What is Financial Market? Capital Market and Money Market Instruments

Introduction

Today, finance or money becomes an essential one for human life. Simply because, the human beings are living with lots of hopes and wants. Actually these wants can be technically called as ‘demand’. Any way money is one of the essential thing for human beings to meet these demands. Since, money become as a commodity for the purpose of buying and selling or exchanges, it become a study area in depth.

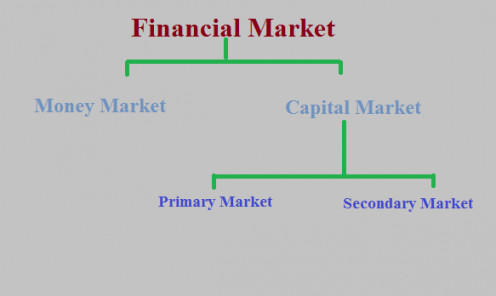

What is Financial Market?

Market refers to one where transactions are occurring between buyers and sellers. Nowadays there are different market can be list out. Among them financial market is the most important one. here the commodity is money or wealth. So, we can say financial market is one where the financial intermediaries or people bring in to contact for the purpose of exchange, the commodities may be cash, securities like Cheques etc.

For the purpose of simplicity, financial market can be classified in to two as follows.

1) Money market and

2) Capital market

What is Money Market?

Money market is the important part of an economy. Generally securities are circulated in the money market for a maturity period of less than one year. That is short term based securities are deal in the money market. So, it is very much helpful for business entities to meet the urgent working capital requirements. The major participants in the money market transactions are commercial banks, central bank and the general public etc.

What are the Common Money Market Instruments?

So, we understood what money market is. Now let us analyze common instruments can be seen in the money market. There are many money market instruments in the world, it may vary from country to country. Anyway following are the common money market instruments.

i) Bills of exchange:

bill of exchange is one of the common money market instrument widely used all over the world. Traders (both domestic and foreign) are widely using this instrument. Bill of exchanges are the bills issued when credit purchase or sale occur. Then a bill is issued instead of making payments in terms of cash. So, the cash must be paid by the buyer within the maturity period of bills. Normally these securities are issued for three or six months.

ii) Treasury bills:

treasury bills are those money market instruments issued mainly by the government institutions. It is issued to the public and the security has a maturity period of below one year. Treasury bills can be purchased for the public. Since treasury bills are issued by the government it has more demand in the economy.

iii) Commercial papers: Commercial papers are the securities issued by the private or big companies to the subscribers of commercial papers. Actually the face value of the commercial papers is very high. This form of securities helps the companies to find the working capital.

iv) Cheques :

cheques are the very common money market instruments. Cheques bears a value which is payable to the person mentioned on the face of the cheque. Cheques are normally bears a maturity period of below one year. This is a security which takes the process of payment only through the presence of commercial bank.

What is Capital Market?

Capital market is also one of the integral parts of the financial market of any country. Capital market securities are long term in nature, that is capital market securities are durable or matured with in above one year. The importance of capital market is, it enrich the capital formation process in the economy. In simple words, the deposits of public are contributed and converted in to capital through investing in securities like shares, debentures etc. In short the role of capital market is nothing but to find the capital or fund for business by encouraging the public deposits.

Categorization of Capital Market

Capital market can be further divided in to two based on the nature of the working. They are

1) Primary market and

2) Secondary market

Each of them is separately described below.

1) Primary Market

Primary market is the market where the fresh securities are supply to subscribe. That is the companies or the fund required authority issue new securities to contribute their overall capital. So, in the primary market securities are directly supplies by the issuer and this will be converted in to capital when the public subscribe and paid the value of securities. In simple, primary market helps a company or issuer of security to collect capital or the increase the existing capital.

2) Secondary Market

In the secondary market the existing securities are dealing. That is the ownership of a security transfer from one person to other. Here the already issued securities are exchanged based on the demand and supply of the security. Stock exchanges, share brokers etc are the major participants in the secondary market. Even though the values of securities are varying, it never directly or immediately affects the capital or survival of the company or the security issuer.

What are the Common Capital Market Instruments ?

As mentioned what is capital market, there are many securities dealing in the system which having a maturity period of above one year. There are different forms of capital market instruments see all over the world to accumulate capital fund to the business entities. Following are the common capital market instruments widely using.

1 – Shares

Shares are the securities issuing by a company for their shareholders. That is the shareholder must pay the amount of share to get the ownership of the security. The company share a portion of profit as reward. It is called dividend. Any way there are different types of shares. Actually share holders are the real owners of the company.

2 – Debentures

Debentures are another capital market instrument widely using. This is also issuing by companies. The debentures are issued with a higher face value and when a person buy the debenture, he will be beneficial by a share of profits. This profit is called interest.

Any way financial market is vital for any economy, if the financial market is a developed one absolutely the economy can enjoy the economic benefits as a whole.