and spent the rest of the morning reading through it.

Here is the link to the complete ruling. This is meant as a summary, but I suggest that readers please read the complete ruling if in any way possible. If you can't right now, that's what this summary is for. But remember to bear in mind that your opinion cannot be complete if you haven't read the primary document and reasoning. (Nothing to any readers personally, just that I've seen a lot of misinformation posted today.) I did my best to present the case the exact way Chief Justice Roberts did, just in briefer wording, but I can't be certain I contained any bias I may have.

Bear in mind, the Supreme Court challenged two parts of the act. One was the individual mandate, which is the one that I will focus on in this hub. The other was the Medicare expansion, which was overturned in part due to violating the 10th Amendment. I will write a hub on that as soon as possible [Here it is now, Part two: Medicare expansion], but for now let's just focus on the individual mandate.

This hub will mostly consist of a summary of the points made by the SCOTUS, and I will do my best to present them in the most unbiased way I can. I will refrain from giving my opinion until the end, where you will see a large, bolded label that reads My take, upon which you will have crossed the boundaries into the world of Zermop. Anything before that and from this point on is as unbiased as I can make it, just a summary of the Supreme Court's / Chief Justice Roberts' reasoning. Unless otherwise attributed, all quotes are from Chief Justice John Roberts's written opinion in the Affordable Care Act ruling. Comments are welcome, but as I do not censor, please comment responsibly.

What is the Affordable Care Act, or Obamacare?

Quoting a summary by Justice Roberts (Any underlining is by me, for emphasis): "The individual mandate requires most Americans to maintain “minimum essential” health insurance coverage. 26 U. S. C. §5000A. The mandate does not apply to some individuals, such as prisoners and undocumented aliens. §5000A(d). Many individuals will receive the required coverage through their employer, or from a government program such as Medicaid or Medicare. See §5000A(f). But for individuals who are not exempt and do not receive health insurance through a third party, the means of satisfying the requirement is to purchase insurance from a private company."

"Beginning in 2014, those who do not comply with the mandate must make a “[s]hared responsibility payment” to the Federal Government. §5000A(b)(1). That payment, which the Act describes as a “penalty,” is calculated as a percentage of household income, subject to a floor based on a specified dollar amount and a ceiling based on the average annual premium the individual would have to pay for qualifying private health insurance. §5000A(c). In 2016, for example, the penalty will be 2.5 percent of an individual’s household income, but no less than $695 and no more than the average yearly premium for insurance that covers 60 percent of the cost of 10 specified services (e.g., prescription drugs and hospitalization)." (p.7)

This selection, like the rest of the hub, deals mostly with the individual mandate. I will cover the overturned Medicare expansion in some other hub. People can continue getting their insurance through Medicare or their employer. This act is meant mostly to encourage people who do not yet have insurance to purchase it, to prevent cost shifting by healthy individuals.

The underlining provided by me is to emphasize information that seems to forgotten, or misunderstood. The first underline is to show that Obamacare does not provide care for illegal immigrants, something I've heard conservatives screaming all over the Internet. False. Not true. Illegal immigrants do not get coverage.

The second spate of underlining deals with how the "penalty" (for not having insurance) is calculated. It's based off a percentage of your household income, which will begin at 1% and top off at 2.5 percent, if the act is implemented in 2014. The "floor", the minimum any uninsured person will need to pay, is $695, and the "ceiling" is "the average yearly premium for insurance that covers 60 percent of the cost of 10 specified services." Sounds a lot like a tax to me, but more on that later.

What the act does not do, under the Supreme Court view, is make it illegal to not have health insurance. If you don't have it, you simply need to pay a "penalty" to the IRS. But, again more on that later.

Dealing with Tax Anti-Injunction

If we summarize in the order that Chief Justice wrote the ruling, we would first need to cover the Tax Anti-Injunction Act argument. That Act states, with only 14 specific exceptions, "No suit for the purpose of restraining the assessment or collection of any tax shall be maintained in any court by any person, whether or not such person is the person against whom such tax was assessed." This act means a person can only sue a tax after it has been paid, for a refund.

Because some thought the Act shouldn't even come before the Supreme Court, due to the Tax Anti-Injunction, a amicus curiae (in this case, a sort of devil's advocate) was assigned to defend the argument that the Supreme Court shouldn't see it. Amicus' argument was that because the ACA is in many ways similar to a tax (collected by IRS, calculated by percentage of income), it should come under the TA-J.

The Supreme Court countered that Congress purposefully framed the mandate as a "penalty", not a "tax", and it has the right to determine the relationship between the two acts, because(in a distinction that will be crucial later) Anti-Injunction came from Congress as well. Because of this, the relationship should be determined by Congress, and it purposefully framed the individual mandate not to fall under the Anti-Injunction Act. Therefore, the Anti-Injunction Act does not bar the Supreme Court from hearing the case.

Two arguments presented by Federal Government

The Democratically controlled Government presented the Affordable Care Act's constitutionality under two arguments.

1.) Commerce Clause. The Commerce Clause gives Congress the power "To regulate Commerce with foreign Nations, and among the several States, and with the Indian Tribes" (U.S. Constitution, Art.1, Section 8, cl. 3). The argument under this clause is that the individual mandate has "substantial effect" on interstate commerce, and so Congress has the rights to it under the Necessary and Proper Clause. More on that later.

2.) If not, view as tax. However, if the court found that the Commerce Clause does not uphold the ACA, the Government claimed that the act still should be upheld under Congress' tax powers. Under the Constitution, Congress has the right to, "Lay and collect Taxes, Duties, Imposts and Excises, to pay the Debts and provide for the common Defense and general Welfare of the United States" (U.S. Constitution, Art. 1, cl. 1). Again, I'll go into more detail later.

The Commerce Clause defense was the bulk of the presentation, but they more or less asked the Court to fall back and treat the Act as a tax if the Commerce Clause was found to be insufficient to defend it.

Government's argument under Commerce Clause

The Government argues that not purchasing health insurance has "substantial effect on interstate commerce", and interstate commerce is something they have the right to regulate. Additionally, they point out the "Necessary and Proper Clause", which allows Congress to take any necessary and proper action to implement its lawful, constitutional reforms.

It points to the case Wickard v. Filburn, which involved a farmer who grew wheat for consumption on his own farm. The farmer actually lost the case in the Supreme Court, because the Court ruled the amount he grew, and if more people did the same, would have a "substantial effect" on interstate commerce, because growing the wheat yourself would allow you to not purchase in the market. This case gave Congress the right to regulate him, and is the precedent for extending Congress' powers that the Government is pointing to. (Whether Wickard v. Filburn was a wise decision is a discussion for another hub.)

Commerce Clause does not allow the ACA: Invalidated

However, even if we assume that the Wickard case was ruled correctly, the Supreme Court finds that the individual mandate in the ACA is different from Wickard v. Filburn.

The reason behind that is because the Supreme Court views the farmer in Wickard v. Filburn as having already been "active" in the wheat market, due to his activities producing it. The problem with applying that to health insurance would that it would set a precedent for Congress to be able to regulate inactivity as well, allowing them to possibly command Americans to do things that would benefit the country as a whole, like eating broccoli to prevent strain on the healthcare system.

Again in the words of Justice Roberts: "No longer would Congress be limited to regulating under the Commerce Clause those who by some preexisting activity bring themselves within the sphere of federal regulation. Instead, Congress could reach beyond the natural limit of its authority and draw within its regulatory scope those who otherwise would be outside of it" (p.29-30).

An argument by the Government, and a common argument among supporters of the Commerce Clause acceptance, is that healthcare is not similar to broccoli. The Supreme Court disagrees. "The Government argues that the individual mandate can be sustained as a sort of exception to this rule, because health insurance is a unique product. According to the Government, upholding the individual mandate would not justify mandatory purchases of items such as cars or broccoli because, as the Government puts it, “[h]ealth insurance is not purchased for its own sake like a car or broccoli; it is a means of financing health-care consumption and covering universal risks.” Reply Brief for United States 19. But cars and broccoli are no more purchased for their “own sake” than health insurance. They are purchased to cover the need for transportation and food" (p.27).

If the individual mandate was allowed under the Commerce Clause, Congress could use the same reasoning to expand its reach into inactivity. There are thousands of thing people don't do everyday that might help society. An example that has reoccured constantly in this case is the purchase of broccoli. The diets of most Americans are not the healthiest they could be, and in total it causes a great deal of strain on the healthcare system.

In fact, almost 10% of the Medicare funding in past years has gone to treat obesity related problems (heart problems, etc.). If Congress was allowed to regulate inactivity, it could conceivably require all Americans to eat a healthy diet or face "penalties", in the name that obesity has "a substantial effect on interstate commerce". Using the same reasoning could justify government intervention in a host of other activities or, to put it more accurately, inactivities.

In the opinion of at least the Chief Justice, this would not be a good thing. Therefore, the Supreme Court majority ruled that the Affordable Care Act is not constitutional under the Commerce Clause.

My (quick) take on the Commerce Clause ruling

Government telling individuals what to eat (or what to wear, or what to do in general) is a very disturbing concept to me. Liberty and freedom are the things I most admire in any society, because without individual freedom, any happiness is ultimately impossible.

Luckily, Justice Roberts had the insight to see that the Commerce Clause cannot validate the Affordable Care Act. By ruling the Commerce Clause does not allow Congress to regulate inactivity, the Supreme Court has set a lasting precedent limiting the power of the Federal Government, and rightly so.

However, the ruling that the ACA is unconstitutional under the Commerce Clause does not end the discussion. The more convincing argument, and the one that ultimately gets this act upheld, is that the ACA is covered under Congress' powers of taxation.

Government's argument under taxes

The Government claimed/admitted that, even though the Obama administration has repeatedly denied the ACA is a tax, it does have "many" of the qualifying characteristics for one. Therefore, the claim says the Affordable Care Act in fact does qualify under Congress' tax powers.

The Constitution states that Congress has the power to, "Lay and collect Taxes, Duties, Imposts and Excises, to pay the Debts and provide for the common Defense and general Welfare of the United States" (U.S. Constitution, Art. 1, cl. 1). The Federal Government claims that the ACA falls under this clause.

Can it even be treated as a tax?

Some of these reasons were given by the Government, and others were given by the Supreme Court to justify construing the ACA as a tax. In no particular order, these are the reasons why the Affordable Care Act qualifies as a constitutional tax.

1.) Paid into the Treasury by taxpayers at the same time they file tax returns. This is actually several reasons in one, but the gist of this is that the "penalty" required by the ACA is paid in basically the exact same why taxes are paid.

2.) Measured by variables like taxable income, number of dependents, and joint filing status. Again, same as taxes.

3.) Enforced by the IRS (without criminal prosecution tools). The "penalty" would be enforced by the IRS, without the tools that would make it most criminalizing. In the words of Roberts - "...the payment is collected solely by the IRS through the normal means of taxation—except that the Service is not allowed to use those means most suggestive of a punitive sanction, such as criminal prosecution" (p.36).

4.) Provides revenue to the Government (for public services). The entire point of the shared responsibility payment / individual mandate is to provide money to cover basically everyone with health insurance, with the reasoning that it's fair to require it as most everyone will enter the health "market" at some time. Sicknesses and injuries are unpredictable but inevitable. Additionally, the Government's role in providing a fair ladder of opportunity (see my hub "Why capitalism works and socialism doesn't") justifies the mandate.

5.) Not an "exceedingly heavy burden". Due to the floor and ceiling, the Supreme Court ruled that the ACA's "penalty" is reasonable enough to qualify as a tax, or an option for those who for whatever reason want to opt out.

6.) Does not criminalize not buying, makes options available. Like stated in the above reason, the ACA qualifies as a tax because options remain for those preferring to not buy the health insurance. The Supreme Court officially read the ACA as not criminalizing not buying health insurance, but instead taxing those who do not buy health insurance.

And there you have it, the Affordable Care Act is now a tax as defined by the highest court in the land.

Should it be blocked due to not apportioning?

However, as stated eloquently by Chief Justice Roberts - "Even if the taxing power enables Congress to impose a tax on not obtaining health insurance, any tax must still comply with other requirements in the Constitution" (p.40).

There is a brief dispute on whether the Direct Tax Clause prohibits the ACA from going forward. "Plaintiffs argue that the shared responsibility payment does not do so, citing Article I, §9, clause 4. That clause provides: 'No Capitation, or other direct, Tax shall be laid, unless in Proportion to the Census or Enumeration herein before directed to be taken.' This requirement means that any “direct Tax” must be apportioned so that each State pays in proportion to its population."

The Supreme Court, however, states that a tax on health insurance is not "within any recognized category of direct tax" (p.41). Pointing to precedents, the Supreme Court retains its position that the only kinds of direct taxes are capitations (taxes paid by any individual without regards to circumstance) and taxes on land and other personal property. Therefore, the Direct Tax Clause does not bar the ACA.

Why the ACA/Obamacare should be allowed under tax powers of Congress

I have heard conservatives worrying that the difference in the taxes label and the Commerce Clause label is just that, a difference in label, and still sets a precedent for increased Government regulation. Chief Justice Roberts addresses this concern quite eloquently on pages 41-43. In his words: "If it is troubling to interpret the Commerce Clause as authorizing Congress to regulate those who abstain from commerce, perhaps it should be similarly troubling to permit Congress to impose a tax for not doing something. Three considerations allay this concern" (p.41).

"First, and most importantly, it is abundantly clear the Constitution does not guarantee that individuals may avoid taxation through inactivity. A capitation, after all, is a tax that everyone must pay simply for existing, and capitations are expressly contemplated by the Constitution" (p.41). This is the reason the ACA was ruled constitutional; the Constitution doesn't forbid taxation on inactivity, and in fact it explicitly allows them through addressing capitations.

"Second, Congress’s ability to use its taxing power to influence conduct is not without limits" (p.42). The Supreme Court then points to cases like United States v. Butler, in which the Court determined that there is a line where taxation crosses into "punitive action". Though they did not determine exactly where that line is during that case or this one, it is decided that it clearly exists, and so the Court can determine whether any measure crosses it. In this case, the Supreme Court majority rules that the ACA falls solidly into the "tax" definition.

"Third, although the breadth of Congress’s power to tax is greater than its power to regulate commerce, the taxing power does not give Congress the same degree of control over individual behavior" (p.43). I thought the Chief Justice did an excellent job summarizing the reason why taxes allow the ACA to be constitutional while the Commerce Clause doesn't, so I'll quote him verbatim below.

"Once we recognize that Congress may regulate a particular decision under the Commerce Clause, the Federal Government can bring its full weight to bear. Congress may simply command individuals to do as it directs. An individual who disobeys may be subjected to criminal sanctions. Those sanctions can include not only fines and imprisonment, but all the attendant consequences of being branded a criminal: deprivation of otherwise protected civil rights, such as the right to bear arms or vote in elections; loss of employment opportunities; social stigma; and severe disabilities in other controversies, such as custody or immigration disputes."

"By contrast, Congress’s authority under the taxing power is limited to requiring an individual to pay money into the Federal Treasury, no more. If a tax is properly paid, the Government has no power to compel or punish individuals subject to it. We do not make light of the severe burden that taxation—especially taxation motivated by a regulatory purpose—can impose. But imposition of a tax nonetheless leaves an individual with a lawful choice to do or not do a certain act, so long as he is willing to pay a tax levied on that choice. The Affordable Care Act’s requirement that certain individuals pay a financial penalty for not obtaining health insurance may reasonably be characterized as a tax. Because the Constitution permits such a tax, it is not our role to forbid it, or to pass upon its wisdom or fairness" (p.43-44).

The individual mandate is settled

There is still more to Chief Justice Roberts opinion, as it goes on to strike down a sanction in the Medicare expansion, but that concludes his and the Supreme Court majority's opinion on the constitutionality of the individual mandate. In summary, it is constitutional, but not under the Commerce Clause. It's only constitutional if it is construed and defined as a tax, which is now its official label.

GOP Probably-Candidate Romney Reaction

President Obama reaction

My take on the healthcare act

I fully agree with the Chief Justice's written opinion, and would like to add that I think it's beautifully written. Again, here is the link to the full ruling. The first opinion is written by Roberts and is the majority's opinion as well.

The thing I'm most pleased with, and the thing all conservatives should be the most pleased with, is the ruling on the Commerce Clause. The decision by the Supreme Court that the Commerce Clause does not allow Congress to regulate inactivity sets a great precedent for keeping the Government's power in check.

Even the ruling on the constitutionality under taxes should be good news to Republicans (which does not apply to me; I'm not a Republican). First and foremost, I think it was the right call. Under its powers of taxation, Congress does indeed have the right to pass this tax. However, politically speaking, this can easily turn into a positive event for the Republican Party and Mitt Romney. In fact, it's so great for the GOP that some Republicans are going so far as to call Justice Roberts a political genius (though some are still muttering under their breath about impeaching him).

I found an excellent comment on a Washington Post online article summarizing why: "Justice Roberts is a genius. Liberals lose their ability to cry about most politicized court ever, liberals lose their rallying cry for November, Obamacare is branded the largest tax increase in US history, Obama looks like an idiot for having denied it's a tax increase, he'll look even more like an idiot if he tries to agree with the courts ruling while continuing to deny it's a tax increase, the albatross of Obamacare hangs even heavier around his neck as the large majority of Americans continue to be reminded of their dislike of the government takeover of health care, and conservatives have a rallying cry and a redoubling of efforts for November." (Mike Cornelison, post on dailycaller.com).

Whether Obamacare is a good thing for the United States can be the discussion of another hub. Though you may have already gotten your daily shock dose from me even agreeing that the ACA is constitutional, guess what? I also think that the revised Obamacare should pass. Yep, I think it's good policy and should pass. Please wait for the explanation hub I'll be writing shortly before tracking me down and pelting eggs at my home.

In conclusion and summary to this hub, the individual mandate in Obamacare/the ACA has been ruled constitutional - and I agree with the ruling. If you're also interested in the Medicare expansion that was ruled on, here is the link to Part Two. Comments, questions, and feedback are welcome and appreciated!

Other hubs you may enjoy

- Government Healthcare Website Problems: My Obamacare Story

- Judge Finds ObamaCare Unconstitutional

February 5, 2011 This past Monday, January 31, 2011, Federal Judge Roger Vinson, the Senior Judge for the United States District Court for the Northern District of Florida, handed down a 78 page ruling that declared that “The Patient Protection... - Physician and Nurse Shortages In Wake of Obamacare

A related HubPages Forum Post asked about the impact that 40% of American physicians closing their practices will have on Obamacare efficacy from 2010, forward. This information originated from Investors.com News and Analysis. However, I saw the...