How Taxation Works

Almost all goods and services are taxable in this world. Since time in memoriam, like in Biblical times, taxation plays a vital role to have order in local businesses and progress among tribes or nations.

The most basic among taxes is the community tax being paid in order to have the personal identification certificate. It is being renewed yearly here in the Philippines. This way, passive earners will be able to contribute to the economy of the country.

Subject on Taxation in college is required by the government in order for the students to learn something about taxes and how it should be collected among people, companies, businesses and services. Factors like exports and imports are also discussed. Most of the students thought that the subject was boring. I never knew that I could be one of those hubbers who will discuss it here on HubPages.

What I've learned in school

There are two basic kinds of taxes in every country. These are: excise taxes and property taxes.

- Excise taxes - is directly imposed by the legislative body of a government on merchandise, products, or certain types of transactions, including carrying on a profession or business, obtaining a license, or transferring property. It is an absolute charge, regardless of taxpayer's status. Kinds of excise taxes are estate taxes (inheritance tax, gift tax) and sales taxes (like luxury taxes). Corporate tax is measured based from the paying capacity of a corporation. Other forms of excise taxes cover the production or processing or meat, milk, tobacco and sugar.

- Property taxes - are based from the paxpayer's income and the properties he or she own. Income tax is imposed upon assessing taxpayer's income or assets and liabilities. Property taxes are collected mainly from real properties.

Meanwhile, there taxes that are called direct or indirect. Real property taxes belong to direct taxes while value-added taxes for services and commodities belong to indirect taxes.

Kinds of Taxes

Taxation around the World

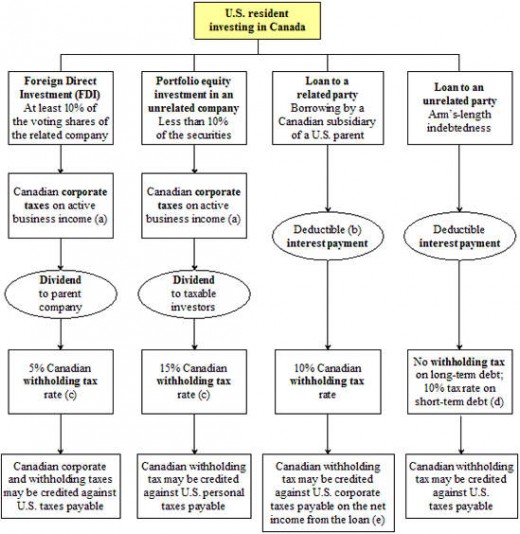

The current maximum U.S. (United States) corporate tax rate is 35% The U.S. federal government collects taxes on multi-national firms based on their worldwide income, the same rate on domestic firms.

The only difference is that multi-national firms can claim tax credit for taxes paid on foreign governments on income earned abroad, but only on their U.S. tax liability on the income. Like for instance in the Philippines, these foreign firms will take advantage of the cross-crediting, using excess credits from high-tax countries to offset U.S tax due on income earned from low-tax countries.

U.S. multinationals generally pay tax on the income of their foreign branches or subsidiaries as they repatriate the income, meaning, a delay of taxation called deferral. Deferral, the credit limitation and cross-crediting all provide strong incentives to shift income from the U.S.A. to other high-tax countries to low-tax countries.

Other high-tax countries, using the worldwide system on foreign tax credit, are Japan and United Kingdom.

France and Netherlands use a territorial system that exempts foreign income from taxation.

Hybrid tax systems exempt foreign income when the foreign country's tax system is similar to that in the home country.

Back to U.S., its statutory corporate tax rate just changed a little since the 80s. Good thing is that most avanced industrial countries have lowered their tax rates but the U.S. rate is now higher than other member countries of Organization for Economic Cooperation and Development (OECD). The American Jobs Creation Act of 2004 replaced existing tax subsidies for exporting with new corporate tax benefits.

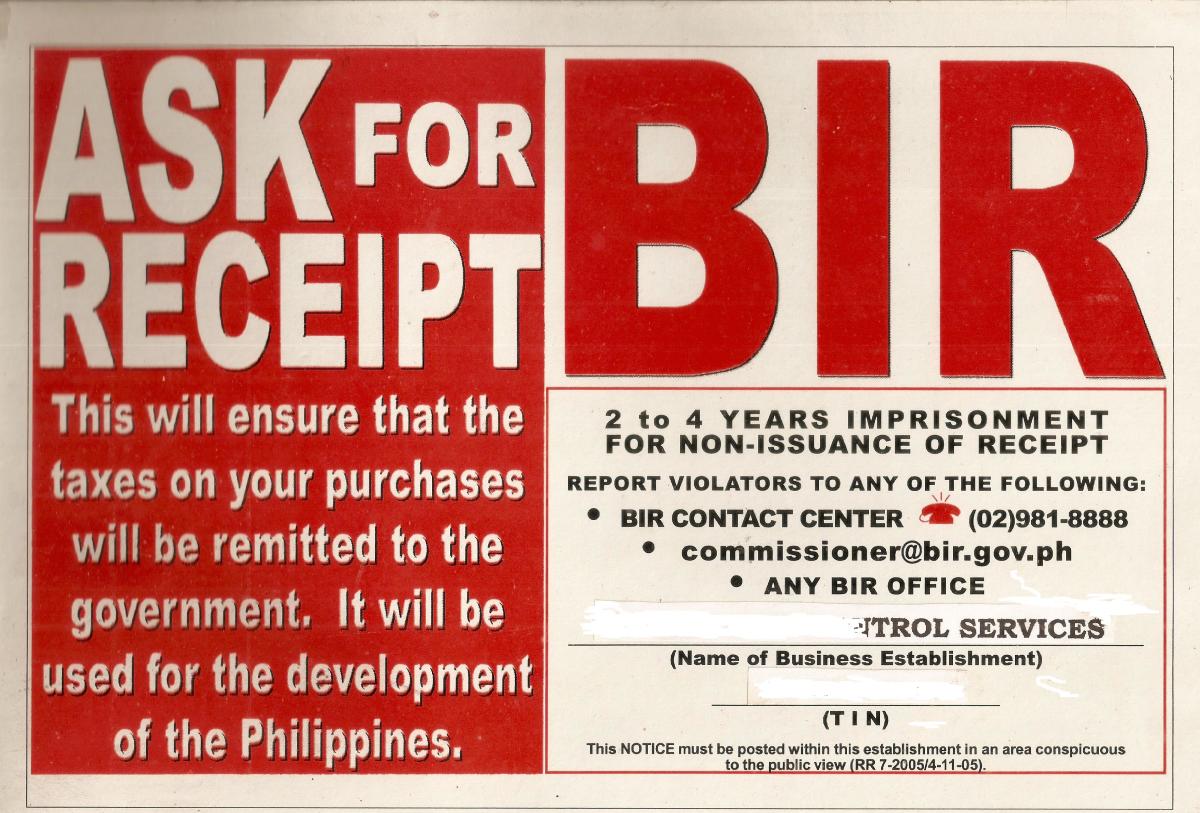

Taxation in the Philippines

The Comprehensive Tax Reform Program (CTRP) in the country boosts the tax collection in the country, including the foreign direct investment (FDI) inflows,

In the early 90s, Administrative Order 112 created the Presidential Task Force on Tax and Tariff Reforms. Chaired by the Finance Minister, it crafted a package of recommendations which formed the CTRP that intended to widen the tax base, simplify the tax structure in order to minimize tax evation, and make the tax system more easier to administer.

As a developing country, the present administration gives much emphasis on foreign direct investment to strengthen the economy and give jobs to more Filipinos. More jobs, means more taxes to collect from business establishments.

This link on current Philippine Taxation will give you an overview on how the country fare at the international market.

The U.S. Tax Gap c/o bchristiantax1

Tax & Taxes

- Tax and Taxes - Personal Finance - HubPages.com

Taxes are an aspect of personal finance that benefit significantly from strategic planning. By getting advice from a tax attorney, financial planner or other finance professional, individuals and businesses can minimize tax liabilities and maximize t

Closing the Tax Gap: IBM's New Business Analytics Offering for Smarter Tax Collections c/o IBMIBV