Obamacare Help: Enrolling In A Healthcare Marketplace Plan

Encouraging persons to go the new Healthcare Marketplace website is an exercise in damage control. The site's launch uncovered woeful preparation on the part of the Marketplace's designers and staff, while glitch-stricken users continue to voice their frustration while trying to enroll in their government approved healthcare by the March 31, 2014 deadline.

As the site undergoes service and updates for improvement, alternative forms of applying have been made available — but if you would like to try enrolling online, here are some tips for when comparing and choosing your new insurance plan on the Healthcare Marketplace site.

When shopping for a new Marketplace health plan, pay special attention to:

- The Plan-Tier System (Bronze, Silver, Gold, and Platinum)

- Catastrophic Plans

- Using the "Compare Plan" Tool

- Deductibles/"Out-Of-Pocket" Costs

- Specialized Medical Benefits

(If you still need to register an account and fill an application for healthcare, you can visit my step-by-step guide for registering and applying online — including glitches to watch out for)

Enrolling In a Plan Online:

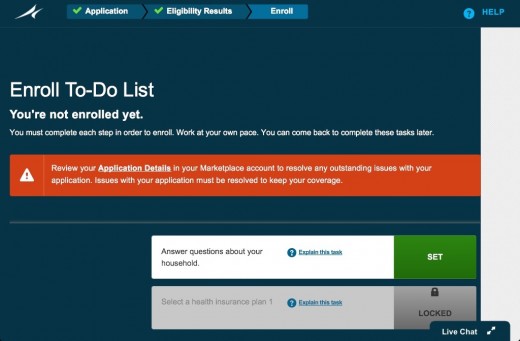

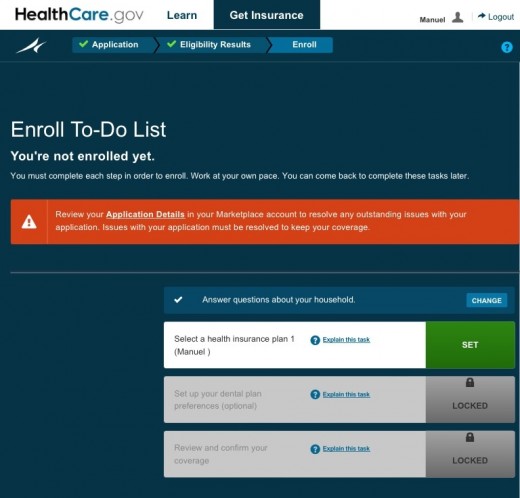

After having registered an account on the site and submitting your finished application, enrolling in a Marketplace plan begins here — in your "Enrollment To-Do List".

Answer Questions About Your Household:

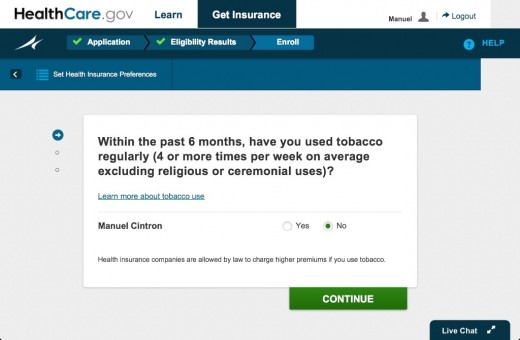

Again, you'll be asked to answer questions about your family and household (like in the application), only much shorter. Click "Set" to begin this section.

Expect to be asked if you or anyone under your plan has used tobacco habitually in the last six months. Be aware: your insurance provider is allowed to charge higher premiums to tobacco users.

After completing the family/household questionnaire, you should be returned to your "Enrollment To-Do List", where you can begin the big step — what this is all for: selecting your plan.

Select a Health Insurance Plan:

As with the family/household section, click "Set" to see the health plans available to you (based on the information in your application).

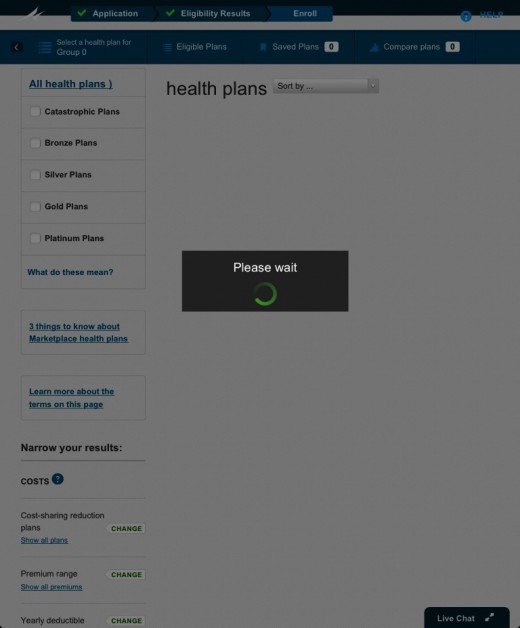

Similar to when you submitted your application, a loading screen will appear.

The site seemed to take its time 'loading' plans available to me, but I gave it the benefit of a minute or two. The page never finished loading though, forcing me to attempt refreshing it (which was successful).

TIP: if the page with your available health plans fails to load, try refreshing the page to load it properly.

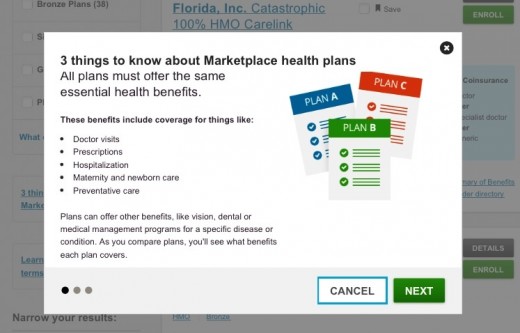

If it loads properly, you should first see this window with key informations about new policy requirements.

Under the new minimum requirements of the Affordable Healthcare Act, any insurance policy you have must include crucial coverage like doctor's visits, pregnancy care, a prescription plan, as well as hospital and preventative benefits.

TIP: If you have coverage that only focuses on part of these benefits, or focuses on treating a single aspect of your health (vision, dental, treating a specific condition/disease), your healthcare will not meet minimum requirements of the March 31, 2014 deadline.

The Plan-Tier System:

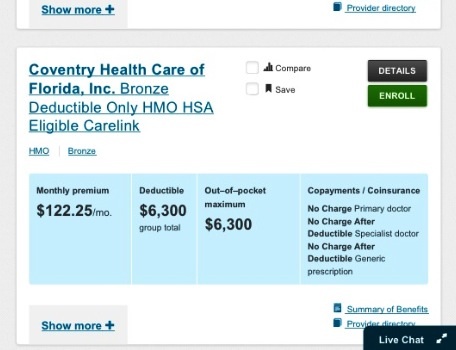

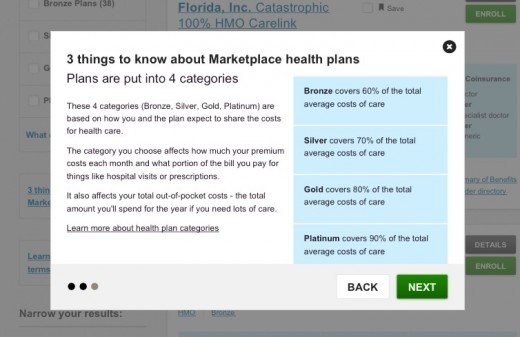

Plans will be divided in the Marketplace into coverage tiers — Bronze, Silver, Gold, and Platinum.

All plans cover the same list of things from the previous window, but how much you pay in monthly premiums and how much you pay when being treated differs for each.

Some higher-tier plans can also include benefits you would purchase separately otherwise.

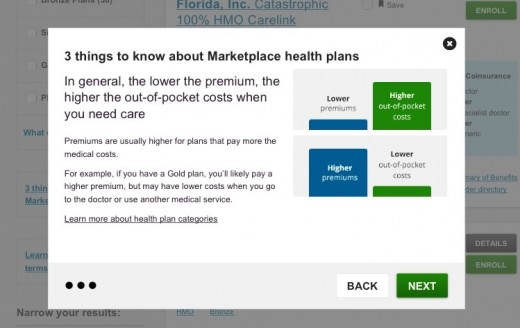

Choosing a plan for yourself is a matter of balancing how much you can afford to pay monthly and how much you'd want to pay when needing care. The higher the monthly premiums, the less you pay for treatment (typically).

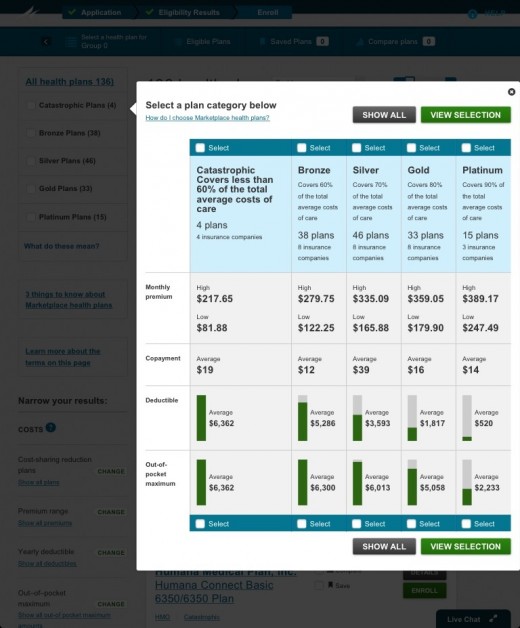

This window shows an example-comparison of how plans from each tier stack up side-by-side (when shopping, you can compare plans you are considering in the same way by using the Marketplace site comparison tool). Notice the additional "Catastrophic" plan-tier.

Catastrophic Plans:

These are plans for persons under the age of 30 or over-30 with a hardship exemption. Catastrophic plans are exactly what they sound like: they cover you if you need a lot of care in a worst-case-scenario.

The premiums are lower than Bronze plans, but you are required to pay all of your healthcare costs out of pocket — up to cap of a few thousand dollars. Essential care (anything necessary to keep you alive) that exceeds that cap will be paid for by the insurer.

Catastrophic plans also cover preventative care (for keeping you out of life-threatening conditions). This includes three primary-care visits a year and screenings and vaccines for most diseases (forms of cancer, HIV, forms of hepatitis, STDs, autism in children, illnesses specific to women, even obesity and smoke-use).

If you are eligible for purchasing a Catastrophic plan, you will see them in your available plans after submitting your application to the website. If you don't see any — your application information was considered ineligible.

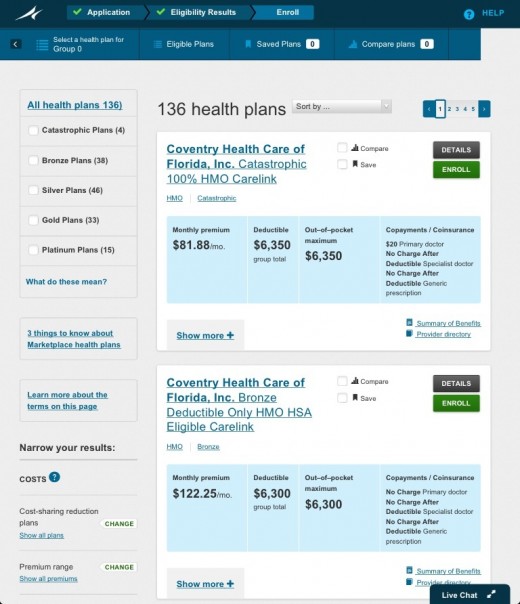

Now you can begin thumbing through and comparing your available plans.

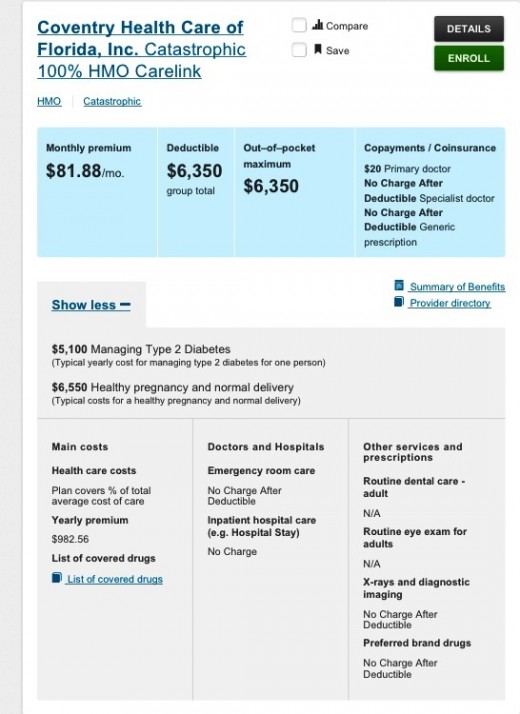

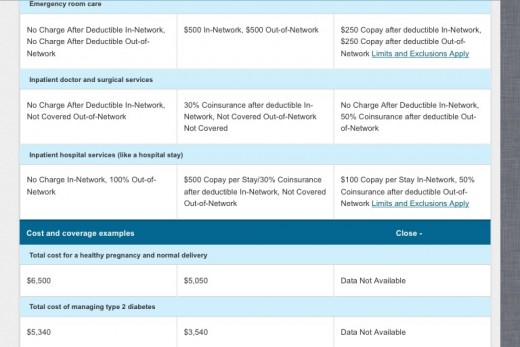

Beneath each plan, a "show more" tab can be clicked to see more basic details about that plan, like your yearly premium and how much (if at all) you must pay for extra services like radiology and emergency-room-care.

This plan does not require you to pay anything extra for those after your basic deductible. Costs for treating highly common situations like a pregnancy (full term and delivery) or Type-2 diabetes (cost of a year's worth of treatment) are also shown.

While you search through your available choices, should you begin seeing multiple plans you'd like to compare side-by-side, you can click the "compare" button at the top of each plan (located between the plan's name and the "details" and "enroll" buttons).

Selecting this will put a checkmark on this plan, saving it for when you click the "compare" button at the top-right of the page. You should see a counter next to this button, increasing with each plan you select to compare. You must have a minimum of two plans before opening the "compare" function.

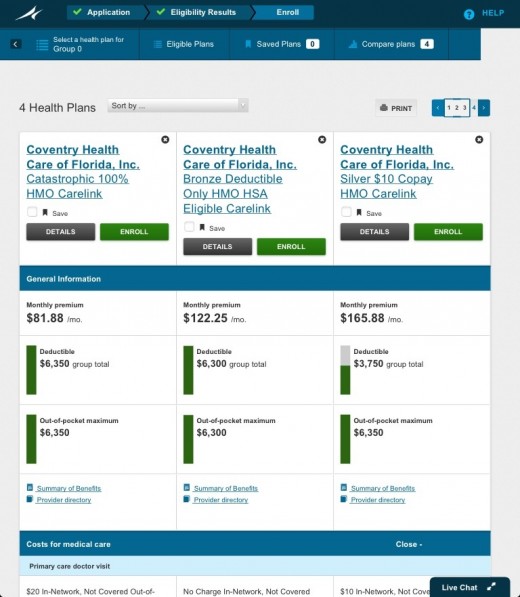

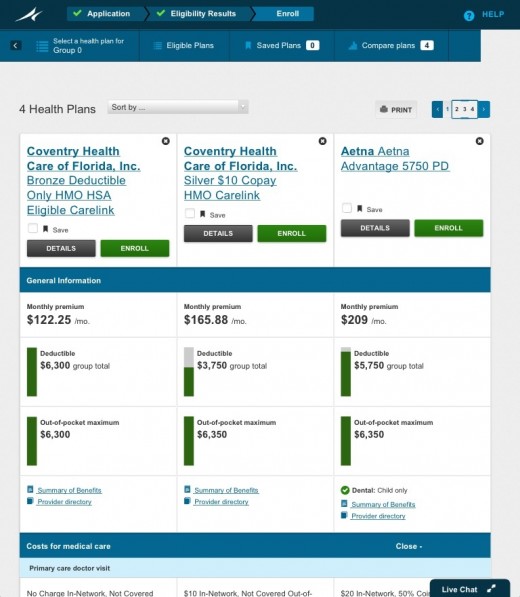

For this example, I selected four plans from multiple tiers. Unfortunately, the compare tool can only display three of your selected plans side-by-side at a time. The fourth of my plans remains hidden until I opt to make it visible (which, if you guessed, makes the first plan hidden).

TIP: the Marketplace site's comparison tool limits you to three plans visible side-by-side. Scroll down through your first three plans to become familiar with where to look for details important to you — write them down elsewhere to help keep track of what plans have what benefits.

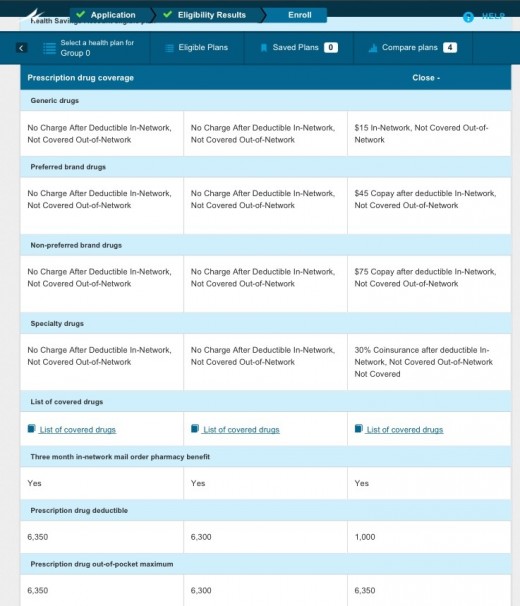

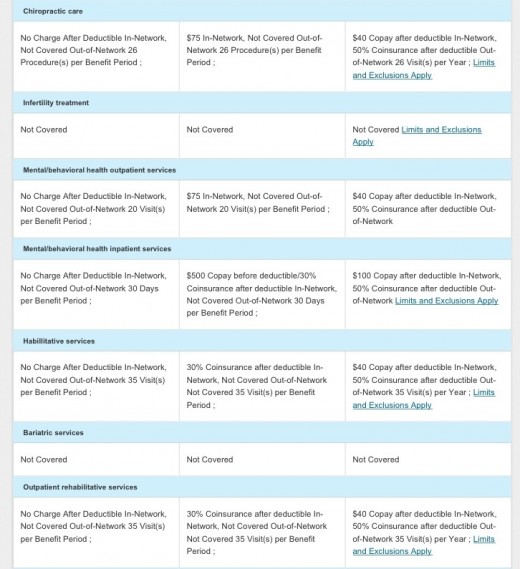

You'll notice between these first three plans (a Catastrophic, Bronze, and Silver plan), insurance coverage in-network for the first two plans is covered by your regular deductible — but with an increasing copay for generic, preferred, or specialty drugs (other plans may charge on top of the deductible). Also notice that none of these plans cover outside their networks.

This can appear confusing as the higher-tier plan charges an additional fee where the others do not — but consider that when filing a new prescription, your insurance must approve (and can deny) helping pay for certain prescriptions.

A higher-tier plan, with its additional prescription copay, may approve covering certain prescription drugs more readily — with less "red-tape" to you.

Deductibles/"Out of Pocket" Costs:

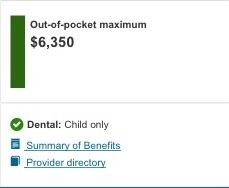

Pay attention to details in the "Deductible" and "Out-Of-Pocket" categories as well. The prescription drug annual "out-of-pocket" cost to you increases by $50 from a Bronze-tier plan, while the deductible is $1,000 compared to the over-$6,000 of the Bronze and Catastrophic plans.

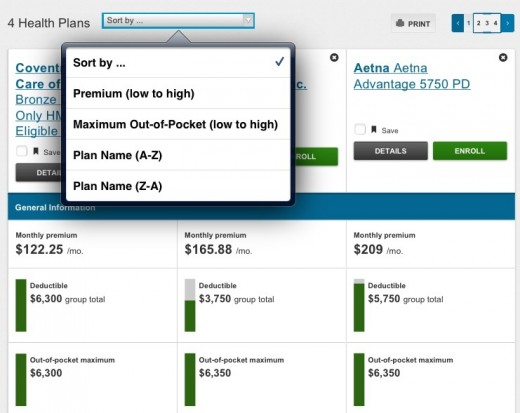

TIP: if you'd like to search for plans by how much the premium will cost you every month (or how much you should expect to pay "out-of-pocket", use the "sort by" pull-down menu located by the number of plans you are comparing (top-left).

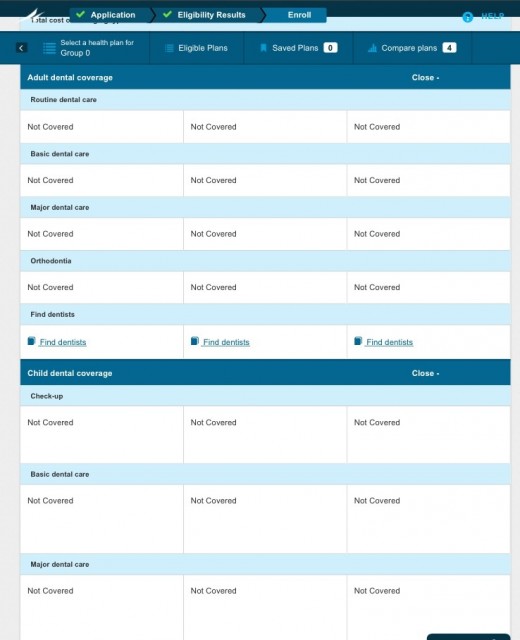

As far as dental care is concerned, none of these plans cover dental benefits for adults or minors. If you recall the "Enrollement-To-Do" list earlier in this article, a third and optional step before finishing enrolling is selecting additional dental coverage from another provider.

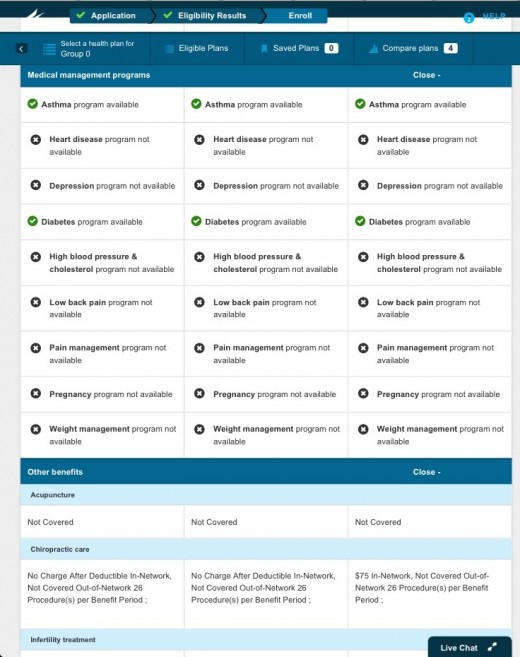

Management of chronic conditions like asthma and diabetes are covered by all these plans — even the Catastrophic.

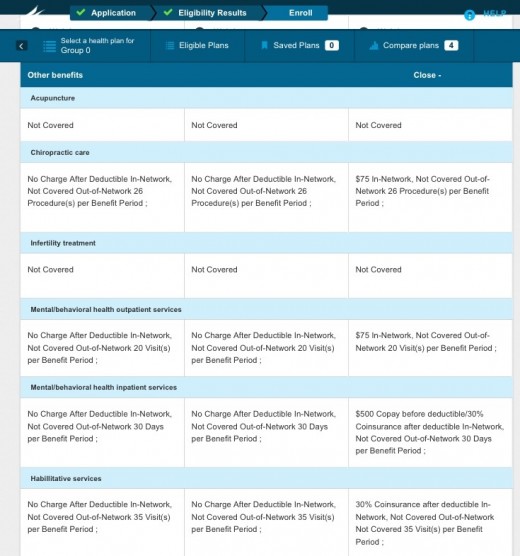

Coverage for other treatments like acupuncture or chiropractic care varies from plan-to-plan. These three only cover chiropractic care (as well as both in-and-outpatient mental health care).

Use the comparison tool to weigh the cost/benefit balance between your hypothetical plans — paying attention to your monthly premiums versus how much your expected to pay "out-of-pocket"/your deductible.

TIP: use the "summary of benefits" option at the bottom of each plan's "general information" section to see the main points of each. You should still check the plans entirely for information that may be specific to your situation.

When comparing the "costs of medical care" between possible plans — its important to notice your benefits both in and out of your network.

Here, the fourth plan's higher monthly premium can be seen working for you (paying up to a 50-percent co-insurance in the event that out-of-network care is all that's available to you).

Certain plans can charge you equal amounts for emergency room coverage, both in-and-out of your network (beneficial for those who travel often and may not always be near network care). The fourth plan also has no additional charge for in-network surgical procedures after your deductible (with a 50-percent co-insurance out-of-network).

Specialized Medical Benefits:

Unlike the first three plans, the fourth does not have an asthma program, but does cover chronic care for heart conditions (an important detail if no one in your family has asthma, but someone needs a pacemaker).

Plans with higher monthly premiums can cost more upfront, but can pass benefits back to you if purchasing for someone who you know will need regular care for key conditions.

Of all the plans, the fourth offers the best benefits for outpatient and inpatient mental health services.

If you hadn't noticed, this plan also offers dental care for covered minors — a critical cost savings if you weren't planning to purchase a dental plan for yourself, but would still like your children to have benefits.

Important details like these should be the focus of how you select your new Healthcare Marketplace plan. You must balance how much you can pay monthly with how much you'd like to pay when the time comes for needing treatment. Certain plans assist more in the treatment of certain conditions than others.

If you're a couple interested in beginning a family, a plan that helps manage a pregnancy and its delivery generously should be important to you. If you, or someone under your would-be plan has a history of heart trouble — pay special attention to a plan's "Medical Management Programs" when making your choice. Keep an eye out for included special benefits — like children's dental. A sharp eye for these details can help you to select the Healthcare Marketplace plan best suited to your medical needs.

If you'd like to learn more about the changing landscape of healthcare and how the Marketplace will affect you — the next piece in my Healthcare Marketplace series will cover Penalties and Exemptions to not having insurance by March 31, 2014.