Roth IRA Contributions

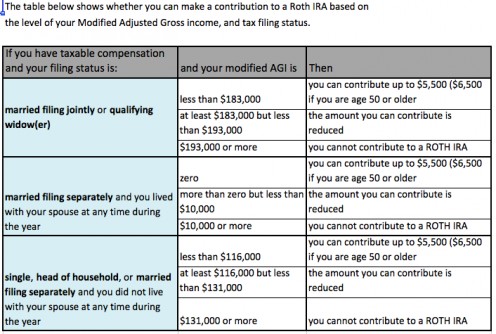

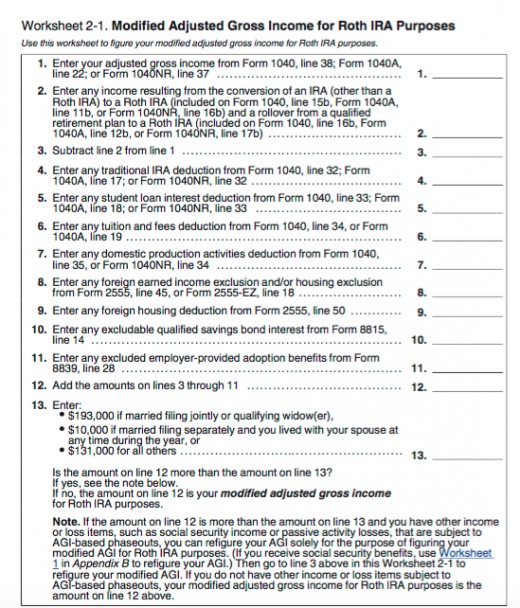

Who can contribute to a ROTH IRA: A taxpayer may contribute to a ROTH IRA if they have taxable compensation and your modified adjusted gross income amount does not exceed a certain threshold. Please see the chart below for information concerning the modified adjusted gross income thresholds. There are no age limitations for contributions to a ROTH IRA unlike the traditional IRA. For the traditional IRA one cannot make contributions to the retirement account beginning in the year the taxpayer reaches the age of 70 ½.

Modified AGI's effect on Roth IRA Contribution

What if only one taxpayer (spouse) has taxable compensation: A taxpayer can contribute to a Roth IRA for their spouse provided that they file a joint return, their modified adjusted gross income is under $193,000 (for the 2015 tax year) and the contributions satisfy the Kay Bailey Hutchison Spousal IRA limit. Per the Kay Bailey Hutchison rules, if you file a joint return and your taxable compensation is less than your spouse’s income, then the most you can contribute to your Roth IRA is the smaller of $5,000 ($6,500 if you are age 50 or older), or the total taxable compensation of both spouses reduced by (1) your spouse’s traditional IRA contribution for the taxable year, and (2) any contributions for the year to a Roth IRA on behalf of your spouse. Therefore, the maximum total combined (both spouses) contributions which can be made for (tax year 2015) is $11,000, if both spouses are under 50 years of age. If only one spouse is age 50 or over then the maximum combined contribution to a Roth IRA is $12,000. If both spouses are aged 50 or over then the maximum combined contribution is $13,000.

Compensation: For purposes of making contributions to a Roth IRA taxable compensation includes salaries, wages, tips, commissions, self-employment income, non-taxable combat pay, military differential pay, taxable alimony and separate maintenance, and bonuses. Please note that self-employment compensation refers to “net earnings” from your business, provided personal services are a material income producing factor, reduced by any deductions you made for contributions you made to another retirement plan of the business and less the deductible part of the self-employment taxes.

Compensation, for purposes of making a contribution to a Roth IRA, does not include interest income, dividend income, earnings and profits from property, pension or annuity income, deferred compensation, income from certain partnerships, or any amounts you exclude from income.

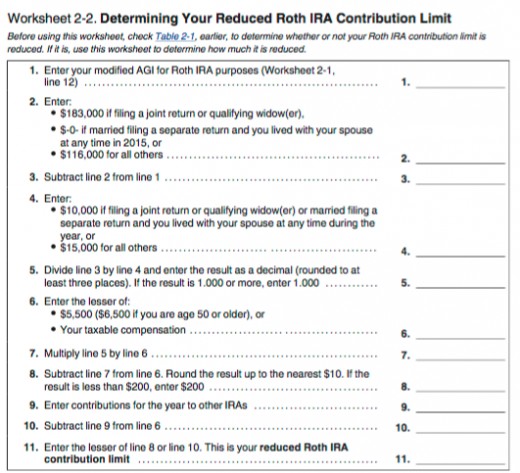

The amount you can contribute to a Roth IRA, for the 2015 tax year, is the smaller of the following: $5,500 ($6,500 if you are age 50 or older), or your taxable compensation for the taxable year. This is provided that you have not made contributions to a traditional IRA. If however, you make contributions to a traditional IRA and a Roth IRA, then your contribution limit would be what you could normally contribute to a Roth IRA under the rules listed above, reduced by all contributions to all IRAs which are not Roth IRAs. Please note that “employer” contributions under a SEP or Simple IRA plan do not affect this limit, but employee contributions do.

Deadlines: Contributions to a Roth IRA can be made any time during a tax year, or up to the due date for filing the return not including extensions.

What if I contributed to a traditional IRA, but want the contribution to be a contribution to a Roth?

If a taxpayer initially contributes money to a traditional IRA, but later determines he wants the contribution to be a contribution to a ROTH IRA then he has some options.

Determine why you want your contributions in the ROTH IRA.

Reason 1: For some people, they make contributions to a traditional IRA during the tax year hoping that it will yield them a tax deduction benefit on their return. However, when they go over their finances later on in the year they find out that they are ineligible for a tax deduction. If this occurs, and you are eligible to make a contribution to a Roth IRA then you may want to do a “recharacterization” of the contribution. A recharacterizing of contributions means that you treat the contribution as if it was originally made into the account you wanted instead of the account you put it in. To do the recharacterization process you “must” do a trustee-to-trustee transfer of the contributions from the traditional IRA to the Roth IRA. So long as the transfer is made by the due date, including extensions, for the tax year the contributions were made then you can elect to treat the contributions as if they wee originally made to the Roth IRA.

Reason 2: For other people, they do not meet the requirements for making contributions into a Roth account directly, however, they prefer to invest in the Roth account because of the tax benefits one can receive later in life. If this occurs, you may wish to do what is referred to as a “back-door” Roth Contribution. Taxpayers sometimes find that they do not meet the requirements to make a contribution to a Roth IRA; however, you can “always” make a contribution to a traditional IRA (provided you are not turning 70 ½ during the tax year, and meet certain other taxable compensation requirements). While you can make contributions to a traditional IRA, you may or may not be able to take a deduction for the contributions. (See link below to rules for traditional IRAs) However, once you contribute to a traditional IRA you can then do a “conversion” of the contributions from the traditional IRA to the Roth IRA. There are three ways to accomplish this. (1) You can use the rollover method where you take a distribution of funds form the traditional and then “roll it over” into the Roth IRA; (2) you can do a trustee-to-trustee transfer, where you have your brokerage account wire the money into another Roth IRA account at another institution; or (3) you can do a same trustee transfer. This is where you have your traditional IRA and Roth IRA with the same brokerage and the broker merely moves the money.

Please note that “Back-door-Roth” transactions should only be done if you truly understand the transaction. This is because this transaction many times will lead to a taxable income situation which taxpayers are unaware of. Many people think that if they make a non-deductible contribution to a traditional IRA and immediately convert it to the Roth that it is automatically a non-taxable event. This may not be true. When you transfer money from a traditional to a Roth IRA (in a non-recharacterization transaction) you must look to see if the traditional IRA had only “basis” or a combination of “basis” and non-basis assets. Basis refers to contributions in a retirement account for which you get no tax deduction benefits for. If your traditional IRA has both “basis” and non-basis amounts in it you cannot just determine that you are moving over your basis. The conversion “must” be done on a ratio of basis and non-basis assets. Non-basis assets, which are rolled over will be deemed taxable income on your return.

Tax Deductions for Contributions to a Traditional IRA

http://hubpages.com/money/Tax-Deductions-for-Contrbutions-to-a-Traditional-IRA

Excess Contributions to a Roth IRA: If you find that you over-contributed to your Roth IRA, then you have until the due date of the filing of your return, including extension, to remove the excess contribution and any investment earnings on the over-contribution to avoid a 6% excise tax on the over-contribution. Additionally, if you contributions to the Roth IRA for a particular tax year exceed the limit which can be contributed, you can apply the excess contributions to a later tax year, so long as the contributions for the subsequent tax yeas are less than the maximum allowed.

Benefits of Having a Roth IRA: If your distributions are deemed a qualified distribution then you may be able to use the distributions from the ROTH IRA, both your after-tax contributions and any income growth on the contributions, as tax-free distributions.

Qualified Distribution: A qualified distribution is any payment from your Roth IRA which meets all of the following requirements:

It is made after the 5-year period beginning with the first taxable year for which a contribution was made to a Roth IRA set up for your benefit, and

The payment or distribution is:

- Made on or after the date you reach age 59 and a half, or

- Made because you are disabled (defined earlier), or

- Made to a beneficiary or to your estate after your death, or

- One that meets the requirements under First home buying Exception

Additional Benefits of Having a Roth IRA: Distributions, which are not "qualified distributions" follow an ordering rule. When a distribution is taken from a Roth IRA the distribution is deemed (1) first to be a return of basis or post-tax contributions. These distributions, which amount to a return of basis, are non-taxable returns of capital. Once, the distributions from direct post tax contributions have been exhausted, (2) the next set of distributions are deemed to come from conversions and roll-over contributions, on a first in first out basis. The distributions from this set of fund besides being done on a first in first out basis are deemed to come form the taxable portion first and then the non-taxable portion. (3) Lastly, the earnings from the contributions made are taken into account.

To learn more about various areas of taxation, click the articles below:

More about tax rules:

- Mortgage Interest Deductions: Mortgage Interest Deductions are "itemized deductions" which may help you lower your taxable income, and therefore your tax liability. Mortgage Deductions are subject to several limitations.

- Gambling Loss Deductions: Gambling Loss Deductions are "itemized deductions" which may help you lower your taxable income, and therefore your tax liability. Gambling Losses may only be taken up to the amount of Gambling winnings.

- Contributions to a Traditional IRA: Contributions to a traditional IRA "may or may not" result in a deduction to gross income. One's filing status, modified adjusted gross income, earned income, and whether they are covered under a retirement plan at work can effect one's ability to take a deduction for a contribution to a traditional IRA.

- Student Loan Interest Deductions: Payments of one's student loan interest may result in a tax deduction based on whether the interest is on a qualifying student loan, and the taxpayer meets certain eligibility requirements.

Have you ever considered opening a Roth IRA?

Roth IRA Quiz

view quiz statistics© 2016 James

![Intuit TurboTax Premier 2015 Federal + State Taxes + Fed Efile Tax Preparation Software - PC/MacDisc [Old Version]](https://m.media-amazon.com/images/I/419laQUjH2L._SL160_.jpg)