When Price Exceeds Income

When Prices Exceed Income

What Do You Do ?

When Prices Exceed Income!

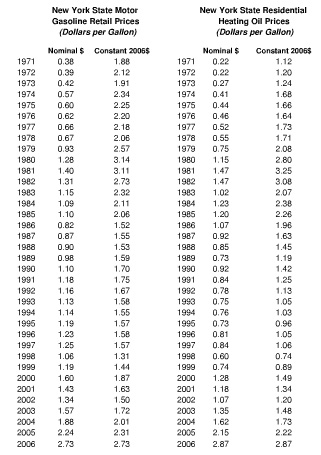

This may become reality at the present rate of inflation and unemployment. With no increase in wages on middle class workers for ten or fifteen years, while the price of goods increased every year. Tax payers are desperately working hard to keep from getting into this financial drain as property taxes and new taxes added from local governments to make up for loss in sales tax. The price index rose to record highs by 2011 but wages stayed the same. Take home pay became less due to expenses taken out either by taxes or insurance. An indication that prices may exceed income due to health or auto insurance.

This has been a steady process with increases and slow downs for the past thirty years, but the presidential election of 2000 was the indicator that the price of “goods” will rise quickly and wages will not. Mid 1990’s was a short halt in that financial drain with a freeze in most prices and some moderate increase in personal income mostly for the rich. But the first president of the twenty first century was the “scare” that tipped the price increase. Wages were frozen and labor unions became disabled by the federal government crushing the bargaining power between wage earners and employer. This was first used in 1969 with Vietnam protesters, and again with air traffic controllers union as President Reagan called the military to take the place of strikers.

Insurance companies started controlling the economy by 2010 with price increases caused by advertising on cable channels which increased the demand, causing health insurance premiums to sky rocket. What was once a benefit is now a burden both for the employer and employee. With the employee not prepared to handle the burden of less take home pay every year prices could exceed income.

What happens when prices exceed income? People are in debt with a paycheck and still juggling between child care or health care and food. The scare is real and in front of your eyes every day, insurance companies can raise rates with out notice. Utility companies can add an extra tax with out notice and expect users to pay, or cut off the electricity. What do you do? We have already cut out what is not needed, and trying to figure how to keep the necessities.

As 2020 nears very little has changed to the income/price index ratio. The chart above has seen gas prices fall over a period of time only to see them rise quickly. Today we are close to 2011 gasoline prices and wages have risen, only recently, to keep that statistical balance between cost of goods and wages. The cost of health insurance keeps people imprisoned to paying a system that does little for the healthy. Other than health care, housing has risen sharply since this article posted. Rent and mortgage rates are at all time high with the population slowing down the demand for living quarters is high. The probability of pricess exceeding income is happening now to the elderly and sick. Who's next?