A search for a true LION of a MAN

A true LION of a MAN must stand out from the crowd, mustn't he ?

the GUY I view as a LION of a MAN

I call the man that possesses the capacity he must be possessed of in order to make a worthy husband a lion of a man. And I define the capacity a true lion of a man must possess as the capacity to ensure the social and financial safety and security, in addition to the decent living, of his wives* and children and the decent upbringing of the kids and to ensure a decent livelihood of each grown-up child.

[ *It becomes a true lion of a man to go polygamous and indulge in the luxury of multiple marriages, as I see it.

an ELABORATION of my VIEW

Thus, a true lion of a man must be able to provide his wives and children with a decent residence first. Then he must provide them with food, clothing, footwear, TV sets, fridges, PCs, cellphones, private cars, et cetera, et cetera, i.e. everything they would need, the quality and quantity of which must correspond to a decent standard of living. He must employ a good number of competent security guards to ensure their protection against any harm or danger from thieves, robbers, kidnappers, terrorists, etc. He must pay the full cost of the education and extra-curricular activities of his kids at institutions of repute. He must get his spouses and children adequately insured against all sorts of curable disease. But before indulging in the luxury of marriage, you must, if you are a true lion of a man, get yourself duly insured because accidents happen and there's no knowing how long you are likely to live. You might meet with your abrupt end in a week or a year following your marriage, but you cannot get rid of your duties and responsibilities towards your wives and children who are likely to see the light of day after you pass away. The size of your insurance must be so big as to be able to yield, after being deposited in a bank after your death, enough earnings to cover all expenses you would have to bear in order to discharge your all matrimonial duties and obligations had you been alive.

How many men have capacity to purchase a life cover of that size? Let's carry out an investigation into the issue.

Let's look into the USA, the wealthiest country*, first.

[ *According to the World Bank's GDP ranking 2012, the USA is the wealthiest, in terms of the size of GDP ( about $15.7 trillion, as against India's $1.84 trillion ). ]

Stalin is also remembered for his trademark moustache. But, does a big moustache make a man a true LION of a MAN, I wonder.

some BASIC FACTS about the USA

According to the UNDP International Human Development Indicators, the USA's HDI ranking was 3 and GNI per capita $43,480 ( as against India's 136 and $3,285) in 2012. The per-capita GNI of the USA is well above $33,391, which corresponds to very high human development, according to the UNDP yardstick for 2012. [ '$' in the above stands for constant 2005 international dollars. ]

However, those figures hardly reflect the true socio-economic status of average Americans as the wealth distribution in the US society is very unequal. The USA's income gini co-efficient was 0.477 in 2012 (Table A-2. US Census Bureau Income, Poverty, and Health Insurance Coverage in the United States: 2012) as against India's 0.34* in 2010. Thus, it is obvious that there was more inequality in the USA in 2012 than that in India in 2010.

[ *According to the World Bank, the gini index of 100 implies absolute inequality; by this yardstick, India's gini index was 34 in 2010. Nevertheless, according to the US Census Bureau, the gini index of 1 denotes absolute inequality. Thus, India's gini index 34 by the World Bank's standard ought to correspond to 0.34 by the US Census Bureau's yardstick. ]

With the per-capita GNI of $43,480, the total income of an American family of two adults and two kids comes out at about $174,000. But in reality over 40 per cent economically active American citizens did not have taxable income in 2010, and the per-capita income figure of the rest ( over 59% ) was about $86,3901. And themedian income figure of all US households was $51,017 in 20122. That means earnings per household of 50 per cent US households were below $51,017.

The median incomes of the US family households and non-family households in the same year were respectively $64,053 and $30,880, while the median income of the households with married couples was $75,6942. And the median incomes of the full-time, year-round working men and women of America were $49,398 and$37,7912 respectively. All these figures are manifestly much less than the per-capita taxable income of American citizens in 2010. The latter is unlikely to go up significantly in the following years because of the poor growth3 of the US economy following the ' great recession ' the US economy underwent in the recent past (i.e. during the period from December 2007 to October 2009). In actual fact the median household income of the USA slightly fell from $51,100 in 20112 to $51,017 in 2012.

NB With per-capita GNI equal to $ 52 947 ( ' $ ' stands for 2011 PPP $ ), the USA continued to enjoy very high human development in 2014 as well, but its HDI rank dropped to 8 in that year ( Table 1 Human Development Index and its components, Human Development Report 2015. ) Nevertheless, its gini index having remained almost unchanged ( 0.480 in 2014* ), it's evident that wealth and income inequality in the USA did NOT a bit go down in 2014.

*Income Inequality, Income, Poverty and Health Insurance Coverage in the United States: 2014

A true LION of a MAN is he, isn't he ?

references:

1 Of the total 142,244,789 US citizens with some income, 84,474,911 had taxable income in 2010, and their total income was $7,341,627,129,000. [See Table 1, SOI Tax Stats:Individual Income Tax Returns (IRS, USA)] Thus, percentage of those who paid income tax was around over 59 and their per-capita income about$86,390.

2 Table 1. US Census Bureau, Income, Poverty, and Health Insurance Coverage in the United States:2012

3 After registering negative growth (i.e. –3.1%) in 2009, the US economy grew by 2.4% in2010, 1.8% in2011, and 2.2% in 2012. See World Bank Data GDP growth (annual %)

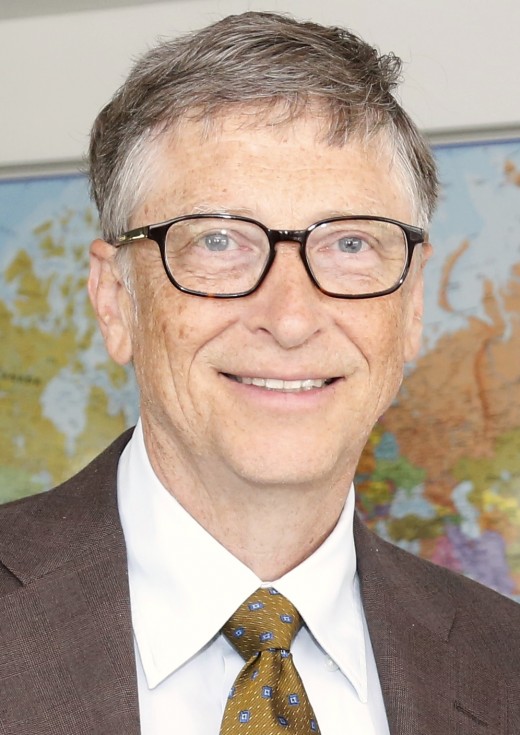

He's worth over $ 1 billion. He's, beyond doubt, a true LION of a MAN. Nevertheless, the part cannot equal the whole. We cannot appraise all men by one Donald Trump or Bill Gates , can we ?

WHAT do these figures SUGGEST?

Do these income figures suggest that American men deserve the appellation ' a lion of a man ' ?

A two-bedroom, three-bath house(interior area:1920 square feet; exterior area:206.18x461 acres) at 101 Warren Street, New York costs over $5 million.And 2-bedroom apartments (meant for 2,3 or 4 persons) in the East Harlem neighbourhood of Manhattan are sold for $175,000. Two-bedroom apartments at 400 West 37th Street Manhattan, NY 10018 rent for over $4,400 per month, i.e. over $50,000 per annum.

A 2013 Audi S8 Sedan costs over $100,000 and a Bentley continental 2011 over $200,000. The minimum price of a TOYOTA Land Cruiser is $75,255. And a 2013 Cadillac Escalade Hybrid would cost you $87,095.

How many American lions of men are able to afford a decent home and a decentcar for their wives and children?

INCOME ELIGIBILITY for HOUSING under the US Public Housing Program : WHAT does it SIGNIFY?

The US Department of Housing and Urban Development runs a programme known as Public Housing Program that is aimed at providing US citizens who cannot afford home with decent and safe housing. Under this programme, low-rent houses are made available to eligible US citizens through open lotteries, and for this the eligibility criteria include an income figure equal to 175 per cent of the area median income ( AMI ). The AMI of the New York city for 2013 was $85,900 for a family of four. That means an American guy with a spouse and two kids and an annual income of $150,325 is eligible for the federally subsidised housing. This practically amounts to the admission that an American heading a four-member family and having an annual income under or equal to $150,325 is poor. But this figure is over 645 per cent of the official figure of Federal Poverty Threshold for 2012 for a family of four ( 2 adults+2 kids ), which is $23,283 ( or about 638 per cent of the figure of Federal Poverty Guidelines for 2013-2014 i.e. $23,550 for a four-member family or household ), and over 174 per cent of the US per-capita taxable income in 2010 ( i.e. $86,390 ) and nearly equal to 294 per cent of the median income in 2012 of all US households. These data manifestly mock the US official poverty-ratio figures for 2012, viz. 11.8% of all families and 15.0% of total population. It is also to be noted that around 90.5% US households' per-household annual income was below $150,000 in 2012 (see Table A-1., US Census Bureau Income, Poverty, and Health Insurance Coverage in the United States:2012).

NB The US official poverty-ratio figures for 2014 were 11.6 per cent of all families and 14.8 per cent of total population. ( See Income, Poverty and Health Insurance Coverage in the United States: 2014 .) Thus, no appreciable change in poverty in the USA between 2012 and 2014 is visible. And the official poverty threshold of $ 24 230 for a family of four in 2014 also shows that there has been no sea change in the overall situation in America, as I see it.

The US National School Lunch Program & TELLTALE income eligibility CRITERIA for FREE and REDUCED-PRICE school MEALS

In the USA you are certain to encounter the National School Lunch Program, afederally assisted meal program, the purpose of which is to serve 'nutritionally balanced' meals ( breakfasts, lunches, and after-school snacks ) daily to millions of American children in over 100,000 public and non-profit privateschools ( of both high school grade and under ) and residential child care institutions. Meals served are mostly either free or nominally charged1. The US Department of Agriculture ( USDA ) provides US school districts with funds through its school meals programme and spend billions of dollars every year for this purpose. Families with incomes not over 130 per cent of the Federal Poverty Guidelines ( FPG ) figure corresponding to the family size are eligible to get free meals for their kids; and families with higher incomes are eligible for school meals for their kids at reduced price if their income figures do not exceed 185 per cent of their respective FPG figures2. If the income of a family exceeds 185 per cent of the corresponding FPG figure, it is also entitled to get school meals for its children but has to pay the ' full price ' ; nevertheless, this ' full price ' is, according to the USDA, ' still subsidised to some extent '. The reduced price of a packet of lunch costing $3.10 is now ( i.e. for July 2013 through June 2014 ) only 40 cents ( i.e. about 13 per cent of the full cost ).3

The annual FPG figure for the period July 01, 2013 to June 30, 2014 for a family of four is $29,440 (for Alaska), 130% and 185% of which work out at $38,272 and $54,464 respectively. But $54,464 is close to the median income figure ( $51,017 ) of all US households in 2012. Thus, it follows that over 50 per cent US families or households are so poor as to be eligible for either free school meals or meals at reduced price ( i.e. around 13% of the full price ) for their kids.

In addition to the National School Lunch Program, the USDA also provides funds for Special Milk Program for children, Child and Adult Care Food Program, andSummer Food Service Program, all of which are meant to afford poor American children and adults adequate food and nutrition.

references:

1 63% of lunches and 89% of breakfasts served perhaps in 2010 were either free of charge or served for some nominal charge, according to the USDA. ( ' More fruits, veggies in U.S. school lunch rules ' by Ian Simpson and Lisa Baertlein in REUTERS dated 25/01/2012 )

2 Child Nutrition Programs; Income Eligibility Guidelines (Food and Nutrition Service, USDA) Notice

3 Federal Register / Vol. 78, No. 144 / Friday, July 26, 2013 / Notices

FREE and SUBSIDIZED EDUCATION in the USA : the WAY I VIEW it

There are two types of educational institutions in the USA : ( 1 ) public and ( 2 )private. And private institutions belong to two categories : (1) profit-makinginstitutions and (2) non-profit ones. Both the public institutions and the private institutions ( including the profit-making ones ) receive funds from the federalgovernment, the state governments, and the US taxpayers ( funds provided by the taxpayers are known as ' taxpayer subsidies ' ). The public elementary and secondary schools impart education completely free. Last year ( i.e. in 2012 ) CNN reported that public schools spent $602.6 billion in 20101 and the average per-student spending was $10,6151. The highest per-pupil spending in that year was $18,6671 and it was made by the public schools in Washington DC1. In 2011 the USA spent a total of $595.1 billion2 on educating American boys and girls of the public elementary and secondary schools; and the average per-pupil expenditure figure was $10,5602 . And it was New York's public schools that made the highest per-pupil spending ( $19,076 ) in 20112 . Those who cannot afford a meal worth $3.10 for their kids are not expected to send them to private schools. According to an estimate, around 89 per cent of the total American elementary and secondary students attended free public schools in 2009.3 This overwhelming figure, as I view it, definitely implies that the American guys that fathered these school children haven't got either the capacity or the mindset to bear the cost of education of their kids. Did fathers of the rest ( i.e. 11% of the total American elementary and secondary schoolchildren ) that attended private schools in 2009 bear the full cost of their kids' education ? Of course not, because many ( maybe almost all ) of those kids had working moms.

Let's now have a look at the cost figures of tertiary education. According to astudy* by AIR** and Nexus**, each American student earning a bachelor's degree at a public college or university received over $60,000 in subsidies ( known as ' taxpayer subsidies ' ), which figure went up to ' nearly $110,000 in the most selective public institutions 4. These figures ' reflect the amount of money colleges and universities receive in direct government support and tax breaks.They do not include loans and grants provided by state and federal governments to help students meet tuition costs. '4 Thus, it is implied that the actual cost of obtaining a bachelor's degree from public institutions is far higher.

[ * The study at issue was published in May 2011. ** AIR: American Institute for Research; Nexus: Nexus Research and Policy Center ]

The 25th-of-May-2012 issue of The New York Times carried a report titled ' Colleges for Profit Are Growing, With Federal Help ', which said, ' The volume offederally guaranteed student loans to students at so-called proprietary colleges— the ones that intend to operate at a profit and get nearly all their revenue from their government — continues to grow '. From this it obviously follows that those American lions of men that get their children educated at private profit-making colleges do not pay a substantial portion of the full cost of tuition.

What's the cost of studying medicine in the USA?

The Albany Medical School (private) charges a first-year(2012-13) student no less than $56,999 ( which figure includes the health insurance fees of $3,009 ).5 And a non-resident first-year student has got to pay $74,764 ( including health insurance fees of $802 ) to study medicine at the Illinois Medical School ( public ).5

The annual tuition cost for studying engineering at the Massachusetts Institute of Technology (private) was $38,940 ( for 2009-2011 ) and at Stanford University ( private ) $41,420 ( for 2009-2011 ).6 And the total cost of studying 2-year MBA at Tepper School of Business ( under Carnegie Mellon University ( private ) ) is around $158,000 ( which includes the tuition and university fees totalling around$115,000 ).7

references:

1 'Which places spent most per student ... ?' by Jamie Gumbrecht

2 See Figure 2 and Table 8 of Public Education Finances: 2011 (a US Census Bureau report)

3 Table 254. Elementary and Secondary Schools— Teachers, Enrollment, ... ; US Census Bureau, Statistical Abstract of the United States: 2012

4' Taxpayer Subsidies for Most Colleges and Universities Average Between ...'

5 AAMC Tuition and Student Fees Reports

Around 90 per cent American school children attend free public schools because their fathers are lacking in the capacity to meet their tuition fees. Do those fathers deserve to be reckoned true LIONs of MEN , I wonder .

MEDICARE, MEDICAID, CHIP & OBAMACARE : WHO are they meant for?

The US federal government runs a number of health insurance programmes. Medicare and Medicaid are two such programmes meant to provide health coverage for those citizens who lack the capacity to afford the cost of private health insurance. Still, 15.4 per cent Americans did not have any health cover in 2012.1 What's the reason for this? The only answer that seems plausible is that the income eligibility criteria for Medicare and Medicaid programmes are unrealistic. The Children Health Insurance Program (CHIP) is another important federal programme designed to provide American kids fathered by poor guys with health cover.

The ' average CHIP income eligibility level for children is 241 per cent of the federal poverty level ' ( FPL ), according to Medicaid.gov Keeping America Healthy. Many American states, such as Massachusetts and Maryland, have raised this income eligibility level to 300 per cent of the FPL and in New Jersey it is350 per cent of the FPL.2 But 350 per cent of $23,550 ( the FPL for a family of four in 2013 )3 comes out at $82,425. Thus, in New Jersey a four-member family with an annual income of $82,425 is reckoned poor. This is another evidence that shows how unrealistic and absurd the US official FPL figures are.

Some millions of US citizens and children still go uninsured. In order to afford them adequate health coverage, President Obama launched a new health care project, popularly known as Obamacare, in 2010, which is aimed at covering all Americans under 65 in 2014.

references:

1 Table 7. US Census Bureau Income, Poverty, and Health Insurance Coverage in the United States:2012

2 APPENDIX 2: Children's Health Coverage: 2011 Upper Income LimitsCONNECTING KIDS TO COVERAGE: Continuing the Progress 2010 CHIPRA ANNUAL REPORT

the USA's enviable PRIDE : the HIGHEST health-care SPENDING per capita

The US citizens, for all the failings and limitations of theirs, can justly pride themselves on the fact that their per-capita spending on health care happens to be the highestin the world. By the WHO Global Health Observatory data , it was $ 8523.83 in 2011 ( higher than last year's $ 8269.37 ). But around 47.35 per cent of this, or $ 4034.82 ( as against last year's $ 3926.41 or 47.48 per cent of the total expenditure per capita on health ), was government spending. ( See Health expenditure per capita, by country, 1995-2014 United States of America, Global Health Observatory data repository . ) It is a clear evidence of how limited the capacity of US citizens is.

[ '$' stands for PPP int. $ ]

[ Compared with the USA's $ 8523.83, India's per capita total expenditure on health was the deplorable $ 202.95 of which government spending was only $ 55.08 in 2011. See Health expenditure per capita, by country, 1995-2014 India , Global Health Observatory data repository ]

NB Per-capita total health-care expenditure in the USA in 2014 was $ 9402.54 of which $ 4541.17 ( i.e. 48.3 per cent of the total health-care expenditure per capita ) was Govt spending ( Health expenditure per capita, by country, 1995-2014 United States of America, Global Health Observatory data repository ). It shows that Govt's share in the total health-care expenditure per capita is on the rise in the USA , and thus it shows to what degree an average American man or woman happens to depend on the american society for their own health care.

the RIGHT SIZE of your LIFE COVER : how MANY Americans' LIFE is RIGHTLY covered?

The India Edition of The Wall Street Journal dated August 29, 2010 carried a report titled ' More Go Without Life Insurance '. It said, ' Nearly a third of US households have no life-insurance coverage '. In another report titled ' LIFE INSURANCE OWNERSHIP ', the Insurance Information Institute said : ' Fifty-threeper cent of all people in the United States were covered by some type of life insurance in 2010, according to LIMRA's 2011 Life Insurance Ownership Study.' It also reported that another finding of the study was : ' Insured individuals owned an average of $154,000 in life insurance coverage in 2010, compared with an average amount of $102,300 for people covered by group policies. '

From the foregoing it is obvious that 47 per cent Americans went without any life cover and the rest that had ' some type of life insurance in 2010 ' were notadequately covered. Can a sum of $102,300 or $154,000 generate, at the current US rates of interest, enough income to ensure decent living for your surviving kin, say a spouse and two kids ?

According to an estimate by the Insurance Information Institute, the size of life insurance of a guy with an annual salary of $36,000 at death and survived by a spouse(36) and two kids( aged 1& 4 years ) ought to be not less than $1.375 million.1 But it has got some serious limitations. First, an annual income of $36,000 is too meagre vis-à-vis $56,756 (the 'average CHIP income eligibility level' for 2013, i.e. 241% of $23,550 ( the FPL for a family of four in 2013 ) ) and$150,325 ( the highest income figure that qualifies you for the federallysubsidised housing ). Second, both the surviving spouse and the kids might be much younger, e.g. your wife may be a teenage mother of two twins, each being under 1 year. Thirdly, the cost of education (both elementary and secondary) of the kids has totally been left off. Fourthly, it has been assumed that the kids would attend public colleges where tuition fees are around $15,000 per year per student. But kids may go to 'the most selective public institutions' where the actual cost of education per student is way over $110,000. Your kids may also like to study medicine, engineering or opt for a degree in business administration. A worthy father must be able to afford the full cost of education of his kids, I reckon. Fifthly, the cost of living through the years when kids will receive tertiary education has been left out outright too. Sixthly, the cost of living through the years following their completion of studies and prior to getting decently employed has also been totallymissed out. Seventhly, kids may not find decent jobs and may opt to start a business of their own. Where would they find the necessary capital ? This question is also left out.

references:

Does Uncle Sam deserve the appellation ' a LION of a MAN ' , I wonder.

WHO are the truly NON-POOR in AMERICA?

Every informed and sensible human is moved to rack their brain in order to find an answer to this query following what happened in the USA recently. The US Congress, responding to the call of the US President, passed the American Taxpayer Relief Bill of 2012 on January 01, this year (i.e. 2013), and thus Americans believe they averted what they call the ' fiscal cliff '. The bill, having been signed off by the President, soon became a law, the American Taxpayer Relief Act 2012. It was designed to extend a lot of tax relief to American middle-class taxpayers earning not above $250,000 per annum, who would have to pay, on average, an additional amount of $1,600 in tax if it had failed to get through the Congress. The new law also entitles the US middle class to some more benefits,viz. the Child Tax Credit, the Earned Income Tax Credit, and the New American Opportunity Tax Credit, for the next five years at the very least. All these are meant to help middle-class Americans spend a little more for the well-being of their families and the upbringing of their kids. Thus it is implied that were it not for all these benefits, American guys with earnings not over $250,000 would have been too hard pressed to fulfil their familial duties and obligations. Nevertheless, I have strong reservation as to whether all these benefits are adequate to make them able to afford the full cost they have to incur in order to discharge fully all their familial and parental duties and responsibilities. It is not to be missed that the American wealthiest who earn over $250,000 yearly and constitute merely, according to the US President, ' 2% of Americans '1, and who, by the law at issue, must pay ' a little more '2 as their tax rates have gone up and their tax benefits gone down also believe that they deserve, I guess, on the same grounds similar benefits as well.

According to the US Census Bureau stats, only 4.2 per cent American households had per-household earnings equal to or over $200,000 in 20113. That means 95.8per cent households' earnings per household were under $200,000 in 2011. And the percentage of similar households in 2012 was 95.5.4 Now, the US President says only ' 2% of Americans ' ( with per-capita income above $250,000 ) are thewealthiest. If we accept, for the sake of argument, that these ' 2% ' are all menand that they're truly non-poor, then the remaining 98 per cent of American menfolk can't deserve to be reckoned the true lions of men, can they?

references:

1 ' Congress passes Cliff Deal ... ' ( an article ( updated on January 02, 2013 ) in The Wall Street Journal ) by Janet Hook, Corey Boles, and Siobham Hughes

2 'The Seven Things You Need to Know About the Tax Deal' by Matt Compton (January 02, 2013 )

3 Table A-1; US Census Bureau Income, Poverty, and Health Insurance Coverage in the United States:2011

4 In 2012, 4.5% US households' per-household earnings were equal to and above $200,000. See Table A-1; US Census Bureau Income, Poverty, and Health Insurance Coverage in the United States:2012

According to the former US President Obama, the non-wealthiest in America adds up to 98 per cent of American citizens, and they happen to be so hard up as to be unable to afford the cost of the well-being of their dependants and the upbringing of their kids.

Taj Mahal of India is a wonder of the world ; but the menfolk of India are no wonders, are they ?

Do Indian menfolk stand out from the rest of the manhood ?

According to the Census of India 2011, India houses around 0.25 billion* households. Now, supposing a household has got 2 adults, there happen to be a total of 0.50 billion adults in India, of whom only 0.0125 billion** paid income taxes in 2012-13. Evidently, only 2.50 per cent adult Indians paid taxes in 2012-13, which means over 97 per cent Indian men and women did not have taxable income in 2012-13, as I see it. Now, supposing there's one male adult per household, we have a total of 0.25 billion adult Indian males, 0.0125 billion of whom works out at 5.0 per cent ( the number of Indian women with taxable income being ignored outright ). From this, it's obvious that as many as 95 per cent men in India did not have taxable income in 2012-13. Now, if we take cognisance of the number of Indian women with taxable earnings, we find out that the total number of Indian males that paid taxes on their earnings in 2012-13 is significantly less than 0.0125 billion. Thus, the percentage of Indian men with taxable income comes out at well below 5.0 per cent in 2012-13, which means well over 95 per cent of Indian menfolk did NOT have taxable income in 2012-13.

The taxable income amounts to a total income of over merely Rs 250 000 per annum. I don't think a guy with an annual income of Rs 250 000 deserves to be reckoned a true LION of a MAN. How many men in India truly deserve the appellation ' a LION of a MAN ' ?

* Precisely 0.2467 billion ( See Houses, Household Amenities and Assets ( As per Census of India 2011 ); INDIA IN FIGURES 2015 .

** Just 1% of population pays taxes, reveals government data ( report in Times of India , May 1, 2016 )

NB This section was added in September 2016.

the INDIVIDUAL versus SOCIETY

Man is a social being. And the plain truth is an individual is an insignificant member of society. The fulfilment of your matrimonial ( or familial or parental ) duties and responsibilities is, as I view it, so big and heavy a mission, compared with an individual's capacity, that you oughtn't to expect, whether you're an American or an Indian, to accomplish it fully and properly.