Save Money for Travel in Your 20s

Save Money, Travel Young

Save Smart, Spend Smart

Do You Save Your Money?

Over the past couple years people have told me that travel in my 20s will be improbable, difficult, or flat out impossible. But it isn’t. Then again, I’ve always been good at saving money.

If you're trying to figure out how to travel the world, and afford it, you're not alone. Many people around the world plan carefully and work hard to make it happen. If travel is a priority in your life, you can make it a reality.

In this blog post I want to explore some techniques for saving money for travel. I save in two main ways.

- Save money in advance

- Plan well and travel cheap

This blog post will be on part 1 - saving money in advance.

Saving Money in Advance

I know a lot of young 20 year olds who have found themselves with money for the first time and consequently they spend it. Fast. But you don't have to spend all your money as soon as you get it. Smart saving allows you to build wealth even while you don't have much to work with.

If you make travel a priority you can save, quickly or slowly, to make it happen.

Below are my 4 key tips for saving money.

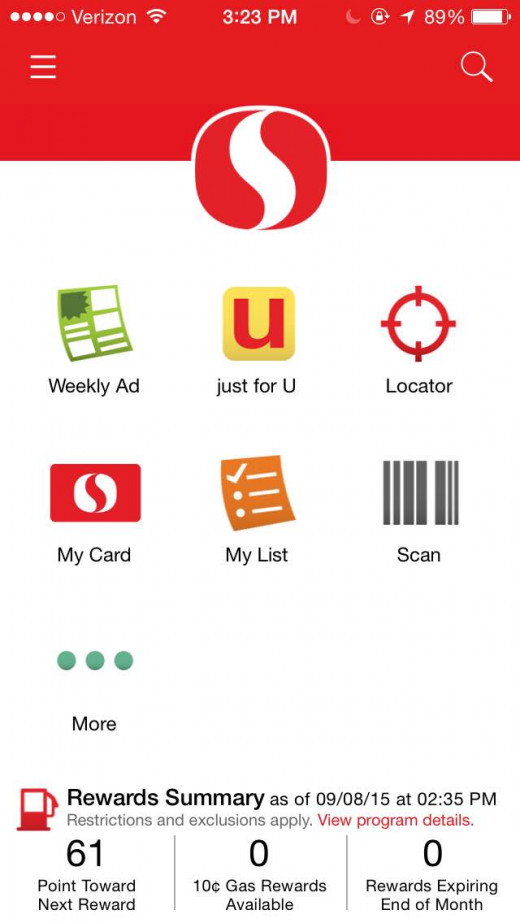

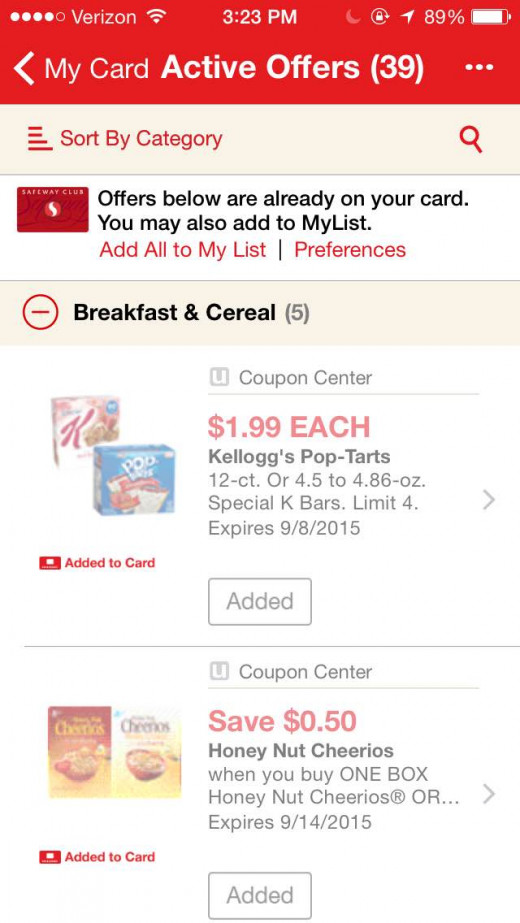

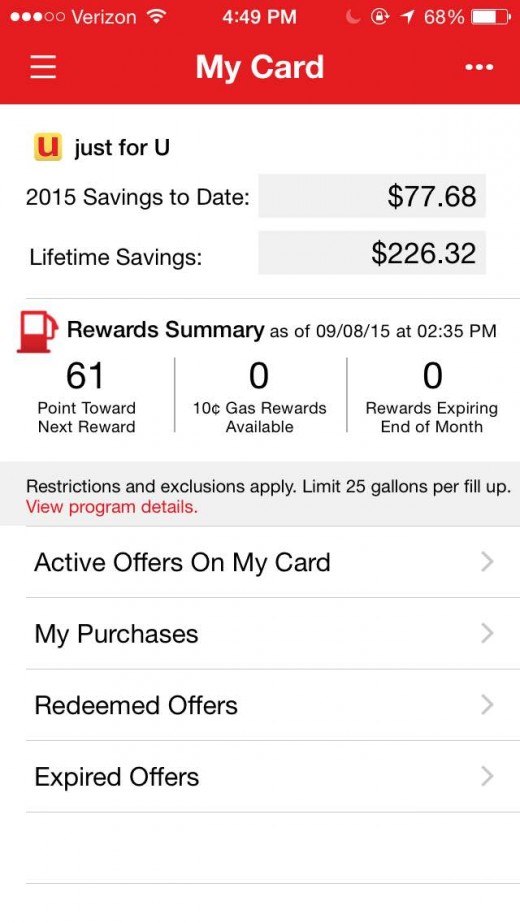

Using Coupon Apps: The Safeway App

Click thumbnail to view full-size

1) Shop Smart

On a monthly basis there are three things you have no choice but to pay for - rent, utilities, and food. Groceries are necessary and expensive. For this reason I spend a fair amount of time ensuring I only buy what I'll use and spend as little money as possible.

To save money shopping for food I recommend the Safeway App. This app is a fantastic way to gather coupons so you can shop higher quality, but not at a premium price. I still recommend getting your staples at a cheaper grocery store – I recommend Winco or Grocery Outlet – but the quality at Safeway is usually better. The best strategy is to know what kind of food you're looking for (sweets, snack, dinner) and scroll through the coupons offered on the app. It also tracks what you've purchased in the past and offers coupons for similar products. This strategy has kept me at a budget of under $200 per month on groceries.

Bonus advice – cut out your daily $5 coffee order. You won’t miss it as much as you think and $5 a day adds up way faster than you would expect. $5 a day, five days a week, for 52 weeks is $1,300. That’s a round-trip plane ticket right there.

2) Control Your Spending and Save for Travel

I am an impulse shopper. I’ve struggled with my weakness for “sale” signs for a while and finally came up with a strategy to overcome it. I limit how much discretionary income I have. When I get a paycheck I keep the amount of money I would need for rent, utilities, groceries, and some overage in my checking account and put the rest in savings. On top of this I put a dedicated amount (let’s say $100 per paycheck) into a separate travel savings account. That money is taken out of my paycheck and deposited into the separate account before I get it. I never see it. It’s gone.

I forget I have this money and it slowly accumulates to fill up for future travel. Something as small as $100 or $200 a month adds up. Within a year you can afford a big purchase with this money alone.

Keeping your money is separate pools is an effective way to ensure that you don't overspend. This can be in many forms. Some people create savings accounts they don't touch, some people limit themselves using the envelope system to very specific amounts of money per category, and still other people use receipts to keep track of their spending. You need to find the most effective way to trick yourself into thinking you have less money than you have.

The key is to live below your means. This doesn’t mean live in poverty; it just means you don’t have to spend all the money you have. Saving might be a lot of work, but it’s a lifestyle choice worth making.

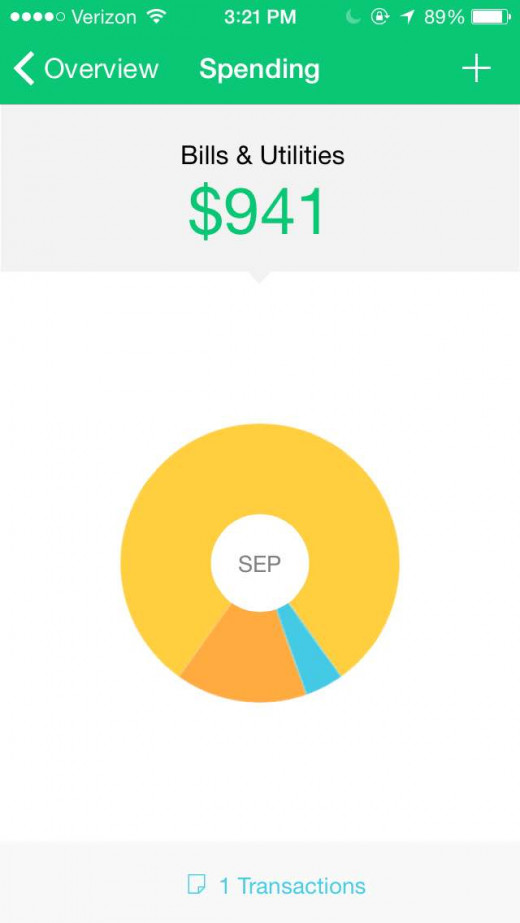

Use a Budgeting App

Click thumbnail to view full-size

3) Budgeting for Travel

Budgeting is one of the best ways to save money. I recommend a two-pronged approach.

- Monthly using the Mint app

- Weekly to accommodate for special events

The Mint App allows you to track your monthly spending and use that data to budget for future months. Budgeting weekly allows you to adjust this overarching budget for birthdays, visitors, staycations, and other special events. Rigid budgeting doesn't work for everyone because you can never predict all the money you're going to spend in a given month. Adjusting is the key to success. Don't stop living just because you want to save money!

Another tip for budgeting – use a cashback credit card. I buy all my groceries on my credit card and use the statement online to see how much I spent and where. At the end of the month I can see if I spent too much – and it has the added bonus of getting me a little extra change for every purchase. Cashback is essentially free money you can transfer straight into your travel savings. And it's hard to say no to free money.

4) Do Extra – Work on the Side

We’re college recent grads working approximately the 9-5 (less for me!) and not usually making a ton of money, so sometimes we need to supplement our income. Right now I’m housesitting. I stay the night at someone else’s house and get paid to do it; I’d say it’s a good deal. If I put half that money in my checking account and half in the travel account I’ve got spending money and travel money.

Options for extra ways to bring in cash:

- Babysitting

- Freelance writing or webdesign

- Watching a neighbor's dog or house-sitting

- Dog walking

To find odd jobs try care.com, Craigslist, indeed.com, or the old fashioned walking around the block strategy.

One of My Favorite Videos: More Advice

Do You Budget?

Make it Happen

In the end my advice is – if travel is important to you make it a priority, and make it happen. Put money aside for it. Work for it. Set a goal and reach it.