Student Loans and Your Personal Credit

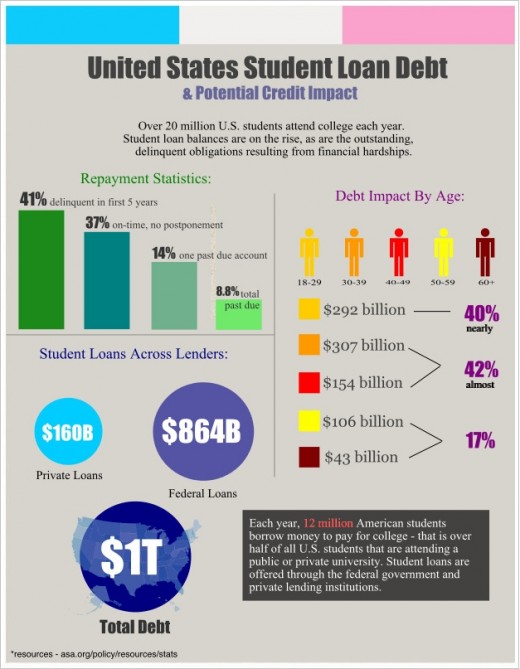

The unbiased availability of financial aid and student loans for college students in the United States is arguably one of the greatest resources in the nation. The cost of a college education in U.S. has steadily risen over the last decade however, and so has the amount of debt American students are in. Student loans are reported to the three national credit bureaus – Equifax, Experian, and TransUnion. It is important to remember that these loans are outstanding debt and a person’s payment history may affect their credit score. Understanding how student loan debt can affect credit may help protect your personal credit and lead to a more secure financial future.

Student loans are issued by the federal government and by private lending institutions – these can be banks, credit unions, or other private finance companies. In most cases, a person will need to follow the process described by their college financial aid department for federal student loans. Applications for student loans, including some federal public loans and private loans, may require a credit inquiry. This hub will explore the credit reporting and credit scoring implications for federal student loans and private student loans.

Federal Direct Loans

Student loans are offered by the United States government through the Department of Education. Direct subsidized and unsubsidized loans allow students to defer repayment until they have graduated college, after which they typically receive a 6-month grace period to begin making monthly payments. Each student is assigned a loan service provider that manages their account balance, transaction history, and deferral dates. It is important to contact your loan service provider when graduating because missed payments on federal student loans may result in additional fees or default. These missed payments may have a negative impact on your credit score, and they will be reported on credit reports with the three credit bureaus. Missing payments may also restrict an individual’s eligibility for income-adjusted repayment plans.

Do you have outstanding student loans?

Financial Aid Resources

- Home | Federal Student Aid

Get ready for college or career school, learn about federal student aid and how to apply using the FAFSA, and get information on repaying student loans. - Federal Direct Loans

This website provides information for college students, parents, and financial aid professionals about the U.S. Department of Education's Direct Loan Program.

Private Student Loans

As the cost of public colleges and private universities continues to rise, private lending institutions have introduced education loans to students to cover the increased tuition costs and living expenses. Often, these loans require cosigners so there will be two credit inquiries – one for the student, and one for the co-signer, usually the parent. Credit scores are more important when applying for private student loans – individuals with little or no credit history, or those with bad credit, may not be eligible for them. The interest rates may not be as competitive, and repayment options will be less flexible than with federal student loans. This is important to remember when budgeting to repay the loans. Missed payments on private student loans will impact your credit report and score, and are not usually eligible to claim in bankruptcy proceedings. The resulting damage to credit history may exclude someone from savings on interest rates in the future.

Repaying Student Loans

With federal student loans, there are a few options available for repaying the debt. The best option for you depends on the dollar amount of outstanding loans, how much income you have, and how long you plan to pay on the loans:

- Standard Repayment – this offers a fixed monthly payment over a specific amount of time, up to 10 years.

- Extended Repayment – depending on eligibility, this repayment option allows more time and lower monthly payments, but higher interest costs.

- Graduated Repayment – this option starts with a smaller monthly payment and increases every two years until paid in full.

- Income Contingent Repayment – with this plan the monthly payment is determined annually based on income and allows up to 25 years to be paid in full.

- Income-based Repayment – this plan adjusts the monthly payment during any period you experience a financial hardship.

Private student loans may have a few of these options, but keep in mind that the requirements for their repayment plans are often less forgiving than the federal student loans. If you have both federal direct loans and private student loans, it is important to communicate with each loan service providers to work out the best repayment plan for your financial situation. This can help avoid credit problems that could potentially harm your chances for lower interest rates, better insurance premiums, or even small business financing.

Student Loan and Credit Resources

- Credit Reports and Credit Scores: How to Improve Credit Applications

Whether putting in credit applications online or in person, these are tips for providing personal information and improving the chances of being approved for credit. - Credit Reports and Credit Scores: Tips for Establishing New Credit

Students just graduating high school or new residents in the U.S. typically start with a blank credit report. Use these tips to establish credit if you have limited or no credit history. - Credit Reports and Credit Scores: Updating Identifying Personal Information

Updating your personal information with the major U.S. credit reports is an important task that may improve your chances of being approved for credit or qualifying for lower interest rates and premiums. - Federal Direct Loans: Subsidized and Unsubsidized Student Loans

Student loans offered by the U.S. government may be subsidized or unsubsidized. This affects when interest begins accumulating, and when repayment is expected. Learn the differences between the types of loans to encourage smarter repayment decisions. - Laptop Payment Plans for College Students

A quality laptop is essential for a college education. UpgradeUSA offers affordable and flexible payment plans that help students build credit.