First Time Buyers: All you need to know about the Help to Buy ISA

What is the Help to Buy ISA?

In 2014 the government announced a new Help to Buy ISA available to people who want to start saving for their first house, and want to benefit from government aid. The Help to Buy ISA helps first time buyers save up for the sometimes out-of-reach house deposit, by contributing up to £3000 towards it. This will be music to many young persons' ears, and will make owning your own home more realistic, accessible and achievable.

Elligibility for the Help to Buy ISA: Can I get one?

A Help to Buy ISA can be opened by just about anyone. If you can pass the following set of eligibility markers, you'll do just fine...

- Are you over 16 years old?

Yes? Great, carry on. - Have you ever owned or part owned any property in the UK or abroad, bought or inherited?

No? Welcome to the pre-property ladder.

So, as you can see, the Help to Buy ISA isn't very strict in term of who can and who cannot open one and start saving.

Let's do the Maths

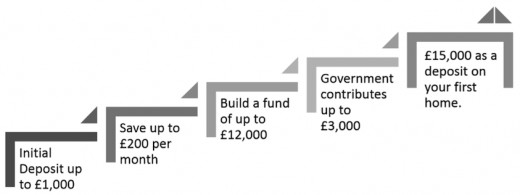

The Help to Buy ISA involved an initial lump-sum deposit, followed by smaller monthly deposits. The government then matches 25% of the total, so long as the whole amount goes towards a deposit on your first home. In summary:

- Initial deposit up to £1000

- Monthly deposit up to £200

- Maximum of £12000 in the Help to Buy ISA account

- Government contributes 25%

- Maximum £15000 towards a deposit (including government's contribution)

The scheme can also be explained in terms of this: You open your account and deposit up to £1000, plus the month's £200 (so actually, you can deposit £1200 in your first month). The government will contribute 25% of your total - that's £300 pound. Then every month after, for every £200 you deposit in to the Help to Buy ISA, the government will contribute £50. You deposit up to £12000 in to the ISA, with the government contributing a maximum of £3000.

Let's do the maths:

- £1200 lump-sum deposit in the month you open the account

- £200 deposited in to the Help to Buy ISA every month

- It will take 54 months (4 years and 6 months) in order to receive the maximum government contribution of £3000.

- This is calculated on the assumption that you have a spare £1200 to deposit within the first month of opening your Help to Buy ISA

Also note that you need a minimum of £1600 in order to receive the government's contribution. In other words, you can't simply deposit £1000 today and then receive £250 towards your deposit tomorrow. So for those of you in the enviable position of being ready to sign on the dotted line... well, sorry, but this new scheme won't really help.

How Long You'll Have to Save

AMOUNT IN ISA

| GOV CONTRIBUTION

| MONTHS

|

|---|---|---|

£1600

| £400

| 3

|

£5000

| £1250

| 17

|

£10000

| £2500

| 42

|

A table to show the amount in a Help to Buy ISA and its equivalent government contribution, plus the number of times an individual must deposit £200 a month in order to reach these amounts. (Based on £1200 deposit in the first month)

Three Key Problems with the Help to Buy ISA

- The Help to Buy ISA is inaccessible to the people who need it most. For the people who need the most aid in building up a suitable amount of money to put towards a deposit on a house, putting away £200 a month in savings is a near-impossible task.

- On the other end of the spectrum, for those more fortunate - the people who have a substantial amount of money left at the end of the month - the maximum monthly deposit serves as an annoyance.

- The Help to Buy ISA automatically favours those who have only recently started saving up their first time buyer's deposit. Without a doubt, there well be thousands of people in the UK for whom the Help to Buy ISA has arrived simply too late. If you have been saving for a deposit for a number of years, you will now miss out on up to £3000.

Which? Help to Buy ISA video

The Best Help to Buy ISA

You're probably aware of the UK's current financial climate and the currently despicably low interest rates. You'll be pleasantly surprised to hear that there is a Help to Buy ISA provider that is offering a relatively generous annual interest rate. In terms of generosity, Halifax is paving the way for other banks offering the Help to Buy ISA. You may find that the interest rate on the Halifax Help to Buy scheme is actually better than that of your current Cash ISA or building society account.

Halifax are offering an annual interest rate of 4%, which is the best I have found so far. I would advise that you open a Help to Buy ISA this year even if you don't plan on buying a house anytime soon. The 4% interest rate will grow your money quicker than many other savings accounts available on the market today. Plus, you'll have the option to put the ISA savings towards a deposit up to December 2030 - plenty of time for you to change your mind and start looking at buying your first home. And if you do put it towards a house, not only will you have that 4% interest on your ISA, but you'll have the government's contribution too.

Likewise if you're already in a position where you're looking at saving up or a deposit, or are already looking at houses, then the Help to Buy ISA is an absolute must, a complete no-brainer. the more help you can get, the better. The government's contribution is literally free money for anyone already on the path to saving for a deposit. So take advantage while you have the chance. You can only open a Help to Buy ISA before December 2019, act now!

Will you be opening a Help to Buy ISA?

For how long have you been saving?

Further Reading and Useful Links

If you're serious about saving up for your first house, then I recommend taking a read of the following, and taking a look at the Halifax Help to Buy ISA with its generous 4% interest rate. I've linked to some of the most helpful pages I've found so far. They've been very useful resources for me as I continue to save up a deposit and I hope they help you too.