The Compulsive Money-Spender Personality Type

Compulsive Spenders manage finances in a care-free way that allows for fun. Anyone who suggests putting a budget together and sticking to it may find they have just handed out an insult. The suggestion, even when kindly offered, can be too readily taken as criticism of the Compulsive Spender's care-free manner being totally irresponsible—even should they have been known to easily blow the rent or food money!

Money management to them is keeping their expenditure options open. This is their top financial priority. When they think they are being unfairly restricted, they may become deeply offended by the implication that they do not know what they are doing when it comes to personal finances.

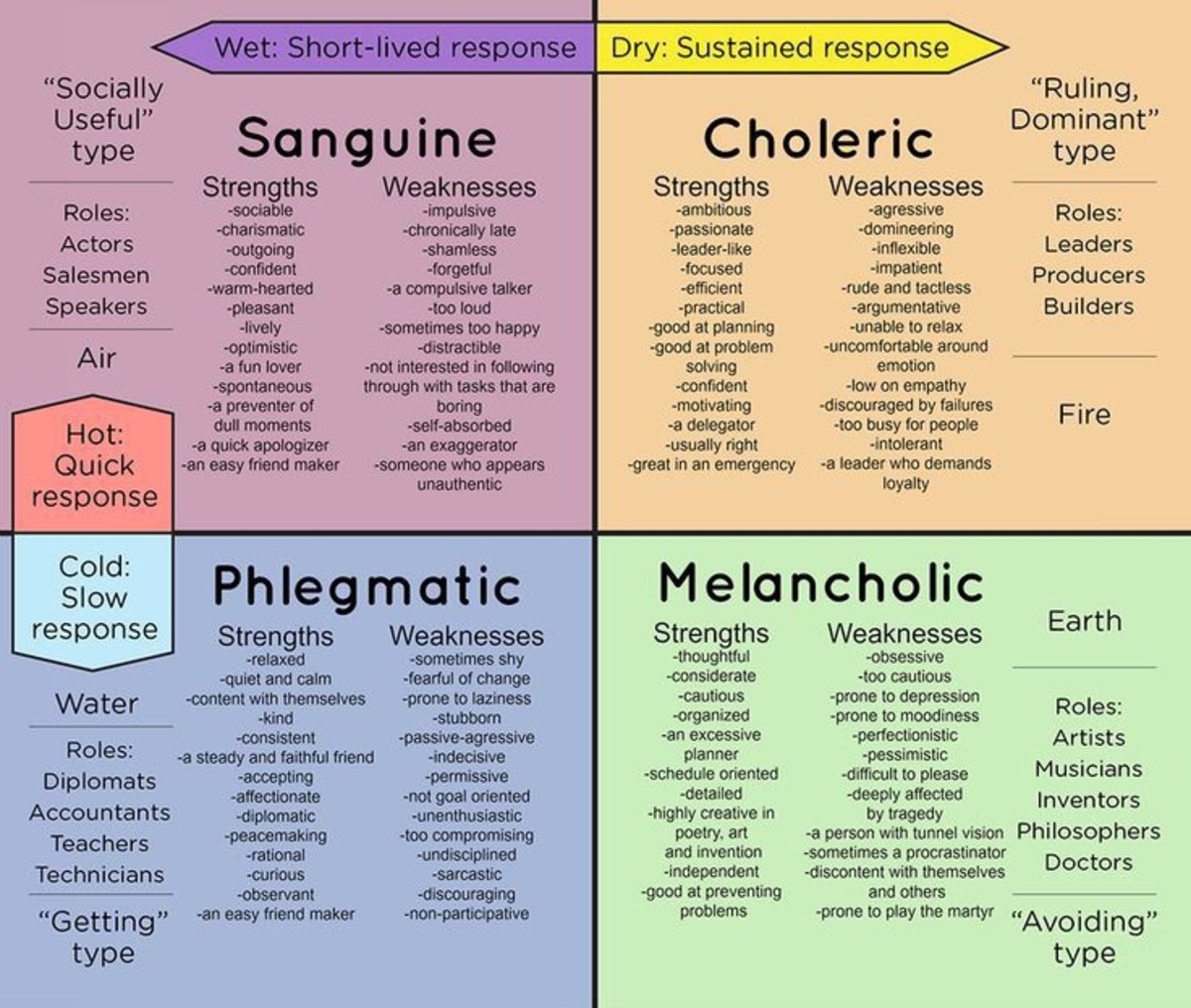

The Compulsive Spender has a temperament that one contemporary branch of psychology (Myers-Briggs typology) would label SP for Sensing-Perceiving.

- When Your Spouse Spends Too Much

Three types of over-spenders: 1) Completely irresponsible, 2) Generally responsible but are irresponsible with money, and 3) Generally responsible and spend more than their spouse thinks they should.

Hurdles for the Compulsive Spender

The Sensing-Perceiving (SP) temperament type of the Compulsive Spender are the Myers-Briggs® personality types of ESTP, ISTP, ESFP and ISFP. People of these types have a peculiar tendency in their spending habits. They tend to manage their finances in a care-free way for fun impact.

Their true need for fun, however, can present a challenge if they fail to connect it with any defined planning. Should he or she not stop to think first, their optimistic response to some new exciting adventure that comes along may lack the required financial capital.

Motto: Spend, and God will send.

Financial Satisfaction for the Compulsive Spender

The Compulsive Spender can reconnect current spending to the budget by periodically comparing actual expenses with established budget plans.

Freedom for "fun" expenses can have a clear place by keeping the Compulsive Spender's care-free money management to a few helpful guidelines. Setting s 24-hour rule can help the Compulsive Spender to

- give him or her a chance to "sleep on" a decision about a financial expenditure, and

- help the Compulsive Spender's thinking to catch up with what initially felt good at the time.

Avoiding credit can do the same thing. Setting aside funds planned as "easy-come, easy-go" money can allow their compulsiveness the desired freedom to respond to unplanned, welcomed opportunities for fun, and at the same time keep their hands off their savings.

Habits of the Compulsive

This preference for some freedom to spend on compulsion also means the Compulsive Spender will

- not want to miss the moment, and

- find fun and adventure in the uncertainty.

They tend, therefore, to

- buy now,

- have little store or brand loyalty, and

- have ingenuity in how to pay.

There are four money personalities

Don’t quite resonate with traits of the Compulsive Spender? Check out descriptions of the Generous Spender, Strategic Spender and Tightfisted Spenders

- Four Money Personality Types and Budget Planning

When our type of "money personality" isn't considered in financial decisions and planning, we can struggle with dissatisfaction. What's in conflict isn't the item itself, but the differences in money spending views inherent in our personality types. - The Tightfisted Spender

They do best planning "fun money" and funds for unforeseen needs. - The Generous Spender

Motto: Spend to express who I am. - The Strategic Spender

Motto: Spending requires competence.

Much of the above is based on material that was presented in a powerpoint by Ray Linder.

© Ms_Dee all rights reserved