How To Save Money & How To Budget Your Income and Expenses

Know Your Salary & Savings

Learning how to budget is essential in the modern world. Being able to take control of your finances and monitoring your bank balance is the perfect start when it comes to managing your income and finances. The first step is to look at your savings history and maximise your savings by limiting your expenses.

Saving and monitoring your cash inflows and outflows is important. Not only will it save you from those unfortunate and embarrassing situations, it'll also help you plan your finances, help you stress less and help you get a better handle of your own money and personal wealth. Whether it's a lot or a little, it doesn't matter. When reading this article, just think of all the situations in your life where you think you could have saved those extra few dollars, or rather how much you could have saved if you didn't make all those unnecessary purchases on video games, household items and tools sitting in the garage which you've never used.

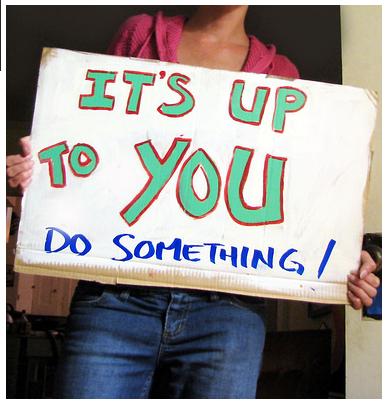

The first tip to saving money involves organising your finances. Simply put, being able to manage your money means understanding and monitoring your savings and expenses. You've only got a limited amount of income, so it's up to you whether you decide to save or spend it.

Managing Your Income

Tip #1 - Understand where your income is coming from

Being able to know how much money you make each month will help you save money and control your expenses. If your only income is your full time job, then make sure you know how much money you earn every week, fortnight or month. This will help you to know if you've been short paid for any of your weeks at work.If you have more than one source of income, make sure you understand how much you are earning from each source. For example, if you make money from selling items on ebay and from your full time job, make sure you know how much of a profit or loss you are making from your ebay sales. The last thing you want to do is find out that you're actually making a loss. This means that, essentially, you're wasting both time and money.If you're relying on your alternative source of income ensure you collectany outstanding debtswhich people may owe you. The last thing you want is to have sold an item to someone without receiving the money for it.

Know Your Expenses

Tip #2 - Know your expenses

Whether you've got monthly phone bill expenses, internet fees, utility bills including water and electricity, or monthly child support payments, make sure you understand how much money you need to set aside each week or each month for your routine expenses.Everyone has expenses, and the best tip to manage/organise your expenses is to keep a record of your previous expenses. Write them down and understand how much you are spending each month. Some of these may be recurring expenses, some may be one-off expenses such as buying a car. Take note of what each expense relates to. If you're unsure, do some research and make some phone calls. The last thing you want to do is find out you're paying a monthly internet bill for a service which you thought you cancelled years ago.

Pay Off Your Credit Card - Say goodbye to credit card debt

Tip #3 - Say goodbye to your credit card

For most people, a credit card will only mean debt, debt and more debt. If you don't need it, then don't have it. Credit cards have high amounts of interest which will mean more expenses if you don't pay off your debt fast. If you have any outstanding credit card card debt, put as much savings towards your credit card debt as possible, and do this as often as you can. For more information on how to pay off your credit card - see the following: "Credit Cards - What You Need To Know".

Save Your Money

Tip #4 - Don't be tempted to spend - Save your money

If someone gives you a gift of money, whether it be $2 or $50, don't be tempted to immediately spend it on something you don't need. Hold onto it, put it in your bank account, and use it to buy something when you really need it. Get a penny jar if you need to and keep most of your money there instead of in your wallet where you'll be tempted to spend. If you're wallet or purse seems empty, then you can always top it up with more money later on. Save your money!!

Look For Sales

Tip #5 - Stock Up During Sales

Be careful with how much you spend. Before making purchases, big or small, see if you can get it the item cheaper elsewhere. With competition the way it is these days, companies are reducing the sale price on most of their items. Look out for a 50% off sale and you could save just that, 50%. This means you'll have an extra 50% which you would have otherwise have spent elsewhere for nothing if you didn't buy the item when it was on sale. Sometimes it means waiting for a good deal, so it you don't need it right now, wait until you can get a good deal.

Buy During Sales

Prepare A Budget

Tip #6 - Prepare A Budget & Stick To It

When people hear the word budget, the first things that come to mind are financial stress and having to actually take some serious time out and do some hard thinking. Preparing a budget is simple, depending on how seriously you want to approach it. Write down all your recurring bills as well as the date from the past 6 months. The reason you need to take the last 6 months is that utility bills generally occur once every 3 months and one bill is generally not enough to give an indication of the amount you're spending. This includes phone, internet, water, electricity, etc. Anything which comes up on the same date every week or every month should be included.

Once you've done this, record all your other expenses from the past 3 months. The best way is to take a look at your bank statement and get your information from there. It won't include everything such as cash payments, however, the cash had to have come from somewhere so make a note of all your withdrawals from your bank account in the past 3 months.

Based on Tip#1, you should already know your sources of income and how much money you earn. Write down all your cash inflows (income) in one column, and all your cash outflows (expenses) in another. I would recommend choosing a set period of 3 months which includes at least one of every expense. Add a total of both income and expenses at the bottom then simply subtract your expenses from your income . This should give you a number which shows how much money you're left with at the end of every 3 months after all your expenses. It may be a shock, or it may not be. For many of you it will be a shock and make you start to consider how you're surviving with only so little spare cash available. Don't panic. It just means you'll need to start saving more and spending less.

The next step is to think about how much higher you want that final number to be and how you're going to get there. From now on, keep a hold of every receipt. If you buy something and don't have a receipt, write it down at the end of the day on a piece of paper.

Monitor Your Expenses

Tip #7 - Cutting down on your expenses

The greatest tip to saving is to cut down on your expenses. Take a look at all your expenses from Tip #2 and Tip #3 and think to yourself "how many items did I buy which I don't need or could live without".

Instead of buying a $10 lunch and a $20 dinner every day, think of alternatives so you can spend only $5 on lunch and $10 on dinner. This will mean that instead of spending $30 each day on lunch and dinner alone, you'll only be spending $15. This may mean preparing meals instead of buying all your meals pre-cooked or from your favourite fast food outlet.

Instead of spending hundreds of dollars each time a new iPad or iPhone is released, why not hold on to what you have for the time being and save that money and put it towards paying off your credit card debt, or earning interest in your bank account.

Managing Your Bank Account

Tip #8 - Monitoring Your Bank Transactions

Checking your bank statement or online banking transactions on a daily basis means you will be able to recognise any unusual transactions including services you don't need or recurring subscriptions you don't use. If you notice these types of transactions or fraud, make sure you contact your bank or the relevant supplier and cancel your services to avoid any more fees. If you notice you have any bank fees such as account fees, make enquiries to your financial institution to have these waived or transfer your money elsewhere to a bankaccount where you won't have to pay any unnecessary hidden fees or charges.

We're all tempted to spend money on the things we don't need, but do we consciously realise at the end of the year how much money we spent on fast food or items which we didn't really need to buy? If you can cut down the amount of spending you do in your life, you'll be left with a lot more money in your bank account at the end of the money which means you can buy the things you need, or actually have enough money at the cash register the next time you do your shopping, instead of feeling embarrassed that you don't have as much money as you thought you did.

For more information about how you can increase your savings, stay tuned for my next hub on "How To Increase Your Savings"