Historical data on taxing the rich

federal income tax rates history,

During the eight years of the Eisenhower presidency, from 1953 to 1961, the top marginal rate was 91 percent. (It was 92 percent the year he came into office.)

What does it mean, though? For the duration of Eisenhower’s presidency, that rate affected individuals making $200,000 or more per year or couples making $400,000 and above per year.

In 2015 dollars, that's roughly $1.7 million for an individual and $3.4 million for a couple. - http://www.politifact.com/truth-o-meter … senhower-/

The top rate in 2015 is 39.6 percent

So was Eisenhower a communist? Why should the rich pay more?

Piketty said, "The evidence suggests that progressive taxation of very high incomes and very large estates partly explains why the concentration of wealth never regained its astronomic Belle Époque levels after the shocks of 1914-1945.”

Taxing the wealthy more goes back a long way. The Vikings had a 'belt tax' if your stomach was too big - a fat cat - there was a fine for that, or a tax which ever - had to give up some money.

Warren Buffet and Mark Zuckerberg want to pay more in taxes. In August 2015 Trump said the rich should pay more taxes, but he is a compulsive liar and so his opinion doesn't matter.

The wealthy do not pay their fair share. Yet it has been said that no matter what the tax rate is, it wouldn't matter because if you're rich, you can avoid paying taxes. The biggest income tax loophole is the definition of income. Mitt Romney used to pay less than 15 percent— based on the legal capital gains tax rate at the time—on the millions he cleared while head of Bain Capital.

Tax havens, shell companies, equity swaps, evading capital gains tax, dodging estate tax, shell trust funds, incorporating and life insurance/real estate borrowing.

I know millionaires who pay no income taxes. It's actually quite easy to do.

Tax law has become so corrupted by rich campaign contributors who bend laws in their favor that it's no wonder the country is so deeply in debt.You forgot a step promisem. The recipients of that money. You can't buy what is not for sale, no matter how rich you are. So who is the real culprit behind our "corrupted" tax system?

GAGA, politicians are beholden to money if they want to stay in office. Campaign laws and rulings from the Supreme Court such as Citizens United have corrupted the process.

Yes, we can blame politicians. But my main point remains that great wealth leads to abuse of power and tax laws that favor the wealthy. Note that two Supreme Court justices had a private meeting with the Koch brothers just months before they ruled on Citizens United.

http://www.nytimes.com/2011/01/20/us/po … 0koch.htmlPromisem, even the Red streak in me has problems with the results of the Citizen's United decision. But I think my problems with it require legislative campaign finance reform to fix them, not a different court decision.

And speaking of the Court, your link does prompt an interesting question that needs some more thought, (on my part). Consider... are we so distrustful that we need out Justices to be social celibates? To Common Cause's point - they don't even know when the Justices attended. It seems their implication is that any contact is a taint.

If Common Cause's complaint was of the nature of a 'tarmac' meeting, they might have a valid point, but as I read it, I think their case is asking more than is reasonable. I think the station of being a Supreme Court Justice demands a bit more trust and respect than Common Cause is offering.

GA

The rationalization and "reasons" from liberals to collect more taxes are always awesome! "Because we set high rates in the past (but we won't talk about the effective rates paid)". "Because we don't like people getting rich, so will take their possessions". "Because the Vikings did it". "Because Buffet wants to pay more taxes but won't do it voluntarily". Because I say the wealthy do not pay their 'fair share' (as defined by me to be all wealth more than I have)".

They'll even bemoan that "Mitt Romney used to pay less than 15 percent on the millions he cleared while head of Bain Capital" while forgetting that they've never paid 15% of their income either! Yet it's "not fair" and Mitt must not only pay more dollars but more percentage as well.

Bah. If you wish to steal wealth from the rich, come right out and say so. Don't try to rationalize your way to it (can't be done) - just acknowledge you wish to steal and have the guns and might to do so legally.So you are in favor of ultra rich billionaires not shouldering their fair share of the tax burden?

One thing I do agree on is eliminate income taxes for anybody making less than $25k. I don't understand how a person making less that the poverty line can still owe income taxes. I know the ETIC is supposed to offset this, but just seems cruel to tax ultra poor people so that the ultra rich can slide.

"Mercer has, according to his colleagues, a theory of humans which is that they have no inherent value. That a human being is only worth as much as they can earn. He argues that he earns thousands of times more than a school teacher, which makes him that much more valuable than school teachers. And people on welfare, he suggests, have no value. They have negative value. He argues, though, that cats have value—because watching them provides pleasure to people." - https://www.thenation.com/article/one-o … ecipients/

"So you are in favor of ultra rich billionaires not shouldering their fair share of the tax burden?"

If "fair" means "I can take whatever I have the force to take", then yes. How about you take a shot at explaining why it is "fair" for one person to pay more for a product than another does? You might begin by explaining why some should not participate in the needs of the country at all, even though they receive exactly the same benefit.

I will add that there is at least a kernel of truth in Mercer's statement - human beings can have to (financial) value. It is a liberal myth that all have an equal (financial) value and thus must receive equal amounts of money - money taken from those that more - simply for existing.Product? What product? Talking taxes not retail. You and I both pay taxes for roads neither one of us have ever drove on. Progressive taxes is what I'm talking about here

Yes I know. Some people pay thousands of times what others do for the privilege of having a country. For military protection, for a highway system, For a government, for the CDC. For (mostly non-existent) border control, for research that benefits all.

For all the products government supplies us, both material and non-material. Can you explain how it is "fair" that some pay thousands of times what others do? Not how or why it is necessary, how it is somehow "fair"?

Can't be done? Weren't you paying attention? I just did

Hello ptosis, another "tax fair share" topic. These are always good for illustrating different ideologies.

However, to have a good conversation, you should establish some accepted guides. For instance; what do you think the rich's fair share should be? Is it a certain percentage, or dollar amount, or is it just whatever is needed to cover our government's spending shortfalls?

Those questions may sound antagonistic, but they are valid to your discussion. Otherwise you will just have a thread of liberals vs. conservatives spouting and defending ideologies.

Here's another for instance; you used Mitt Romney as an example of the rich not paying their "fair share," but the facts of your Romney example do have some interesting angles;

If a Mitt Romney is paying $3,000,000, (Mitt's 2010 tax paid), and an 'average' Joe, (middle 20%), paid $5,600, does Mitt paying 535 times more than the "average" tax payer have any bearing on the determination of what "fair" is?

Would the information that relative to comparing Federal income tax rates, that Mitt paid a higher rate than 97%*** of all tax filers? *This came from a factchecker.org article about an Obama campaign ad.

*** I did not fact-check factchecker.org's figures, but even if they are specifically inaccurate, I am confident they are at least in the ballpark.

As you can see, you really need to define what your "fair share" is, and how it will be determined, before you can have a good conversation.

I look forward to participating, once you set the stage.

ps. Don't you think your Buffet and Zuckerberg declarations lose a little steam when the question of "Why don't they voluntarily pay more taxes if that is the way they feel?" question is asked?

GA"Fair" is everyone paying the same amount for the same product. It is a social myth and a injustice that we as a people have decided to vilify a small group by declaring that paying thousands more than others is "unfair" because it isn't enough. The wealthy of America have become the "Jew" of Nazi Germany as we deliberately and falsely accuse them of the immorality that we ourselves exhibit every day.

It's your discussion ptosis, I can't define it for you. I can only offer the questions that you can use to establish the parameters of your point.

It is probably obvious that I disagree with your contentions, and I did offer some perspective to your generalizations, but that's about as far as we can go until you provide some details relative to the questions asked.

GAI bet you want a flat tax, which I think is unfair. Progressive or flat each system may be called "unfair" according to who benefits or is treated differently. There is no perfect fairness.

"A flat tax is good for growth because it doesn't penalize those who work hard and add value to our economy" This is not to say that people don't deserve to keep what they earn. The key word is "earn." The tripling of income by the wealthy is the result of money-transferring financial strategies, government deregulation, and tax cuts -- NOT because they worked three times harder than everyone else. - http://articles.chicagotribune.com/2010 … x-tax-cuts

What is fair? Fairness in a taxation system requires that those with the greatest capacity to pay should pay more tax than those with a lesser capacity to pay. It's important to reduce tax breaks that favor the top 1 percent. Low-income earners have a higher "Marginal Propensity to Consume," which means that they spend a greater percentage of their overall income on consumption.

" It's very difficult to have a sales tax of more than around 10% without finding that you've got a huge tax avoidance problem as the grey economy explodes. This is the problem with the Fair Tax proposal by the way, that they want to have a 24.5 % sales tax levied just at that final retail sale. " - https://www.forbes.com/sites/timworstal … 3caffb2fc9"Fairness in a taxation system requires that those with the greatest capacity to pay should pay more tax than those with a lesser capacity to pay."

I disagree. The price of a loaf of bread, lawn mowing services or a new car doesn't depend on my earning power; why should the services of a government be any different?

"It's important to reduce tax breaks that favor the top 1 percent."

Why? So you can take more of their earnings or belongings to buy what you want but don't want to pay for? That hardly seems equitable or "fair". If we must have a graduated tax schedule (and I don't disagree that it is necessary to maintain the country) how about no deductions. For anyone. Not for home mortgage, not for school tuition, not for medical costs, not for IRA contributions, not for anything. Only a "deduction" for each member of a family under the theory that the income is paying for everyone there and it is part of the graduation (the families first X dollars are tax free). Pay taxes on the net income received, after legitimate business costs (advertising, R&D, travel, product purchases, etc.). And no more "refunds" of what was never paid in the first place.

If we want to encourage a business to locate in the inner city, or our state; if we want them to go green, if we want them to use natural gas buses then cut them a check and make it open for all to see. And open subsidy for all to understand what we're actually paying for and what the cost to the taxpayer is rather than hiding it it tax deductions, whether lower property taxes, sales taxes or income taxes.No ptosis, I do not want a "flat tax." The pragmatist in me accepts the reality that a progressive tax system is the least burdensome on those least able to pay.

In principle, I agree with Wilderness' mantra that the only "fair" system is one where everyone pays the same. Postcard simple. No deductions, loopholes, rebates, credits, or refunds. But that principle won't support the needs of reality. So I accept progressive rate taxation as the next-best choice. But I hold to limits on that progression of rates. If the produced revenue won't pay the bills, than the spending has to be cut - not the tax rates raised.

I strongly believe the "rich" are already paying more than their fair share, and cries for them to be taxed more are unfounded in reason. Which also means that I think their use of all legal means to reduce their tax payment is acceptable too.

Now, after two tries, I am still hoping you will address the questions I originally asked, but I am wondering if you can answer them without exposing the cracks in the foundation of your OP.

ps. I would also be interested in your perspective on that "The Tax System Explained in Beer" illustration I posted.

GAJust so - the only fair system is where everyone (presumably adults only) pays $10,000 or whatever the country needs. Equally just so is that it cannot work, so a progressive system using both percentages rather than dollars and raising those percentages according to income is required.

" If the produced revenue won't pay the bills, than the spending has to be cut - not the tax rates raised."- ahh - cut where? You all know we are still in sequester - correct? Cut corporate welfare and bloated defense and have a single payer health-care system would help everybody.

I strongly believe the "rich" are already paying more than their fair share, and cries for them to be taxed more are unfounded in reason. Which also means that I think their use of all legal means to reduce their tax payment is acceptable too. - Legal means, yes, sustainable = ??

"The richest 10% pay about 20 percent in federal taxes, and it goes down from there, with the richest 400 paying less than 20 percent. When all taxes are included (payroll, sales, state and local), the super-rich pay about the same percentage as America's middle and upper-middle classes." - http://www.alternet.org/economy/5-ways- … you-and-me

Corporations feel entitled to lower taxes, too, having cut their income tax rate in half in just ten years.

Why does the super rich feel entitled to avoid taxes on the backs poor? The bottom 90 percent are earning on average about $280 more a year than 30 years ago, (adjusted for inflation. - the hidden tax) -

"Entitlements for the rich mean cuts in safety net programs for children, women, retirees, and low-income families. They threaten Social Security. They redirect money from infrastructure repair, education, and job creation.

And the more the super-rich take from us, the greater their belief that they're entitled to the wealth we all helped to create." - http://www.alternet.org/economy/5-ways- … you-and-me

Our main focus is on personal income taxes but any analysis of "fairness" should include the whole tax system, not just one part of it. "Overall, the poorest 20 percent of Americans paid an average of 10.9 percent of their income in state and local taxes and the middle 20 percent of Americans paid 9.4 percent. The top 1 percent, meanwhile, pay only 5.4 percent of their income to state and local taxes. " - http://www.cnbc.com/2015/01/15/do-the-w … class.html

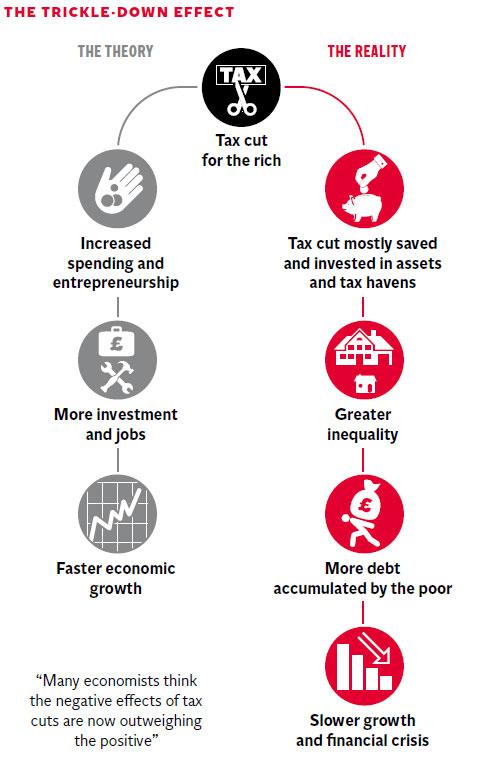

"The explosion of income and wealth among America’s super-rich, the dramatic drop in their tax rates, the consequential devastating budget squeezes in Washington and in state capitals, and the slashing of vital public services for the middle class and the poor means that trickle-down economics is a lie."- http://www.huffingtonpost.com/robert-re … 44606.html

"The richest 10% pay about 20 percent in federal taxes, and it goes down from there, with the richest 400 paying less than 20 percent."

Care to convert those percentages into dollars (or into millions of dollars) paid in taxes? Or will that show the lie that it is "unfair" the rich aren't forced to give up even more?

"When all taxes are included (payroll, sales, state and local), the super-rich pay about the same percentage as America's middle and upper-middle classes."

Last I saw of Trump's taxes paid, it was on the order of $1,500,000 in one year. I don't know of any upper class person paying that much - why is it you refuse to discuss what the rich are actually paying, hiding it behind percentages of income?

"Entitlements for the rich mean cuts..."

What "entitlements" do the rich get...outside of maintaining control and ownership of their earnings, just as the rest of us do?

"Corporations feel entitled to lower taxes, too, having cut their income tax rate in half in just ten years."

Can you justify a business owner paying corporate income taxes and then personal income taxes on every dollar earned? You don't pay income taxes twice - why should they?Deleted

How can you justify allowing business owners who understand almost nothing of the world except business to direct our entire societies?

Every penny spent that does not forward their agenda is fought against by their representatives. The results are personal misery for anyone they can hire cheap and environmental threat on a grand scale.

They need to be brought in line and their talents used constructively for the benefit of all.I assume your "they" means business owners. Like myself; I have a part of retirement income invested in stocks. I am thus one of those business owners whose "agenda" of a comfortable retirement results in personal misery for anyone with a job and an environmental threat on a grand scale.

Thank you! Although I must disagree that my evil must be brought into line and my talents used for the benefit of all: I prefer that my talents be used to make my life livable rather than living in poverty and on the dole.

(Can you really believe that the road to Utopia for all lies in confiscation of business profits from stockholders? I doubt it - you just want what doesn't belong to you.)Tax and spend would give you far more opportunity to have a say in how your community goes and how your country plots its future.

Not exactly utopian.

What you have how is a complete abdication of responsibility by ordinary citizens as they hand more wealth and, hence, more power to the one per cent."What you have how is a complete abdication of responsibility by ordinary citizens..."

You're right - half the nation takes no responsibility for supporting the needs of the nation. Surely an untenable situation, and one that will not be corrected by raising taxes on those already paying the bulk of our needs while adding more to the roles of those that pay little or nothing at all.

I realize that modern socialism advocates giving the people the illusion of freedom and ownership; allowing them to work and earn but then taking those earnings for a bureaucratic committee somewhere to decide how to spend it: our ex-president made that statement, in fact. Because, presumably, that bourgeois committee knows better than the "owner" how it should be spent. It isn't my idea of freedom.

Actually I DO pay taxes twice, we all do. You insist on dollar amount. I'm talking percentages.

A value-added tax (VAT) is a consumption tax levied on products at every point of sale where value has been added, starting from raw materials and going all the way to final retail purchase by a consumer. Ultimately, the consumer pays VAT; buyers earlier in the chain of production receive reimbursements for previous VAT taxes paid.

Excise taxes are special taxes on specific goods or activities—such as gasoline, tobacco or gambling—rather than general tax bases such as income or consumption. Excise taxes are often included in the final price of products and services, and are often hidden to consumers.

Inflation

The hidden tax.

Is generated intentionally by governments.

It is an automatic tax on workers and the poor.

Although many harms, benefits others, including the government and its associates.

________________________________

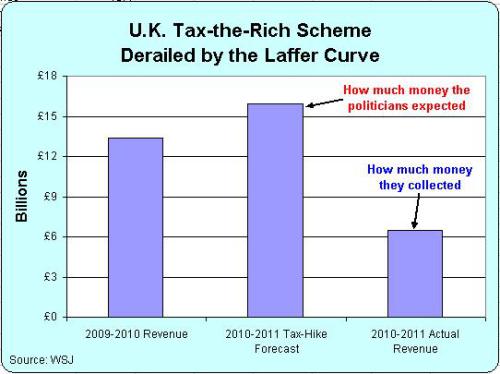

Perhaps you are talking about the Laffer Curve?

Yes, I know we all pay taxes 2,3 and 4 times. But not federal income taxes; the others are state, local, sales, FICA, etc. which business owners also pay. I'm sure you understand the question was why should a business owner pay federal income taxes twice when no one else does.

I know you're talking percentages; the question was why? To cover up just how much the rich are paying or is there another reason? Neither you, I nor the rich pay their taxes in percentage signs rather than dollar signs; why is that the only number you will discuss?

Yes, I know the British are grossly over-taxed - it is the result of embracing and demanding a nanny state to care for them. But it has little to do with the US...unless that same nanny state, removing personal responsibility to take care of themselves and support themselves is the aim in the US. While it may be your goal, it isn't mine.

You forgot to add that inflation is an automatic tax on the rich as well, and a much larger one than on the poor. Again, somehow, the simple fact that the rich are paying far more than anyone else is set aside - why? Is it an effort to convince the world that they should pay more, buying the things you want but don't want to pay for?Here is a short article perhaps pointing out our difference:

https://lasvegassun.com/blogs/elsewhere … bill-by-m/

The article points out that Sheldon Adelson, casino magnate, stands to "gain" a "windfall" of some 40 million dollars if the ACA goes into effect, through tax savings that will no longer be forced from him.

Question: what gives you the right to take that 40M from it's owner? Adelson grew up poor and built what he has himself through hard work. He recently donated 20M to a university on the West Bank; what gives you the right to decide that his 40M shall be spent as you want rather than letting him choose, whether he gives it away or keeps it? Because you feel that your cause is better than his?

Talking ethical right here - not legal. We know that liberals had the might, the guns, to take that 40M from it's owner under Obama, but is it ethical and right to do so? Are those wishing to steal that 40M gods of some kind, whose decisions are defined as being right whether they are or not?

Is it just rationalization, possible only because of tear jerking from a gullible population that wants what they do not have?

I did try ptosis. Three times I offered the opportunity for you to define your OP issues. Three times I opened the door for a substantive discussion. But all you have offered in response is more rants, more mimes, and avoidance of challenges to your OP's declarations.

I would be glad to continue this discussion, but only if you want a discsussion, and not just a soap box to stand on. Here is a quick link if you wanted to make the forth time a charm:

What is your definition of a "fair share" for the rich to pay?

GAI did

I did

I did

3x I did Candyman. You don't want to talk percentages. That's is not my fault. So please calm down and quit reacting as if I'm ignoring you. You don't have to respond if you don't want to talk percentages.It's good to hear from you again, ptosis.

But no, you didn't, (x3)

I asked, "For instance; what do you think the rich's fair share should be? Is it a certain percentage..."

Your first response was" "What's fair to you? Percentage wise?".

Then I commented that, "It's your discussion ptosis, I can't define it for you."

Your second response to that was a tirade about the Flat tax proposal that led off with:

"I bet you want a flat tax..."

Once again you did not answer what you thought the rich's fair share should be. Even granting that your first response indicated you think it is a percentage, you failed to offer what you thought their "fair share" percentage should be.

As you can see, that is two "no, you didn'ts"

Then of course there was your third reply, that came straight from your "soap box" about; sequester, and cuts to children's programs, and the whole litany typically used to defile those Evil rich... and declare the reality and the compassion of your demands for more. It's for the children, the poor, the elderly, the homeless lepers without even a bag to collect their droppings. And of course their dastardly acts of "avoiding taxes on the backs of the poor." **

... yet not one word about what you thought their "fair share" should be. Not one word about the "fairness" of the "Mitt Romneys" paying 535 times what the 'Average Joe taxpayer pays. Or about the data that said the real Mitt Romney actually paid a higher tax rate than 97% of the tax filers of that same year.

That was the third, "No, you didn't," and it was the worst of the bunch.

So, this "Candyman" thinks you are too afraid or too uninformed to defend your OP. I don't need to calm down,I wasn't agitated, and I wasn't the one ducking and dodging politely asked pertinent questions of the author of a topic thread.

Man up, ptosis, what are your answers to those questions? What about your perspective of a "fair share" tax rate percentage? What about those 'different' Mitt Romney facts?

** You see, I can have a "soap box" too.

GAThank you.

The current tax bracket rates found at http://www.bankrate.com/finance/taxes/tax-brackets.aspx

Let's just look at singles - current rate

10% $0 to $9,275

15% $9,276 to $37,650

25% $37,651 to $91,150

28% $91,151 to $190,150

33% $190,151 to $413,350

35% $413,351 to $415,050

39.6% $415,051 or more

If I was dictator of The Confederate States of America. (no loop holes, all income)

0% $0 to $23,000

10% $$23,000 to $75,000

15% $75,000 to $200,000

28% $200,000 to $500,000

33% $500,000 to $5,000,000

35% $5,000,000 to $50,000,000

39% $50,000,000 to $100,000,000 (I.E. - Safra Catz $51,695,742 in 2011)

42% $100,000,000 to $500,000,000 (I.E. - Tim Cook $377,996,537 in 2011)

45% $500,000,000 to $700,000,000

49% $700,000,000 to $1,000,000,000 (one billion dollars)

52% $1,000,000,000 to $5,000,000,000

54% $5,000,000,000 to $10,000,000,000 (ten billion dollars)

60% $10,000,000,000 to $50,000,000,000

70% $50,000,000,000 to $1,000,000,000,000 (one trillion dollars)

80% over one trillion dollars

Since the current tax code favors the rich with preinflation tax limits (when gold was $35/ounce)therefore they are not paying their fair share and the ones in the lowest brackets are pulling more than their fair share. This is what I'm proposing because 100 years from now the minimum wage could possibly be $25,000 a year with inflation continuing to devalue the dollar.

But of course that would never happen.

And that's just the start, begin constitutional amendment process for;

1) limiting Citizens United USSC decision

2) single payer medical care for all

3) repeal fed laws on marijuana - let the states decideHello again ptosis, Now, we have something to work with, but I am puzzling through your inclusion of pot legislation in a tax rate discussion.

Before I get sidetracked, I also agree with your final three listed actions, although I am not sure a Constitutional amendment process is right for all of them.

Regarding your tax rates, I am almost in agreement - in a broad sense, but do have some differences.

I would support 'standard deductions', as we currently have, for the taxpayer and their dependents, but beyond that I am with you; no itemized deductions, no loopholes, etc., and certainly no use of the tax code for social engineering.

However my agreement in principle stops at a point of detail. I would support a 33% tax rate from $500,000 and over - everything over. That 33% is the maximum I would call equitable, (as in relative to a progressive taxing system, not as in "fair," and considering that there would no longer be an industry of deductions and 'loopholes').

I think your rate schedule beyond that 33% is just taxing success for being success. How do you justify taxing more for higher degrees of success? The purpose of progressive taxation isn't to penalize success, it is to proportion the burden of our country's financial needs. I have not abandoned the position that there is a point where government spending must be controlled by the reality of reasonable expectations - not by the depth of the money pool available to be tapped.

And on that point, I think we are miles apart in our thinking.

With no condescension intended, this response of yours is what I was saying was needed to hold a discussion - from the beginning.

GAA joke - because I feel too lousy for a serious discussion today.

If cigarette tax is imposed to reduce smoking, and a alcohol tax is to discourage drinking, then explain the income tax.

The intention is not to penalize success, it's a social intention in my mind to discourage people like Soros, Koch and Mercer from screwing with our lives because they have all this money, and use it for their own pet social experiments.

The Sixteenth Amendment (Amendment XVI) to the United States Constitution allows the Congress to levy an income tax without apportioning it among the states or basing it on the United States Census.

I'm not sure but I think this admendment nullifies an earlier part of the constitution that says the Fed can only tax states.

"The Supreme Court ruled today that taxpayers who sincerely believe the Federal income tax laws do not apply to them cannot be convicted of criminal tax violations, even if there is no rational basis for their belief.

But at the same time, the Court said a belief that the tax is unconstitutional, as opposed to inapplicable, is not a shield against criminal liability for refusal to pay taxes." - http://www.nytimes.com/1991/01/09/busin … ester.html

2 percent on all income over $4,000 (roughly $90,000 today) – was America’s first peacetime national income tax.

So yeah, wish to reduce the hold of the military-industrial complex hold on USA then wouldn't have to tax so much."The intention is not to penalize success, it's a social intention in my mind to discourage people like Soros, Koch and Mercer from screwing with our lives because they have all this money, and use it for their own pet social experiments."

Are you sure that doesn't simply "I wouldn't allow people to keep wealth past what I consider as too much?" Because it certainly sounds like it.We will get back to it when you feel better ptosis, because I don't get the "social intention" part, relative to Federal Income Tax rates.

GA

- ahorsebackposted 8 years ago

0

So why exactly should the higher earner be more liable for your share of entitlements than YOU are ?

That is what really needs to be explained and addressed here , or with all of the social safety nets in place today how he - she is deemed more responsible ?

What the layman needs to understand --and most people have no clue -----Is exactly how much the self employed gets away with in legalized tax evasion ----"write offs ", I worked for twenty five years as self employed before retiring and those who work within the 'employed by others " generally speaking ,are paying the majority of taxes in America . The people who own the companies are the worst , rich or not so rich , they benefit the most from the present IRS . They also provide the most economic spread for the overall economy , employees , economic involvement , etc.....

The DIFFERENCE IS, that there are differences between the perceptions of who is rich in tax breaks of self employment and and who is rich by other means , If one is "Trust Fund "rich their rate should be taxed higher than say one who is "write off rich ". Problem , the tax codes are deceptively and incredibly complicated for reasons that favor those with money by and because of the rich lobbying for tax legislation . There needs to be a tax code revolution in America . Flat taxes ? Graduated flat taxes ? And , it could eliminate half or more of the IRS employees . Ready for that ?

The average American doesn't understand the advantages -complexities of the tax system in America ,

It's extremely cpmlicated to say the least .I'm a fan of flat tax, no deductions, if the government could cap the amount they could take. And if that tax applied to individuals only. Corporations would have to pay a different rate. But, have you ever wondered what effect such a move would have on the economy? Half the IRS unemployed, tax lawyers and accountants suddenly without clients. Their entire staffs immediately unemployed. Entire industries where probably millions of people work seasonally suddenly shuttered forever. It could be one factor keeping a flat tax further away from happening.

But. Every economic system will be abused. Over time, wealth will find itself bottle necked at the top. I'm afraid I do see the necessity of shaking the trees in the forest occasionally, to make the fruit fall to reseed the forest so new growth can be achieved.Easy answers:

1. Market distortions lead to income distortions. Some people simply don't earn the money they make.

2. More wealth leads to more abuse of power, laws that favor the powerful, elected representatives that bow to their demands rather than run a true republic / democracy.

3. Divide total federal expenditures by the number of people in the U.S. It's a simple fact that we can't afford huge defense expenses (by far the largest discretionary expense category in the budget) without higher tax rates on the wealthy.

4. Extreme income inequality and weakening social networks (the conservative mecca) leads to more povery, more hunger and civil unrest.

Do we want to live in a country that provides more for those with the greatest wealth and less for those with the greatest need?

What values do we have in America?The values in America are a little warped at the moment. We were a land of opportunity. Many think they have the chance to become wealthy, if they work hard enough and are smart enough. To tax the rich would put them in jeopardy of being taxed when they reach that goal. They think you are attacking what they will be.

Unfortunately, opportunities for growth have dried up and 'the rich' many are railing about are not rich in the ways most of us could attain, or would if given the opportunity. These are those who control corporations which have slowly eroded the protections of the workers, are systematically removing full time employment opportunities to replace them with part time workers who have no benefits. These are people with golden parachutes, no matter how much they trash the company they head prior to leaving.

No one wants to believe themselves one of the little people but most are and our ability to affect change will get smaller and smaller, the longer we refuse to stand together.The values in America are a little warped at the moment. We were a land of opportunity. Many think they have the chance to become wealthy, if they work hard enough and are smart enough. To tax the rich would put them in jeopardy of being taxed when they reach that goal. They think you are attacking what they will be.

------------------------------------------

Well, Live to Learn, you do understand. Well written and I would have expected such grace from our side of ideological ledger. The problems is that the old days of Horatio Alger ideas are just that, not working anymore. Hard work is not its own reward. The reality in America is that these ideals have become much like the bunny rabbit in a greyhound race. There is the incentive to run but the vast majority will never attain to the lure. But, you are always encourage to run for it. And over time, it has become more and more the truth.

------------------------------------------

Unfortunately, opportunities for growth have dried up and 'the rich' many are railing about are not rich in the ways most of us could attain, or would if given the opportunity. These are those who control corporations which have slowly eroded the protections of the workers, are systematically removing full time employment opportunities to replace them with part time workers who have no benefits. These are people with golden parachutes, no matter how much they trash the company they head prior to leaving.

---------------------------------------------------

The haves are more than just 'haves" they now must make attaining financial success more inaccessible for the 'have nots'. That is how the system works.They have inordinate power in Washington and are more than happy to buy off legislators. Those legislators are diverted from supporting the masses that put them there. That is the danger to the very concept of democracy. You're are in fact, not blind, you can see the changes and where they are leading. Trump just said recently, that he does not want the poor or non-wealthy to hold positions in his administration. But, I don't trust the corporate class or wealthy to be running things with the best interests of the less affluent in mind, which are most of us.

------------------------------------

No one wants to believe themselves one of the little people but most are and our ability to affect change will get smaller and smaller, the longer we refuse to stand together.

-------------------------------------

While all wealthy people (institutionally) pose a threat, there is side one of the ideological divide which is more in a hurry to impose these disadvantages on people than the other.

This is where I come from and why I consistently resist the right and its ideals. There is no 'impartial' in this critical issue. You can't stand together with those that are adamantly opposed to the ideals that are to bring us together. While I am accused of taking sides, in regards to success in this struggle, there is only one side.As I've previously stated I think the bickering is counter productive. If we listen to each other most agree on problems. We'll have a better chance at finding solutions once we accept that fact because then we can truly listen to each other with respect, minus all of the fear mongering.

So, the points that you made in your original post is really of no concern to you? We may agree on the problems, but do we agree upon the solutions? I think that all the points that you brought up are reasons to fear for the future. Are you really willing to get at the solutions regardless of where it leads or in the interest of avoiding bickering, you are just content with the status quo?

"Are you really willing to get at the solutions regardless of where it leads..."

Are you? The typical liberal solution is, always and forever, and bandaid made of money in an effort to cover up the symptoms. A pain pill to make it all feel better. A face lift to make it look better.

But so seldom do they try to find answers...and then do something towards a cure.The conservative solution is to simply ignore it as part of their agenda and master plan in the first place?

Might as well - we don't have the money liberals want to cover up the symptoms and libs won't let us address the real problem. Good example might be guns: we are a violent nation, so libs want to confiscate (presumably with compensation) all the guns so we can kill each other another way. Never, ever, even trying to understand why we are so violent.

Or the problem of poverty: libs will shovel money forever, trying desperately to make it appear that we're all well off...while never even trying to solve what creates that poverty in the first place. This time, though, they simply guarantee that poverty will continue, with millions chained firmly to their purse strings and providing the votes to keep them in office. Let a conservative try to provide jobs and they'll promptly deprive him of the capital to do it with...either that or throw up massive roadblocks prohibiting such an act as we all know that all employers (except liberal politicians) are evil, wishing to create nothing but sweat shops for children."Might as well - we don't have the money liberals want to cover up the symptoms and libs won't let us address the real problem. Good example might be guns: we are a violent nation, so libs want to confiscate (presumably with compensation) all the guns so we can kill each other another way. Never, ever, even trying to understand why we are so violent."

---------------------------------------

This gun thing about every liberal wanting to take your gun is just more BS, Wilderness. You would not want me to say that all conservatives are bigots at heart, now would you? With the behavior of the GOP lately, it was all I can do to not say that.

---------------------------------------

Or the problem of poverty: libs will shovel money forever, trying desperately to make it appear that we're all well off...while never even trying to solve what creates that poverty in the first place.

" This time, though, they simply guarantee that poverty will continue, with millions chained firmly to their purse strings and providing the votes to keep them in office."

------------------------------------------------

While the GOP continues to vote to let the aristocrats control our future without challenge. It is obvious who I would trust the least. The Bread and Circuses talk of conservatives types is just that much more bullshyte. Conservatives do not provide jobs, they line their pockets. Check the out Scrooge McDuck Disney animated explanation as to how capitalism works. Sounds a lot like you, you really believe all of that stuff, don't you?

----------------------

" Let a conservative try to provide jobs and they'll promptly deprive him of the capital to do it with...either that or throw up massive roadblocks prohibiting such an act as we all know that all employers (except liberal politicians) are evil, wishing to create nothing but sweat shops for children"

----------------------------------

And without the law they would if they could create the sweathops, because they had no issue doing it in the not so distant past. They are just as corrupt now as they were then, if not more so. It is only government and the law that stays their greedy hand. No wonder a big part of their mantra is to get Government out of the way.

I"m sorry but what?

I see the problems. I thought that was what I outlined. What are the solutions? We'd have to work together to find the solution which works for both of us. It couldn't be all your way or all my way. That would be unfair. This selfish bickering is the problem. And, you have to admit you have made it clear that your way or the highway is your goal.

Rather than "provides more for those with the greatest wealth", don't you really mean "allow rich and poor alike to keep and control what they legitimately earn"?

Truly, it appears that you have fallen into the liberal trap of assuming that what others build is actually yours to do with as you wish.

Hey folks, I remembered hearing this example - relative to progressive taxation systems- once before, and since I think it fits this discussion I went hunting for it.

I apologize for the large block of cut-and-paste, but you have to see the example for it to make sense;

From: danieljmitchell.wordpress.com

The Tax System Explained in Beer

Now if I were into sarcasm, I would say, "Sure, That example doesn't mean anything, the rich just aren't paying their fair share!," but I'm not, so I didn't. ;-)

ps. the article also has a link to a video explanation of the "Laffer Curve" regrading progressive tax rates. It is an excellent, but simplistic, explanation of the crux of ptosis' "Eisenhower's years" of taxation perspective. I bet those interested in discussion, rather than just ideologue rant, will find it worth their time.

GAGA, Interesting story about the men and beer.

Lets have a sequel? It turns out that the tenth man owns stock in or owns the brewery or tavern that supplies the beer to all. The man uses his wealth to cajoles his representative to create tax breaks and subsidies for the beer and the brewers forcing the budget people to make a choice between food subsidies for children and advantages for the brewers. Rich people always seem to have this power and influence, they are never just 'customers'. With so many more people like the tenth man ultimately running things everywhere where critical decisions are made, it is not too hard to figure which will win out?

This is out there, I know. Your quaint example is mere arithmetic, but the reality is calculus.

Can we presume that the tenth man is actually paying? What about loopholes and offshoring?That is no sequel Credence2, that's a different story. How about addressing the point of the story as simply as it was made?

You "sequel" details have no bearing at all. The illustrated points were simply explaining the mechanics. So, rather than speculate, or add stuff to suit your perspective - what do you think is wrong with the point of the story - in its simple math form?

ps. you were right, that was "out there," way out there,

GAThat is no sequel Credence2, that's a different story. How about addressing the point of the story as simply as it was made?

I will, yes, on the surface it is pretty clear the point that you make. But do you really think that a member of the American aristocracy at the 1 percent are on a level playing field with the guy in the street?

What I say, when I think to the advantages that are enjoyed by the wealthy within a society that is virtually built for their advantage, well being and comfort in every way, why am I going to say that it is all equal?Well, at least we are making some progress Credence2. Now, how about a few more steps before we get to your "aristocracy at the 1 percent ."

Caveat: No facts in this, just made up numbers for illustration.

Let's use Famous Amos, of Famous Amos Cookies. The accepted notion is that Famous Amos started out baking cookies to scrape by, stumbled on a hit, and became rich - and famous for his story.

If that's true, and he went from scraping by to millionaire status, and then used that money, the tax system, and every other legal, and, moral, advantage he could find to reach hundred(s) millionaire status, does he go from Average Joe to Evil Rich Man in the process?

Now that he is in that really high income and net worth stratosphere, he can legally, and morally, let his money now earn money for him. Has he crossed a line from legitimate earner to Evil Rich man just because he no longer has to 'labor' for his income?

My question is..."When does a successful person become part of the broad-brush stroke of Evil Rich Man that doesn't pay his fair share?

GALet's use Famous Amos, of Famous Amos Cookies. The accepted notion is that Famous Amos started out baking cookies to scrape by, stumbled on a hit, and became rich - and famous for his story.

-------------------------------

Isn't he the guy that is now penniless, and had to litigate over the rights to his name as associated with his brand?

---------------------------------

If that's true, and he went from scraping by to millionaire status, and then used that money, the tax system, and every other legal, and, moral, advantage he could find to reach hundred(s) millionaire status, does he go from Average Joe to Evil Rich Man in the process?

------------------------------------------

The rich verses the poor is a reality of our existence. We only got along when there was a sizable middle class that allowed us all to delay the inevitable moment when such disparate interests collide. With rulings like Citizens United, it is obvious that the money changers are using their power to circumvent popular sovereignty. Are these the 'wise guys' that you were referring to when we were discussing the validity of Electoral College earlier? With the House of Lords lording over the House of Commons, democracy itself is threatened.

Think about it, how did the lords and nobles of old, while clearly in the minority, remain in power? America's very survival depends upon a balance between the affluent and everybody else, otherwise the guillotine will be brought out of the museum.

I did find that the income inequity of the 1 percent is more applicable to .001 percent which is probably a handful of folks that have skewed the ratio of financial advantage over the middle class beyond the point of just the 1 percent.

-------------------------------

Now that he is in that really high income and net worth stratosphere, he can legally, and morally, let his money now earn money for him. Has he crossed a line from legitimate earner to Evil Rich man just because he no longer has to 'labor' for his income?

---------------------------------------------------

it is not the 'big bad rich guy', it is a culture where it seems like they are accumulating power in all areas of American life to their advantage. I don't think that it is a fair exchange to cut almost 1 trillion in Medicaid over the next few years, threaten Vet benefits in exchange for tax cuts, that mostly benefit the wealthy. Would the conservatives say the same thing if I spoke of reducing defense outlays to save tax money? They would make a fuss. And as Panther has said, I defy the conservative who say that DoD can be profligate with money while we cut Meals on Wheels. This is a clear wealth transfer.

I am always going acknowledge the wealthy and their right to a bigger box of corn flakes than I can buy, but that is limit of the advantages that they should enjoy and it is enough. Who writes the tax codes, and changes the laws? But if they use their superior resources and access to the powerful to the detriment of the man in the street, there will be 'trouble in River City'. But, I no longer labor for my income, so who am I to talk...

---------------------------

My question is..."When does a successful person become part of the broad-brush stroke of Evil Rich Man that doesn't pay his fair share?

-----------------------------

That is a difficult question to answer, I have to do more study of the tax codes to attempt to answer it.Hey Cred, we are really rolling along now. At least we are refining the application of the "evil rich" label. And that's too bad about ol' Amos. I hadn't heard. But he did serve to illustrate my point.

Now if only I could justify nitpicking your response for points I disagreed with... and there are several. But that wouldn't be very productive, because there are more points there that I do agree with.

I also think our situation of serious wealth inequality is a festering problem, but I don't blame it on the rich. I also think the results of the Citizens United decision are very harmful to our political election system, but I don't think the Court's decision was wrong. I think the issue needs a legislative answer.

And unfortunately, I too think we are heading for "trouble in River City," but perhaps not for the same reasons as you. Or, on the other hand, our reasons might not be too different. *shrug*

Damn, I am just feeling too mellow tonight. Maybe tomorrow night will be more exciting. ;-)

GA

- Will Apseposted 8 years ago

0

It is worth noting that when taxes on the wealthy were high during the fifties and sixties, Western economies were booming.

Investment and philanthropy were tax deductible then as now, so there were serious incentives to

a. fulfill a useful role

b. do something for your country (or even other people's)

There was less incentive to use wealth to pursue personal political agendas and undermine democracy, as many billionaires do at the moment.I keep hearing that - that back when the wealthy paid huge taxes, as much as 90%.

It's not true of course - there is a vast difference between the top tax rate and the effective tax rates actually paid. Isn't it time to drop that tired claim and substitute the truth, that the wealthy are paying more now than at almost any time in the past?

- Will Apseposted 8 years ago

0

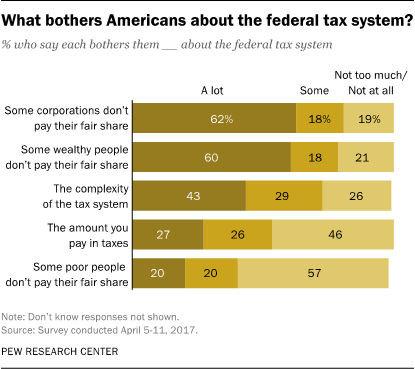

Just a note on what people are most concerned about in regard to taxation in the US, from the Pew Research Center:

http://www.people-press.org/2017/04/14/ … air-share/IDK why some people insist that higher taxes for the rich is somehow stealing "hard work" when the rich have been stealing from the poor in more ways than one.

"The Senate bill, unveiled today, is not a health care bill. It’s a massive transfer of wealth from middle-class and poor families to the richest people in America. It hands enormous tax cuts to the rich and to the drug and insurance industries, paid for by cutting health care for everybody else."

-former President Barack Obama, June 22, 2017

Yeah, that doesn't sound fair.

The top 1 percent of wealth holders own almost 40 percent of all wealth. And the top 10 percent hold almost 90 percent.

Money was appropriated for the top in hopes that it would trickle down to the needy,” - Will Rogers.

Trump's Trickle down economic plan means the middle-class are squeezed as most of the gains go to the 1%

Why would you - a middle class person - support Trump's plan? A few people are getting rich at the expense of the rest of us. Trump's plan is just a bunch of old bad ideas including the perception that somehow money trickles down to the poor.

" the GOP has never confronted one salient point: The Laffer curve has no numbers. Even if the theory is correct—and experience demonstrates it is not—the curve itself proves there is a point at which tax cuts become irresponsible, causing deficits to explode. Remember, it is the Laffer curve, not the Laffer declining vector. So where on that curve is the perfect tax rate to bring in the most government revenues? The empirical analyses conducted by independent economists have come up with 68 percent, 70 percent and 35 percent—all higher than the current rate of taxation, and much higher than what the Trump tax-cut plan is proposing. " - http://www.newsweek.com/trump-tax-cuts- … tic-590903

"The remedy that Summers and Balls – and Chang – propose is: higher wages for ordinary workers, higher rates of tax on the super-rich and corporations, as well as a co-ordinated international closure of tax loopholes, with the money used to finance more public infrastructure investment." - http://www.independent.co.uk/news/busin … 89183.html- Will Apseposted 8 years ago

0

Essentially what the right offers is this:

The power to choose between Apple, Samsung and generic Chinese goods.

The power to decide how much time to spend at the mall

And the freedom on offer?

Freedom for the right is about the freedom of business to get along without oversight, so there is nothing there for ordinary folk.

But what do ordinary right wingers hope for?

They hope to be left alone. No demands from government and none of that difficult decision making for the future. They want to leave that to their betters. Mmm, nope does not explain our differences.. it actually supports my position. A multi-billionaire gets involved in politics to further steal money of the backs of other people. I thought you didn't like leeches......

Really? Then you think your cause is better than his, so the fruits of his labor are really yours to do with as you wish. As demonstrated by the comment that he is stealing his own money from the backs of the people that have claimed it as theirs.

Pretty much what I said, isn't it? But you didn't indicate how you justify it - is it just that your cause is superior in your opinion and therefore his earnings shall belong to you instead of the one that earned it?

- PrettyPantherposted 8 years ago

0

Without reading through this whole thread....

I'm going to share a real-world example that is exceedingly simple to understand.

When I was a young, working, single woman, I was roommates with my friend Deana. She was the best roommate I had ever had. We were compatible in every important way that roommates need to be. We shared an apartment that she could afford. We both worked full time, and I made considerably more money than she did. I wanted to move up to nicer digs in a better neighborhood, but she would not be able to afford half the rent. I could move up without her and pay full price, or I could search for another roommate, knowing that the chances of finding one as compatible as Deana were small. To solve this problem, I proposed we pay a proportion of rent and utilities based upon our salaries.

So, for example: I made $4,000 per month and she made $2,000 per month for a total monthly income of $6,000. Our rent was $1000 per month. Since my income was 2/3 of the total income, I paid 2/3 of the rent, or $667, and she paid 1/3 or $333. I wanted to live in a nicer apartment in a better neighborhood and was willing to pay more since I had more. I could have moved up to these nicer digs without a roommate, but it would have cost me more; or I could have looked for another roommate and risked having a lousy one. To me, this was an equitable arrangement that benefited me financially and gave me peace of mind.

This is how I see living in this country. I want to have well maintained streets, a public library, museums, pretty parks, drinkable water, healthy food, and other amenities. I also want my neighbors to have them, even if they cannot contribute quite as much. Because, if they don't have them, it creates an unpleasant environment for me. If my neighbors work a minimum wage job and struggle to feed their children good food, or pay the rent, or keep their car in good order to get to their jobs, or don't have enough money to go to the doctor, it ultimately affects me and my pleasant environment. Hungry children don't learn as well and grow up with greater societal problems; people who avoid going to the doctor because they can't afford it ultimately cost their employers and society a lot more money; someone who can't afford a roof over their head camps out in the city and creates rubbish and unsanitary conditions. You get the idea.

This is how I see it. I know some of you think this means I want to "steal" your money, but no, it just means that I want this world to reflect my values, just like everyone else does. We all get to choose the people who create the laws, including the taxation laws, so it is not "stealing" when these duly elected people decide to raise taxes, just like it is not "charity" when they decide to lower them. It is just a reflection of their values and what they want our society to be.

I want our people to be educated, civil, cultured, healthy, and productive. I want my surroundings to be attractive, harmonious, efficient, and pleasant. To achieve that, I am willing to pay more taxes, and I will vote for those who believe it is acceptable for the very wealthy to pay even more. It is not a one-to-one ratio, but it is generally true that those who make vast amounts of money also use vast amounts of resources, compared to those who don't. They could not make that money without the organized society in which they live. It benefits them to keep that society humming along so they can continue to make money. We seem to have forgotten this basic idea, and we seem to have forgotten that the lowest wage earner is just as essential to the efficient running of the economy as the highest wage earner, and it benefits all of us for that low-wage earner to be healthy, educated, and productive.

Just my two cents.Your story is admirable, and it is what makes the world go 'round. We all do it, from providing the extra for unaffordable rent to picking up the restaurant tab for a friend down on their luck to donating unused toys to the Christmas fund of the Salvation Army.

But there is a fatal flaw in the story; it isn't what we're talking about here. It needs changed to represent what we are seeing today. Instead of picking up the extra rent, you visit Joe, the man that lives in the mansion down the street and, at gunpoint if necessary, force him to cough up the funds. The next year you realize you haven't seen a movie in over a year (can't afford it) so you force Joe to provide for that, too. It's in a good cause, after all - keeping you happy and comfortable without the ugly necessity of actually doing anything to earn it yourself.

And then Bob and Carol, living in your old neighborhood, see what you did and like the idea. They gather up their own guns (politicians, IRS, police) and pay a visit to Joe themselves, forcing him to pay for their new digs.

It still isn't enough; you think of those poor people living in that decrepit neighborhood where you were and begin a program nation-wide to convince everyone else to visit their own "Joe's" and forcibly take what they want to improve their lives, too.

It hasn't cost you hardly anything for your new digs: Joe footed the bill at gunpoint. None of the others paid anything, either; only Joe and his friends. It has gone from admirable altruism and generosity to forcing others to pay for what you and others want but cannot afford.

This is what we're seeing. A well organized program to forcibly take what we want but cannot afford from those that can afford it. We are providing very little of the charity we slap ourselves on the back for providing - the "Joe's" of the country are paying for it all. All we've done is convince people that they can have what they want if they will only gather a large enough force to take it, whether Joe wishes to give it or not. And we rationalize it by saying that without us Joe wouldn't be wealthy, so that wealth, legitimately and legally obtained, actually belongs to us. We even claim we're willing to pay the bill ourselves, while continuing to take it (and more every year) from Joe so it doesn't actually cost us anything at all.

This we call "moral" and "ethical".You continue to insist that duly elected representatives voting to levy taxes is "theft." It isn't. We've had this discussion many times. I don't like everything my taxes pay for, but I don't whine that the government is "stealing" money from me to pay for drone strikes. I notice you don't, either. Rather,, helping people is your particular bugaboo.

,

You can vote for those who represent your values and I'll vote for mine, but to claim that legally enacted taxes are theft when you willingly participate in this organized society is ridiculous. No one is holding a gun to your head forcing you to live in this particular system of government, so if you choose to stay and enjoy its benefits, you cannot legitimately claim you are being "forced" to pay taxes. By choosing to live here in this organized society, you agree to its rules.

Panther, I guess that I was looking for these words, dancing around the principles that you explain so well, before our crusty and flinty conservatives friends who are penny wise and pound foolish.

It is the same with health care, before ACA, are we to go back to emergency room medicine with folks without insurance in an auto accident using tax payers money for care or leaving him or her on the road to expire because of no insurance? With Trump and the GOP you're not going forward, you've gone back.I feel like our humanity is slowly ebbing away. We live in a country where half the citizens think its okay for rich people to live and poor people to die, as though money is itself a virtue.

When a rich man hires wily tax accountants to legally avoid paying taxes, he's "smart." When a disabled veteran legally receives extra compensation from the government for his disability, he's "double dipping." When a rich man legally guts worker retirement accounts to further line the pockets of his rich cronies, that's "just business." When a poor man takes advantage of a legal loophole to get an extra couple hundred dollars in government services, that's "gaming the system."

These same people accuse us of hating the rich. Not true. It is they who demonize the poor and exalt the rich, when both are merely looking out for themselves, as humans are wont to do."I feel like our humanity is slowly ebbing away."

I agree, although it truly seems like the idea of "I can have whatever I can grab" is my reasoning. Our society is absolutely rampant with theft, from cars (to joyride in) to shoplifting to fraud and no one seems to really care. The concept of forcing the rich to pay for what we want but don't want to pay for is just another example of the same attitude. When it comes to giving charity, we are among the generous people on earth, bar none. It's just that wee problem of deciding that we know better than the owner how their money should be spent, so will take it for our own purposes that bothers me. A lot.

Disabled vets: I have some problem with vets and disability, but I think you would too if you were in my shoes. In general, a vet missing a leg, or with PTSD or some other real disability is absolutely entitled to whatever it takes to give them a comfortable life. I saw the thread on that and couldn't reply because I was too angry - those people are due far more than they get.

But it IS a little funny to see your other generalizations. You DO realize that the exact opposite is just as true: the poor that manages to get more charity is "smart" while the rich man using tax loopholes that are just as legal is evil. If we don't hate the rich then it's long past time to quit vilifying them ("it is the rich who demonize the poor and exalt the rich") for doing the exact same things the rest of us do. Earn as much as we can, and take every tax deduction we can find.

And a good two-cents it was PrettyPanther, And also one I think, with a basic logic that most of us conservative-minded folks would agree with. But your example was one of generalities, and it is the specifics where our ways part.

Good roads, good schools, good personal security are things all of us want - and are willing to pay for. And most of us are willing to pay to help poorer folks reach a better life. And we are willing to help folks in dire temporary circumstances. In short, we, (of course my "we" is an assumption of myself, I don't speak for the category), are willing to pay more taxes to help folks with basic needs needed to improve their life too.

Our, (us conservative-minded folks), 'problem' with this "the rich aren't paying their fair share," and "those evil rich" mantras, is that we believe there are limits, and the "tax them more" folks don't seem to think there should be any. Our "rich" already pay more. When I went looking, I found that in 2014 the "rich." (income over $200,000), paid 55% of all income tax revenue, but only earned 26% of all money earned in the same year*. (I would bet that that number is even higher now)

*I did not verify this, just took what I found

Our government establishes poverty levels to determine income levels for assistance, yet uses numbers that are 3 or 4 times that level as eligibility thresholds. Geez, I remember hot dog and potato soup dinners as we got closer to payday, but by today's levels we could have been having steaks. Limits. That what the "tax the rich more" crowd does not understand. And that's why some folks look at it as theft. The rich are already paying the lion's share of support of our country, but because compassionate folks think a hot dog dinner is inhuman, they are demanding that the rich pony up some more.

The biggest point to take away from your story was that you 'chose' your actions. Nobody forced you. Your roommate didn't demand that you pay 90% of all costs, and toss in free HBO and Netflix - just because you could afford it. It is a different matter with the "tax the rich more" mantra.

GAYet, conservatives, right now, are working on a bill that would result in the loss of health care for over 20 million Americans that includes deep cuts to Medicaid. This, with a budget for increased defense spending far above what was even requested by the defense agencies, and elimination of effective social services like Planned Parenthood and Meals on Wheels. And, tax breaks for the wealthiest Americans.

Does this reflect your values? I have to think it reflects the values of most conservatives since they are now in control of the purse strings.

Is needing expensive drugs to treat your chronic illness a "temporary emergency"? If not, do you propose poor people just do without? Or, would you support diverting some funds from defense to health care? If not, are you saying you value excessive defense spending over your poor neighbor"s life? If so, why are conservatives supporting the meanness, the values demonstrated, by the proposed health care bill and budget?

Where you spend your money and who you vote for speaks volumes about your core values, and from where I sit, modern-day conservatives, as a whole, are uncaring, selfish and very short-sighted. Why do I say this? Look who they have put into office and look at what those elected representatives are doing.PrettyPanther, I do enjoy our discussions, but you are making me feel like the the guy that pees in everyone's cheerios.

Just addressing your medicaid and 20 million folks losing coverage point. I think you are looking at it from an unrealistic emotional perspective that ignores a few hard truths. I am going on memory here, (which isn't as sharp as it used to be), so just hold me to the concept, not the exact specifics.

You may be aware of this, but your comment leads me to believe that you aren't. And I am not addressing the GOP's plans at all. Just the reality of those incomplete Medicaid issue claims like yours.

The picture of the "Medicaid expansion" that gave so many millions of folks free coverage is this: It was part of the Obamacare package. A carrot and stick option/mandate. If a state chose to go the expansion route, then the Federal government would cover its increased medicaid costs - for a limited period of time, and I think I recall that fed coverage was a decreasing amount, until it ended - this year, (2017), I think. (except for that state Senator that traded his "no" vote for a "yes" vote in exchange for a Fed guarantee to pay his state's expanded medicaid costs forever). If a state did not choose the expansion option, then there were drawbacks, I just don't recall what they were.

For illustration, a small population state, like Wyoming or Vermont, might have a billion dollar, (or two, or three), total budget, and the medicaid expansion costs might be three or four hundred million. Of course that is not a problem when the Fed is paying it, but, as many of the state governors that did not expand, considered, how would the state pay those costs when the Fed money stopped? That was also one reason the mandate was so important. It was the mandate money that helped the Feds pay for those state medicaid expansions.

So, the Fed money stops, and now those small budget states have to find a way to generate and additional three or four hundred million dollars. How are they going to do it. Tax increases! How would you feel if your state taxes jumped 30%, (or so), to cover that shortfall?

Your emotional consideration is to condemn the cold-hearted choice to end the expansion and toss those folks off the rolls, but the reality of the choice is that your state just does not have the money to fund the expansion. What do you do? Cut other essential programs, (like Meals on Wheels-types), raise everyone's taxes, (on an already tax burdened population), or what?

*(I think I recall California needing to come up with an additional $40 billion)

Put those shoes on PrettyPanther. Be the governor. How would you get another 20% or 30% budget increase? What would you tell your citizens? Does your state have a defense budget you can gut? Does your state have enough of those "evil rich tax dodgers" that you can soak for more money to cover the loss of those Fed funds?

Now, take that question to the federal level. What's to be done? Of course! Tax the evil rich some more. And consider while doing so, that the medicaid expansion threshold was lowered to as much as 200% of the poverty level. To the point that some families that could have gotten an Obamacare plan with a huge, (50-75% subsidy), could now choose to get on medicaid and get it completely free. Would you be OK with paying for that family's total healthcare, when by the calculations applied to the population in general would have required them to pay at least some part of their healthcare coverage?

It sure seems like you are blaming the Conservatives for something, that when viewed outside the bubble of party ideologies, isn't nearly what it is made out to be.

GAIt's getting late, so I will reply tomorrow. Here is an explanation of Medicaid funding through the ACA. http://www.kff.org/medicaid/issue-brief … lications/

"Enhanced Matching Rates. In some instances, Medicaid provides a higher matching rate for select services or populations, the most notable being the ACA Medicaid expansion enhanced match rate. For those states that expand, the federal government will pay 100 percent of Medicaid costs of those newly eligible from 2014 to 2016.1 The federal share gradually phases down to 90 percent in 2020 and remains at that level. There is no deadline to adopt the expansion; however, the federal match rates are tied to specific years."

GA, did you see the link I posted above, about the tax savings for Sheldon Adelson?

https://lasvegassun.com/blogs/elsewhere … bill-by-m/

His current tax includes, as a small portion of it, a 43 million dollar "contribution" to ObamaCare. 43 Million dollars! And that is only because of the 3.5% ObamaCare tax - he still owes the rest of his taxes, which will dwarf that figure. Yet it's "unfair" that he pays so little and it is a virtual crime that he may get to keep control of it if the newest version passes.

But it is his 0.12%. He already pays his legal tax obligations - in the range of tens of millions of dollars. Why do you think you have a right to that additional 0.12%? Just because it's a tiny percent? How about 3.5%, would that be Ok too. It's only $43 million of his money. He can afford it right? So it's Ok for you to demand it, right?

Geesh.

GA0.12% of my net worth amounts to about $500. Yes, $43 million is a lot, but it hurts Sheldon no more than that $500 would hurt me, which is not at all.

Geesh.Rationalizing that small percentages won't hurt him if you take his money doesn't change that you are taking it, possibly against his will. That you, not he, is determining how best to send his earnings.

It is also no more than rationalization that because you have decided your cause is just it means that he must agree that it takes priority over what he thinks needs to be done with his money.Sigh....Of course, it's not up to me personally. That 3.5% was passed by our duly elected representatives. It is now about to be repealed by our duly elected representatives. See how that works?

Yep! The majority, those with the guns, IRS, FBI and cops decided they wanted what they didn't have.

Does it make it right that a large group with the necessary force takes it instead of just you? The Europeans took America by force - was that right, too (by modern standards, not those in effect at the time)? History is replete with such examples - does might make right then?

Hold on there PrettyPanther... "Geesh" is mine.

Your rationalization is an example of the problem with these "tax the rich more" demands. That $43 Million can be so easily minimized as 'peanuts' just because the owner can afford it.

No matter what size the percentage - $43 Million is not "peanuts."

Reminds me of budget cut efforts. $100 Billion might need to be cut, so a $100 million cut isn't worth the bother. Geesh.

I think that looking at any number of millions - one or forty-three, or one hundred, as just pocket change is crazy. And that is the main rationalization behind demands to tax the rich more.

GAAre you saying that dollar amounts are never relative? My parents paid $4,000 for the home they lived in for 65 years until they died. If they paid $4,000 for it now, it would indeed be peanuts to them. When they bought it, it was their biggest investment and a large chunk of their money, definitely not peanuts.

So, yes, $43 million to Adelson is like $500 to me. Peanuts,"I think that looking at any number of millions - one or forty-three, or one hundred, as just pocket change is crazy. And that is the main rationalization behind demands to tax the rich more."

I want to address this statement. I agree with you that every dollar amount matters when looking at a budget. However, if you're dealing in trillions and you're attempting to balance a budget that is, say, in a multi-billion dollar deficit, then you're going to have to look at larger amounts when considering both expenditures and sources of revenue. Yes, $43 million is a lot of money but its a drop in the bucket when considering the federal budget in its entirety.

Now, for your comment that looking at $43 million, or any amount, as just pocket change is "the main rationalization behind demands to tax the rich more." I do not think it is the main rationalization. There are many economic reasons why the super wealthy holding onto their money is bad for the economy. I'm not an economist by any stretch of the imagination, but it is clear that something is out of whack when economic gains consistently benefit the super rich while the middle class continues to stagnate. Money that is hoarded is not circulating back through the economy, which is why the economic gap keeps widening. Higher tax rates for the wealthy ensures that money flows back into the economy, which stimulates business and helps keep the middle class strong.