Rental Property Ownership and Capital Gains: The Explanation and Computation!

A capital gain is the taxable profit you make when you sell your rental property and as such constitutes somewhat of a paradox.

Namely, the fact that you have a capital gains indicates that you made a profit on your rental property investment (good news) and yet are now obligated to pay taxes on that profit (bad news),

In this article, we’ll look at capital gains and show you how to compute it in a simple, straightforward way so you get the idea. Obviously, not unlike any tax issue, it is always best to consult a tax expert before you buy or sell any rental properties.

Capital Gains

As stated, capital gains are the profit a real estate investor makes on an investment property held for more than 12 months and is taxable once that property is sold.

Okay, but computing capital gains is not as simple as buying a property for $200,000, selling it for $250,000, and then expecting a gain of $50,000. A gain is the difference between a property’s “net selling price” and its “adjusted basis” and is not computed by merely deducting the price you originally paid for a property from the price it is eventually sold.

Net Selling Price

The net selling price is computed by taking the price that your rental property is sold for less the costs associated with the sale.

sale price

less cost of sale

= net selling price

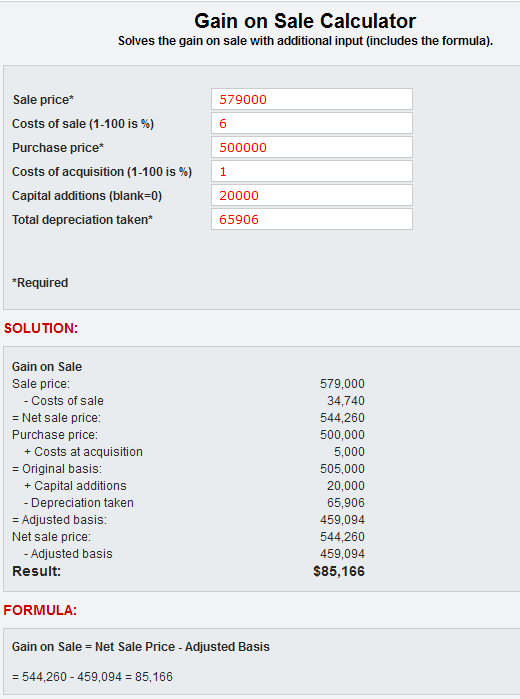

Say that you sell your property for $579,000 and pay a 6% real estate commission then your net selling price would be $579,000 - 34,740, or $544,260.

Adjusted Basis

The adjusted basis is computed by taking the original cost of the property, plus the cost of acquisition and capital improvements, less accumulated depreciation.

cost of property

plus cost of acquisition

plus capital improvements

less accumulated depreciation

= adjusted basis

Say, for example, that you originally purchased an apartment building for $500,000, paid closing costs of $5,000, made capital additions of $20,000, and have taken $65,906 in depreciation. Your property’s adjusted basis at sale is $500,000 + 5,000 + 20,000 – 65,906, or $459,094.

Computing the Gain

Okay, now that we know the net selling price ($544,260) and the adjusted basis ($459,094) we can compute the capital gain by taking the difference

net selling price

less adjusted basis

= capital gain

$544,260

– 459,094

= $85,166.

Long Term Gain vs. Short Term Gain

The IRS sets the rate at which the gain is taxed depending on whether the gain is short term or long term.

Under the current tax code, if you hold a property for less than 12 months and sell for a profit, the gain is classified as short term and treated as ordinary income. If you hold it 12 months or longer then the gain is classified as a long-term capital gain. The difference to you can easily amount to thousands of dollars because current rules tax capital gains at a lower rate than ordinary income. So consider timing before you decide to sell a rental property and remember to consult your tax adviser.

Sample (calculation)

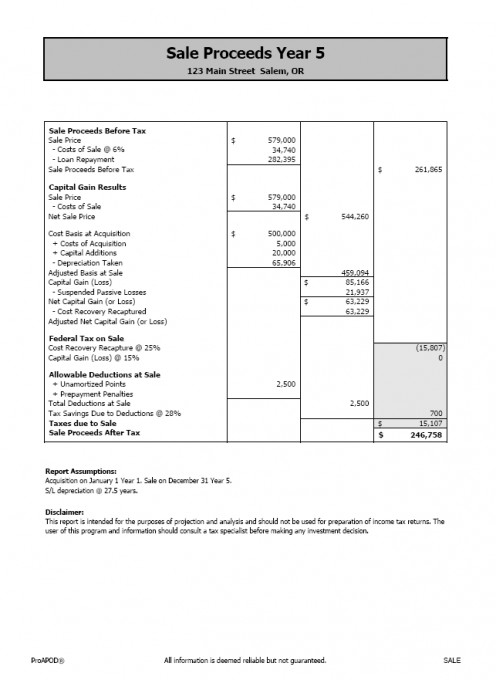

Sample (capital gains in a report)

About the Author

James Kobzeff is a real estate professional and the owner/developer of ProAPOD - leading real estate investment software solutions since 2000. Create cash flow, rates of return, and profitability analysis on rental property at your fingertips in minutes! Learn more at www.proapod.com

ProAPOD also provides iCalculator - an online real estate calculator that enables you to learn dozens of real estate definitions and formulas as you calculate. You save 64%. Learn more at real estate calculator

Other Articles

- How To Calculate Cash on Cash Return | The Method And Formula!

The method, formula and calculation for cash on cash return with insights in how to use it in your next real estate analysis. - Internal Rate of Return (IRR): Measure Rental Property Financial Performance!

Learn the definition and uses for internal rate of return (IRR) and how you can apply it to measure a rental property's financial performance. Includes instructions on how you can make the calculation in Excel. - 5 Questions Investors Should Ask and Answer About a Rental Property That Can Save Their Nest Egg!

Five questions a prudent investor should ask and answer before making any investment in rental property that might save their - Understanding Time Value of Money and How Real Estate Investors Gauge It

Time value of money explained and how real estate investors incorporate it into their analysis to measure rental property cash flows and rates of return. - The Present Value of a Future Cash Flow - Why Understanding Present Value is Crucial To Any Real Est

Learn the difference between present value and future value and why these time value of money concepts are crucial to your cash flow analysis of investment real estate.