How to Calculate Put-Call ratio

Share your opinion

Have you ever known about this?

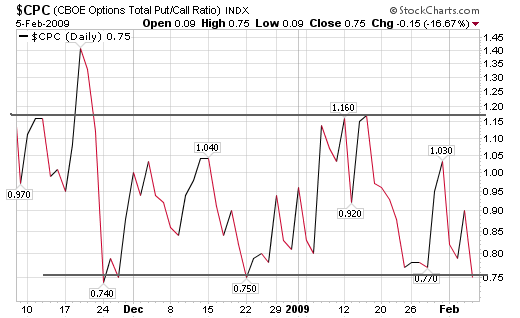

Put – Call Ratio:

Ratio between traded put options and pull options within a certain period (day/week/month) is termed as put-call ratio. Put-Call ratio is one of the components which give the way of market which emerged from option trading. Investors doing option trading considers Put-Call ratio as the component which tell the opposite way of the market movement. The investors can understand the whether the market is going towards Bullish or Bearish way from Put-Call ratio.

How to Calculate Put-Call ratio:

The Put-Call ratio is calculated by using following formula

The Put-Call ratio =Total no: of traded Put options / Total no: of traded call options

For example if the no: of traded put options of reliance is 25,000 and no: of traded call options is 30,000, then according to formula.

Put-Call ratio = 25,000/30,000 =0.83

Mainly there are two types of Put-Call ratio:

1. Equity Put-Call ratio

2. Index Put-Call ratio

Equity Put-Call ratio:

It refers derivative division of equity options Put-Call ratio. In this segment also 2 types of Put-Call option.

- Total Equity Put-Call ratio

- Single Equity Put-Call ratio

Total Equity Put-Call ratio: It is the ratio of total equity’s put options divided by the total call options. Put-Call ratio of equities average value will be less than 1, between0.5 to 0.7. Because those who are doing trading on equity trading, buys more call options than put options.

For e.g.: Consider the trading done in NSE on 17-04-2012, the no: of put options=50,840 and call options=1, 01,680 then the Put-Call ratio will be=50840/101680=0.5

How to calculate Put-Call ratio in normal condition:

If the value of Put-Call ratio in normal condition will be equal to 1 or more than one, then the market will be a Bearish sentiment. In this time investors will buy more put options.

If the value of Put-Call ratio is 0.5 or less than 0.5, then the investors have Bullish sentiments on markets.

In some cases Put-Call ratio gives opposite sign of market, only the investors think in opposite ways.

Like to improve your Business

More On Business

- The Capability Maturity Model (CMM) Improving Business Operations

The Capability Maturity Model (CMM) helps any company improve its competitive position. Designed for military contracting, it helps every business succeed. - How to make Plain Chocolate: Start a Money making b...

Everyone loves to eat chocolate. I like to share an easy way of making beautifully packed chocolates. It is easy to make the chocolate in 7 steps and you can sell it in shops. - OFFENSIVE AND DEFENSIVE STRATEGIES: THE GAME PLAN FO...

Offensive and Defensive Strategies in business are tools to survive in a fluctuating scenario in the business world. Whatever strategies you choose companies need to plan ahead because these strategies need commitment, time and money. - An interview with RIM india MD

Hot debates are taking around the globe about the manufactures of the Blackberry, the ‘Research In Motion’. News coming in newspapers around the world about this Canadian company is not so good. - Business Checking Online and Free Checking Account O...

If you own a business, read this! Find out which banks offer the best deals.