Low Rate Car Insurance Tips

Searching for Low Rate Car Insurance

If you think searching and purchasing low rate car insurance is easy, well, you are right! That is if you know how and where to search. Let's start with the"how" first. During the pre-internet era, looking for a low rate car insurance is a tedious process which goes like this. First, you have to find a car insurance company. It's up to you if you want to call them up or go to their office personally to inquire and get quotes. The second thing you have to do is compare the quotes and choose the ideal low rate car insurance policy for you. And the third and last step to this long process is finding an insurance agent. Your agent would be the one to handle your queries about your low rate car insurance policies and the many required paperwork. When the internet was invented, this tiresome procedure opened up new ideas to make it easier for car owners to find low rate car insurance online.

What Makes Low Rate Car Insurance Low?

But first, before we discuss the "where" part, you have to know first what makes a low rate car insurance low. The premiums of a car insurance, like other types of insurance, depends on lots of factors which car insurance companies consider when calculating the rates. Besides, having a low rate car insurance is not all there is because you also want a policy with the right coverage which can financially save you in times of need.

Low Rate Car Insurance:

3 Aspects to Calculate Low Rate Car Insurance

There are three aspects about you which car insurance companies base their calculations on your premiums. It is vital to answer questions regarding these factors accurately to make sure the quotes you will compare are accurate as well. This not only makes finding a low rate car insurance easy, it also helps you to figure out which car insurance policy has the perfect coverage for you.

1. Personal Information to Get Low Rate Car Insurance

Personal things about yourself such as your age, since drivers under 25 are seen as high-risk drivers therefore they have higher premiums; marital status, since married men are more likely to easily purchase a low rate car insurance; your address because the more pleasant your neighborhood is and the less likely your car will get stolen or vandalized, the higher chance you will get a low rate car insurance; traffic citations, if you're applying for SR22 car insurance; These are some of the much needed information about yourself to accurately calculate your premiums.

2. Car Information to Get Low Rate Car Insurance

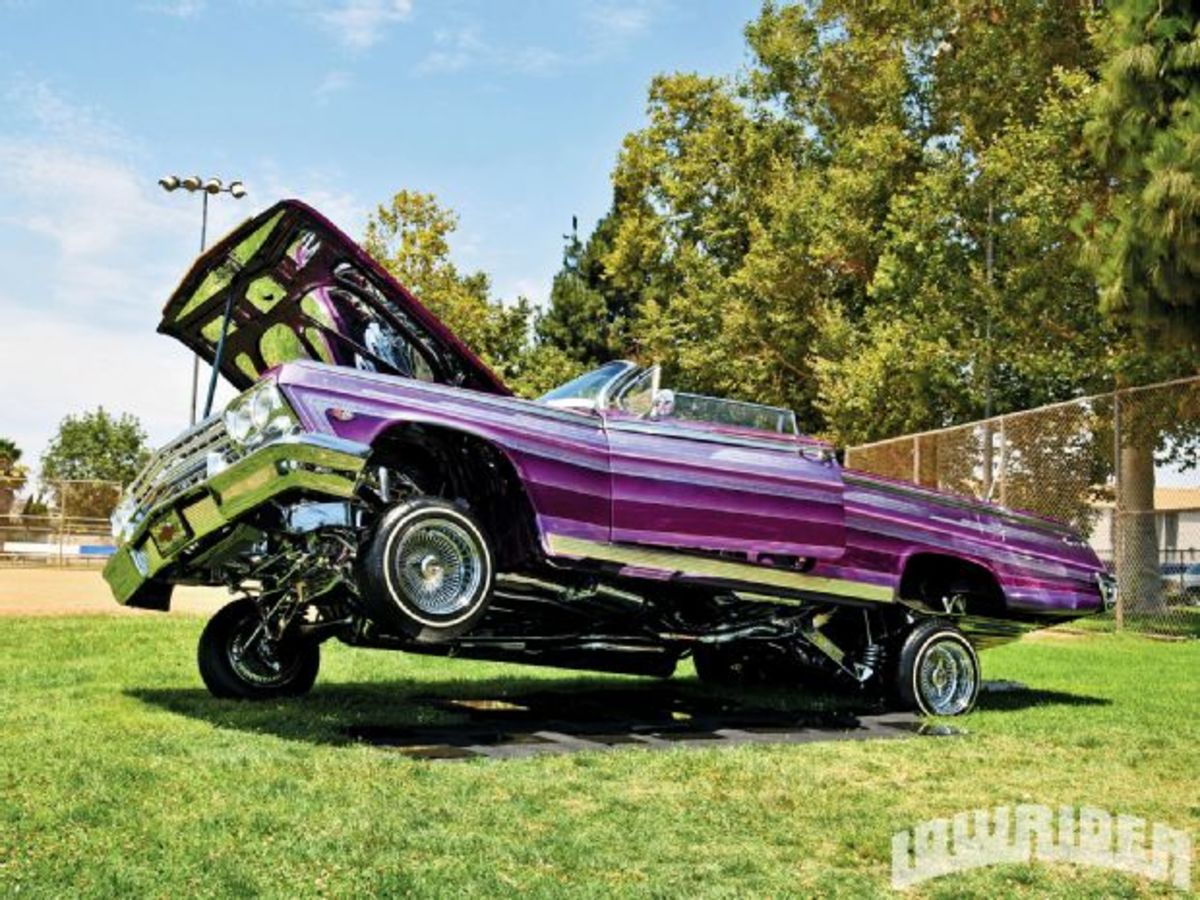

Information about your car is also needed to make sure you are eligible for a low rate car insurance. Installing safety devices in your car, driving a low profile car instead of a flashy one and a minimal car travel mileage can get you low rate car insurance premiums.

3. Financial Information to Get Low Rate Car Insurance

And last is information regarding your financial income. If you think your income will decide the kind of insurance you will get, you are wrong. Having to pay for an expensive car insurance policy you don't need is what you don't want to happen. It is still best to choose a low rate car insurance policy which features the appropriate coverage you need.

Compare Quotes to Get Low Rate Car Insurance

Now that you know how you can avail low rate car insurance, it's time to find out where you can effortlessly compare car insurance quotes. There are lots of websites on the internet which offers services for searching and comparing car insurance quotes and SR22 car insurance quotes. These types of websites choose only the most reputable and credible insurance companies to get car insurance quotes. So start searching for that low rate car insurance policy because it's free, secure, fast and easier than ever!

Are you from California? You also might want to check the "Ten Things You Have To Do To Get Cheap California Auto Insurance"