A Review of the Social Security Myth by Milton Friedman

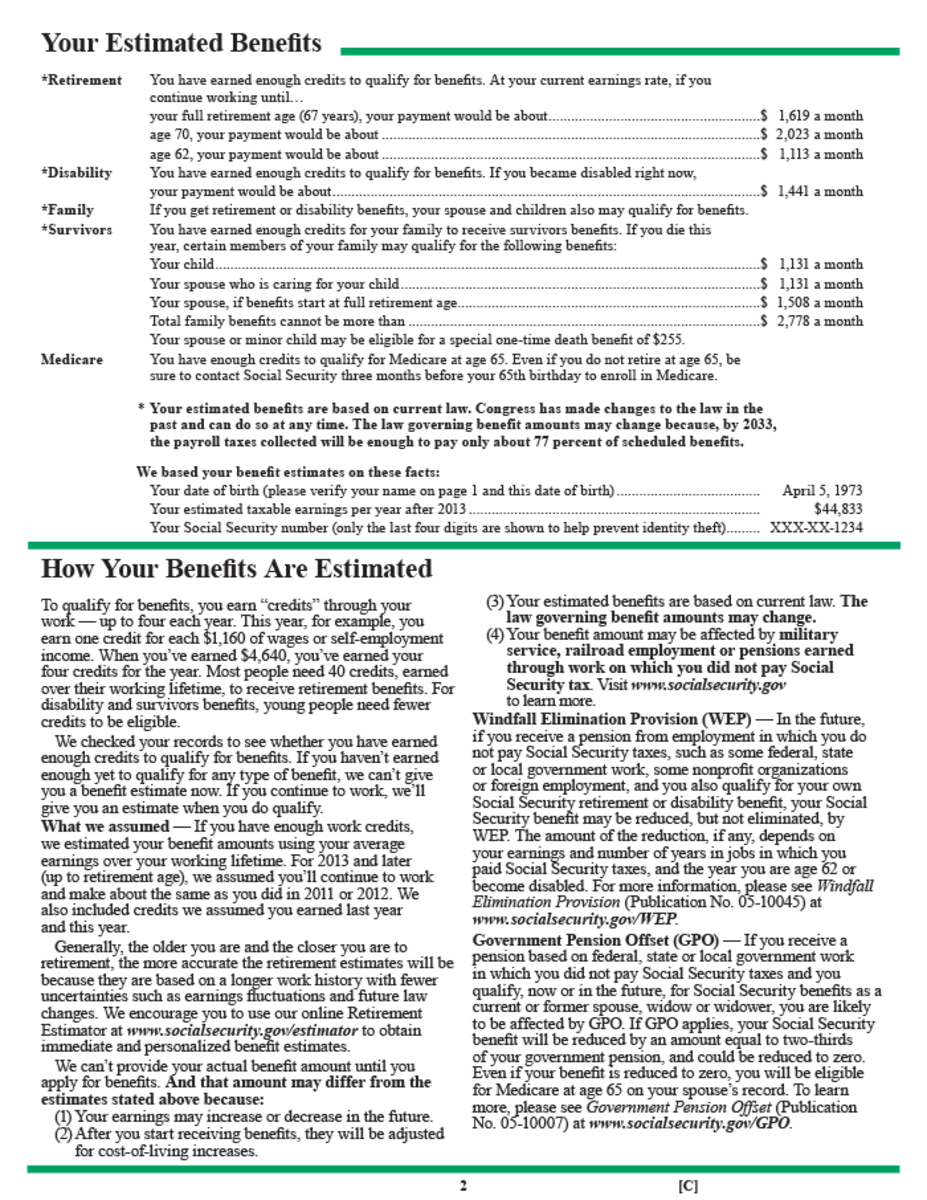

Friedman calls social security the greatest sacred cow of them all. It is a combination of bad tax system and a bad way of distributing welfare. No one today would defend either system separately. Social security system consistently refers to the taxes that you pay as a contribution. There was no underlying public demand for social security. In 1930, the demand had to be created, developed, and produced. This was done by people who sincerely wanted an expansion in the scope of government. Social Security was sold as an insurance scheme. There is very little relationship between social security and traditional insurance. The amount of money that someone makes doesn’t depend on his or her poverty or his or her indigence but depends on the type of industries that he or she works at. Freidman says that a tax on wage is up to a maximum. It is a tax on work that discourages employers from hiring people and that discourages people from going to work. It is born on lowest wage group. The people who pay more taxes will receive more social security benefits than those who do not. If someone is at retired age but chooses not to retire and chooses to work, he or she receives no benefits but has to pay taxes in what he or she makes. If the person chooses not to work, he or she will receive benefits. Social Security subsidies are categorized as benefits. Today, we have a system where people have been taxed to pay to the people who are receiving them. That is, the young are taxed to subsidize the old. Social Security taxes are not invested in a system that allows employers to save for their own retirement benefits.