Top 2 Profits You Make With Investment Real Estate in the Short Term!

Real estate investment is really a long-term process that requires a commitment over the long haul, and certainly is not as liquid as stocks, bonds, or mutual funds.

Nonetheless, even despite the fact that windfall profits should not be expected to occur overnight with any investment real estate, we can’t ignore the earnings you can look forward to in the short term as well as the potential of earning great returns over the entire course of a lifetime.

In this article, we are going to discuss two ways that real estate investors routinely profit in the short term from investment real estate.

Cash Flow

Simply stated, cash flow is the monthly or annual cash return you receive from your investment.

This is what most investors seek after most so they are drawn to real estate investing because there is always the opportunity to create monthly and annual cash flow with real estate investment property.

For instance, since cash flow is a direct function of how much money you put down to purchase the property, if you purchased the property without the aid of a loan your cash flow would be substantial because a loan payment wouldn’t be taking a bite out of your net operating income. Conversely, a minimal down payment with the aid of a loan to cover the balance means you would be making a loan payment that would reduce your cash flow accordingly.

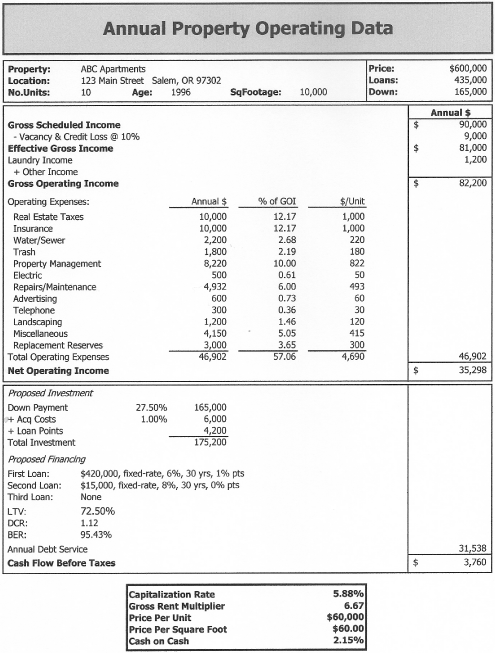

Other factors that impact cash flow are vacancy rates and operating expenses. Here’s how it all works:

Gross rental income

less Vacancy allowance

= Effective gross income

plus other income

= Gross operating income

less Operating expenses

= Net operating income

less Debt service

= Cash flow

You can see from the schema above that net operating income (which pays the mortgage payment) can vary up or down depending on vacancy allowance and operating expenses. Therefore, both vacancy allowance and operating expenses must be considered seriously along with the debt service when computing the cash flow a real estate investment generates.

Okay, but real estate investors are not going to get excited about cash flow per se until they relate it to the amount of money invested. What they look for is the cash-on-cash return.

Here’s the formula.

Cash flow / Cash investment = Cash-on-cash return

Tax Benefits

The other short-term benefit with a real estate investment concerns the investor's income taxes.

Amongst other deductions, the IRS permits owners of rental income property to make a deduction from their annual earnings for depreciation (also called cost recovery). Here’s the idea. The IRS theoretically assumes that structures (called “improvements”) of investment real estate wear out over time and therefore permits an annual tax deduction for that loss based on the property’s “useful life” as specified in the tax code.

This is a sweet deal for real estate investors because deductions for depreciation are really a paper loss (i.e., not an out-of-pocket expense). Nonetheless, it reduces the earnings you will have to pay taxes on; so you can produce a positive cash flow and still have a loss as far as the IRS is concerned.

Here’s a simplified schema of how the concept works.

Income

less Operating expenses

= Net operating income

less Mortgage interest

less Depreciation

= Taxable income

You can see the benefit. Rather than having to pay taxes on the proceeds that actually might be collected, real estate investors are taxed on the income that remains after allowable deductions. So tax benefits are truly a short-term benefit that cannot be ignored with a real estate investment.

About the Author

James Kobzeff is a real estate professional and the owner/developer of ProAPOD - leading real estate investment software solutions since 2000. Create cash flow, rates of return, and profitability analysis on rental property at your fingertips in minutes!

ProAPOD also provides an online real estate calculator that enables you to learn dozens of real estate definitions and formulas as you calculate. You save 64%. Learn more at real estate calculator

Other Articles

- Internal Rate of Return (IRR): Measure Rental Property Financial Performance!

Learn the definition and uses for internal rate of return (IRR) and how you can apply it to measure a rental property's financial performance. Includes instructions on how you can make the calculation in Excel. - How to Examine Expense Ratios to Uncover Possible Pr...

Learn ways that a close examination of operating expense ratios can alert you to possible problems existing with the rental property you are considering to purchase. - Which is Better, Cap Rate or GRM? The Battle to Esti...

A look at cap rate and gross rent multiplier along with a determination as to which is best to use to estimate rental property value and to measure the rental property's financial performance. - The Present Value of a Future Cash Flow - Why Unders...

Learn the difference between present value and future value and why these time value of money concepts are crucial to your cash flow analysis of investment real estate.