Flat Income Tax or Current Income Tax

US FEDERAL INCOME TAX ~ Flat Income Tax or Current Income Tax

Cast you vote and share you opinions on Flat Income Tax or the current Income Tax.

Each year I spend weeks gathering receipts, W-2's, 1099's, bank statements, etc. in order to file our annual Federal Income tax return.

What Fun Right!

Each year I ask the burning question: "Is there an easier way?"

Each year I ask the burning question: "Is there a faster way?"

Each year I ask the burning question: "Is there a more equitable way?"

Each year the voice in my head suggests an answer: "How about a simple Flat Income Tax"

A Flat Income Tax ~ The Definition

"A flat tax (short for flat rate tax) is a tax system with a constant tax rate. Usually the term flat tax refers to household income (and sometimes corporate profits) being taxed at one marginal rate, in contrast with progressive taxes that vary according to parameters such as income or usage levels. Flat taxes offer simplicity in the tax code, which has been reported to increase compliance and decrease administration costs." ~ Wikipedia

Progressive Tax ~ Definition

The Current US Income Tax

"A progressive tax is a tax by which the tax rate increases as the taxable base amount increases. "Progressive" describes a distribution effect on income or expenditure, referring to the way the rate progresses from low to high, where the average tax rate is less than the marginal tax rate. It can be applied to individual taxes or to a tax system as a whole; a year, multi-year, or lifetime. Progressive taxes attempt to reduce the tax incidence of people with a lower ability-to-pay, as they shift the incidence increasingly to those with a higher ability-to-pay." ~ Wikipedia

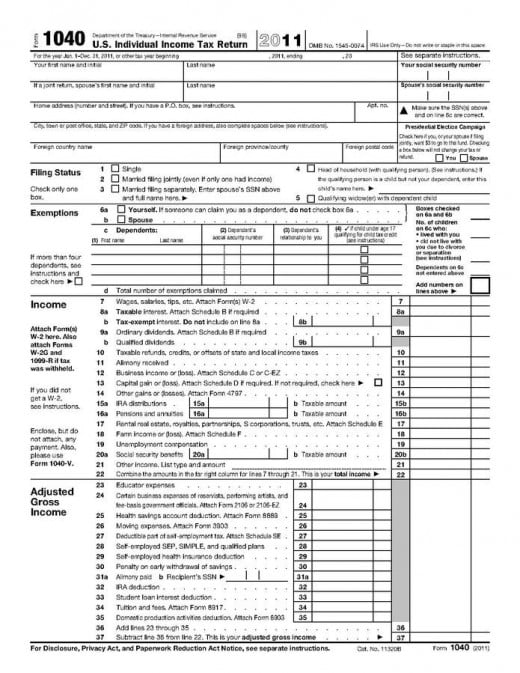

The Process of Filing a 1040 Income Tax Return

Here is where the Real Fun Begins!

In an attempt to decrease our tax burden, we spend days, even weeks, trying to find the elusive tax deductions.

- Dependents

- Mortgage Interest

- Medical & Dental Expenses

- Contributions

- State Sales Tax

- Property TaxB

- usiness Expenses

- Education Expenses

- Casualty, Disaster, and Theft Losses

As the list grows shorter each year, we ask ourselves "should we have had a child last year?"

Then when I look at the actual form, I wonder if I need a lawyer, a tax specialist, a CPA or all of the above! Wouldn't it just be easier to send them a percentage of my Gross Income and get back to living?

Now I Ask You The Burning Question, What Do You Think?

Flat Income Tax or Current Income Tax

© 2010 Cynthia Sylvestermouse