What is Takaful Islamic Halal Insurance

Read more on Islamic Insurance...

With increasing Muslim population in the West the demand for halal insurance and financial products is on the increase. Many of the leading financial institutions and banks are all gearing up and providing services which are Shariah compliant. There is also an influx of new energetic Muslim Financial services entering the market like Salaam Insurance Services and Islamic Bank of Britain.

They are all looking to offer alternative financial services addressing the needs of the Muslim and the non-Muslim communities.

With the increase in financial troubles around the world it may prove to be the best alternative to traditional interest based financial products that have plagued the world with greed and corruption.

Islamic insurance is not a new concept within Muslim society. The idea of a person protecting him or herself against loss or misfortune is described in the Qur'an through stories of some of the prophets (pbut). In Arabic this concept is known as "takaful". It is acknowledged that the foundation of shared responsibility or Takaful was laid down in the system of "Aaqilah".

Islamic Insurance Video

Aaqilah was an arrangement of mutual help or indemnification in case of any natural calamity, everybody used to contribute something until the loss was indemnified. This kind of method was invaluable in the days when people lived in small groups or tribes as society evolved this work was taken on by Islamic financial institutions. Islam accepted this principle of reciprocal compensation and joint responsibility.

What is Takaful?

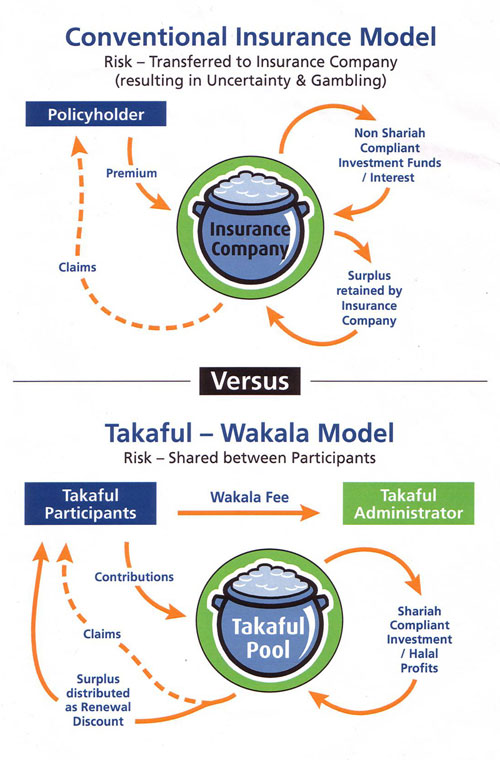

Takaful, means "guaranteeing each other", it is the same as insurance. It represents the concept of insurance based on mutual co-operation and solidarity of people by participating in a takaful scheme. Takaful satisfies the need for insurers that now need to provide Shariah compliant insurance services as an alternative to the conventional insurance. Takaful is commonly referred to as Islamic insurance.

The image on the right depicts visually how the takaful insurance plans work:

Related Articles...

- What is Islam 101

Islam is the second largest religion in the world with an estimated 1.200 billion Muslims in the world! - How to make money with pictures and images

There are so many methods you can use to make money online, some very good and some methods not so good. There are many free online money making schemes and there also others which require you to invest some money. - Islamic Finance the real alternative to capitalist financial systems!

Islam = PEACE therefore ISLAMIC = PEACEFUL Islamic finance is nothing more than a method of monetary dealings that embodies all aspects of the transaction, unlike the existing system which merely concentrates on the returns that will be generated..

Islamic Banking Learn more!

What does Takaful offer?

Takaful or Islamic Insurance is founded on the cooperative principle and on the principle of separation between the funds and operations of shareholders, thus passing the ownership of the Takaful (Islamic Insurance) fund and operations to the policyholders. Muslim jurists conclude that insurance in Islam should be based on principles of mutuality and co-operation, encompassing the elements of shared responsibility, joint indemnity, common interest and solidarity.

The takaful Islamic insurance policyholders are joint investors with the insurance vendor (the takaful operator), who acts as a mudarib – a manager or an entrepreneurial agent for the policyholders. The policyholders share in the investment pools or funds profits as well as its losses. A positive return on policies is not legally guaranteed, as any fixed profit guarantee would be analogous to receiving interest and offend the prohibition against riba.

Get more Islamic Images

In conventional insurance business excessive uncertainty in dealings and investment in interest-bearing assets is considered to be incompatible with the Shariah and is prohibited.

However, takaful based Islamic insurance complies with the Shariah (which outlines the principles of compensation and shared responsibilities among the community or policy holders and insurance fund administrator) and has been approved by Muslim scholars. Muslims and non-Muslims can now take part in car, property; health and family (life) takaful based halal insurance plans.