EDUCATION LOANS IN INDIA-Student Loan Schemes From Banks

Proud MBA Students On Their Convocation(My Daughter Included)

Click thumbnail to view full-size

Student Loans From Indian Banks

Indians believe in higher education. Parents want their wards to become experts in their field, and pursue streams such as Engineering, Medicine and also a Management degree. This makes them command higher salaries right from the start of their career, at Campus Interviews. Indian education is among the best in the world, and students armed with these degrees are a much sought after breed. Both in India and abroad. Now, the cost of educating a student through these higher steps used to daunt many parents(In India, parents foot the entire education bill, until the student lands himself/herself a job). Students availed of scholarships where available, to pursue higher education. Becoming a graduate is essential among Indians. Today, most opt for higher studies because of the availability of education loans through banks in India. To be a cut above the competition, one needs to get the added qualification, and get job offers that pay you so much more. Students looking for an educational loan cite this as an incentive to be able to pay off the loan sooner with lucrative salaries. Parents readily agree to be their guarantors.

Public sector banks in India are governed by RBI (Reserve Bank Of India) rules with regards to disbursing an education loan.Today, even private banks and foreign banks are wooing the student community with attractive education loans.

Earlier for want of capital, good students opted out of education after a basic degree and ended up with ordinary jobs. It is becoming increasingly mandatory for students across India to seek professional education, to land plush jobs and launch a great career.

Financing their studies, with an education loan from a bank is becoming increasingly common among deserving candidates. Funding expensive professional education is no more a distant dream!

Indian Students In London Metropolitan University

INDIAN PILOT TRAINEES

What You Need To Look For When Shopping For An Education Loan In India

- When shopping for a student loan, choose a bank that is situated at your place of study rather than one that is far away in your hometown. Unless you plan to study abroad. It is even better if your existing bank is willing to sanction a loan, and you can see if that bank has a branch operating in your place of study for easy transfer of funds and withdrawal facilities. The closest branch to your university or college will be the most preferred. It is also wise to befriend the manager of your local bank where you have an account well in advance so as to build up the rapport before you ask for a loan, any loan. For an education loan, you will need a guarantor, preferably a parent or parents, depending on the amount of loan required. If your loan is more than 4 lakh Indian rupees, a collateral is also mandatory.

- Choose a bank that offers you a holiday period-one that allows you to start repayment of your loan 6-12 months after you successfully land a job. This will give you some breather.

- Know also that all courses are not financed by banks. Most prefer to offer student loan facility only for traditional courses such as Engineering, Medicine, MBA, etc. Some educational institutions also have a tie-up with a particular bank to offer education loans to their students pursuing courses. Make sure that the course you wish to pursue is recognized and is approved by the governing body. For example, an Engineering or MBA degree must be approved by the AICTE ( All India Council For Technical Education). Courses abroad are also financed once you get admission, but only for the above mentioned streams.

Eligibility To Avail Of A Student Loan

Any Indian national can apply for an education loan.

Admission must be secured prior to the application to any recognized University in India or abroad.

Admission to an Indian University must be through the Selection process or an Entrance test.

It is mandatory that parents or guardians of the student applying for the loan be co-borrowers.

How Much Can A Student Get As Education Loan From A Public Sector Bank

3 Education Loan Categories Depending On Loan Amount

- The RBI rules state that a student can avail of an education loan upto rupees 4 lakh without any security or margin, for studies in India. If any bank refuses to give an education loan without collateral for a loan amount of upto 4 lakh, the applicant can complain to the RBI(Reserve Bank Of India).

- For student loans amounting between 4 and 7.5 lakhs, a third-party guarantee becomes necessary. A 5 % margin is cut, meaning you will get 5 % less, and have to find other means to bridge that amount. A third-party guarantor can be an uncle, neighbor, or friend who can stand guarantee for the full amount.

- For studies abroad, student loans above 7 lakhs are sanctioned against collateral in the form of Property, Fixed Deposits, NSC Certificates, worth the loan amount with a 15 % margin. Here again, you have to find other resources to bridge that 15 %.

Interest Charged On A Student Loan: A higher rate of interest(1 % more) is charged on the Loan Amount if you avail of a student loan of more than 4 lakh.

Some banks charge 1 % less interest for girls seeking an education loan. This is to do with the Government policy of encouraging girl students.

Repayment: Repayment begins with an option - You can choose to begin repayment anywhere between 6 months to a year after landing your first job, after completing your course.

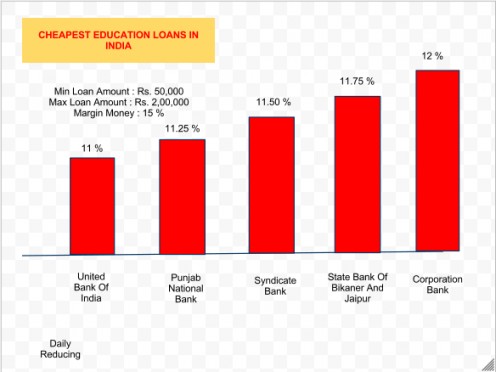

Cheapest Education Loans

Documents Necessary to Apply For An Education Loan In A Public Sector Bank

Students applying for education loans in India have to furnish their details as follows.

Mark sheet of last qualifying examination for school and graduate studies in India

Proof of admission to the course

Schedule of expenses for the course

Copies of letter confirming scholarship, etc.

Copies of foreign exchange permit, if applicable.

2 passport size photographs

Co-borrowers such as parents or guardians are to also furnish such details as

2 passport size photographs

Statement of Bank account for the last six months

Income tax assessment order for the last 2 years

Brief statement of assets and liabilities

If you are not an existing bank customer you would also need to

establish your identity and give proof of residence.

HOT TIPS :

Public Sector Banks are governed by RBI rules in disbursing of loans and that includes the education or student loans for Indian nationals. Foreign Banks, Private Banks and Public sector Banks are vying with each other to offer student loans on attractive terms. But, in general, public sector banks may take time to sanction or disburse your loan, but repayment will be easier on your purse.

It is wise to shop for a student loan among the banks in your locality and compare the terms and conditions, so as to understand what is being offered and what you can avail of before actually approaching for a loan.

Always begin with a bank where you have accounts, and cultivate familiarity with the manager. It is easier to get loans from a bank that knows your credit worthiness, than approach a totally new bank.

Note the speed with which loans are disbursed in the bank of your choice, the documentation process, courteous staff, quick service. These along with the pricing of the student loan will help you make a wise choice.

FINANCE YOUR DREAM COURSE

I have seen many deserving students from the lower income brackets who make it to Engineering courses and B-schools in US, UK and Australia, with the help of a student loan. They are diligent in repayment of their loans after completion as most have landed plush jobs with a wonderful career ahead of them. Do you not want to be an achiever ? Is money the problem ? Don't let that bother you anymore. Avail of an education loan and fulfill your dreams. GOOD LUCK !

EDUCATION CERTAINLY PAYS-Nitin Nohria Is The First Indian Appointed As The Dean of HARWARD BUSINESS SCHOOL IN 2010

Helpful Hubs

- Credit Cards For Students-Helpful Tips For Students Using A Credit Card

College students are often seen spending too much at restaurants, movies, shopping arcades, etc. Some pay cash, others by wielding a credit card. Some parents opt to give their children an add-on card for... - The Secret Behind Indians Performing Well Academically

Education in India is imparted in Government run schools and for those who can afford it,expensive private schools. From the time a child is born,the parents set about the task of educating the child. It is... - Are Women MBA's Better Than Their Male Counterparts-The Benefits Of Being A Woman With An MBA

MBA aspirants across the world have their reasons for it.Whatever be their qualification,and whatever their field of interest,pursuing an MBA assures them of a respect that others would die for.Besides,a fat... - How Women Can Become More Confident In Today's World

God created the heavens and the earth.Then he created the flora and fauna.And then his greatest creation,Man,came into being.To look after and enjoy everything that was around him and to have fellowship with...