Kuwaiti and Malaysian Islamic Bank Comparative Appraisal

Kuwait Finance House and Bank Islam Malaysia Comparison

The differences between the Middle East and Malaysian Islamic banks

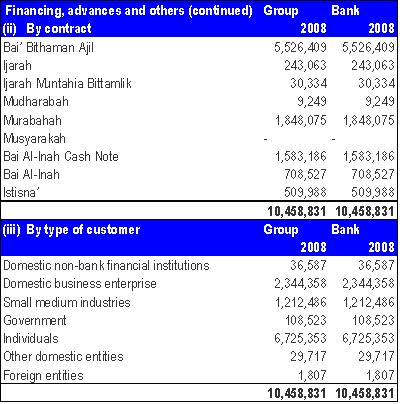

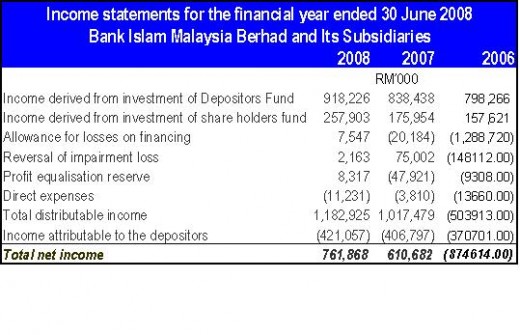

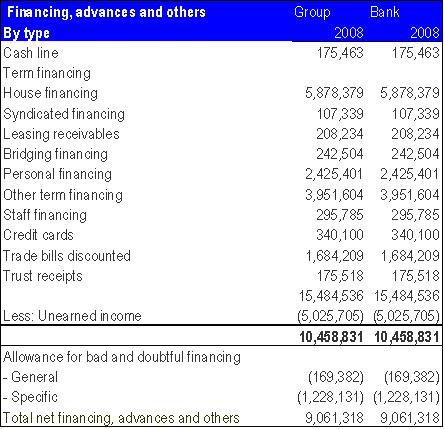

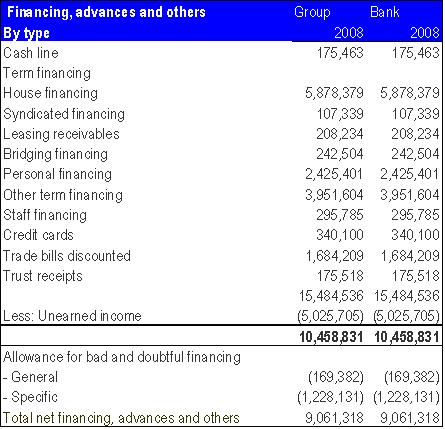

If we look at financing pattern of the two Banks there is marked difference between them. The model for Kuwaiti is bank is Investment Banking Model where they finance institutions but model for the Malaysian bank is retail banking model where they finance retail investor. The major differences are as below.

• Kuwait Finance House- Kuwait major financing is Murabah but for Bank Islam Malaysia Bai Bithman Ajil.

• There is no financing BBA in KFH because it is not considered shariah compliant in Kuwait.

• Housing Finance is major activity along with term financing and personal financing for Bank Islam Malaysia. KFH Kuwait does not have this Kind of Portfolio.

• KFH Kuwait is less transparent and less diversified in Financing and balance sheet is very opaque.

• Ijara is second mode of Financing for KFH but it is very small for Bank Islam Malaysia.

• KFH Kuwait is much more stringent in following Shariah Norms.

• Bank Islam Malaysia is more people oriented retail financing and small business financing but for KFH Kuwait this is non existent business.

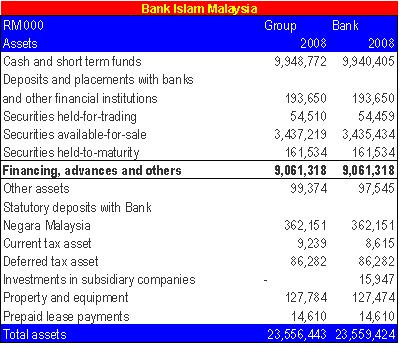

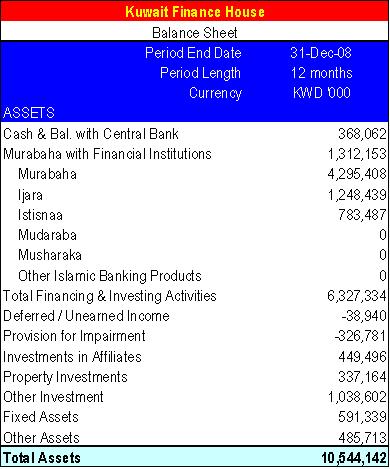

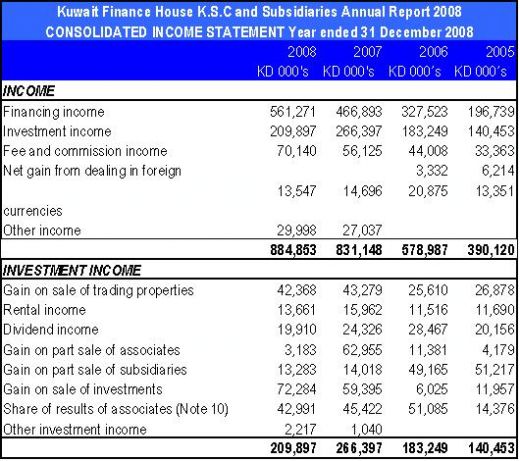

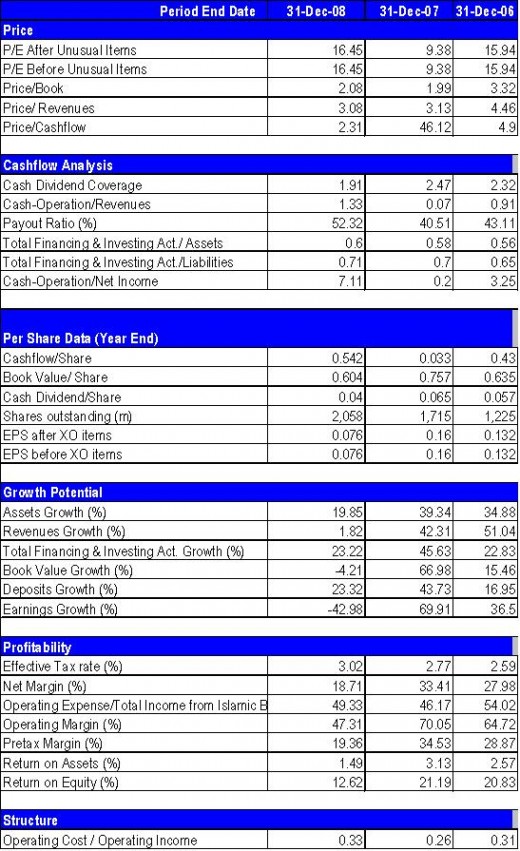

The salient features of the balance sheet of KFH are

Islamic Connection

- Islamic Insurance Takaful Introduction and Present Market

MAQASID E SHARIAH The Objectives of Shari'ah Many jurists have tried to explain the aims and objectives of Shari'ah upon which it is established. Among these the outstanding figures are the... - Islamic Project Finance Strcucture

Assumptions 1. FDI Foreign Direct Investment 100% FDI is allowed as priority sector Infrastructure Investment. 2. Tax As priority... - Islamic Fund Structure - Unit Trust and Mutual Fund Structure

Islamic Fund Structures Shariah Compliant Equity Funds Shariah Perspective Unit Trusts are based on the concept that risks and rewards are shared by the investors, employing the expertise of... - Islamic Finance and Shariah Compliance Challenge

1. Shariah Compliance Shariah compliance of financial products is essential to ensure credibility of the products and institutions. It is, at the end of the day, what differentiates conventional from... - Do's and Don't Islamic Finance

Islamic Economic System Islamic economics is based on the Shariah i.e., the Islamic law, which governs secular as well as religious activities. The basic objectives are to ensure general human... - K U W A I T - F I N A N C E - H O U S E

- http://www.bankislam.com.my/

Islam on Amazon

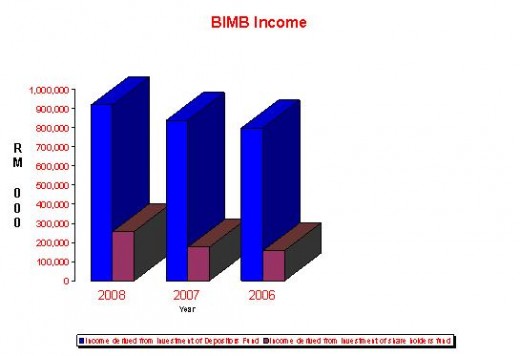

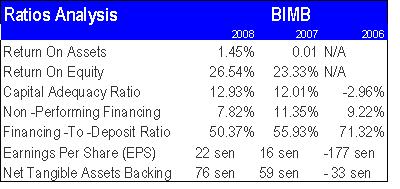

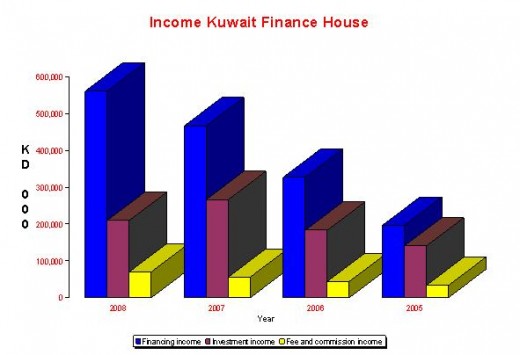

Graphic Comparison