The Economic River

Recession, slump, depression, it doesn’t matter what it’s called; the only question is how it can be fixed. The experts, with economic models to support their various theories, have been pontificating and trying for the last how many years and yet it continues. It’s complicated, they say, which I believe, is the problem. It isn’t complicated and the solution is very simple.

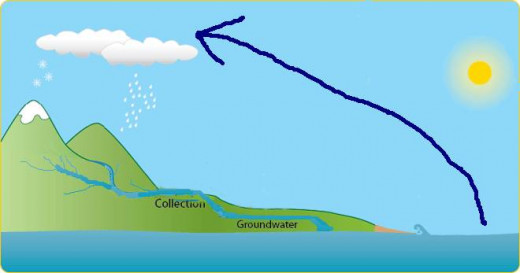

I’ll start with a simple analogy, the rain cycle, a simple system that keep the rivers flowing, because the economy, any economy, is like a river, it needs to keep flowing and when it slows we have a drought. What we have is an economic drought.

In the weather cycle, moisture evaporates from the sea, the wind drives it over the land where hills and mountains force the clouds to rise and cool. The cooled moisture falls as rain or snow to form streams. These streams grow into rivers and these rivers carry this flow back to the sea. If the rain doesn’t fall, the streams dry up, the rivers shrink and everyone dies of thirst, but of course, there is still plenty of water in the sea. It’s just not moving.

This is how an economy works. The wealthy with their businesses and investments equate to the ocean. The ordinary worker collecting their wages from working the various businesses run by the wealthy, equate to the streams, the headwaters of the rivers that keep the economy flowing.

The problem is that over recent years, the bankers and the wealthiest individuals have been doing all they can to hold onto their money. They have, as shown by all statistics on the subject, got richer while the average worker has seen their wages capped or even reduced. Those at the top have seen their salary rise by 20% and more while wages have only increased by 1-2%, for those who are lucky enough to have seen a rise. And remember, 20% of £$500.000.00 per year is a lot more than £$2% of 10,000.00 per year.

Of course there are other issues, both in the water cycle and the economy. There are lakes and ground water reserves, call these banks and individual savings, but the principle remains the same and it is simple.

The problem is exacerbated by the fact that those who make the decisions are counted among the wealthy and the wealthy see recession as something to fear because it might reduce their pot of wealth, despite that they possess far more than they can ever spend. Call it greed and avarice if you like but insults don’t help. This isn’t said to insult and nor should that wealth, when fairly earned, be begrudged.

The money sits in the ocean leading to a reduced rainfall of pennies leading to reduced flow in the economic river and in response to this reduced flow, the ocean holds on to even more of its money. It is fear of loosing what they have more than greed.

And then governments, under the advice of economists, who are by their position, among the wealthy themselves, apply cuts. But these cuts are in jobs and help to the poorest, never to the rich who hoard more fearing the poverty they see growing all around.

The poor, having less, spend less. The local shop sells less, so orders less from their supplier. The supplier, seeing trade fall off, reduces production and lays off employees who then have less and so the cycle continues. In response and in the hope of boosting the economy, the government is encourage give money to those it calls the wealth creators. All very fine except for one serious mistake. This mistake is in identifying who are the true wealth creators.

Those who are rich, who started as a small business and drove it to become the multi-national conglomerate it now is were certainly wealth creators in their time. But they have wealth now, and they have a multi-national business to run which takes all their time and effort.

The true wealth creator of today is the small business, the one-man band that might well grow to become some multi-national conglomerate, but these are being starved of cash and investment because those raised with wealth only see being wealthy as evidence of being a wealth creator.

Give a million pounds, dollars, Euro’s whatever, to a millionaire and it will be pocket change. What will they buy? They have everything? What business will they start? They already have one to run?

Give 1 pound, dollar, Euro or whatever to a poor person and they will be in the shop that week to buy whatever it is they need. That shopkeeper will increase his sales and therefore order more from their supplier and so the money flows and it will flow, back to the sea from where it came and back into the rich man’s coffers, but now worth more because there is profit in trade, in money when it flows, but there is none when it stagnates and sits in the ocean doing nothing.

The solution to the economic drought is simple. The problem is fear, but what those that have everything fail to see is that fear of loosing will bring about the very loss they fear. Those that have nothing have nothing to loose and when there is a drought, it only takes a single spark to start a wildfire that will bring all too ruin.

It is not complicated and there are theories that support what is said here and also proof. The American Depression was only brought to an end when money once again started to flow. An economy flows from the headwaters to the sea, not from the rich to the poor. The problem of debt cannot be solved by damning the flow even more, but by doing the reverse. The banks of a flowing river sprout green and lush and in time, this growth will cure that problem.

The solution to any problem is always simply. It is only made complicated by those who, for whatever reason, are unwilling to accept what is often an unpalatable truth.