Put Americans first, not American Businesses

Financial and investment services have a long and storied tradition of...taking advantage of grandma and robbing her blind.

When you hire an investment adviser, their advice may or may not be in your best interests. If your adviser is a fiduciary, their advice and actions are required to be solely in your best interests and all conflicts of interest must be disclosed.

More likely though, your adviser is a broker-dealer or registered representative and their advice and actions are not held to this same standard. Their advice only has to be suitable. Believe it or not, this lower standard could result in your broker prioritizing their commissions ahead of recommending the best investment option. Forbes has a great explanation in the difference in standards, linked below.

http://www.forbes.com/sites/peterlazaroff/2016/04/06/the-difference-between-fiduciary-and-suitability-standards/#54f7223435bf

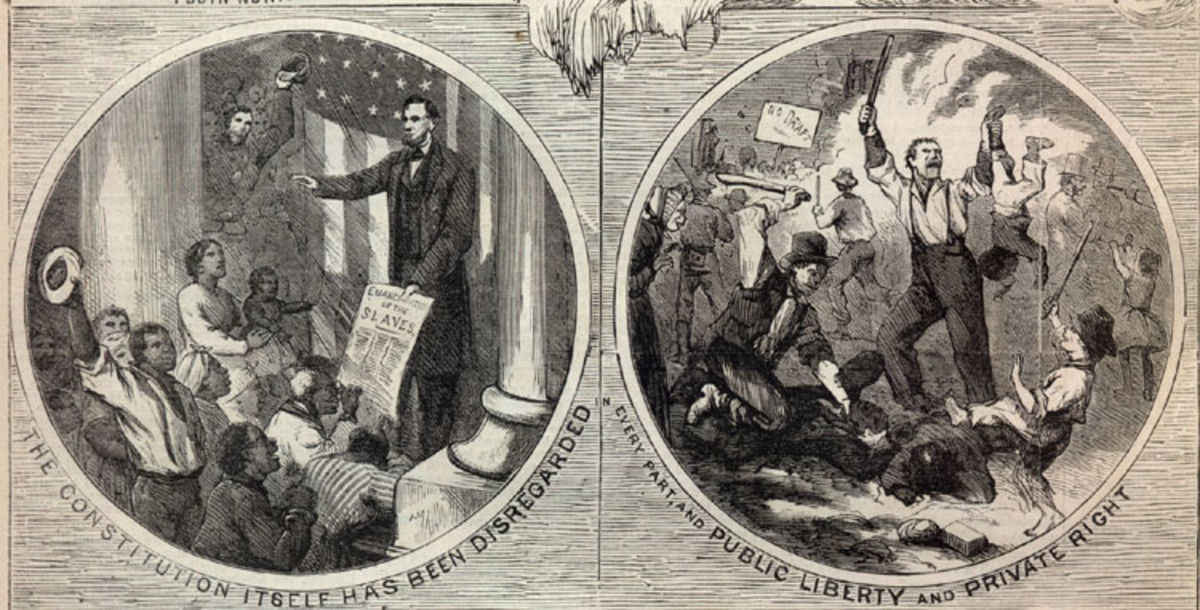

After years of wrangling, retirement investors finally scored a small victory in April 2016. The Department of Labor finalized a rule that requires all advisers who receive compensation for providing investment advice to do so adhering to the fiduciary standard.

House representative Jeb Hensarling (R-Texas) is currently working on the 'Financial Choice Act' reversing the fiduciary standard. Mr. Hensarling's reason for the act is the fiduciary standard is among, "...rules that hurt struggling citizens." It is hard to imagine any scenario where allowing someone to sell investment advice not in best interests of their clients is bad for struggling citizens. Rather, its only goal can be to allow big donors to revert to putting their interests first.

http://www.investmentnews.com/article/20160627/BLOG07/160629920/based-on-new-hensarling-bill-gop-not-keen-on-sec-fiduciary-rule