War of Wealth

Money War

Class War

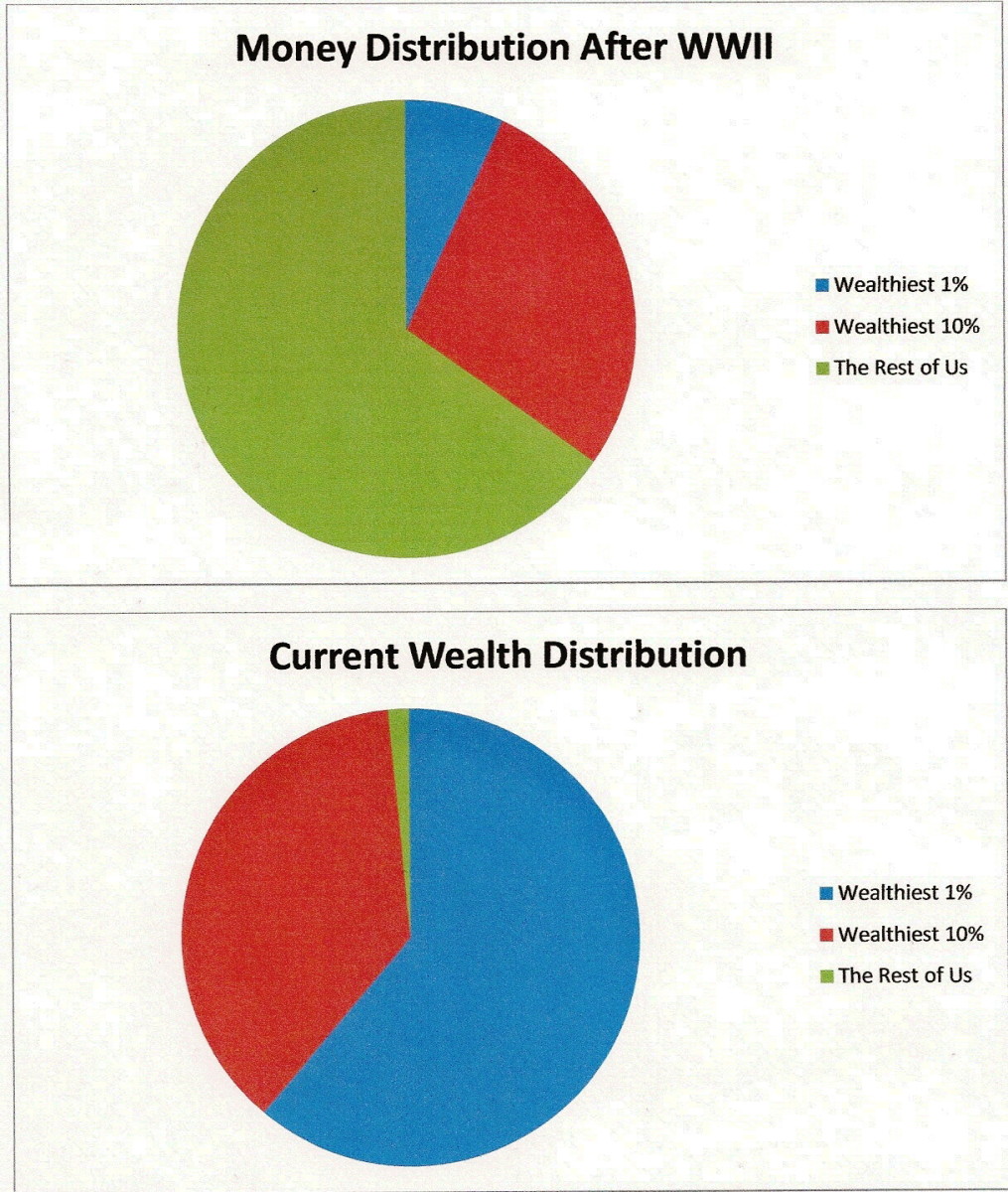

Recently President Obama has been accused of trying to start a class war by wanting the rich to pay more taxes.

Why did I not hear this when he paid billions of middle class tax dollars to bail out the Banks and Wall Street?

Unfortunately, in the world today, it is money that talks or at least, it is the voice of money that is the only voice that is heard.

In the media, the silence of the low and medium income is almost deafening, yet when one whisper is made by money, the media are clambering to find extra space.

If there was a war of classes, as the media are owned by the rich, it is difficult to see how they could remain impartial messengers of the facts, if that is what they currently are.

Politicians

Politics

Basically there are two political points of view.

One is that bigger taxes should be paid in order that the government can pay for what the people need.

The problem with this is that many think that the government is unaware or unconcerned about what the majority of the people really need.

The second view is that minimal taxes should be paid, thereby leaving the money with the people, to spend it on what they really need.

The problem with this is that too many people do not have enough to buy what they really need.

In reality, either system could probably work if administered correctly.

The real problem is that politicians bicker so much between the two policies; they leave themselves no time to do the job they were elected to do.

Income Tax

Taxes

The wealthy claim that they are the ones that create jobs and wealth, therefore they are already doing their part for society.

What they conveniently forget is that, if it was not for the tax dollars educating the people, the rich would not be able to find competent staff. The staff could not make it to work if not for the tax dollars maintaining roads and public transport.

They also forget that, if it were not for the lower paid in the mining, farming and energy jobs, they would not have the raw materials with which to create or expand a business. That is not to mention the fire and police that protect their interests.

No one in a country is an island; everyone in some way is dependent on another.

With the exception of perhaps gardeners and maids, people do not employ people, businesses employ people.

The rules for personal income tax should therefore be etched in stone or at least the constitution.

Personal income tax should be set at a rate of “x” for all earning above a figure “y”. The “x” being the same regardless of amount of income.

Each administration can decide on what the “x” and “y” figures should be but must always be applicable to all evenly.

There should be no chance of “loop holes”, therefore no tax relief on personal income.

Tax relief is currently, possibly given to those with children in education. That should stop, let them pay the income tax and let the government pay any part of the education bill that is applicable.

Businesses employ people and so the rates of business taxes can reflect employee recruitment numbers.

The rate of income tax should reflect that all in a country are equal and equally share in its responsibilities.

We are always told that business is not personal, so let’s keep it that way, do not allow any business to affect any person’s rate of income tax.

- Kinder Garden Congress

America is faced with serious problems, debt and drugs being two of them. Is it the childish attitude of congress that has helped to make these problems and stops them from being solved? - Street Call: Alms for the Poor

Millions of dollars are given to charities annually. How can we be sure the money is reaching the intended needy? Is there anything we can do to protect our donations? - Let's Get Serious

Why do politicians insist on making trivial laws to try and boost votes, instead of dealing with the big pictures? - Is the United States Third World?

By many criteria the US is third world. Is this possible and what does it mean? - A Weighty Economic Problem

The three things that are growing in the US are: the debt, peoples size and health costs. Is it possible to combine the three to find a solution? - The Dangers of the Deficit

We have all heard of the deficit but what does it really mean? Could it result in the break up of the US? How and why? - Bridging the Economic Gap

With China's growing economy, can the United States stay ahead?