4 Easy Steps Anyone Can Follow to Create A Financial Plan

But I'm Still Young, Why Should I Have a Financial Plan?

Financial planning may sound intimidating, and sometimes the way people approach financial planning make it sound pretty boring too. But financial planning can be fun.

Starting when you are young gives you more time to make things happen. But there is another plus you have when you are young that you may not realize. Young people are more in touch with their own desires.

That may sound unfair, but let me explain. I was at a seminar, sitting with a group of people in between sessions. One of the presenters was there too and we were asking him questions. His big speech boiled down to: "know what you want and go for it". And most of the questions we had really were... "How do I know what I want?"

He thought we were all crazy. How can you not know what you want? I think it's a side effect of getting old. After too many years of trying to do and be what everyone else says you should, you forget what it's like to have dreams of your own.

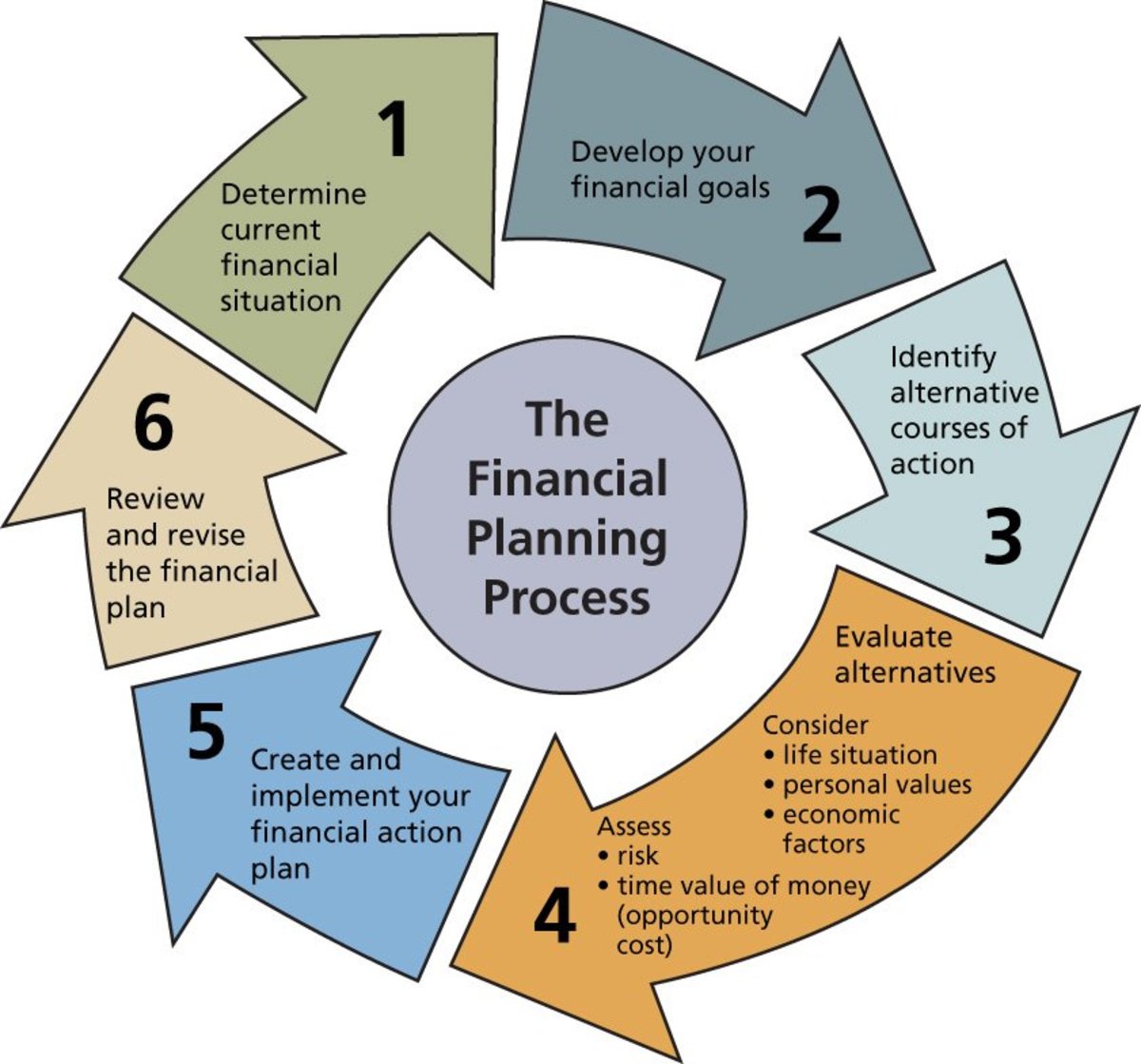

Step 1: Know What You Want

The first step in financial planning is to figure out what you want. A lot of financial planning information assumes you want a pretty traditional life: go to college, buy a car, pay off your loans, get married, buy a house, have some kids, send them to college and then retire.

Blah, blah, blah.

That's fine, if that's what you want. But if you really want to be successful with your financial planning, then take some time to dream. Like you did when you were a kid. Sit down with a catalog, or some magazines and think about what kind of life you really want to have. What things do you want to own, what places do you want to go, what difference do you want to make in the world, for your friends and family, or for yourself?

Instead of falling back on the typical life, why not have some fun with this? What do YOU want? Do you want to have kids, or do you want to travel the world? Do you want a house, or will an apartment with a closet full of designer clothes be more your style? Do you want a sports car, or would you rather start a non-profit and improve the world somehow?

Financial planning will be a lot easier if you are working toward goals that you really want and make you feel excited when you think about achieving them.

Spend some time letting yourself dream of the things you'd like to do and have in your future. You can write out a list, or make a dream board. But one way or another, you should record what you want. You can always do this step again if you change your mind later.

Step 2: Figure Out What it Would Cost

The second step is to put some numbers with your plan. I told you to dream big in step 1. Now, in step 2 we are going to analyze that dream.

Everything has a price. I'm not just talking about money here. Sure, most things on your list probably have a price tag. But they also have a price in time. When do you want to have or do this thing? How much of your time will you spend (daily, weekly, monthly) doing it, or cleaning it, or worrying about it?

Give everything a price tag.

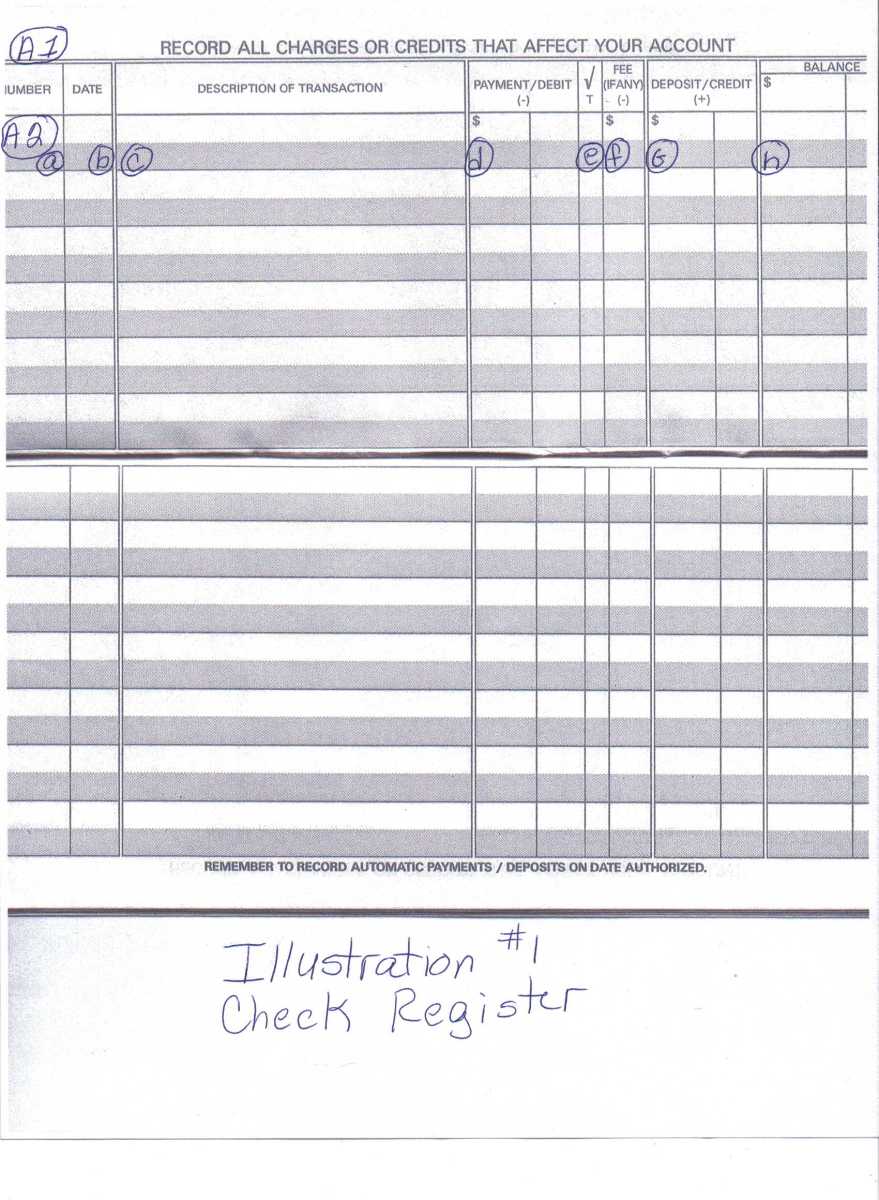

Do some research if you need to. Find out what everything would cost if you wanted it today. Put a money value on everything on your list, then add it up.

Don't forget life in general. How much does it cost you to live for a month? Are you living the lifestyle you want? Create a monthly budget for your dream life. How much would it cost?

How long do you want to live? 100 years? Figure out how much that will cost and add it to your total figure. ($10,000 a month X 12 months X 100 years...look, I only want $12 million!)

Make a Timeline.

You might want to get some index cards, or something similar so that you can write down each thing you want and then easily move them around. Create a timeline and decide when you want to buy or accomplish each of them.

Once you are finished playing and have a good idea when you want everything to happen, make a more formal list and find a place to keep it where you can look at it again on a regular basis.

Count the hours too.

Most things will require time as well as money. I'm not talking about the time it takes to earn the money to buy it. I'm talking about the time it takes to own and maintain it.

A big house will take more time than a small house. You have to clean it, mow the lawn, and look in more closets when you play hide and seek with your kids.

If you want to run a non-profit, then how much of your week will you spend working on it?

Make some hard choices.

Now that you have some cold hard facts about what everything will cost in time and money, go back through your list and make some choices. You can always win the lottery... but you only get 24 hours in a day, and you probably won't live much more than 100 years.

If you don't have time for everything, which things are the most important to you?

Get rid of the rest...and recalculate how much what's left will cost in dollars and cents.

Step 3: Figure out Where the Money Will Come From

Now that you know how much it will cost to have everything you really want (and have time for) in life. It's time to find a way to get the money.

I already mentioned the lottery. It's not very likely, but it is a possibility. So start there.

And if you don't win the lottery? What kind of jobs/career could earn you this kind of money. Bill Gates and Warren Buffet both have more than you can win in the lottery. So don't think a large number means it's impossible...it just means you have to think out of the box.

How many years do you want to work? Whether you start your own business or you work for someone else, at what point in your life do you want to retire?

Divide your total dollar amount by this number of years to get an idea of what your average salary should be. Can you make that much in your chosen profession? If not, what can you do to boost your income?

Grow Your Income with Investments.

You can invest your savings in mutual funds, stocks, real estate. By understanding compound interest you can figure out how much you need to invest today (and at what interest rate) in order to have the amount you want later on in life.

Multiple Streams of Income.

It's a great phrase that basically boils down to get another job. That job doesn't have to be at the corner store though. Write a book. Start a business. Buy some investment property.

Just keep in mind, each of these will cost some time as well as money to get started, and possibly to keep going. Adjust your plan as you go to include the cost and know what you are going to have to give up in order to find the time and money to make it happen.

Making Sacrifices.

The definition of sacrifice is giving up something you want for something else that you want more. The whole point in planning is to make these choices consciously. There will be things that cancel each other out. You can't be Hugh Hefner AND have the world's greatest marriage. The two just won't live in the same box. Decide which is most important.

There may be things on your list that aren't worth taking on a second job. Or that second job may become an obsession that makes you change your mind about ever retiring.

Be Flexible.

Just because you wrote down your plan doesn't mean you can't change it. Plan to re-evaluate your plan once in a while and revise it when your life and desires change.

Step 4: Put Your Plan Into Action

Now that you have a financial plan. Put it into action.

If you need more education to get a better job, go back to school. If you just need a better job, dust off your resume and start looking. Or research what kind of investments that can grow your savings into a comfortable retirement fund.

If you've followed these steps, then you should know what you need to do next. Go do it!