Importance of Public Expenditure

Introduction

Today, public finance is one of the interesting areas of study which influences on different matters of an economy like growth, development, progress etc. Public expenditure is one of the significant matters of public finance. The government or the authority can influence the economy through adopting fiscal policy. Public expenditure is a strategic tool for maintaining the economic stability.

By meaning, public expenditure refers to the expenditures incurred from government or an authority. It may aim on various fields like education, healthcare, defense, law, infrastructure etc.

In earlier times (especially during classical economists), public expenditure had limited scope, because most of the olden economic systems were based on laissez-faire or free competition. During that time, the role of government was very limited. The main function of government was to protect the wealth and individuals and also to establish peace in the society. Further they believed that, public expenditure will lead to inflation since there is a possibility to increase money supply in the economy. But after the great depression of 1930s, J.M Keynes published his masterpiece in economics titled, “General theory of Employment, Interest and Money” in 1936. In which, he highlighted the role of governments in a country to stabilize the economy. Modern economists emphasizes on the vitality of public expenditure, because of the increasing tendency to build a welfare state throughout the world countries. Therefore, government has to do more in the economy to easiness the process of growth and development.

Importance of Public Expenditure

Today, the role of public expenditures of countries increased drastically. There are many reasons for this change. Following are the some of the reasons of increasing the role of public expenditure.

i) Welfare State

Today, economists are emphasizing on the role of a welfare state in the progress of a country. Governmental welfare activities are very essential for the establishment of equality in the country. It is also very essential to uplift the backward regions and peoples in to the forefront of the development.

ii) Impact of Public Expenditure

Public expenditure may directly influence many part of an economy such as consumers, producers, workers etc. So it can be used for maintaining economic stability. Public expenditures like investment, scholarships, subsidies, bonus etc will directly affect the various economic agents.

iii) National Security

A huge portion of public expenditure flows to the defense sector for ensuring the security of the economy. Today all the countries are spending lots of money for the defense requirements and their related researches.

iv) Growth of Democracy

In this modern time, there is a wide trend towards democratically controlled systems. At the same time it requires huge public expenditures for the establishment and the maintenance of it. There requires continues or regular expenses from government to do functions of the democratic system, conducting elections, campaigning etc.

v) Role of Planning

Every economies of the world are functioning based on some predetermined norms and planning. It is very vital to understand the barriers of the economics of growth and development. Then there requires huge amount of funds to implement various plans and policies to overtake the economic and social challenges.

vi) Developmental Activities

The ultimate aim of any economy is to achieve development. But it is a more comprehensive concept which requires dedicated and continues efforts. The role of government is to boost the developmental process. It requires huge expenses. The developmental activities include crucial efforts or challenges like poverty eradication, employment generating schemes, measures of reducing inequalities etc.

vii) Increase in Price Level or Inflation

Inflation or price level rising is a common phenomenon in every economy. So the public expenditure should also increase in accordance with the increasing of price level since inflation declines the value of money.

viii) Modernization

Modernization of an economy is very significant one for the growth and development. Industrial development requires huge public finance. For that, government must setup basic infrastructural facilities for the promotion of the economy. In fact, modernization of all sectors of the economy is a more expensive task.

ix) To Meet Increasing Social Needs

Along with the raise in population, the economy must be capable of developing its facilities like educational institutions, hospitals, infrastructures, banking and finance etc. Otherwise it may lead in to the conditions of underdeveloped economies. Therefore, to secure development, the economy must able to satisfy the social needs. As the population, the economy must be capable of developing its facilities like educational institutions, hospitals, infrastructures, banking and finance etc. Otherwise it may lead in to the conditions of underdeveloped economies. Therefore, to secure development, the economy must able to satisfy the social needs.

Do you think that, welfare can bring through public expenditure?

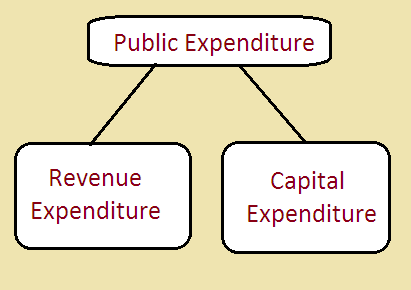

Types of Public Expenditure

Broadly, public expenditures of an economy can be classified in to two types like revenue expenditures and capital expenditures.

Revenue Expenditure:

Generally, revenue expenditures of governments are based on short term period. It can be seen in the current account of balance of payments. It is recurring and repetitive in nature. It may be in the forms salary, administrative expenses, interest payments, subsidies, grants-in-aid etc.

Capital Expenditure:

Capital expenditures of governments are not repetitive in nature. It occurs at a single time. It may be in the forms of funds for projects like construction of bridges, parks etc. Disinvestment is also regarded as capital expenditure.

Public Expenditure VS Private Expenditure

Apart from public expenditure, there is also another one called private expenditure. As mentioned above public expenditures incurred for an authority or government. On the other side, private expenditure is connected to the expenses of private individuals and firms.

Conclusion

Public expenditure is one of the most important subject matters in public finance. It deals with various expenditures of an authority or a government. Nowadays, public expenditures have to do more functions in the economy since the concentration of economies is to achieve development and sustainability. It will also helps to bring equality in the economy.