The Folly of Trickle-Down Economics

Trickle-Down Economics is an economic theory whereby if the Government gives the wealthy a cash injection that they will invest that money in the economy which in turn will stimulate economic growth.

However, in practice, rather than investing the extra money in the economy there is a great tendency for the wealthy to syphon the money off into savings, which has no economic benefit e.g. counterproductive.

Because of the ‘cost of living’ crisis and the ‘Energy’ crisis, on the 23rd of September Liz Truss, who became the newly appointed UK Conservative Prime Minister on the 6th September, held an emergency ‘mini-budget’, in which it was announced that the top rate tax for the 1% highest earners would be cut from 45% to 40% (trickle-down economics).

In making that decision Lis Truss refused to accept advice from the UK Government’s Official Independent Economic Advisors, and did not heed the warnings from senior Conservative MPs (politicians) who advised against her making such a political decision at this time.

The immediate effect of such a policy was a dramatic and sudden fall in the £, bringing it to near parity with the $ (something previously unheard of); making imports more expensive and thus exasperating the already hyper-inflation.

The IMF condemned such a policy and advised to the UK Government to reverse its decision.

The Bank of England (unprecedentedly) condemned the Government’s action, and on the 28th September stepped in and bought £65 billion of bonds to salvage the economy from the damaged caused by the UK Government’s ‘poor’ fiscal policy.

Also, the Bank of England, indicated that as a result of such a policy, it would have to raise Interest rates dramatically over the coming year, which would have pushed mortgage payments up as dramatically, at a time of a cost of living crisis, causing misery to millions of home owners; and in response many banks started to refuse ‘new’ mortgage agreements because it was obvious that home owners wouldn’t be able to afford the mortgage repayments with interest rates being so high.

Quite naturally, the opposition parties condemned the policy to cut the top rate tax, and also around two dozen Conservative MPs (politicians) also condemned their own Government for such a poor/damaging decision.

And perhaps more worrying for Conservative MPs, within days of the mini-budget to cut the top rate tax support for the Labour Party in the ‘Opinion Polls’ shot up dramatically: Labour(socialists) now have a 33% lead over the Conservatives (capitalists) in the opinion polls; which if maintained until the General Election in two years’ time would mean a landslide victory to Labour – So quite naturally a lot of Conservative MPs, who are set to lose their seat in the next General Election if Liz Truss can’t reverse the Conservative Government’s current unpopularity, are quite naturally shitting themselves!

As a comparison, at the last General Election in 2019 the Conservatives had a 10% lead over Labour:-

• Conservatives = 43%

• Labour = 33%

In last week’s Opinion Poll (following Liz Truss disastrous mini-budget) Labour has a 33% lead over Conservatives:

• Labour = 54%

• Conservatives = 21%

Labour Surge To Massive 33 Point Lead Over Tories In Latest YouGov Poll: https://youtu.be/wkF8qU9CZJA

In spite of Liz Truss (in typical Margaret Thatcher Style) said she is ‘Not for Turning’, yesterday (just 10 days after announcing that she was to cut the top rate tax for the 1% highest earners) has done a dramatic U-turn – And abolished her plans to cut the top rate tax.

Within hours of Liz Truss doing a U-turn, and scrapping the proposed top rate tax cut, the value of the £ jumped back up to its pre-mini-budget levels, the value of UK Government guilt-edge bonds rose back to their pre-mini-budget levels and the Bank of England indicated that it wouldn’t need to raise interest rates to such high levels that it was predicting last week; all of which has helped to calm the markets.Arthur, the money cycle is way more complicated. You just can´t assume that a lowered tax differential allows money to be taken out of the race track just because evil wealthy do so.

I think it is just the opposite, at least to some extent. Me think a higher disposable income leads to higher investments. Because that is what average wealthy do: They put their money to work, they invest, create more productivity, try to achieve higher profits.

Now - we can argue if higher disposable income for the not so wealthy creates enough consumption to do the same trick.

My take: Consumption does have an effect (but only for one rotation of the money cycle). Investing money, creating productivity is far more effective because it works for repeated cycles (until investment wears down and gets less productive and requires replacement).

So - trickle down economy works, if you are on the "investors" side of the economy. It does have its limitations though when it comes to the "consumer" side of the economy.

I have no degree in economics and no insight into British politics, but could it be that above assertion helps to explain the two opposite approaches of British conservatives? Ms Truss supporting the investors, Mr Sunak supporting the consumers? Just thinking..Yep, I concur that the “money cycle” (circular flow of income) is way more complicated than I’ve expressed in my opening statement; you could write a whole thesis on it and still only scratch the surface. I do have qualifications in economics (and economic history) and obviously an insight into British politics - which makes the subject more interesting to me on an academic level.

What you say is correct if the MPC (Marginal Propensity to Consume) is high e.g. 80%; that being where people spend/invest 80% of their additional cash injection, and save 20% (Marginal Propensity to Consume): In such a scenario for every $1 the Government injects into the economy (be it in the form of tax cuts to the rich or increased benefits to the poor) the net result over a period of 18 months to two years is that that $1 will grow the economy by $5 (the Multiplier Effect).

The formula for calculating the Multiplier Effect is explained in laypersons terms in this short video:-

The Multiplier Effect (In less than 5 minutes) https://youtu.be/lShcx6hLy24

In theory you are right; higher disposable income given to the wealthy does lead to higher investments; that is what the ‘Trickle Down’ economic theory is all about. However, in practice it does not always work, that’s why the Conservative Government did a win-fall tax on British banks in 1981 and on the British oil and gas industry in 2011; and why the Conservative Government are currently under political pressure to do a win-fall tax on the British oil and gas companies during the current cost of living and energy crisis.

To elaborate, around 50% of our natural gas used in Britain comes from British oil and gas companies, like SHELL and BP, and these companies are selling their gas to the British Utility Companies at ‘World Market’ prices (which is extremely high at the moment due to the Ukraine war): Therefore the British oil and gas companies are making insanely huge profits; more profits than they’ve ever made before.

Therefore, last year Boris Johnson (the then Prime Minister) was under considerable political pressure to do a win-fall tax on the British oil and gas companies and use the money to bail out the Utility Companies who were having to pay more for the gas than they could legally sell it to consumers because of the price cap that Ofgem (Government Regulator) had imposed on the Utility Companies.

However, Boris Johnson refused to do that, with the result that 31 of the 55 Utility Companies went bankrupt last winter. Boris Johnson’s reason for refusing to do a win-fall tax is that he wanted the British oil and gas companies to use their extra profits to invest in Renewable Energy; which to some extent they are doing, but not to the extent that the Government would like e.g. most of their extra profits is going into savings, not investment in the economy. And the current Conservative Government has no intention of doing a win-fall tax because it’s contrary to her political ethos.

In economic terms it doesn’t make any difference whether the money is invested in the economy or spent in the economy, it all has the same ‘Multiplier Effect’ e.g. give a low paid worker or an unemployed person an extra $50 each and they will spend most of that money in the shops to buy food etc., that increases demand, the knock on effect being that the shop keepers, receiving all those extra $50, and increased demand for their stock, will buy more goods from their suppliers, and employ extra staff because the shops have become busier. The net result is that the suppliers increase their orders to the manufactures, increase production, and employ more staff, and so on across the whole supply chains. And with the increase in employment, more people are earning more money (and paying more taxes) and thus you get economic growth and an increase in Government Revenue through more people in employment paying more taxes.

So whether the Government gives an extra cash injection to the wealthy, in the form of top rate tax cuts, or an extra cash injection to the poor through increased welfare benefits; in economic terms (in theory) you should get economic growth because of the ‘Multiplier Effect’; in practice, how successful that is, is dependent on how high the MPC (Marginal Propensity to Consume) is, the higher the MPC, the more successful the economic strategy.

The big question is, how effective is ‘trickle-down’ economics (often favoured by right-wing governments), and how effective is ‘trickle-up’ economics (often favoured by left-wing governments).

There is little doubt that trickle-up economics is effective because the poor can’t afford to save, any extra money given to them by governments will be spent, and thus the MPC will invariably be high. Whereas there is less evidence in the real world that ‘trickle-down’ economics is as successful. A couple of American Republican Presidents tried ‘trickle-down’ a few decades ago, and subsequent studies found no evidence that it had any real impact on the economy.

And most certainly, when Liz Truss tried it in her mini-budget last month the financial markets recoiled, causing the UK economy to crash; and the trickle-down policy was condemned by financial and economic institutions across the world, including the IMF (International Monitory Fund). And within hours of Liz Truss doing a U-turn and abandoning her trickle-down policy the UK economy perked back up e.g. the value of the £ returned to its pre-mini-budget level etc.

So it’s not just me condemning trickle-down economics, it was a concept that was condemned by the IMF, Bank of England and even the UK Government’s own official independent economic advisors (Office for Budget Responsibility). If such institutions condemned Liz Truss (Prime Minister) for trying to implement ‘trickle-down’ economics in the way she did at this time, then that must send a clear message that such a policy isn’t as easy as the theory.

The worry that the financial markets had of Liz Truss trying to use ‘trickle-down’ economics at this time was their lack of faith that the cash injection to the 1% wealthiest would have been invested in the economy and that consequently it would have left the Government with a big hole in its finances that would have to paid for either by ‘additional Government borrowing’ and or by cutting welfare benefits to the less well-off and poor; neither option of which would be economic sound.

IMF issues a rare & stinging rebuke to the UK: https://youtu.be/jGIklOjPhOUIt seems to me that the "trickle up" theory is just as deficient.

Assume you give all the poor and needy a $50 bill. They spend it, of course, and in numbers that might require additional labor. But then it is gone, the surge in business dies and the extra help is laid off. The economy, and the poor, return to what they were.

That doesn't include the multiplier effect, and the effect will last a little longer because of that, but in the end nothing has truly been accomplished by giving charity, and those in charge look with dismay at the poor that are still poor...deciding that they must do it all over to accomplish anything.

And the end result is a society founded on charity, on playing "Robin Hood" and forcing people to give up what they've earned in order that others can have more. Unless balanced very carefully, a downward spiral resulting in the loss of those footing the bill (as the rich leave).If it wasn’t for the ‘circular flow of income’ yes; but in economic theory all those poor people spending their $50 in the shops, increasing demand leading to the hiring of additional labour creates jobs e.g. more people earning more money, and thus spending more money, generating more demand; ergo economic growth. In economics the whole process isn’t instant, but any change in the money supply (as part of the circular flow of income) is recognised as generally taking between 18th months and two years to work its way through the system.

The long and the short of it is that money doesn’t just get spent and then disappear in a black hole, it gets spent over and over again (circular flow of income, and the multiplier effect) e.g. what you spend in the shop becomes income to the shopkeeper, the shopkeeper uses that income to pay your wages and in return you use your wages to buy goods in the shop, and so on: and at each stage it gets taxed so the government receives tax revenue on that money multiple times, so that if the MPC (Marginal Propensity to Consume) is high enough e.g. 80% then that money will grow fivefold within two years, and the Government will get the money back in taxes that it gave out in the first place.

Of course, putting theory to practice is another matter, easier said than done; and thus Governments use economic advisors to help them formulate their policies.

These short videos explain in layperson terms what I’ve just said above:-

• Circular Flow Model https://youtu.be/YNfIlfua6L0

• The Multiplier Effect https://youtu.be/RqWYmQQzXxs

Carefully reading what you wrote, I think that if I’ve understood correctly, that if the $50 to each of the poor is just a once off payment that the effect will not be long lasting; which seems a valid point. However, if the extra $50 was an increase in benefits e.g. an extra $50 per month, then the effect would be to stimulate economic growth; and if the MPC (Marginal Propensity to Consume) is high enough e.g. 80% then it’s not charity as (as explained above) the Government will get the money back as it gets taxed multiple times in the ‘circular flow of income’ e.g. taxed every time its spent or given back in wages etc. So if balanced very carefully, for which Governments are reliant on their economic advisors to advise them on, then increasing benefits in such a way can be self-financing. Likewise, cutting benefits can have the reverse effect and cause the economy to shrink, leading to less tax revenue for the Government.One final thought:

If the Government gave the poor too much money too soon, so that they had more money than they need to survive, then the poor would begin to save the money rather than spend it (Leakage) – and that would then become what effectively you describe as ‘charity’: So getting the balance right is a ‘fine’ art.Government does not "give" any money, even in your socialist countries. It steals from people who work and then after it has paid its tax collectors it redistributes what it wants. Charity is when someone gives away their own belongings.

Government NEVER does that.Agreed. Which is why government "charity" is finely tuned to not make the recipient ever more dependent on government. As soon as some form of independence is shown they are again spun into the ring of poverty. If they have the temerity to take on a job and pick up $50, $100 will be taken from their next charity check.

At least that's how it works in America; I can't say for the UK.It’s a little different in the UK:

Over the decades the welfare system has become very complex and confusing, and for the past 10 years the conservatives have been trying to simplify it by merging all the different benefits into one single benefit (universal credit) e.g. the idea that ‘one size fits all’?

But in essence, under the British Benefit system:-

• If you are unemployed then you are allowed to earn up to £20 ($22) per week without it affecting your unemployment benefit.

• If you are unemployed you are allowed to have up to £16,000 ($17,744) in savings without it affecting your unemployment benefit.

• If you are unemployed, and you can prove that you are actively seeking employment (Jobseeker’s Allowance), then you get increased welfare benefits e.g. higher benefits than a person who is unemployed and not seeking employment.

• If you are on benefits because you are on a low wage then for every additional £1 ($1.11) you earn you get £0.55 ($0.61) less in welfare benefits; until a point is reached where you no longer get benefits.

The whole welfare system in the UK is designed to encourage (reward) unemployed people for actively looking for work, and to give them an incentive to earn more (rather than discouraging them from earning more) by reducing their benefits gradually, as they earn more.

Traditionally all benefits are increased annually by the rate of inflation. However, at the moment there is a major dispute within the Conservative Party because Lis Truss (our new Prime Minister) wants to increase next year’s welfare benefits in line with wage rises which is expected to be much lower than the current rate of inflation; while many Conservative MPs want her to increase benefits in line with inflation. Although Liz Truss has already announced that next year’s pension’s increase will be in line with inflation e.g. 10%.Here is an article from a left-UK journal:

"For 9.6 million families, benefits make up more than half of their income (30% of all families)" The UK as twice as many people as Califoria. California has about 600,000 families depending on welfare. Even if it had twice that there is quite a difference between 1.2 million and 9.6 million.

https://www.theguardian.com/politics/20 … acts-mythsYep, and so what; it’s not as if the UK’s current benefit system, which was founded by the Labour (Socialist) Government in 1948 has crippled the UK economy, if anything its enhanced it e.g. the UK is one of the more wealthiest countries in the world, a lot wealthier than Brazil.

Did you actually read the whole article in context, or just cherry pick the bits you liked?

Are you aware that there are two main types of ‘Benefits’: Social Benefit, which is NOT means tested and therefore anyone regardless to their class status, including the wealthy, are entitled to it, such as ‘Child Benefit’ and ‘Disability Benefits’; and Welfare Benefits, which are means tested e.g. unemployment benefits.

For example, out of the 9.6 million in the UK who get Benefits 788,000 get Child Benefit and over 3.9 million get disability allowances; both of which are NOT means tested, which means that out of the 4.7 million Brits on these non-means tested benefits, wealthy people (the Middle classes) get these benefits just as much as poor people.

There are three levels of disability allowance, known as PIP (Personal Independence Allowance), dependent on to what extent your disability affects your ability to mobility (walking) e.g. my wife’s ability to walk is mildly affected by her bad back so she only gets the lower end of the disability allowance. Whereas, a close friend of ours (a Priest) has a bad leg and one lung, which makes walking far more difficult, therefore he’s on the highest level of the disability allowance, which entitles him to a free ‘new’ car once every three years, complete with free car insurance and free car maintenance, so all he has to pay for is the petrol (gas).

Under the Motability Scheme, for eligible disabled people, 30,000 new cars are purchased per year, which wouldn’t otherwise be bought; so that is certainly a bonus for the car manufacturing industry:-

How does the Motability Scheme Work? https://youtu.be/wnG5R5NuQ1A

Also under the British benefit system, 1.3 million of the 9.6 million Brits receiving benefits are those getting ‘Carer’s Allowance’. Carer’s Allowance isn’t fully means tested, the main criteria is that you have to be able to look after someone who is receiving disability benefits for at least 35 hour per week e.g. you can’t claim Carer’s Allowance if you are working full time.

As a retired person, I do have the time to look after my wife, who gets disability allowance because of her bad back, and therefore I am her official carer, and therefore get paid by the Government to look after my wife; effectively being paid by the Government to be a househusband, in spite of the fact that I am middle class and have enough income from my Works Pension, State Pension and savings to be more than comfortable in my retirement.

Interestingly, out of the 9.6 million Brits who receive benefits, only 618,000 are unemployed; most of the rest are either retired, on low pay, or Middle Class receiving non-means tested benefits, such as child benefit and disability benefits etc. So yes, 30% of all families in the UK do get benefits from the Government, but not all of them are poor, many are Middle Class (wealthy people) who are claiming non-means tested benefits such as child benefit and disability benefits.

I’m lucky in that I worked all my working life in a middle class job, buying our own home and building up a good works pension, and entitlement to the State Pension, and paying my taxes; so that I was able to retire early, at the age of 55 (owning our own home) on a good pension, so as to be able to still enjoy three holidays (vacations) a year in our retirement.Arthur, the UK government under the Labour Party, seems to be the best with welfare schemes or packages. I believe if Nigeria had continued with the Parliamentary system of government, the challenge of 'youth restlessness' shouldn't arise in these present times. It's a socialist or labour government that the people cry for. Critically, all the past and present government are capitalistic bent, that's on a mission to gather and horde. For example, goods and billions of money donated to support the people during the Covid-19 lockdown is yet to see the light of the day. Instead, they were locked up to be distributed later to party members for sale! Interestingly, it led to a nation-wide strike, the 'SAR Must Go' protest, and the breakdown of law and order. Consequently, the Police became afraid of the people.

Yep, thanks for your in-put.

You might find this article of interest e.g. a British millionaire who had previously donated to the Conservative Party has now defected to Labour:-

https://news.sky.com/story/gareth-quarr … y-12713961

First, you do not even need to go there on the wealth disparity. England has been raping brown-skinned countries around the world for hundreds of years, and that wealth you gained from the slave trade was put back into your economy. You started with the Irish, but as soon as their land was totally exploited you moved on and started starving people in other places.

Of course I read the whole article. Most of it was an attempt to justify the govenment socialism but they did not try to lie on the actual numbers, which is what I qouted.Yep, I think we are in agreement on this!

The so called 'Great British Empire' is something many Brits are NOT proud of, but which quite naturally the far-right-wing of the Conservative Government are very proud of and like to crow about (especially during the Brexit campaign). Many of the far-right-wing Conservatives (capitalists) wishing to go back to those days of British Imperialism.I would hope those people that do support it would realize that it was wrong then and it is even worse to wish that we could go back to those times.

I totally, agree with you; although listening to the hard-right-wing of the Conservative Party during the Brexit Campaign one got the distinct impression that they do not realize that it was wrong, and do wish to go back to those times.

But attitudes are slowly changing for the positive: Back in 2014 59% of the British public felt that it was something to be proud of, while only 19% felt it was something to be ashamed of; while opinion polls since have shown remarked shift in opinion e.g. the 2020 opinion poll showed that only 34% of the British public felt it was something to be proud of.

Also, a ray of hope in that the younger generation are less positive about the British Empire than older people (a trend which I hope continues) e.g. back in 2014 65% of Brits over the age of 60 was proud of the British Empire, while only 48% of Brits under the age of 25 felt the British Empire was something to be proud of.

Also, there is a political division:-

50% of people who voted for Brexit felt that the British Empire was something to be proud of, while only 20% of people who voted to remain in the EU felt that way.

Also, only 9% of people who voted for Brexit were ashamed of the British Empire, while 30% of Brits who voted to remain in the EU felt ashamed.

What is needed is more ‘Public Awareness’.

This link may be of interest you:

https://whorunsbritain.blogs.lincoln.ac … -changing/Great link. That last paragraph on the link was a nice summary too--it was a complex series of events.

For clarity, I assume that you are aware that our current UK Government is NOT a socialist government, but a hard-right-wing Conservative (Capitalist) Government.

One amusing benefit which only people on certain benefits get in the UK is the £10 ($11) Christmas bonus from the Government e.g. people on welfare benefits don’t get it. The people entitled to it include people claiming disability allowance (a non-means tested benefit) and their ‘carers’, and everyone on State Pension regardless to their social status (class).

The scheme was introduced by a Conservative (capitalist) Government back in 1974 as a ‘good will gesture’; and every Government ever since (regardless to their politics) has honoured the tradition.

At the time £10 was a lot of money, the Christmas bonus is the only benefit that has not been indexed linked, so these days £10 isn’t worth as much, just enough to buy a couple of bottles of wine for Christmas for example; but it’s the thought (gesture) that counts.

I heard about Liz Truss, shortly after she was appointed Prime Minister, by the late Queen Elizabeth. Seeking expert advice that involve the overall good of the country is commendable. It's a trustworthy idea. It's carrying others and the country along, and gaining overall confidence. Liz Truss U-turn is timely, she having come to her senses. Good for Great Britain.

That's the problem, Liz Truss is ignoring expert economic advice in favour of political dogma (ideology). She may have done a U-turn and abolished her plans to cut the top rate tax to the 1% wealthiest earners, but it's far from over. There was a lot of in-fighting within the Conservative Party during the Conservative Party Conference last week, and with her staunch hard-right-wing philosophy there are a lot of Conservative MPs who don't have faith in her.

Mind you, as a socialist, it's good to see the Conservative Party tear itself apart; especially when the next General Election is just a couple of years away.Arthur, that noted. Good for the socialist, labour party, and the others in the next election.

"However, in practice, rather than investing the extra money in the economy there is a great tendency for the wealthy to syphon the money off into savings, which has no economic benefit e.g. counterproductive."

I realize you are a socialist and are publishing this for that reason, but you know as well as any of us that the information above is false. Those people do not bury their savings in a mattress. They put it in a bank, where it is available as loans for those people that need it.Now, now; I may be a socialist, but the international financial markets who reacted negatively to the top rate tax cuts, the IMF (International Monitory Fund) who condemned the top rate tax cuts, and the Bank of England who also criticised the UK Government for the top rate tax cuts, and who had to prop up the economy with the purchase of £65 billion bonds because of the turmoil caused in the UK economy because of the top rate tax cuts are not socialists; if anything they are capitalists.

Besides, put the money in the bank is 'savings'. In economics putting money in the bank, as opposed to spending it, does not stimulate economic growth.

Bank lending and borrowing is part of economics, but it's a separate aspect of economics and in itself has nothing to do with economic growth.

FYI one aspect of economics 'monitory policy' is for the central banks e.g. the Fed in the USA, and Bank of England in the UK to raise or lower interest rates to encourage or discourage people from spending money: -

Specifically, the larger goal of the central bank in raising interest rates is to slow economic activity, but not by too much. When rates increase, meaning it becomes more expensive to borrow money, consumers react by refraining from making large purchases and pulling back their spending, which can help to reduce inflation. While lowering interest rates has the opposite effect e.g. it helps to boost economic growth.

Whether I am a socialist or not has nothing to do with it: The fact remains that saving money in the bank, rather than spending it, does NOT stimulate economic growth - whereas spending money does help to stimulate economic growth: Simple and basic standard economics, which anyone who learns economics at college or university will be taught."Bank lending and borrowing is part of economics, but it's a separate aspect of economics and in itself has nothing to do with economic growth."

Really? Do you honestly think that if I put money in a bank it is the same as dropping it into a sewer? Savings that you put into a bank does not diappear into a black hole. It is used as loans. People take out loans when they want to buy something (a house, a car, etc). Those savings are converted to loans that stimulate the economy.

This is pretty basic information. It is simple and basic standard economics; even socialists accept it. I am not sure why you think otherwise.I suggest that you do an economic course at college (like I did) and then you’d know that simply putting money in the bank does not stimulate economic growth.

Its basic economics that if you have money in your hands you have two basic choices; spend it, or put it in the bank: If you do the former you help to stimulate economic growth, if you do the latter you do not.

That’s one of the prime reasons why Central Banks periodically either raise or lower interest rates (to encourage people to spend or save as appropriate) e.g. raising interest rates encourages people not to spend money (slow down economic growth, and dampen inflation) while lowering interest rates encourages people to spend money (stimulate economic growth): There is nothing difficult to understand about that, that is standard economics.

How does raising interest rates control inflation? https://youtu.be/R8VBRCs2jTUI did take basic economics at university, where they taught that money put into savings is sent back out as loans and thus stimulates the economy. If in your opinion trickle down economics does not work that is fine. If you think putting money in the bank means that it is no longer active in the economy you are wrong.

That is basic knowledge.What economics did you learn then?

It’s not as simple as saying “money put into savings is sent back out as loans and thus stimulates the economy”:-

Yes, banking is part of economics, but in economics it’s a fact that if people put money in the bank rather than spend it, it takes money out of the economy, and does not stimulate economic growth; it's called 'Leakage': That is economic fact.

As taught in economics, things like ‘Investment and Spending’ are known as ‘Injections into the economy’ e.g. they cause the ‘Multiplier Effect’ (economic growth), because they increase aggregate income and boost economic growth; whereas ‘Savings’ is known as a leakage because it takes money out of the circular flow of income and reduces the level of economic activity.

It’s all explained in simple terms in this short video: https://youtu.be/lShcx6hLy24

The key factor, which you are ignoring, which is why simply putting money in a bank does not directly equate to increased loans, and thus does not stimulate the economic growth is the “Marginal Propensity to Consume” (MPC) e.g. how much of any extra income you get will be spent rather than saved. How much you save (rather than spend) is the ‘Marginal Propensity to Save’ (MPS).

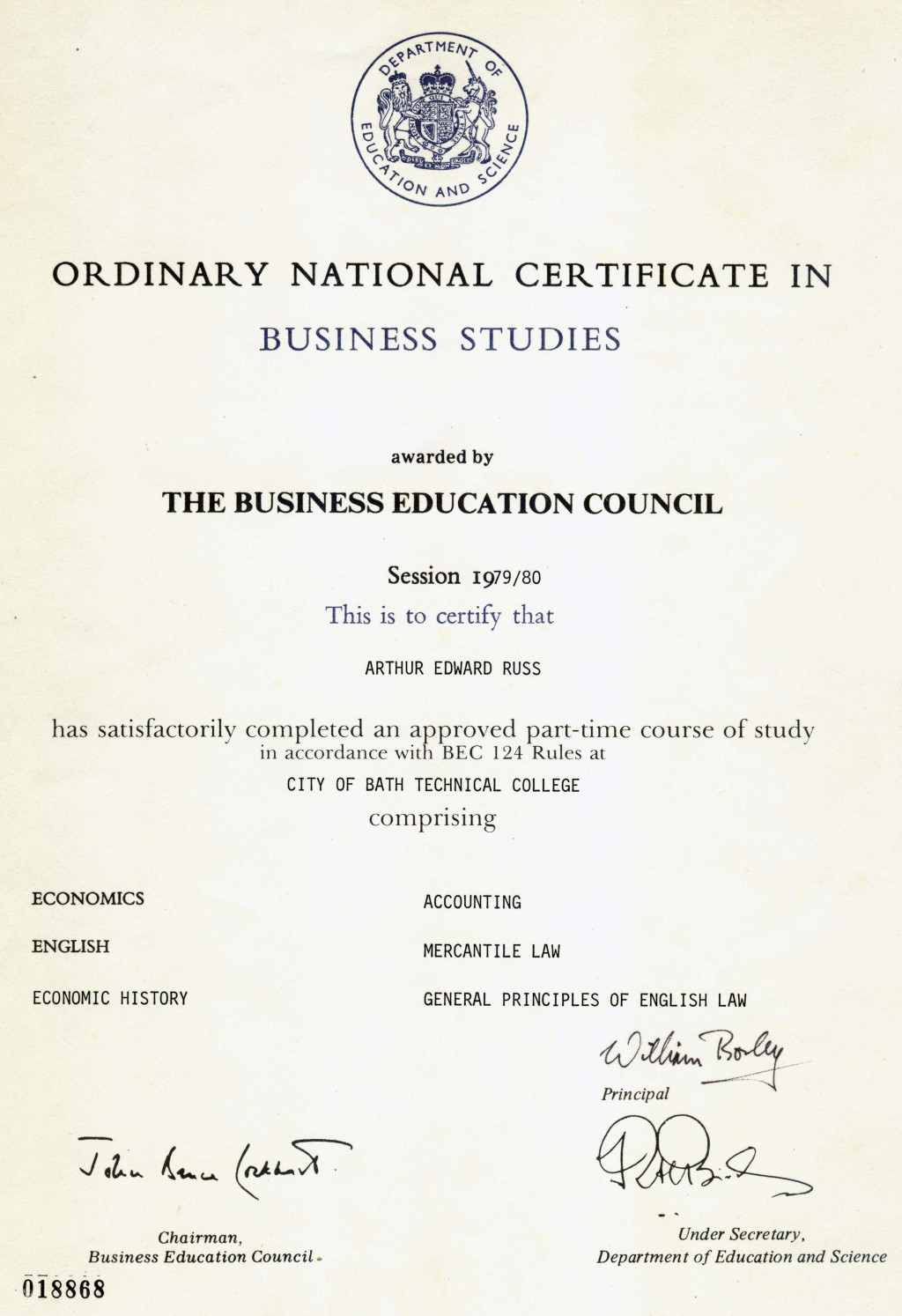

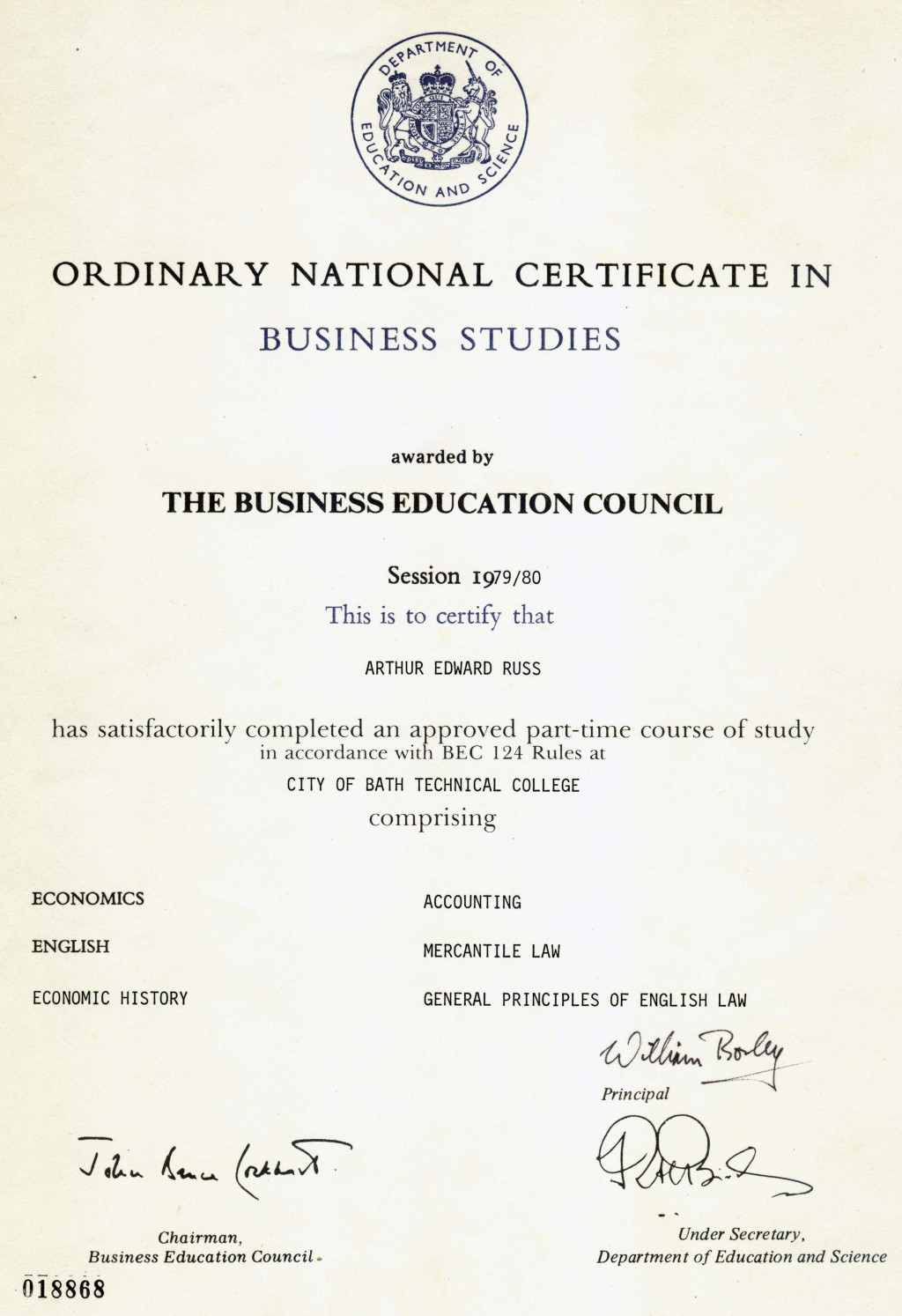

Below is my exam certificate for economics and economic history; where's yours?

What economics did you learn then?

It’s not as simple as saying “money put into savings is sent back out as loans and thus stimulates the economy”:-

Yes, banking is part of economics, but in economics it’s a fact that if people put money in the bank rather than spend it, it takes money out of the economy, and does not stimulate economic growth: That is economic fact.

As taught in economics, things like ‘Investment and Spending’ are known as ‘Injections into the economy’ e.g. they cause the ‘Multiplier Effect’ (economic growth), because they increase aggregate income and boost economic growth; whereas ‘Savings’ is known as a leakage because it takes money out of the circular flow of income and reduces the level of economic activity.

It’s all explained in simple terms in this short video: https://youtu.be/lShcx6hLy24

The key factor, which you are ignoring, which is why simply putting money in a bank does not directly equate to increased loans, and thus does not stimulate the economic growth is the “Marginal Propensity to Consume” (MPC) e.g. how much of any extra income you get will be spent rather than saved. How much you save (rather than spend) is the ‘Marginal Propensity to Save’ (MPS).

Below is my exam certificate for economics and economic history; where's yours?

Economics 101: It is a simple concept. When you put money in the bank it does not cease to exist in the economy.

It really does not take a degree to understand something so basic.It would seem that Economics 101 is to “Learn the basic fundamentals of economics”. From what I can see on the web it certainly looks good; but from my discussion with you it would seem that it lacks depth of understanding?

No it’s not as simple as that, as you should know from your study of Economics 101 there are various types of ‘Money Supply’ e.g. M1, M2 and M3:-

M1, M2 and M3 are measurements of a countries money supply, known as the money aggregates.

• M1 includes money in circulation plus checkable deposits in banks.

• M2 includes M1 plus savings deposits (less than $100,000) and money market mutual funds, and

• M3 includes M2 plus large time deposits in banks

Putting money in the bank is known as ‘leakage’ because it takes money out of the circular flow of income.

Where you say “When you put money in the bank it does not cease to exist in the economy.” What you fail to mention is that putting money in the bank is (in economic terms) is classified as a ‘leakage’ because it takes money out the ‘circular flow of income’; now surely they must have taught you that in Economics 101, if they didn’t then that is a short coming of such a teaching method?This is your original statement:

"However, in practice, rather than investing the extra money in the economy there is a great tendency for the wealthy to syphon the money off into savings, which has no economic benefit e.g. counterproductive."

It is false. Telling me that you have a degree does not change that fact. If you were taught otherwise your teachers taught you something false. This is not the first time in history that teachers tell their students something false, nor is it the first time that students accept it without using common sense to disprove it.Well yeah, if you take things out of 'context'. If you read what I said in 'context' I was talking about the 'trickle-down' economic theory that giving cash injection to the wealthiest members of society would mean that they spend that money in the economy and by doing so would stimulate economic growth e.g. they would have a High 'Marginal Propensity to Consume' (MPC), in other words, spend/invest in the economy to create jobs; whereas in reality they tend to have a high 'Marginal Propensity to Save (MPS), where they save the money in the bank rather than spend it, which does NOT stimulate economic growth.

I guess you have decided that it is okay to use false statements to back up your position then? We have a socialist presidential candidate here that would agree with your position.

There is no false statement, 'Leakage' is the official term used in economics to describe the effects of MPS (Marginal Propensity to Save) on the 'circular flow of income' (another expression used in economics) e.g. when people choice to save rather than spend their extra cash in economics it's known as 'Leakage' from the circular flow of income. Now if you don't understand that, then you didn't learn economics very well e.g. throughout the whole of our discussions you haven't used any economic terms, which seems a bit strange for someone who says they've been taught economics?

Your gripe seems to be that I am a socialist, and you don't like socialists; and all you want to do is just score points rather than debate the issue sensibly.

The fact of the matter is that if the Government give people extra money in the hope that the extra money is spent rather than saved, to encourage economic growth, MPC (Marginal Propensity to Consume) and instead people do save the money, MPS (Marginal Propensity to Save) then that is known as leakage from the circular flow of income, and it does NOT help to stimulate economic growth: It's standard economics which you should have been taught if you had learnt economics, as you claim.As you don't seem to understand 'Leakage' as part of economics I suggest you watch this video below which explains it in simple lay persons terms: -

Leakages and Injections: https://youtu.be/8QUggElc3XII do not need to watch a Youtube video to understand a basic concept. I suggest you look on there for the subect of your next lecture to us "How socialism reduces inflation and provides more goods to consumers."

Sarcasm will get you everywhere – not.

I think you do need to watch the YouTube video to understand a basic economic concept, because you obviously don’t understand ‘leakage’ in economics, even though it is a fundamental part of economics. It has nothing to do with socialism, and neither is socialism nor capitalism used to reduce inflation or used to provide more goods to consumers; its economics that’s used to manage inflation and ‘supply and demand’. Economics that is used by all governments in the western world, regardless to their politics.

I have an extra few millions, and put it into the bank. The bank now has far more money to lend, and in an effort to do so they lower interest rates a small amount.

And the renter in town takes out a loan to build a new home for themselves, hiring carpenters, plumbers, electricians to do so; people that all now make money and spend it.

And that does not stimulate the economy? The wealth is not multiplied many times as the carpenter buys a new car, putting auto workers to work, whereupon they spend their income on a refrigerator putting the refrigerator manufacturer to work, etc.?Here below is a simple step by step breakdown (in economic terms) of the scenario you’ve given: -

1. Putting your few extra millions of dollars in the bank in economic terms is part of your MPS (Marginal Propensity to Save), and in economic terms ‘savings’ is known as ‘leakage’ because it takes money out of the circular flow of income.

2. The effect of putting your few extra millions of dollars in the bank is to slow economic growth; and thus, to counteract your action and to stimulate economic growth the banks do tend to lower interest rates by a small amount (as you said).

The rest of what you say is also correct.

The only aspect of your statement that isn’t quite correct is to say that just because you save extra money in the bank that the bank will automatically lend that money out. Banks having far more money to lend does not automatically mean they will lend more money; how much of that money the banks will lend is dependent on the ‘Reserve Ratio’, which in itself is dependent on other economic factors at the time; such as if bank loans are just not that profitable, because for example they’ve reduced the interest rates to a low level, then banks will tend to have a much higher ‘Reserve Ratio’ e.g. they keep more of the money in ‘reserve’ and lend out less of the money that you saved with them: As explained in this short video https://youtu.be/93_Va7I7LggPutting our points (yours and mine) into context of the current state of the UK economy:

The UK economy is suffering low economic growth and hyper-inflation.

The Hyper-inflation being caused by too much money chasing too few goods (Demand vs Supply) caused primarily because of world-wide supply change issues caused initially by the pandemic and more recently by the Ukraine war.

Following the resignation of our previous Prime Minister (Boris Johnson) in July there was a leadership contest.

In the leadership contest Conservative MPs (politicians) selected two final contesters, but neither got more than 50% of the vote, so it went out to the Conservative Party Membership (ordinary members of the public who pay their subscription to become Conservative Party Members).

The MPs vote for the top two candidates was:-

• 38.3% for Rishi Sunak

• 31.6% for Liz Truss

The Membership vote for the two candidates was:-

• 57.4% Liz Truss

• 42.6% Rishi Sunak

Thus Liz Truss became Prime Minister on the 6th September.

Rishi Sunak MP was the first choice by his fellow Conservative MPs because he was Chancellor of the Exchequer during the pandemic and his economic policies at that time not only kept the UK economy afloat during the pandemic but was also popular with around 80% of the British voting population (General Public).

During their campaign to become the next Prime Minster:-

• Rishi Sunak was advocating raising taxes (fiscal policy) as a tool to dampen demand and thus put downward pressure on inflation.

• Liz Truss was advocating lowering taxes (trickle-down economics) in the hope that the wealthy would invest the money in the economy to create extra jobs to stimulate economic growth.

Two radically different (opposing) policies by two different leading Conservative MPs (politicians): One to tackle hyperinflation and the other to try to stimulate ‘economic growth’.

The rest is history.

The Folly of not Tending to Reality.

Have fun with that.

Or realize:

Human nature is everything.

Freedom is everything.

Boundaries protect freedom.

No boundaries, no freedom and a general rotting occurs.

Then, you try to rid yourself of the rot, and you end up cutting out vital parts of the tree.

A tree which eventually crashes down to the ground.

Instead, water trees so the roots go deep, hold strong and bring nutrients to the trunk, branches and leaves.

And periodically trim the trees to maintain health, balance and life.

There is no such thing as ‘Trickle-Down Economics’

"The problem with this term is that, as far as I know, no economist has ever used that term to describe their own views. Critics of the market should take up the challenge of finding an economist who argues something like “giving things to group A is a good idea because they will then trickle down to group B.” I submit they will fail in finding one because such a person does not exist. Plus, as Thomas Sowell has pointed out, the whole argument is silly: why not just give whatever the things are to group B directly and eliminate the middleman?

There’s no economic argument that claims that policies that themselves only benefit the wealthy directly will somehow “trickle down” to the poor. Transferring wealth to the rich, or even tax cuts that only apply to them, are not policies that are going to benefit the poor, or certainly not in any notable way. Defenders of markets are certainly not going to support direct transfers or subsidies to the rich in any case. That’s precisely the sort of crony capitalism that true liberals reject."

https://iea.org.uk/there-is-no-such-thi … economics/Your first sentence demonstrates that your claim that you studied ‘Economics 101’ is porky pies; it’s nonsensical to say ‘Trickle-Down Economics’ doesn’t exist when it’s taught to economic students in colleges and university across the world. You might disagree with ‘Trickle-down’ economics (like I do) or agree with the theory (like Liz Truss, UK’s current Conservative Government Prime Minster), but it’s rather irrational to deny that the theory exists.

FYI the IEA (Institute of Economic Affairs), for which you provided the link and quoted from, is NOT an economic institution, it’s a hard-right-wing and neoliberal political think tank founded in the UK in 1955 and based in London.

In 2019 the IEA was accused on British Radio of being “a politically motivated lobbying organisation funded by "dark money", of "questionable provenance, with dubious ideas and validity", staffed by people who are not proper experts on their topic.” Quite naturally the IEA complained to UK media regulator Ofcom that those remarks were inaccurate and unfair, and in August 2021, Ofcom rejected the complaint, vindicating that the claims were valid.

The IEA’s political ideology includes: climate change denial; total privatisation; Brexit; and the abolition of the NHS.

You’d be better off listening to genuine Economic organisations such as the ‘Institute for Fiscal Studies', founded in London in 1963 or the Economic and Social Research Council (an Independent Government Body) in the UK formed in 1965."Your first sentence demonstrates that your claim that you studied ‘Economics 101’ is porky pies; it’s nonsensical to say ‘Trickle-Down Economics’ doesn’t exist"

The fact that you read and understood the article I posted is a bunch of porky pies. What I attached came directly from the article. I put nothing of my opinions in it. So, should you have read the article, your argument would be with the author Steven Schwartz.My apologies, I temporarily confused you with DrMark, who does claim that he has studied economics 101; although he hasn’t demonstrated any of that in his arguments e.g. he doesn’t argue on an academic level, as one would expect, if he had studied economics.

The rest of my statement stands, the IEA is not an economic institution, it’s a hard-right-wing political organisation. And FYI I did read their article, and I agree, my argument is with the author.I did take basic economics, enough so that I can tell your answers are just another those of just another socialist trying to justify an incorrect theory by using false information. (This goes back to your first statement about banks, which is false.)

Really, then why don't you debate academically rather than just politically. And FYI none of statements I've made in this forum about banks is false e.g. putting cash in the bank rather than spending it is called 'leakage' in economics e.g. it decreases AD (Aggregate Demand); something which you should know if you've studied economics, as you claim.

This is explained in the following short video:-

A Level Economics - Injections & Leakages: https://youtu.be/6dpVSKiw-3YI took a class in economics. I did not photoshop a degree to put on here.

Your information was false and misleading. Maybe when you studied Marxism they told you that it is okay to lie.What information is false and misleading; what I've written is standard economics. And FYI, I've never studied Marxism, that is far too left wing for my taste e.g. communism, which is something I do not agree with.

You took a class in economics, well why don't you talk economics (academically) rather than just try to belittle standard economic theory, just because it doesn't accord with your political views.

"Your first sentence demonstrates that your claim that you studied ‘Economics 101’ is porky pies; it’s nonsensical to say ‘Trickle-Down Economics’ doesn’t exist"

The fact that you read and understood what I posted is a bunch of porky pies. I didn't share any of my views. What I posted came directly from the article.

Maybe your issue is with the article's author Steven Horwitz. Here are his credentials.

Steven Horwitz was the Distinguished Professor of Free Enterprise in the Department of Economics at Ball State University, where he was also Director of the Institute for the Study of Political Economy. He is the author of Austrian Economics: An Introduction.Yep, Steven Horwitz does certainly have good credentials, and so does Daniela Gabor, professor of economics and macro-finance at UWE (University of the West of England) Bristol. The article in the attached link was written by her, and it has opposing views to Steven Horwitz. I don’t agree with everything she’s written e.g. I think it’s too ideology left-wing, but it does demonstrate that even professional economists can be political.

https://www.theguardian.com/commentisfr … -liz-truss

'When you studied marxism...they told you to lie' That gives me a laugh. Dr.Mark, are you FatFreddyCats? When did you become such! I'm still jinggling.

'Disagree with the policy!' Joe Biden takes aim at Liz Truss over 'mistake' mini budget: https://youtu.be/omQn1GMQVBU

Related Discussions

- 27

Reviving the Middle Class

by Kathryn L Hill 2 years ago

How can this be done? No wonder there are rioting, angry people who topple statues, destroy buildings and light things on fire when given the slightest reason to do so.They don't know how to get what their parents and the previous generations had: The American dream! Is it too much to ask...

- 115

Biden plans to give 36B to pension plans

by Dan Harmon 2 years ago

President Biden announced today a plan to give $36 Billion to pension plans, mostly the Teamsters, because the stock market has fallen so badly and those funds suffered as a result. The taxpayer will now bail out poorly run pension plans, keeping pensions high, rather than putting it into our...

- 50

For all the OWS naysayers!

by Hollie Thomas 13 years ago

For all those who have berated the Occupy Movement, waxed lyrical about their lack of achievement and morality. Yawns, read this: http://www.independent.co.uk/news/uk/po … 31521.htmlApparently, and according to a Bank of England director, they were right!

- 161

Why Do "Conservatives" Have a Worse Economic Record Than "Liberals"?

by Scott Belford 2 years ago

I was working on a different hub and in the process developed the following statistics about GDP growth throughout American history. Since George Washington, whose economic philosophy somewhat resembled those of today's liberals, there have been:- 10 periods where administrations who favored...

- 25

Do Tax Cuts Lead to Economic Growth?

by Ralph Deeds 13 years ago

" ...The defining economic policy of the last decade, of course, was the Bush tax cuts. President George W. Bush and Congress, including Mr. Ryan, passed a large tax cut in 2001, sped up its implementation in 2003 and predicted that prosperity would follow.The economic growth that actually...

- 20

The idea that capitalism is theft

by promisem 8 years ago

Capitalism is the art of legally stealing money from people who don't have the intelligence, education or experience to realize they are being ripped off until it is too late.In other countries, payoffs to politicians is bribery. In the U.S., it is campaign contributions.The new GOP health care...