TAX BURDEN SHARING BETWEEN THE PRODUCER AND THE CONSUMER (INCIDENCE OF A TAX)

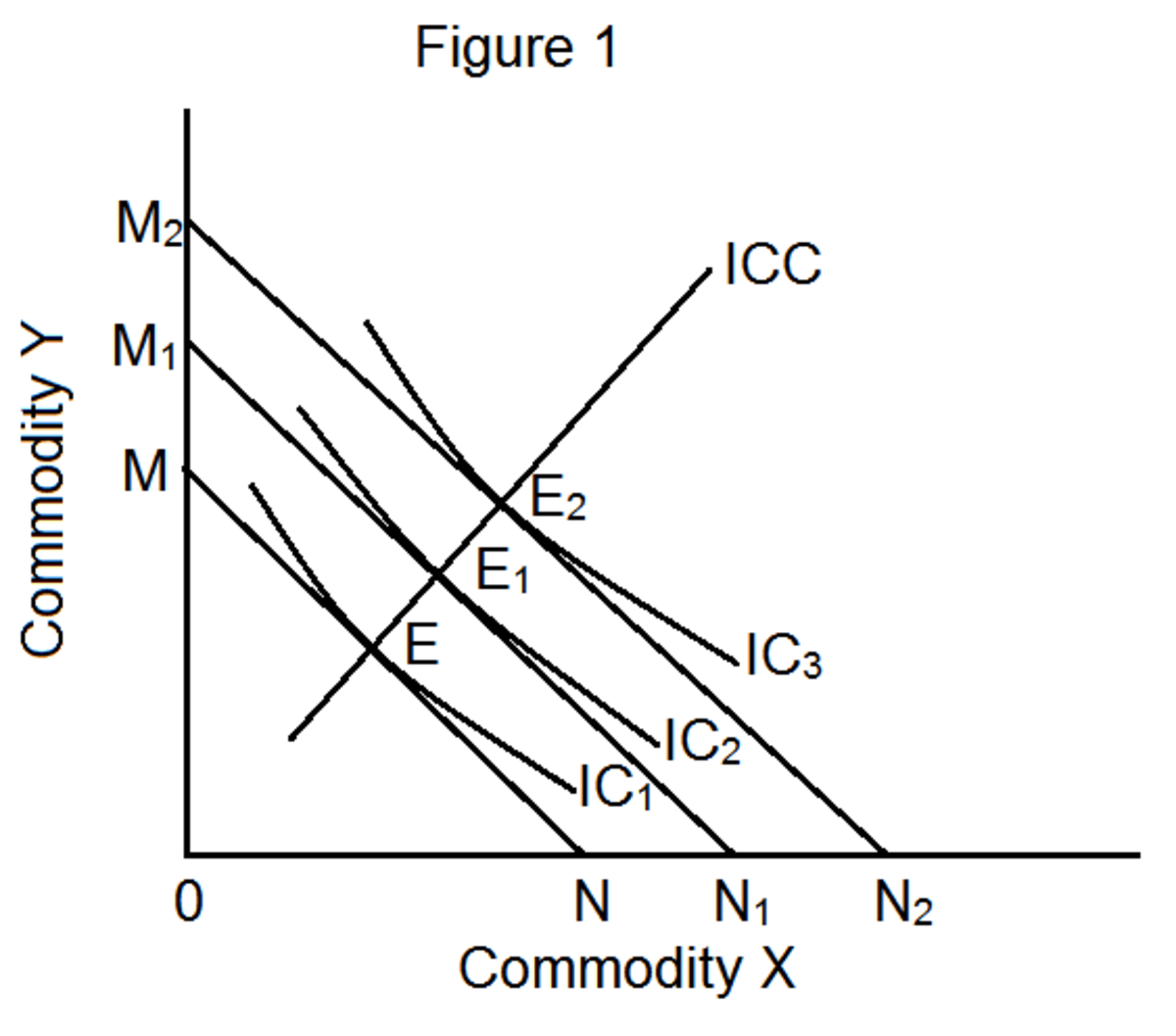

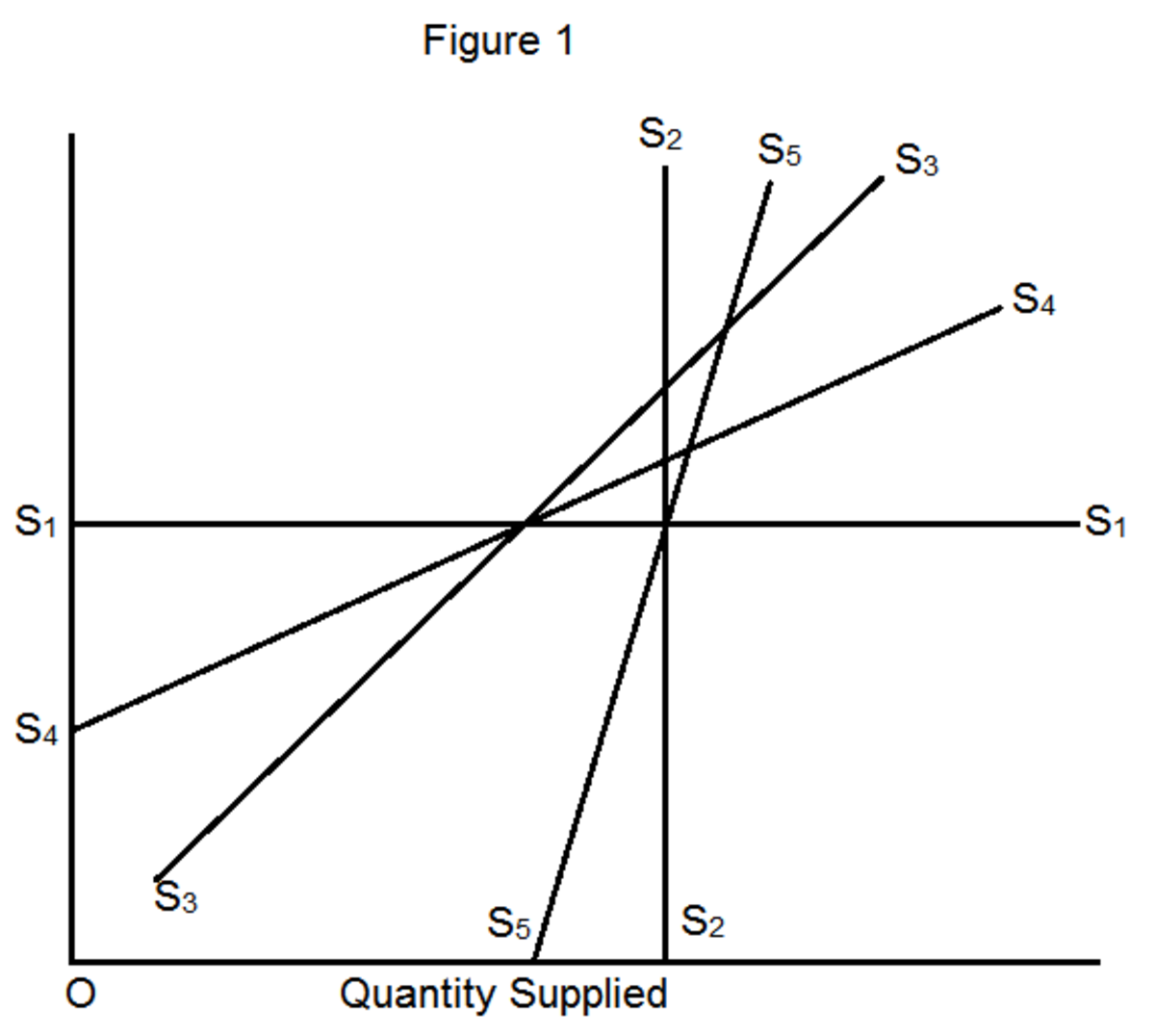

When an indirect tax is imposed on a commodity, the tax burden is borne in varying proportions by either the producer or the consumer or by both the producer and the consumer, depending on the price elasticity of demand for the product. The incidence of a tax measures the final tax burden on different people once the indirect as well as well as the direct effects of the tax is allowed. It is the consumer who often pays the price of a commodity. For this reason, the consumer bears any proportion of the tax which comes to him as price and the producer bears the rest. In extreme cases when the demand is perfectly inelastic, the consumer pays all the tax and when demand is perfectly elastic, the producer bears all the tax. Demand for a product is perfectly elastic when price of that product is fixed and any quantity can be purchased by the consumer. A perfectly inelastic demand involves a fixed quantity of a commodity but price change is possible. The producer and the consumer share the tax burden in the same proportion when the demand is unitary elastic or unit elastic.

For a product with fairly elastic demand, the imposition of an indirect tax on it increases the cost of production of that product and therefore decreases the supply of that product. Given that the demand of that product remains unchanged, the commodity’s price rises. Since the demand is elastic, the increase in price results in more than a percentage fall in the equilibrium quantity. The consumer is therefore able to avoid a greater percentage of the tax, and therefore leaving this bigger portion of the tax to fall on the producer. Hence if the demand for a product is elastic and a tax is imposed on such a product, the producer or seller suffers most by absorbing a greater proportion of the tax.

In a situation where the demand is inelastic, an imposition of an indirect tax reduces supply by the whole amount of the tax. Because the demand is inelastic, the increase in price due to the tax results in a less than a percentage decrease in the equilibrium quantity. For this reason, a greater proportion of the tax is borne by the consumer, and the remaining smaller proportion, born by the producer. The tax burden sharing therefore favors the producer if there is an imposition of a tax so long as the demand for that product has inelastic demand.

In an extreme case where the demand for the product is perfectly elastic, reduction in supply due to the tax has no effect on price because the demand curve is horizontal, that is, insensitive to price changes. Since there is no opportunity in this case for price to increase no part of the tax can be translated to price for the consumer to pay, the producer therefore bears all the tax. For a product with perfectly inelastic demand, an imposition of an indirect tax increases the price of that product by the whole amount of the tax. For perfectly inelastic demand quantity is fixed and the consumer is unable to avoid any part of the tax. The consumer therefore, bears all the tax.

In the case of unitary elastic demand, the tax burden is borne in the same proportion by both the producer and the consumer. The reason for this is that the increase in price that may arise due to the tax, results in the same percentage decrease in the equilibrium quantity. Neither the producer nor seller benefits at the expense of the other. However, in real life situations, one can hardly find a product that has unit elastic demand.

In the nutshell, knowledge of price elasticity of demand is very useful in providing us with a guide, with regards our tax burden expectations on goods and services which constitutes our day to day expenditure.