A Jobless Recovery

The Economy is Beginning to Recover

Just as the first tiny green buds appearing on bushes herald the end of winter and the promise of spring, the increasing sprouts of good economic news herald the the end of the current recession and hold the promise of good times ahead.

Stock markets in many nations, which are usually good indicators of future economic trends, have been rising steadily and have recovered much of the ground most of them lost in last Fall's crash. More and more companies are reporting rising revenues resulting in increasing profits or, at least, decreasing losses.

Output is increasing and orders for raw materials are rising around the world. Even the banks, which looked to be on the verge of total collapse a year ago, are recovering with many of them repaying, with interest, the emergency funds their governments pumped into them.

John Maynard Keynes

Unemployment Remains High Despite Economic Recovery

This has some economists and policy makers concerned and the phrase jobless recovery is being used with increasing frequency. The term jobless recovery refers to the situation where the economy stabilizes at an equilibrium point that is below full employment.

Basically, when we say that the economy is in equilibrium it means that total output of the economy is equal to total demand and there is no pressure to increase or decrease the current rate of output. While companies are profitable and existing jobs are basically secure, the lack of pressure to increase output results in no incentive to employ more resources, including labor, in the production of those resources.

In the years immediately following World War II, the U.S. and many West European governments' Keynesian style economic policies resulted in relatively static economies with little economic growth. The increase in U.S. economic activity following the end of World War II was basically a shift from war production to consumer production and the re-employment in areas like housing and automobiles that brought most existing resources back to full employment.

From that point on the U.S. economy fluctuated between recession and inflation as government monetary policy (control over the money supply and influence on interest rate movements) was used to speed up economic activity during recessions and slowing it down during booms (when the economy began to reach full capacity and inflation loomed).

The result was layoffs when the U.S. government moved to slow down demand when inflation threatened by decreasing the money supply and increasing interest rates. Once inflation no longer loomed as a threat the planners in Washington would increase the money supply and push interest rates down which caused the economy to begin expanding again and workers being called back to their jobs.

This static equation worked until the 1970s when the post World War II baby boom generation came of age and entered the labor force. The economy was not large enough to accommodate such a large increase in new workers even if all of the previous generation had retired. The previous generation, whose numbers were relatively small due to low birthrates in the 1930s and losses of life during World War II, was not old enough to retire at that time and their remaining in the labor force further reduced the demand for additional labor.

Stimulus from Steiger Capital Gains Tax Cut

It was at this point that change began to occur in the U.S. as the Republican Party began pushing for policies aimed at stimulating economic growth rather than simply managing demand.

The first of these changes occurred in 1978 when Wisconsin Congressman William Steiger added an amendment to an appropriations bill that called for reducing the capital gains tax from 49% to 28%.

A capital gain is the difference between the price paid for a capital asset (for tax purposes capital assets include things like buildings, equipment, stock and other financial securities, etc.) and the higher price received for that asset when sold.

Because of past inflation, the price of most capital assets people held had increased but the decline in purchasing power of the dollar due to accumulated inflation meant that even though the price received for the sale of a capital asset had increased the dollars received for that asset would purchase about the same amount of goods as the original investment. However, after the government took 49% of this, mostly inflationary, gain, the investor was left with money that would purchase fewer assets than before.

The reduction in the capital gains tax gave holders of wealth an incentive to sell older, low return assets and invest in new businesses, new and more efficient plant and equipment, etc. The result was an increase in productive capacity which resulted in both an increase in output and and increase in the number of workers needed. This is known as economic growth.

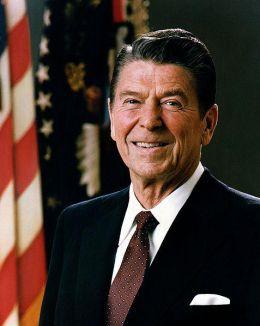

President Reagan and Prime Minister Thatcher Ushered in an Era of Prosperity

The election of Ronald Reagan in 1980 ushered in a new era of pro-growth economic policies in the U.S. This increased economic growth not only benefited the United States but the example of the success of the growth policies of President Reagan in the U.S. and more especially the success of Prime Minister Thatcher's growth policies in Great Britain encouraged other nations around the world to institute similar policies and this resulted in a major advance in world economic growth.

The growth policies of the Reagan and Thatcher governments were not without problems. Economic growth requires change and change usually results in greater economic opportunity for individuals while, at the same time, providing less economic security. New companies and new industries compete with existing companies and industries for both customers and workers with the result that some companies and industries fail leaving their employees jobless.

The introduction of the Personal Computer, is an example of this process as it created numerous jobs and new products both in the manufacturing of PCs and related equipment as well as production of software.

However, this also competed directly with the typewriter

industry which caused sales to drop for companies producing typewriters

and the PC manufacturers also competed with typewriter manufacturers

for workers forcing the ailing typewriter industry to choose between

raising wages amidst falling sales in order to keep enough workers to

maintain production or close their domestic plant and move the

operation abroad where labor was more plentiful and wages lower.

Joseph Schumpeter & Idea of Creative Destruction

The economist Joseph Schumpeter (1883 - 1950) called this process of change, in which the side effect of the creation of new industries and economic growth resulted in the disappearance or destruction of existing industries, creative destruction While the long term result of change is beneficial to everyone, there is pain in the short run workers and owners of dying industries struggle to deal with the change.

Creative destruction is evident in the current recession as older and less efficient companies and industries die or move abroad; as newer and more efficient employers and industries become leaner and more efficient and in the process find ways to produce more with fewer workers. There are also industries, such as housing, where there is a surplus of supply which means that, in the short run at least, there will be lower demand for new construction which translates into fewer workers needed in that industry.

Job destruction is all around. Newspapers are closing and journalists and other workers being laid off as consumers turn to the Internet and other electronic media for information services. Most of those laid off will not get their old jobs back after the recession ends since much of the industry no longer exists. The same is happening with many other employers and industries.

Government Action can Thwart or Bring About a Jobless Recovery

The question is how long will it take before the economy creates new jobs to replace the lost jobs? Here is where government comes in as government policies have a tremendous influence on economic growth and job creation.

Tax cuts and reduced government spending will put more money in the hands of individuals and much of this will find its way into investments in new businesses which will lead to and increase in demand for more workers. This type of economic growth will result in the economy expanding and reaching a new equilibrium at at higher level which both produces more and employs more people.

Raising taxes and increasing government spending will have the opposite effect as a result of both reducing the amount of money people have to invest (as it is taxed away by the government) as well as reducing the amount of physical resources available to entrepreneurs as the government will be competing and buying these same resources for its own use.

If the government of a nation chooses the path to economic growth, we will see the unemployment numbers in that nation begin to drop quickly as new businesses begin seeking employees. Of course, due to structural changes in the economy, people laid off from industries that have died and will not return will have to learn new skills to be able to function in the new, growing economy.

Economic Growth Should be the Goal of Government Policies

For now we can only wait and see how governments choose to act. If the government attempts to manage the economy by intervening in the economy with massive new regulations and programs paid for with high taxes, we will risk a repeat of the Great Depression of 1932 when the Roosevelt Administration came to power in the U.S. and immediately began raising taxes and smothering the economy with programs and regulations just as the economy was beginning to recover on its own from the famous 1929 crash.

Similar policies by governments in other nations caused their economies to suffer the same fate.

On the other hand, if the government takes a hands-off approach and

cuts taxes and spending we could see a repeat of the global economic

boom that was initiated by the Reagan and Thatcher economic policies in the U.S., Great Britain and other nations whose governments adopted similar more liberal economic policies.

Click Here for A Jobless Recovery - Part II

Links to My Other Hubs on Economics and Employment

- A Jobless Recovery - Part II

November 12, 2009 Since my original Hub on October 8, 2009 dealing with the topic of a Jobless Recovery, the economy of the United States has continued to recover from the recession. However, while the... - Using Your Network to Help Find a Job

Networking is basically a combination of word of mouth advertising and information gathering. A network in this case is the people you know and who know you. This includes family, friends, current and... - When an Increase in Unemployment Numbers Herald an Improvment in the Economy

People are often surprised to hear what sounds like bad economic news being presented as good news. As an economic downturn bottoms out and the economy starts to recover one of the first signs of such a... - Democrat vs Republican Tax Cuts

In a previous Hub (see "How Tax Cuts Work") I discussed how a supply side tax cut works. For the past quarter of a century tax cuts have been synonymous with supply side economic theory and Republican... - How Tax Cuts Work

According to October 11, 2006 news reports, the Federal deficit (the amount by which government spending exceeds tax and other government revenues) has shrunk to its lowest amount in four years. In addition...