MONEY-A Quick Thought On Obama's Call for a Raise in the Minimum Wage [192*8]

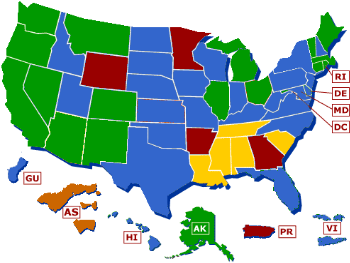

MINIMUM WAGE ACROSS THE NATION

AN INCREASE IN THE MINIMUM WAGE ISN'T THE BEST WAY TO GO

THIS IS JUST A QUIKIE HUB regarding President Obama's call for 1) increasing the minimum wage to $9/hr and 2) tying it to the cost of living. No, Democrats, I haven't forsaken you, I am still an "active-state" liberal, my new, more correct name for progressive (it differentiates philosophically from socialist); nevertheless I do not think the minimum wage is the best way to go, if fact I think it should be abolished because it has the same drawbacks of say, rent control; the effect is to distort normal economic activity.

While the minimum wage does not have the devastating depressing effect on hiring the other side ("limited or minimal-state" liberal and conservatives, two entirely different species) wants you to believe, it does have some, if only in perception, limiting impact. I strongly believe it is a necessary function of a government formed under the concept of Lockean Liberalism of individual rights where those same individuals contract with government to give up some of those rights in order for the government to be able to prevent harm to its citizens from systemic issues beyond their control or from each other. The negative side-effect of grossly unequal distribution of income from unregulated capitalism is one of them. So, the question is, if a minimum wage is not the best idea because it does have anti-growth aspects, what is the better way to do it?

Based on the convincing logic of an economics lecture I recently listened to, the answer is ... "something we are already doing"! And, that is expanding the earned income tax credit. Where the minimum wage has the drawbacks of any artificial floor or ceiling placed on economic activity, the earned income tax credit does not; yet it accomplishes the same goal of providing a livable wage for those who work. It may have other advantages as well such as increasing economic growth as business will at least feel they have more opportunity to expand now that they can pay lower wages.

BUT WON'T BUSINESS STOP PAYING WORKERS?

THOSE ON THE LEFT MAY ARGUE, however, that without a minimum wage, businesses will revert to the conditions that existed in the "Gilded Age" in the 1800s and pay subsistence wages while pocketing the difference for themselves. They will probably be right, some businesses will try to do just that. But, let's consider some things.

First, take the absurd case that all business stop paying anybody anything since the "gov't will take care of it" with the EITC. Well that can't work because to get an EITC, one must earn a wage and wages aren't being paid. OK, then let's suppose the next absurd case, employers pay all of their employees one dollar a day in wages and letting EITC pick up the rest. Now, theory would have it that the employers could live high-on-the-hog and the rest of the nation can survive on subsistence assistance. The problem with this scenario is look who is paying the taxes that fund the EITC ... the employers, of course. They are the only ones earning enough money to be taxed. Further, they also have to shoulder the entire burden for the cost of rest government. Not likely!

So, what is likely? What is likely is that employers will pay wages consistent with the skill level of the job, the scarcity of employees, and any demands unions might bargain for. Does that mean wages will go down for many low end jobs? It probably does, but it also suggests economic growth as more employers enter the market because labor became cheaper. This, in turn, will drive up demand for labor which has the potential for driving up wages as employers compete for employees.

The EITC offers a significant advantage to help this process along. In the Gilded Age, employees were locked into their jobs at slave wages because they literally had no alternatives; it was accept the wage or die, for there was no government support system; a limited-state government enthusiast heaven. Companies went so far as to set up company stores and company towns, paying their employees in company script that could only be used in the company stores ... that was life in America in the early 1800s.

America in the 21st century would be very much different, IF employees have options. With EITC, employees aren't tied to the employer any longer, they can be mobile. They won't necessarily starve to death if they leave intolerable conditions to seek better ones elsewhere. They could find a lower paying job for a while and still be insured of their family surviving while they try to move up the latter somewhere else. This, in and of itself limits how despicable companies can choose to become, simply out of self-interest.

And where is the incentive for someone receiving EITC to "move up the ladder"? In the program itself. Unlike many assistance programs, EITC has a sliding scale that rewards you for doing better, it does not punish you, thereby locking you into the assistance roller-coaster. With EITC, for each additional dollar you earn, you only lose a portion, say fifty cents, of your assistance; consequently, your net position is better than it otherwise would be, you are incentivized to improve.

The EITC is society helping itself. Yes, it is a tax on everybody who pays taxes, but everybody benefits because it does two things, 1) encourages growth by letting the economy work the way it is supposed to work without artificial ceilings and floors getting in the way and 2) keeps people employed and productive rather than on the welfare and a drag, either willingly or unwillingly on society. This is the way I think we should go.

UPDATES

8/9/13: THE BATTLE OVER MINIMUM WAGE seems to be heating up again with an ad war between President Obama and the billionaire Koch brothers. President Obama is using his bully pulpit to push for a higher minimum wage (he should be pushing for a lower minimum wage and higher EITC, IMO) while the Koch brothers are spending millions on ad campaigns keep the minimum wage where it is, or lower it. SOLUTION: Write your Representatives and tell him to Increase the EITC and Lower the Minimum Wage!

HERE ARE A FEW QUESTIONS TO MULL OVER

DO YOU THINK THERE SHOULD BE A MINIMUM WAGE?

DO YOU THINK THERE SHOULD BE AN EARNED INCOME TAX CREDIT?

DO YOU THINK THE EARNED INCOME TAX CREDIT SHOULD REPLACE THE MINIMUM WAGE?

DEMOGRAPHIC QUESTION

DO YOU CONSIDER YOURSELF MOST CLOSELY ALIGNED WITH

- Is the Earned Income Credit (EIC) Fair?

With the federal government in America practically hemorrhaging money, many people are looking towards closing tax breaks and loopholes to save the country money. The EIC is one of them. - Education - Solution 2 - Revamp How Education is Fun...

In my view, Education has become a National Defense Priority! It should be treated as such at both the State and National level. This Hub is about Educational Funding and is the second in a series on my thoughts about the problems with our educationa - The American Dream: The "Occupy Wall Street" Movemen...

The Conservatives have one idea on how the economy ought to work and the Liberals have another. This hub explores the difference and looks at the historical data back to 1945, to see what really happened. - The American Dream: Conservative View I: Tax Policy ...

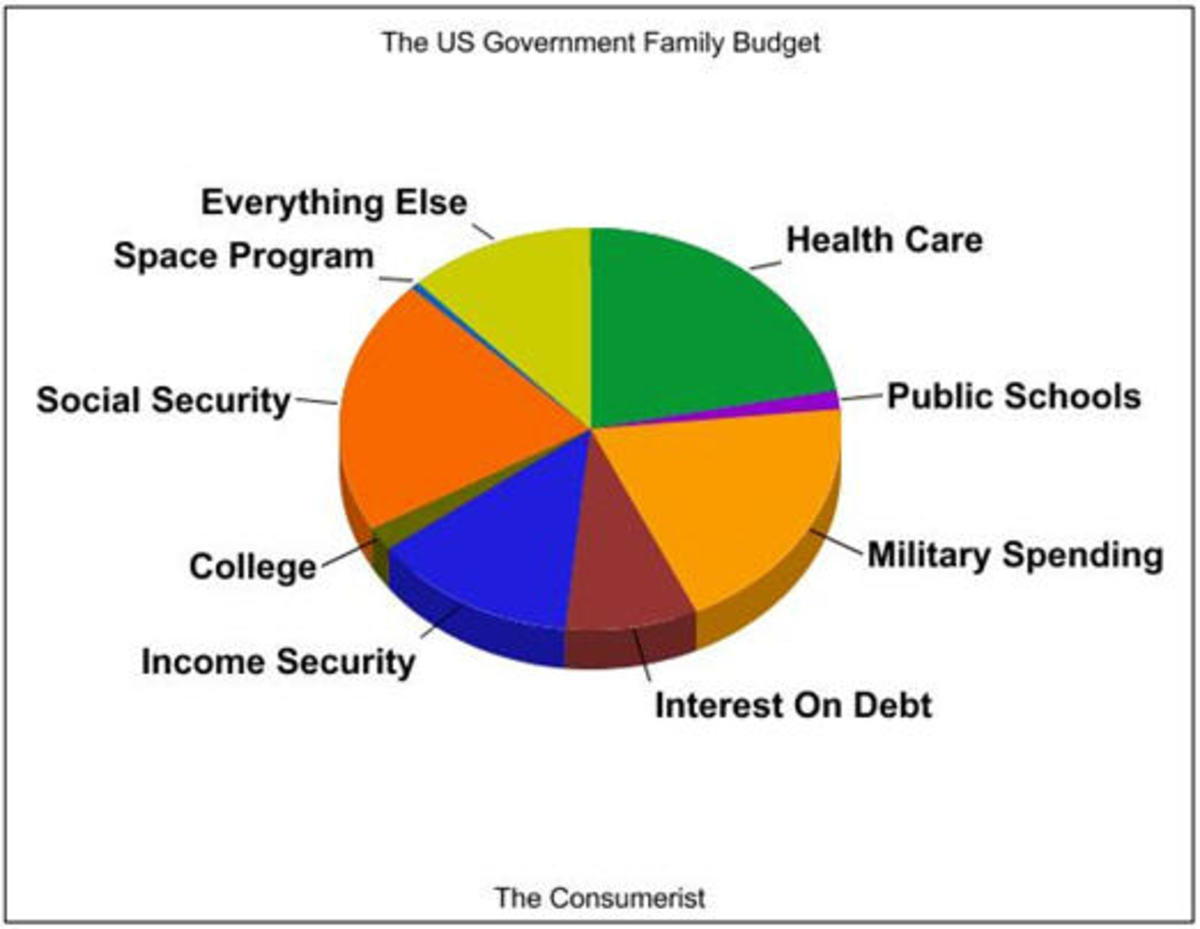

The GINI Index is a good measure of economic inequality in society. It is used with other measures to determine if the Conservative version of the American Dream worked after over 100 years of trying. - What Percentage of Your Tax Dollar Really Goes to He...

When I say - Sorry Conservatives, Why Fannie Mae and Freddie Mac ...

While Fannie Mae and Freddie Mac are not blameless in contributing to the 2008 financial crisis and ultimate Great Conservative Recession, they are not even close to being one of the causes of it, as the Conservatives would have you believe, not even - A Short History of American Panics, Recessions, Depr...

This is Part II of my A Short History of American Panics, Recessions, Depressions: Why Conservative Economics Can't Work hub. Part I finally got too long. - Tax Cuts Spur GDP Growth? Oh Really! Let's Just Take...

The Conservatives say tax cuts ALWAYS spur growth but the REAL answer is IT DEPENDS on the situation. This hub looks at when tax cuts work and when they don't.