Helping to Offset the Cost of Adoption: The Adoption Tax Credit

When you consider or go through the process of an adoption, the costs and the thoughts of various costs to be incurred, can be overwhelming. Between the cost of a search, home study, legal fees and expenses, not to mention the ordinary costs of bringing a new child into your home, you are suddenly faced with a burden that might have been inconceivable before you decided to adopt. But teh tax code does provide some relief.

You may be entitled to a tax credit for qualifying expenses you pay to adopt a child. You do not have to deduct the expenses from income, but instead, the adoption credit directly reduces your tax liability. Generally the credit may only be taken in the year the adoption is finalized, but you may carryover qualified expenses incurred in the year prior to the adoption. Only unreimbursed expenses are eligible for the credit. There is, however, an additional available exclusion from gross income for certain qualifying, adoption-related expenses paid to you by your employer.

Examples of expenses that qualify are: reasonable and necessary adoption fees, court costs, attorney fees, travel expenses (including meals and lodging while away from home), and other expenses directly related to and for which the principal purpose is the legal adoption of an eligible child.

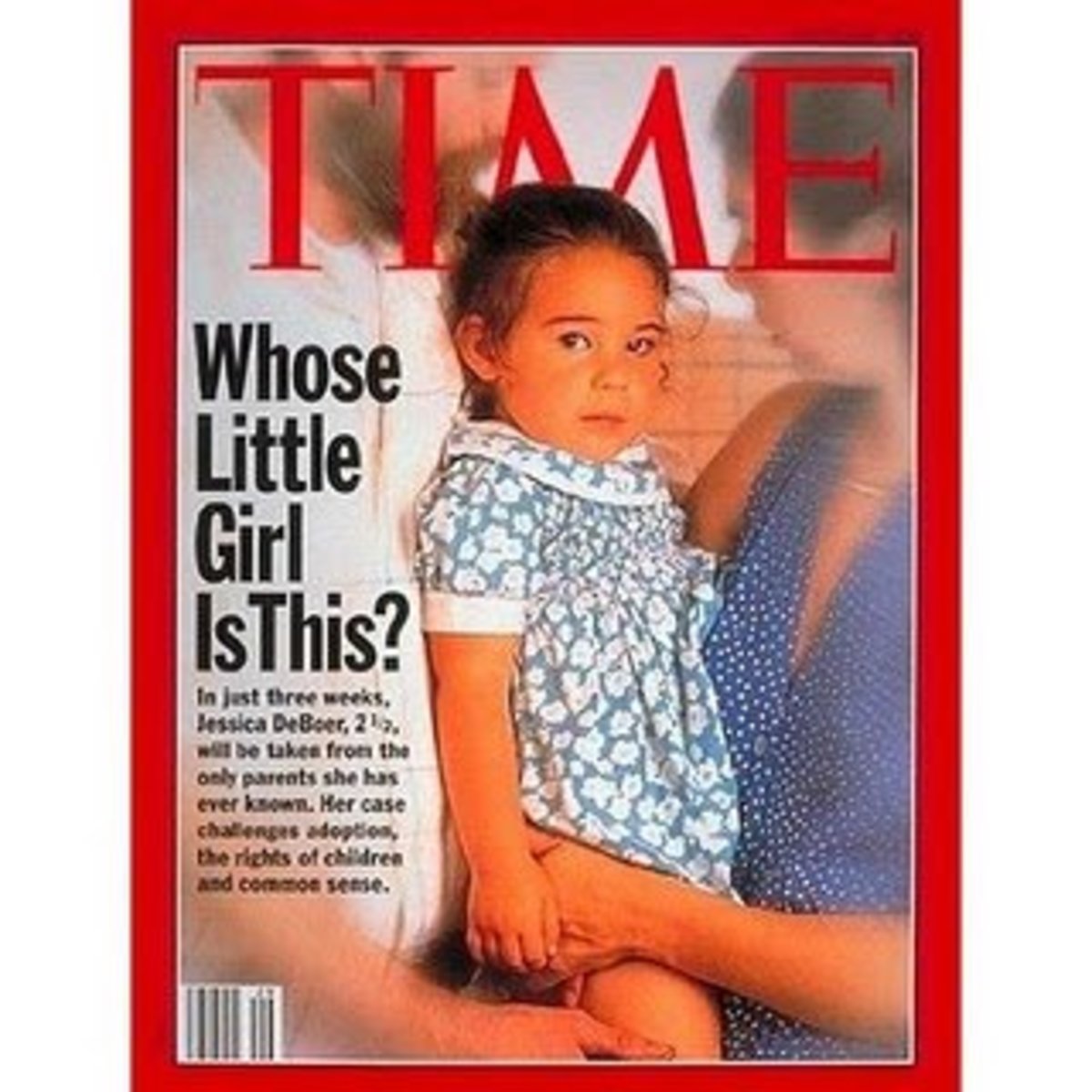

An eligible child is one who is under 18 years old, or is physically or mentally incapable of providing his or her own care. The adoption credit may be taken with respect to an eligible child who is an American citizen or resident of the United States, or for a non-resident, who is not a citizen after the adoption is final. Thus, it is true that, with respect to a domestic adoption, many expenses will qualify for the credit even before the adoption is final, or even if it never becomes final.

Both the credit and exclusion are subject to dollar limits and limitations on the income of the adopting parent. These limits are adjusted annually to reflect inflation and the changing costs relating to adoption. For an adoption of a special needs child only, there are certain expenses relating to the specific needs of the child that are eligible for the credit or exclusion.

Generally, if you are married, you must file a joint return to take the adoption credit or exclusion. If your filing status is married filing separately, you can take the credit or exclusion only if you meet special requirements.

The tax code has provisions to help ease the burden on adopting parents. If you're considering an adoption, take full advantage of these benefits to make sure you come through the adoption in sound financial shape.

For more assistance with legal adoption issues or the adoption tax credit, contact the Thompson Law Office today by calling toll free (888) 322-8975 or (317) 604-1276.