Wall Street Economics: Big Bad Apples In The Big Apple!

In a kamikaze economy, instant millionairism jades the subconscious to the point to of causing individuals to make really bad economic decisions. And really bad economic decisions in a capitalistic society have always come with set implications. The implication of wanting to be an instant millionaire had on the economy, prior to our engine breakdown, was a Wall Street implosion in the makings—i.e., the Madoff ponzi-scheme, fortune 500 corporate greed, outrageous CEO bonuses, etc—an economic engine can only take so much them “boom” a few pistons are blown.

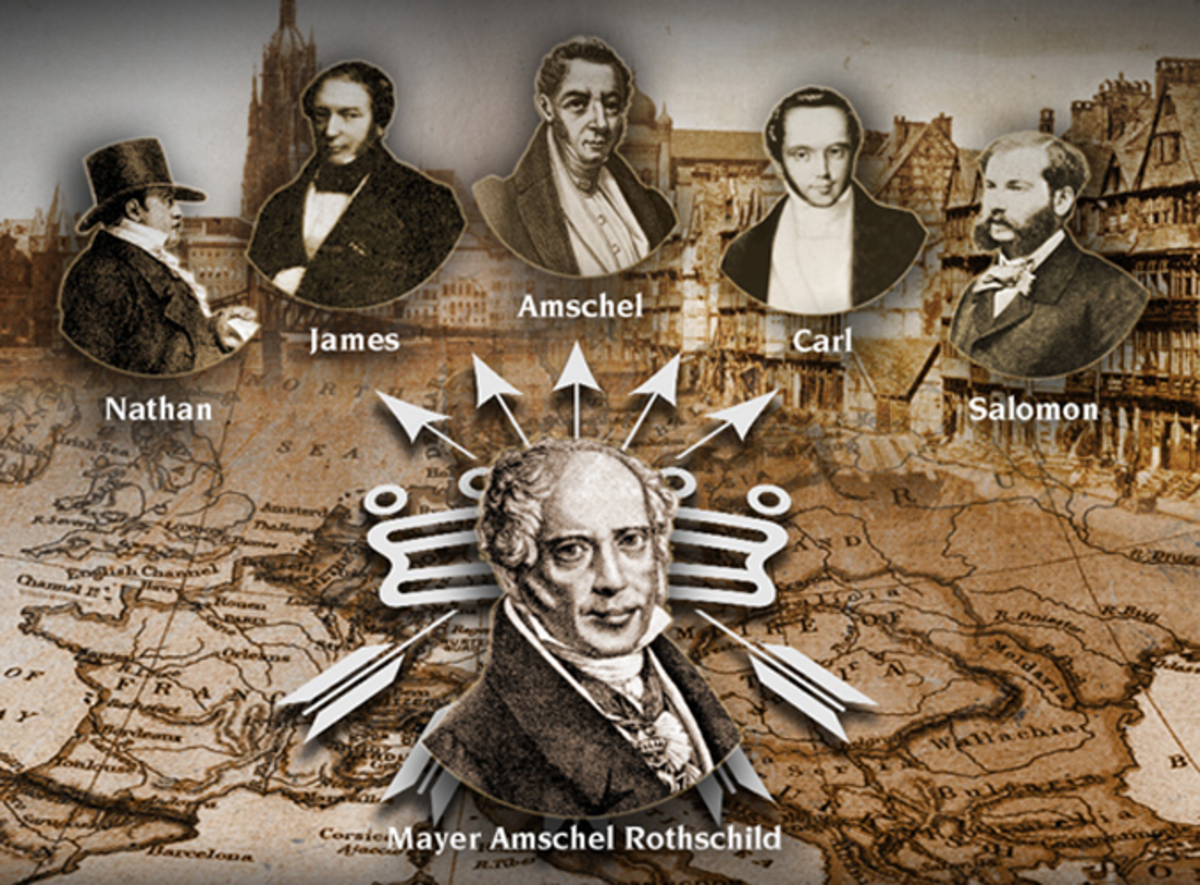

One of the joys in an economic society is seeing someone go from nothing to something: when a person legitimately amasses wealth in an economic system, society should pay him/her the respectable amount of kudos. Legitimate wealth creation? You know...playing by the rules. Fact is, on Wall Street—The Big Apple’s famous financial district—you get the impression that most wealth creation comes along with anything other than playing by the rules. Put simply, Wall Street has been on a path of “bad economics” for some time now, the participants on Wall Street are no longer operating under any kind of financial economic business decorum: “its kill or be killed, big man eat up the little man, lies, deception over truth and honesty.” And to be quite honest, these practices aren’t only bad for the economy but bad for mankind.

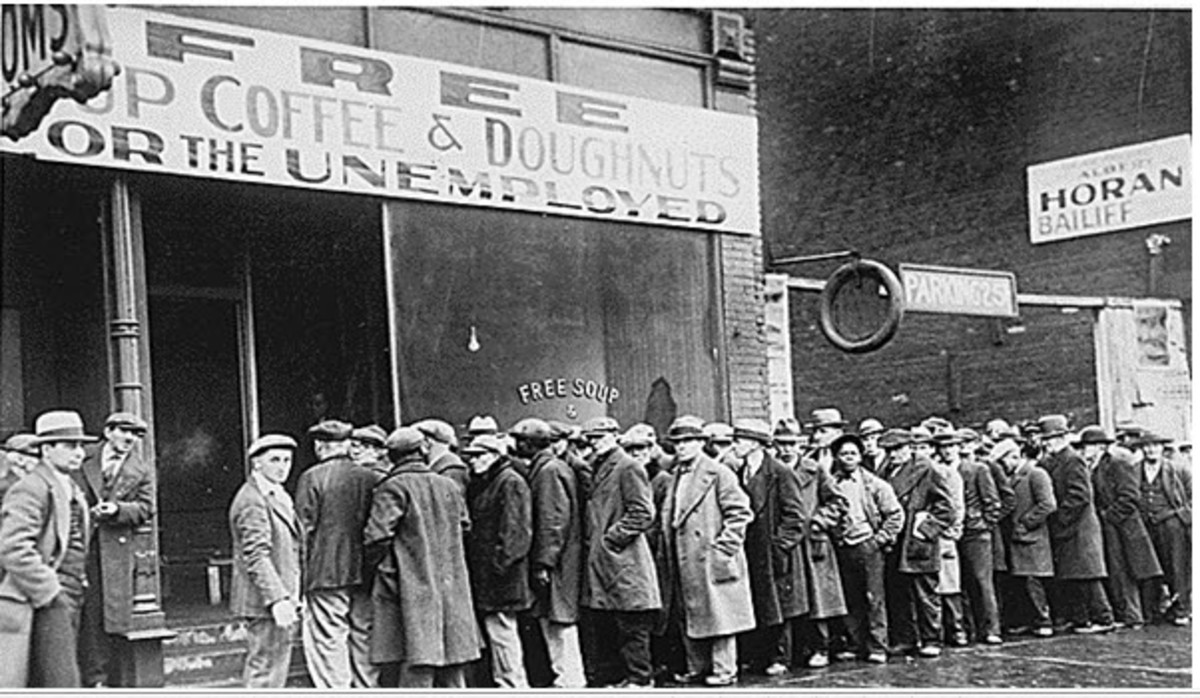

Make no mistake, Wall Street, since its inception, has always had some bad apples, but today’s bad apples—i.e., traders, money managers, financiers—no longer want to move a few steps up the socio-economic ladder rung of success. Some of these bad apples—rotten to its core—would rather have “the world and everything in it.” And you want to know something, in a free market self-interest sense of their adopted credo, the capitalistic system doesn’t have a problem with that: the problem comes when these individuals will stop at nothing—hurting millions in the process—to make this a reality. Because of this fallacious crony capitalistic credo, Wall Street has slowly morphed itself into a sublime illusion. It went from being one big “zero sum game” to one big “con game.” This “con game” is being played over and over by the many different “con artists” that help corroborate the myth that pure market capitalism is a based on “bad economics.” We’re now playing witness to the true destruction of our economic engine at the hands of these con artistes, swindlers, fraudsters—aka, bad apples in the basket case investment corridor of The Big Apple formally known as Wall Street.

Moreover, through the fleecing of the New York Stock Exchange—which in its “hey day” had real value and served as an icon to the rest of the world—America is sending the wrong impression to the world that it’s now open for “bad business.” And an economy that’s open for “bad business” is one that’s also open for “bad economics”—aka, an advanced economic engine headed towards severe breakdown mode.

Conversely, if there was anything close to an economic utopia on earth, then it was in America following WWII. During that very brief period, the house of cards Wall Street built was built on trading financial assets like stocks, bonds, mutual funds and commercial paper. But for some odd reason, those same house of cards have slowly been thrown into a virtual waste site thus replaced by the paper thin derivatives market. As long as investors continue losing their hard earn savings to these Wall Street swindlers and con artists, the symbol of Wall Street as the financial capital of the world, will continue to fade away. The Wall Street that we once grew to know and love is a virtual shell of itself.

Today’s Wall Street is “one big magic show:” to most market economist it’s become one big illusion of grandeur. Like magic itself, the effects of the illusion has to appease the audience—in this case represents the American public; who credously assume that financial assets have real value. Let’s not forget about the preparation: the collusive behavior of these same chicanery traders and brokers, uses conman tactics to sucker in the gullible and uninformed—played over and over again, these money hungry misers come to master the art of the illegal trade. Wall street gurus, ponzi schemers, cronies, misers, riff raffers, fraudsters it’s all the same—they’re all searching for the same full-belly capitalistic end, whereby in order to justify this grand magical illusion, their greed has to reach some kind of monetary apex.

The sad truth is that, it may not be entirely their fault: the kamikaze economy that the Fed has handed over to the American people has lead many to adopt to this “over the top/over the cliff” economic mentality; hence a fast moving economic engine being driven towards self-murder. Michael Lewis in his now famous book titled, The Big Short: Inside the Doomsday Machine talks about this same kamikaze attitude when he says the following:

When the crash of the U. S. stock market became public knowledge in the fall of 2008, it was already old news. The real crash, the silent crash, had taken place over the previous year, in bizarre feeder markets where the sun doesn’t shine, and the SEC doesn’t dare, or bother, to tread: the bond and real estate derivative markets where geeks invent impenetrable securities to profit from the misery of lower- and middle-class Americans who can’t pay their debts.

In conclusion, the kamikaze economy—as handed over by the Fed—has a way of using greed—a proven a human sickness—to get to the bad apples at its cores. Convention wisdom say that if we don’t try and stop it, Wall Street—the symbol of free market capitalism, the world over—could end up being tossed in the same “bad apple waste basket” as the people who run it.