The determinants of FDI inflows

Introduction: Benefits of FDI

The advance of the globalization process and the progress of science and technologies have brought the world closer together than ever before, facilitating the movement and spread of information, capitals, goods and products, raw materials and human capital from countries around the world. On one hand, transnational companies are quick to realize these new potential investment destinations and markets and start moving their resources to even the furthest corners on Earth to capitalize on these new opportunities. Directly investing in these locations helps companies gain easy access to the local markets, reduce transportation costs, and take advantage of the local workforce and natural resources.

On the other hand, countries, especially developing ones, also recognize the importance and contribution of FDI inflows to their economic growth. FDI inflows increase the existing pool of capitals and speed up the transfer of new technologies and knowhow to host countries. Also, the presence of FDI enterprises increases competition in the host countries’ business environment, forcing domestic enterprises to innovate and catch up with their foreign competitors and creates other positive spillover effects.

Trends in FDI flow in recent years

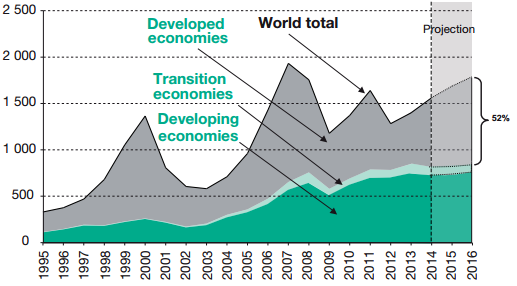

In recent years, the prospects for overall global FDI flows have been very positive. According to the statistics of UNCTAD, after falling from the height of $2 trillion in 2007 due to the world economic recession, the global FDI inflow showed signs of recovery. In 2013, it increased by nearly 9 percent to reach more than $1.45 trillion, and the increasing trend was observed across all 3 categories of the economy – developed, developing and transitional economies. Many experts predicted that this rising trend would continue for the next 3 years.

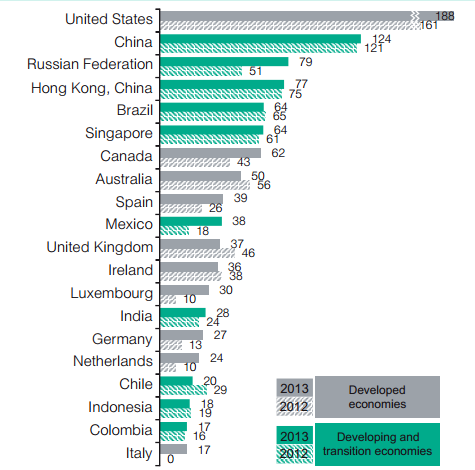

Among all global destinations, with the exception of the year 2009, FDI inflow to developing countries kept increasing, making up for more than 54% of the total global inflows in 2013 ($778 billion), among which, emerging Asian economies accounted for nearly one third of the total global share ($426 billion), significantly higher than that of African economies ($57 billion). China arose as the most attractive developing-economy destination, ranking 2nd among the top host economies for FDI and receiving a total of $124 billion in 2013, up 2.5% compared with 2012. As for developed countries, after reaching a peak of $1.3 trillion in 2007, the total amount of FDI inflow to the region deteriorated and stood at $566 billion in 2012, only slightly greater than that of 2012 ($517 billion). North America attracted $250 billion while the European countries received $246 billion.

In terms of FDI outflows, developed countries maintained their lead, contributing more than $857 billion or more than 60% of the total global outflows. The United States and Japan were the most active investors, investing $338 billion and $126 billion abroad respectively.

FDI inflows: Top 20 host economies in 2012, 2013

Determinants of FDI inflows

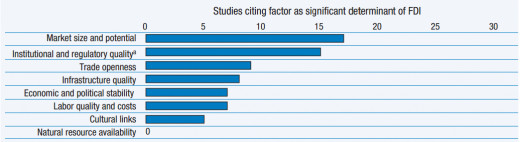

As the role of FDI in economic development has been increasingly acknowledged and emphasized, competition among countries and regions to attract the global FDI inflows to their locations has also intensified, leading to the big question as to which factors encourages or discourages foreign investors from investing in a location. According to various researches, these followings factors are identified as crucial in influencing investors’ location decisions.

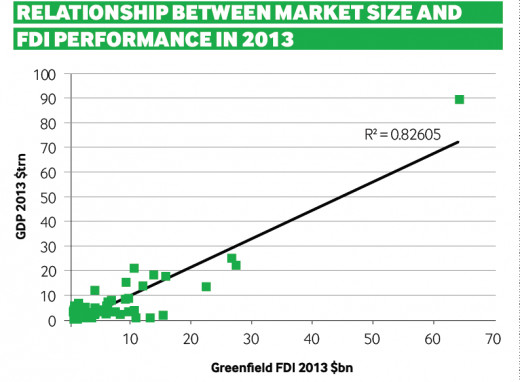

Market size

Market size, which is usually decided by the host country’s population, GDP and per capita income, is one of the most important factors in FDI location decision. Market size gives investors an idea about the host location’s general economic and demographic conditions, the potential demand for their products, local sales and profitability. Zheng (2009) argued that foreign investors who are seeking new markets for their output are most likely to be interested in market size, customers’ potential purchasing power and growth. In addition, Scaperlanda and Mauer (1969) pointed out that market size would positively affect the level of FDI if it was large enough to allow the companies to take advantage of economies of scale and effectively allocated resources. It is no coincidence that China and the United States, the two biggest economies in the world, are also the two largest FDI recipients, accounting for approximately 13% and 9% respectively of global FDI inflows in 2013.

Trade openness

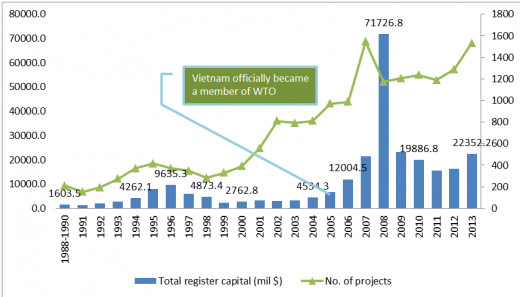

It is generally believed that openness and market freedom encourages FDI and economic growth. Many studies show that trade openness promotes export-oriented FDI inflow into an economy in general and companies often prefer host countries that are close to their export markets, have policies supporting import-export activities and participate actively in many regional or global trade agreements. Countries that undergo trade liberalization are expected to receive more FDI. For instance, after Vietnam officially joined the World Trade Organization, signing various agreements to open its economy and loosen the state’s control in many areas, the country witnessed the largest wave of FDI companies flocking to the country with a peak in 2008 with 1,171 new FDI projects and a total registered capital of $71 billion.

FDI registered capitals in Vietnam from 1988 to 2013

Tax incentives

Although researches have demonstrated that tax incentives are not the deciding factors in drawing foreign investors’ attention, it does prove to have some impacts on investors’ decision, especially when they compare among locations with relatively similar investment conditions. For example, from 1985 to 1994, as Caribbean and South Pacific countries amended their tax policies, making them become tax havens, total foreign direct investment to these locations increased more than five times. Similarly, countries and territories such as Hong Kong, British Virgin Islands etc. with lucrative effective corporate tax rates are also able to attract a steady stream of foreign investments. Moreover, tax incentives enable the host government to influence the structure of FDI inflow. In fact, most governments give more incentives to a certain type of investment or a certain sector to encourage investors satisfying specific conditions.

Labor costs

Labor cost has always been identified as a major FDI determinant and many developing countries claim low labor cost as their competitive advantage in attracting foreign companies. Labor is one component of the total production cost; therefore, labor-intensive industries and companies which have labor costs constitute a large proportion of their total costs are most appealed to cheap labor. Besides, export-oriented FDI companies are even more sensitive to labor cost and they tend to move their production to the place offering low tax rates and cheap inputs including labor, raw materials and energies to cut down on production cost. A study by Wheeler and Mody (1992) found out that for US firms, labor cost played an important role in their global investment location decisions and lower labor cost associated with higher level of FDI inflow. According to a research by Baskaran, Nasrin, and Muchie (2010), low labor cost is the most significant determinant of FDI inflow to Bangladesh and 71% of the foreign investors surveyed indicated that cheap labor was the main factor motivating their investment decisions.

Economic and political stability

Foreign investors pursuing long-term and sustainable investment take economic and political stability of the host country into serious consideration before making investment decision. A stable and reasonably sound economic and political climate enhances the certainty and predictability of future events or changes, increases investors’ trust and makes them feel more secure about the outcome of their investment. In addition, perception of stability adds to investor’s perception of risk and the greater level of instability drives away risk-averse investors, thus reducing the incoming FDI flow. A report by OECD (2002) cited macroeconomic instability, nonenforceability of contracts, and armed conflicts as the biggest risks of capital loss of foreign investors when investing in Africa, which ultimately discourages them from investing in this region despite the high potential rate of return on investment. Another example is the China - Japan's political dispute over islands in South China Sea which caused much tensions and hostile attitudes towards Japanese investors in China, forcing many Japanese companies to redirect their investments from China to other surrounding countries in recent years.

What is your country/region's main comparative advantage in attracting FDI?

Conclusion

In addition to the above-mentioned factors, there are other factors that are potentially the determinants of FDI inflow such as natural resource availability, investment regulation, institution, cultural traits, ease of doing business, infrastructure and so on. Each country has its own comparative advantages in FDI attraction and pursues different goals in order to maximize benefits and minimize risks from FDI. As the competition among countries in attracting FDI becomes fiercer, there will be more factors that companies will take into account before deciding where they would like to invest.

Introduction to FDI

Work cited

Baskaran A, Nasrin S, and Muchie M. (2010), “A Study of Major Determinants and Hindrances of FDI inflow in Bangladesh”, DIR & Department of Culture and Global Studies, Aalborg University.

OECD (2002), “Foreign Direct Investment for Development: Maximizing benefits, Minimizing costs”

Scaperlanda A, Mauer L. (1969), “The Determinants of US Direct Investment in the EEC”, American Economic Review 59, 558-568.

Wheeler, D and A. Mody (1992), “International Investment Location Decisions: The Case of US Firms,” Journal of International Economics, Vol. 33.

Zheng P. (2009), “A Comparison of FDI Determinants in China and India,” Thunderbird International Business Review, Vol. 51, No. 3, p. 263-279.