10 Fantastic Ways to Decrease Your Auto Insurance Payments

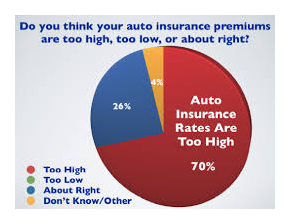

Auto insurance payments are a hassle to many individuals. If you are already paying for health insurance, life insurance and property insurance like many individuals, you may be very interested in ways to decrease your auto insurance payments.

There are several ways to decrease your auto insurance payments. Here are ten different ways to reduce your auto insurance payments.

1. Get Your Driver’s License Early

While some US States permit you to get your license at 16 years of age, other States (i.e. New York) require a driver to be at least seventeen years of age to begin driving a car alone. Getting your license early may not benefit insurance rates during your younger years. However, by the time you reach around 27 years old, you will be presumed as driving for a decade. Your “experience” in driving will positively impact (decrease) the rate of your car insurance.

Car Insurance

How much do you pay for auto insurance per year?

2. Be a Careful Driver

Even if you received your license at an early age, you must still be a careful driver. Refrain from obtaining traffic point violations on your driving record. For example, I recall driving one night in a small town for the second time after regularly driving in a big city, where traffic lights were regulated throughout the day. For some reason the small town had its red, yellow and green lights blinking in the night. It baffled me. I was only aware of yellow blinking lights. As I approached a red blinking light, I didn’t have a clue of what to do. I had reviewed my driver's manual only a long 18 years previously by then. I began to panic. I immediately tried indexing my memories of traffic light lessons from driver’s education in high school. When that failed, I simply glanced over at the white pickup truck also approaching the intersection on the opposite lane, to learn what he did. He slowed down at the light and kept driving. Got it! I, similarly, decided to slow down at the light and keep moving – to my own demise.

I soon saw beaming lights and heard jarring sounds of the police car behind me. I pulled over and immediately pulled out my registration card, insurance card and license. After inquiring of my violation, the cop informed me that I was supposed to make a full stop at the red blinking traffic light. After attesting that I was not from the local town and unfamiliar with its traffic procedures, I still drove away with my first moving violation. Of course I was upset and offended, but the law is the law.

Driver's must be certain to monitor your driving, especially in foreign places. Driving in foreign countries, such as Italy or India, can be quite difficult, as there are minimal driving regulations in those countries at all. Always get car rental insurance of the foreign country. Moving violations on your driving record can follow you across seas as well.

3. Take a Defensive Driving Course

Contact any driving school to sign up for a defensive driving course. Taking a defensive driving course will automatically reduce your auto insurance rates. Defensive driving courses allow you to practice methods of securing your car, as well as other drivers in the event of possible or actual collisions. Defensive driving courses are in-class courses for which you are tested at the end of the course on the content and practices learned. Upon successful completion of the course, you receive a certificate that can be presented to your auto insurance company for a rate deduction.

4. Drive Less

For most people, driving less may be difficult to accomplish. You may be required to drop off the kids, drive to work, pick up groceries or dry cleaning, etc. with your car. However, there are ways to complete these tasks while driving less with your car.

If your kids attend school close to home, consider walking to pick them up on warmer days. You can have quality time with your kids on the walk home from school. Smaller kids may need a stroller for the commute by foot. How about stopping at the park? If you are driving to work, consider carpooling with local coworkers in the neighborhood, tipping for gas every now and again. Shopping with friends is always fun. Have your friends pick you up for a day out shopping. Be sure there is enough room for all your new merchandise. Groceries and drying cleaning can always be delivered. These are only a few ways to drive less. Using the change in your car mileage from one year to the next will prove to your insurance company that you do not drive as much, which reduces your insurance policy rates.

5. Get Higher College Degrees

Auto insurance companies tend to conduct studies on the demographics of safe drivers. One significant correlation or relationship between the demographics of drivers and their safety in driving is their higher level of education received. There is a significant statistical correlation between drivers with higher education levels and excellent driving records (less infractions or driving violations). Therefore, auto insurance companies use these statistics as a justification to decrease the insurance rates of drivers that have higher education levels.

6. Join Societies, Associations and Club Memberships

Certain societies, associations and club memberships tend to offer benefits to their members by hosting group insurance policies. Certain college sororities and fraternities, such as Kappa Delta sorority, allocate a portion of their members’ payments for various types of member benefits. Some credit card memberships similarly provide these benefits, such as American Express, Diner’s Club or Discover. Auto insurance companies will automatically reduce your insurance rates if you were a member of any of these groups or organizations.

7. Find the Right Employer

Similar to societies, associations and club memberships, employees of many corporations and organizations receive discounts from various auto insurance companies. Individuals at companies such as Purdue University and UC Davis Health Systems, receive auto insurance discounts based on their place of employment. The length of the individual’s employment may likewise contribute to decreased car insurance rates. Soldiers and veterans also receive auto insurance discounts. Federal and States workers tend to receive reductions in their insurance as well.

8. Increase Your Credit Score

Your credit score plays a large role in the rate of auto insurance you receive. If your credit score (or FICO score) is low, then your insurance rate will be higher. Insurance companies associate (correlate) an individual’s poor credit with failure to pay insurance effectively, as well as, poor driving records. Errors on your credit score may contribute to poor credit scores and, therefore, higher car insurance rates than necessary. Take the time to review and repair your credit report with all three credit reporting bureaus: Experian, Transunion, and Equifax. Higher credit scores tend to receive the lowest possible car insurance rates.

9. Use 4-Payment or 2-Payment Plans

If the option is available to you, consider paying your premiums 4 times per year or 2 times per year. Auto insurance companies appreciate receiving as much of their payments as immediately or up-front as possible. When you pay your car insurance premiums in bulk, such as every quarter per year, many auto insurance companies tend to reduce your premiums altogether. You then end up paying much less than if you paid your premiums on a monthly payment schedule. Consider it a ‘thank you’ from the auto insurance company.

Did you know that 15 Minutes Can Save You 15% or More on Car Insurance?

10. Move to the Suburbs or the Country

Believe it or not, but residents of the suburbs and especially outlying rural regions pay much less for auto insurance than everyone else. While individuals who live in urban and suburban municipalities see a slight reduction in insurance rates, relocation to the country conveys huge discounts. For example, when someone I know relocated out of the city to the suburbs, total car insurance premium for one vehicle actually decreased by 50%. Premiums further out in the country for two cars were exceptionally lower. Auto insurance companies are aware that in more densely-populated areas, such as urban cities, there is an increased likelihood of accidents and collisions. Therefore, auto insurance rates for city dwellers are significantly higher than rates for individuals living in the suburbs or the country.

Overall, auto insurance companies do aim to reward and encourage good driving records by individuals, young or old, all over the country. Insurance rates follow the theories supporting risk-reward relationships: If the individual poses a greater risk for the auto insurance company, then the reward to the individual is less. However, if individuals pose a lesser risk for the auto insurance company's coverage of claims, then the rewards to those drivers will be much higher. Rewards are usually in the form of reduced car insurance premiums and payments.

Read more of my financial hubs at: http://missinfo.hubpages.com

A Car Rental Coupon for You. Enjoy!

Additional Ways to Reduce Your Car Insurance Payments

- 12 Car Insurance Cost-Cutters

If car costs are dragging you down, find out how to free yourself from some of the extra weight. - 5 Easy Ways to Help Lower Your Auto Insurance Premiums—Allstate

Saving money is important to a lot of us—and there may be more ways to save than you might think. A good place to start is by taking steps to lower the amount you pay for auto insurance. - Top 10 Ways To Lower Your Car Insurance Bill -- Edmunds.com

Car insurance can cost an arm and a leg, but there are ways to make it less burdensome. Here are 10 things you should know.

This article is accurate and true to the best of the author’s knowledge. Content is for informational or entertainment purposes only and does not substitute for personal counsel or professional advice in business, financial, legal, or technical matters.

© 2014 S T Guy

![ESSENTIAL Car Auto Insurance Registration BLACK Document Wallet Holders 2 Pack - [BUNDLE, 2pcs] - Automobile, Motorcycle, Truck, Trailer Vinyl ID Holder & Visor Storage - Strong Closure On Each -](https://m.media-amazon.com/images/I/41k-QvzFVuL._SL160_.jpg)